7 CMC Markets alternatives for investors

Searching for a reliable and easy-to-use investing platform? Learn about some alternatives to CMC Markets below and decide which platform is right for you.

- Stake offers $3 brokerage for all trades up to $30k

- Access 12,000+ shares and ETFs across ASX and Wall St

- Sign up and deposit within 24 hours to claim A$10 and/or a bonus U.S. stock. T&Cs apply.

Alternatives to CMC Markets

How do the CMC Markets alternatives compare

Each CMC Markets alternative had the following comparative considerations: brokerage fees, CHESS sponsorship, which markets they have available, accessibility and minimum investment requirements.

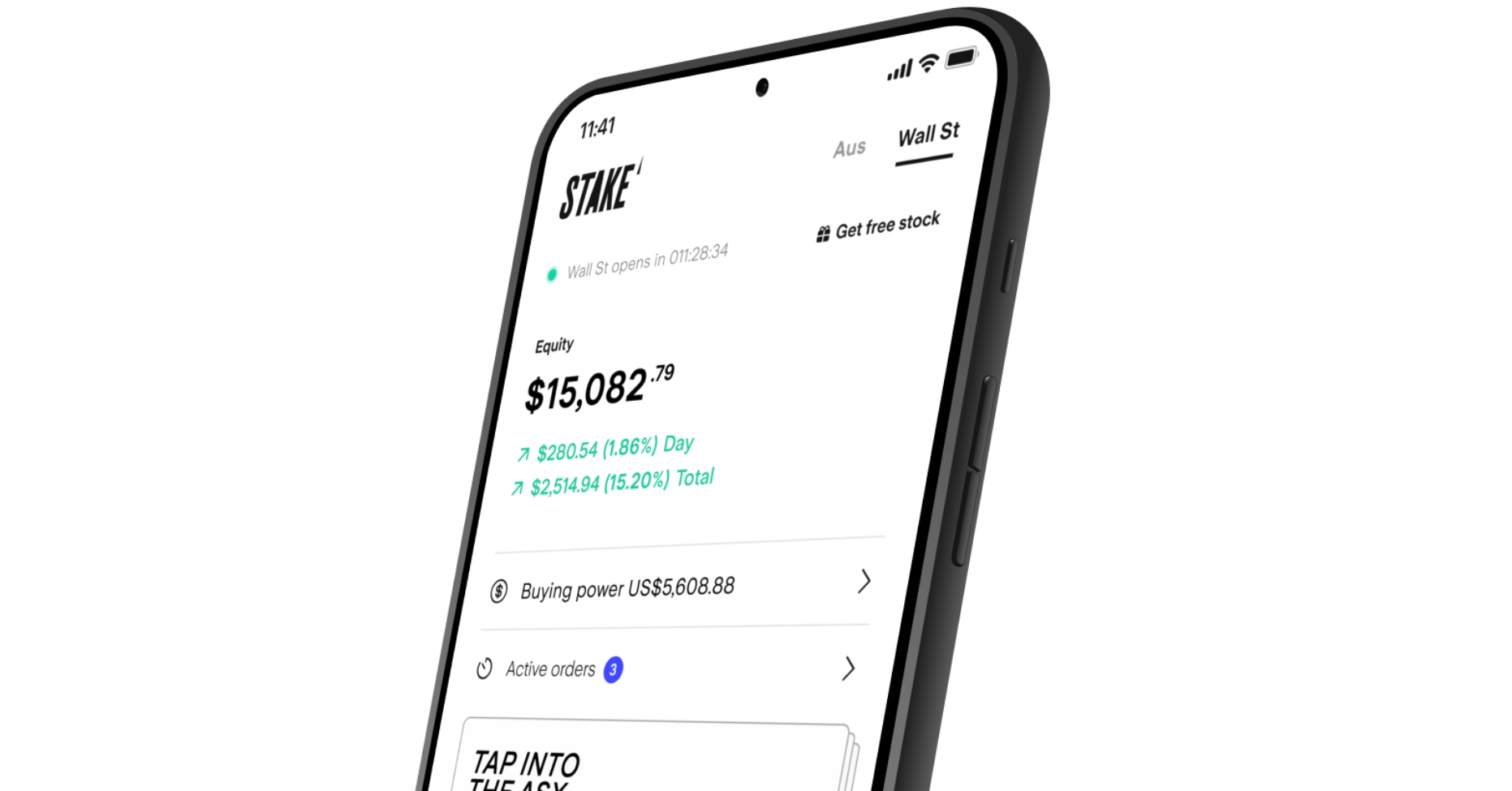

Stake

Stake is a powerful, intuitive investing platform that provides Australians with a seamless stock trading experience. Easily access Australian stocks (Stake AUS) and U.S. shares (Stake Wall St) on one easy-to-use platform that 500k+ investors trust.

