Stake vs Interactive Brokers

Discover the difference between Stake vs Interactive Brokers and decide which platform is right for you.

What you get with Stake:

- A$3 brokerage on all ASX CHESS-sponsored trades up to A$30k

- An Australian-owned and operated investing platform

- A$10 trading credit and a bonus U.S. stock when you sign up and deposit within 24 hours. T&C’s apply.

Stake vs Interactive Brokers comparison

Compare the Stake and Interactive Brokers platforms to assist you in deciding which stock investing solution aligns with your financial goals.

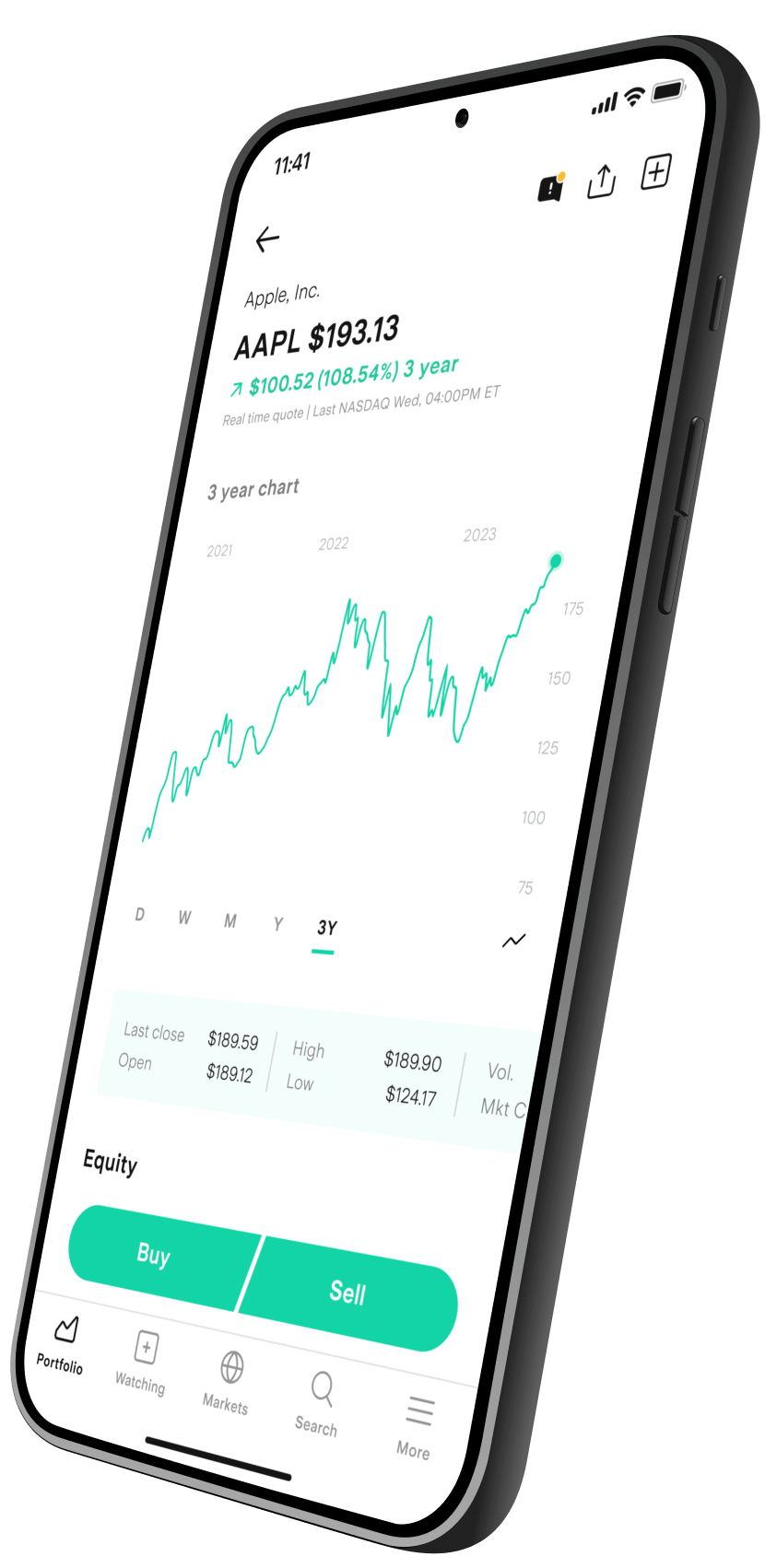

Stake provides Australians with a seamless stock trading experience and access to Australian stocks (Stake AUS) and U.S. stocks (Stake Wall St) with competitive fees. Investors can easily jump in and trade over 12,000 stocks and ETFs on the web or through Stake’s stock investing app.

Interactive Brokers is a multinational investing platform that provides access to stocks, ETFs, bonds, currencies, options, and futures on 150+ worldwide markets. They’re headquartered in the United States and have offices in Sydney, Hong Kong, Dublin, Singapore, Tokyo and more. The platform is not CHESS-sponsored, which means any ASX shares purchased through Interactive Brokers will remain in their custody on your behalf.

👉 If you want to learn about our pricing jump straight to the Stake fees.

How they compare: Stake vs Interactive Brokers comparison

Overview |

| Interactive Brokers |

|---|---|---|

Platform | Web, Android, iOS | Web, Android, iOS, Telephone |

CHESS sponsorship |

|

|

Regulator | ASIC | ASIC |

Referral bonus |

|

|

Signup bonus |

|

|

Minimum deposit | A$0 | A$0

|

Instant Funding |

|

