Stake vs CommSec

Discover the difference between Stake vs CommSec and decide which platform is right for you.

- Stake offers $3 brokerage for all trades up to $30,000.

- You can earn 12 months of $0 brokerage by transferring your existing ASX shares to Stake (min A$1,000).

Sign up and deposit within 24 hours to claim A$10 and a bonus U.S. stock. T&C's apply.

Stake vs CommSec comparison

Compare the Stake and CommSec platforms to help you choose the best stock investing solution for your pursuit of financial progress.

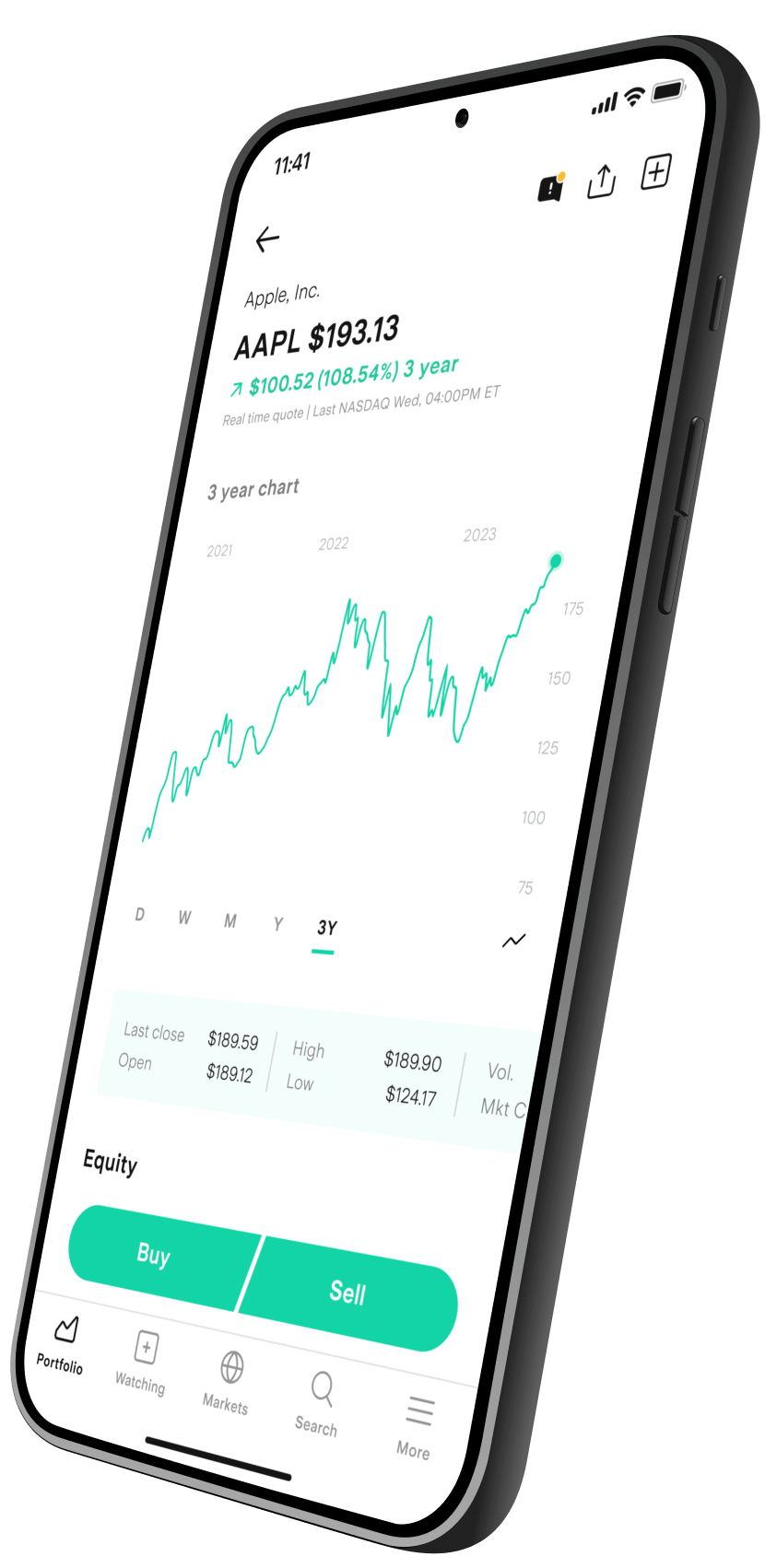

Stake provides Australians with a seamless stock trading experience and access to Australian stocks (Stake AUS) and U.S. stocks (Stake Wall St) with competitive fees. Investors can easily jump in and trade over 12,000 stocks and ETFs on the web or through Stake’s stock investing app.

CommSec is a subsidiary of the Commonwealth Bank and is currently Australia’s largest online stock trading platform. Their offering encompasses their internet trading platform on desktop and mobile, as well as telephone trades and investment advisory services. CommSec provides access to the ASX and also gives its users the option to trade in 13 global markets.

👉 If you want to learn about our pricing jump straight to the Stake fees.

How they compare: Stake vs CommSec comparison

Overview |  | CommSec |

|---|---|---|

Platform | Web, Android, iOS | Web, Android, iOS, Telephone |

CHESS sponsorship | ||

Regulator | ASIC | ASIC |

Referral bonus |

| |

Signup bonus | ||

Minimum deposit | A$0 | A$0 |

Instant Funding | ||

Bank transfer | ||

Credit/debit card funding | ||

Apple Pay / Google Pay funding | ||

Fees | ||

ASX brokerage | A$3 brokerage for all trades up to A$30,000. | With CDIA: $5.00-$29.95 up to 0.12% (over $25,000) |

U.S. brokerage | US$3 brokerage for all trades up to US$30,000. | USD$5.00 |

Minimum trade (AU) | $500 for the first time as | $500 for the first time as |

FX fee | 55bps | 0.55% |

Securities | ||

Australian shares | ||

International shares | ||

ETFs | ||

Extended Hours trading | ||

Fractional shares | ||

OTC stocks | ||

IPOs |

| |

Tradeable markets | ASX, CBOE, | ASX, CBOE, NASDAQ, NYSE, AMEX, ARCA, LSE, SFB, EBS, SGX, OSE, AEB - Euronext, TSEJ, BVME, SEHK, IBIS, SBF - Euronext, TSE |

Last updated 13 November 2024. The information displayed in the investing platform comparison table is not exhaustive and is subject to changes. For up-to-date competitor pricing and product offerings, visit their website. See full pricing details for Stake.

Get $3 off ASX brokerage for a year

Transfer your ASX portfolio (over A$1,000) to Stake and you’ll get $3 off your brokerage fees for a year. It's fast, easy and free.

See Stake pricing, terms and conditions and privacy policy.

Sign up and transferHow we compare

Compare Stake’s brokerage fees with other CHESS-sponsored platforms

Trade Amount |  | CommSec | NAB | SelfWealth |

|---|---|---|---|---|

$0 - $1,000 | $3 | $5.00 (with CDIA) | $9.95 | $9.50 |

$1,001 - $5,000 | $3 | $10.00 - $19.95 (with CDIA) | $14.95 | $9.50 |

$5,001 - $10,000 | $3 | $19.95 (with CDIA) | $19.95 | $9.50 |

$10,001 - $20,000 | $3 | $29.95 (with CDIA) | $19.95 | $9.50 |

$20,001 - $25,000 | $3 | $29.95 (with CDIA) | 0.11% | $9.50 |

$25,001 - $30,000 | $3 | 0.12% (with CDIA) | 0.11% | $9.50 |

$30,000+ | 0.01% | 0.12% (with CDIA) | 0.11% | $9.50 |

Last reviewed: 30 May 2025. The information displayed in the pricing comparison table is not exhaustive and is subject to changes. For up-to-date competitor pricing and product offerings, visit their websites. Please check our pricing PDF for details.

Learn more about the benefits of trading with a CHESS-sponsored platform.