|

Bank transfer |

|

|

Credit/debit card funding |

|

|

Apple Pay / Google Pay funding |

|

|

Fees |

|

|

ASX brokerage | A$3 brokerage for all trades up to A$30,000. Or 0.01% for trades above A$30,000. | A$6 or 0.08% (whichever is higher) |

U.S. brokerage | US$3 brokerage for all trades up to US$30,000. Or 0.01% for trades above US$30.000. | US$0.005/share ($1 min / 1% max) |

FX on deposit and withdrawal | 55bps | 0.20bps (min USD$2) |

Premium membership | Stake Black: From $12 up to just $17/mo | Market data subscription (refer to their site for more information) |

Transferring Australian shares (incoming) | Free (fees may apply with your departing platform) | Fees may apply on the transfer option you require, refer to IBKR website. |

Transferring U.S. shares (incoming) | Fees may apply (learn more) | Fees may apply on the transfer option you require, refer to IBKR website. |

Securities |

|

|

Australian shares |

|

|

International shares |

|

|

ETFs |

|

|

Extended Hours trading | ||

Fractional shares |

|

|

OTC stocks |

|

|

IPOs |  (lite) |

|

Tradeable markets | ASX, CBOE, NASDAQ, NYSE | ASX, CBOE, NASDAQ, NYSE, HKEX, KSE, LSE, TSE, XETRA and more (refer to IBKR exchange listings) |

Last reviewed: 13 November 2024. The information displayed in the investing platform comparison table is not exhaustive and is subject to changes. For up-to-date competitor pricing and product offerings, visit their website. See full pricing details for Stake.

Get $3 off ASX brokerage for a year

Transfer your ASX portfolio (over A$1,000) to Stake and you’ll get $3 off your brokerage fees for a year. It's fast, easy and free.

See Stake pricing, terms and conditions and privacy policy.