The Australian Securities Exchange (ASX) requires a minimum investment of A$500 (excluding brokerage) when purchasing shares in any ASX-listed security for the first time. This is known as the ‘Minimum Marketable Parcel' (MMP) of shares. The MMP applies to all CHESS-sponsored trades.

1000's of 5-star reviews

As a former commsec user, I love how easy the app is to navigate and with ASX now available switching between markets is easy.

I've never written an App review before, but Stake really has continued to wow me.

I started using Stake for US trading, and recently (very easily) transferred my ASX portfolio across to utilise the cheap trades.

Switched from nabtrade. Much better experience. Far cheaper.

A well designed and easy to use app to trade on the USA and AUS markets.

A great alternative to CommSec

Join Stake and get started with a starter U.S. stock, on us. Signing up takes just minutes!

Stake vs CommSec Comparison FAQs

If you’ve currently got shares held with CommSec, you can easily bring them across to Stake:

- Download the app, sign up to Stake and log in.

- Tap the 'More' icon on the bottom right.

Tap 'Portfolio transfers' and then select either AUS portfolio transfer or Wall St portfolio transfer for U.S. shares. Then follow the prompts.

Check out our guide if you want to transfer your shares from CommSec to Stake.

If you transfer ASX stocks over A$1,000, you’ll get $3 off your brokerage fees on ASX trades for 12 months. Transfer your U.S. portfolio over US$500 and get a free Dropbox stock. Terms and conditions apply.

If you have a HIN held with CommSec you can easily transfer it to Stake or another investing platform.

If you want to transfer your HIN from CommSec to Stake, follow the steps below:

- Fill out the Broker to Broker transfer form

- Send the form, a holding statement and your photo I.D. to us at share-transfers@hellostake.com

- After we get your email, we will start the HIN transfer process (around 2-5 business days)

There are plenty of benefits to start investing with Stake over CommSec, but here are just a few:

- A$3 brokerage on ASX trades up to A$30,000 instead of $5 or more. And if you refer a friend to Stake, you can even take $1 off the brokerage for 12 months. This means that by successfully referring just three friends, you can unlock free ASX brokerage for a year.

- US$3 brokerage on U.S. trades up to US$30,000 – don’t pay $5 or 0.12% per trade.

- A seamless, easy-to-use mobile experience made for this century.

Each investing platform has its pros and cons when buying and selling stocks in Australia. If you are still unsure which platform is right for you, refer to these CommSec alternatives or see how Stake compares to other platforms.

Stake is regulated by ASIC in Australia, just like CommSec. Stakeshop Pty Ltd (ACN 610 105 505), trading as Stake, is an authorised representative (Authorised Representative no. 1241398) of Stakeshop AFSL Pty Ltd (Australian Financial Services Licence no. 548196).

Like CommSec, we bring you CHESS-sponsorship, which means that when you buy ASX shares, they are held under your personal HIN. And on Stake Wall St, your U.S. shares are covered under SIPC protection for up to $500,000 (including $250,000 for claims for cash).

Download directly from the Apple App Store and Google Play Store.

CommSec and nabtrade are both good options and have features that will appeal to investors. For more information, check out the CommSec vs nabtrade review.

However, if you are looking for a digital investment platform made for this century that offers simple and transparent brokerage, an immersive experience in the palm of your hand and over 8,000 shares across ASX and Wall St, then Stake is a great choice for you.

Sign up and start investing with Stake today.

You will need to weigh up the features and benefits of both platforms provided above to see which platform is right for you. Use the example below to see how much brokerage fees you would pay investing in exchange-traded funds:

Stake brokerage fee for an investment amount of A$500 is A$3. If you wanted to invest A$500 once a month recurring over 12 months you would pay a total of A$36 in brokerage fees.

CommSec brokerage fee for an investment amount of A$500 is A$5. If you wanted to invest A$500 once a month recurring over 12 months you would pay a total of A$60 in brokerage fees.

You would save A$2 with a single investment of A$500 or save A$24 over 12 months.

Check out how the CommSec brokerage fees compare to Stake using our handy tool on the investment growth calculator page.

This example is using the base brokerage fees, not including any offers or promotions that can reduce these amounts.