Sign up and transferHow we compare

Compare Stake’s brokerage fees with other CHESS-sponsored platforms

Trade Amount |  | CommSec | NAB | SelfWealth |

|---|---|---|---|---|

$0 - $1,000 | $3 | $5.00 (with CDIA) | $9.95 | $9.50 |

$1,001 - $5,000 | $3 | $10.00 - $19.95 (with CDIA) | $14.95 | $9.50 |

$5,001 - $10,000 | $3 | $19.95 (with CDIA) | $19.95 | $9.50 |

$10,001 - $20,000 | $3 | $29.95 (with CDIA) | $19.95 | $9.50 |

$20,001 - $25,000 | $3 | $29.95 (with CDIA) | 0.11% | $9.50 |

$25,001 - $30,000 | $3 | 0.12% (with CDIA) | 0.11% | $9.50 |

$30,000+ | 0.01% | 0.12% (with CDIA) | 0.11% | $9.50 |

Last reviewed: 30 May 2025. The information displayed in the pricing comparison table is not exhaustive and is subject to changes. For up-to-date competitor pricing and product offerings, visit their websites. Please check our pricing PDF for details.

Learn more about the benefits of trading with a CHESS-sponsored platform.

The Australian Securities Exchange (ASX) requires a minimum investment of A$500 (excluding brokerage) when purchasing shares in any ASX-listed security for the first time. This is known as the ‘Minimum Marketable Parcel' (MMP) of shares. The MMP applies to all CHESS-sponsored trades.

1000's of 5-star reviews

As a former commsec user, I love how easy the app is to navigate and with ASX now available switching between markets is easy.

I've never written an App review before, but Stake really has continued to wow me.

I started using Stake for US trading, and recently (very easily) transferred my ASX portfolio across to utilise the cheap trades.

Switched from nabtrade. Much better experience. Far cheaper.

A well designed and easy to use app to trade on the USA and AUS markets.

A great alternative to Interactive Brokers

Join Stake and get started with a full U.S. stock on us. Signing up takes just minutes.

Stake vs Interactive Brokers FAQs

If you’ve currently got shares held with Interactive Brokers, you can easily bring them across to Stake:

- Download the app, sign up to Stake and log in.

- Tap the 'More' icon on the bottom right.

- Tap 'Portfolio transfers' and then select either AUS portfolio transfer or Wall St portfolio transfer for U.S. shares. Then follow the prompts.

If you transfer Aussie stocks valued over A$1,000, you’ll unlock $0 brokerage on ASX trades for 12 months (capped at 10 trades/month). Transfer a U.S. portfolio worth over US$500 and get a free Dropbox ($DBX) stock. Terms and conditions apply.

Interactive Brokers is not a CHESS-sponsored platform. Like some other brokers in Australia, IBKR uses a custodial model where you remain the full beneficial owner of the held ASX shares. However, this level of ownership becomes tricky in the event of a custodian platform going under and potential losses, or delays in claiming your shares, can occur.

CHESS sponsorship automatically applies to your account when you join Stake, this means any ASX shares bought on the platform are held under your own name and HIN.

There are plenty of benefits to start investing with Stake over IBKR, but here are just a few:

- A$3 brokerage on ASX trades up to A$30,000 instead of A$6 or 0.08% on IBKR. Plus, if you refer a friend to Stake you knock $1 off your brokerage for 12 months. This means that by successfully referring three friends, you can unlock free ASX brokerage on trades under A$30,000.

- When purchasing Australian shares with Stake you’ll get your own HIN (Holder Identification Number), so shares are actually held in your name.

- A seamless and easy-to-use investing experience, whether you’re a starter or a pro.

Each investing platform has its pros and cons when trading stocks in Australia. If you are still unsure which trading platform is right for you, refer to these Interactive Brokers alternatives and see how Stake compares.

Stake is regulated by ASIC in Australia. Stakeshop Pty Ltd (ACN 610 105 505), trading as Stake, is an authorised representative (Authorised Representative no. 1241398) of Stakeshop AFSL Pty Ltd (Australian Financial Services Licence no. 548196)

Stake is CHESS-sponsored, which means ASX shares purchased on the platform are held under your personal HIN. And on Stake Wall St, your U.S. shares are covered under SIPC protection for up to US$500,000 (including US$250,000 for claims for cash).

Interactive Brokers has many advanced trading features that are more suited for high-frequency and professional traders. If you’re looking for a slick, intuitive investing platform that’s simple and powerful – Stake may be the platform for you.

Download directly from the App Store (iOS) or Play Store (Android).