Simple, transparent brokerage fees of just $3 (on trades up to $30k) help explain why Stake recently won Canstar’s 2023 Online Share Trading Award for Outstanding Value – Trader.

It only takes a few minutes to sign up and gain access to 12,000+ Australian and Wall St securities. Plus, Stake users can claim a bonus U.S. stock (Stake Wall St) and/or A$10 trading credit (Stake AUS) with their first deposit. T&Cs apply.

- CHESS-sponsored: Yes

- Brokerage fees: $3 brokerage for all trades up to $30,000. 0.01% on trades above $30,000 (AUD for Stake AUS, USD for Stake Wall St)

- Markets/Instruments available: Australian and U.S. markets available for shares, ETFs, OTC stocks, hybrid securities and bonds

- Accessibility: Web, mobile and tablet

- Minimum investment: US$10 for U.S. shares and A$500 for initial Australian investments as per the ASX Minimum Marketable Parcel

✅ Learn more in our comparison guide: Stake vs CMC Markets

Superhero

Superhero is an online investing platform in Australia known for affordable brokerage and access to 9,000+ securities across U.S. and Australian markets. Touting a user-friendly interface and competitive pricing, Superhero aims to simplify investing and make markets accessible to a wide range of experience levels.

Superhero operates on a low-cost fee structure, with brokerage fees at A$2 for AUS or US$2 for Wall St (0.01% of trade value for trades over $20k for both markets). Superhero is not CHESS-sponsored, which means shares are not held under a user’s individual HIN but rather on their behalf by Superhero.

- CHESS-sponsored: No

- Brokerage fees: $2 for AUS or US$2 for Wall St (0.01% of trade value for trades over $20k for both markets).

- Markets/instruments available: Australian and U.S. markets available for shares and ETFs

- Accessibility: Web, mobile and tablet

- Minimum investment: US$10 for U.S. shares and A$10 for ASX shares

✅ Learn more in our comparison guide: Stake vs Superhero

CommSec

CommSec is a subsidiary of Commonwealth Bank ($CBA) and is currently Australia’s largest online investing platform offering a comprehensive range of investment services to individual and institutional clients. CommSec provides access to Australian, North American, Canadian, Asia Pacific, European and Middle Eastern markets.

Their offering encompasses their internet trading platform on desktop and mobile, along with telephone trading options. They’re also able to provide investment advisory services to conveniently provide Australians of all experience levels an entryway to the world of investing.

- CHESS-sponsored: Yes

- Brokerage fees: From A$5.00 - A$29.95 up to 0.12% (for trades over A$25,000) for Australian securities (with CDIA, see CommSec pricing). US$5.00 or 0.12% (whichever is greater) for U.S. securities.

- Markets/instruments available: Australian, U.S. and international stock exchanges available. Margin lending, warrants and options are also available.

- Accessibility: Web, mobile, tablet and over-the-phone.

- Minimum investment: A$500 for initial Australian investments as per the ASX Minimum Marketable Parcel

✅ Learn more in our comparison guide: Stake vs CommSec

Selfwealth

Selfwealth is an Australian-owned and operated investing platform founded in 2012. The platform aims to empower everyday Australians to navigate various markets in Australia and abroad.

Selfwealth operates on a flat-fee brokerage model regardless of the trade size. Their fixed brokerage fee of $9.50 per trade allows users to invest with clarity across Australian, U.S., and Hong Kong markets.

The platform boasts 129k+ Australian users and is currently listed on the ASX ($SWF).

- CHESS-sponsored: Yes

- Brokerage fees: A$9.50 for Australian securities, US$9.50 for U.S. securities and HK$88 for Hong Kong securities

- Markets/instruments available: Australian, U.S. and Hong Kong markets available

- Accessibility: Web, mobile and tablet

- Minimum investment: US$25 for U.S. securities. A$500 for initial Australian investments as per the ASX Minimum Marketable Parcel

✅ Learn more in our comparison guide: Stake vs Selfwealth

eToro

eToro is a social trading and multi-asset investing platform that provides investors with access to shares, forex, cryptocurrencies and commodities with competitive brokerage fees. Founded in 2017 and headquartered in Tel Aviv, eToro has established offices in the UK, U.S., Cyprus and Australia.

Starting out with simple Forex and CFD trading options – eToro has since branched out to offer additional financial instruments including stocks, ETFs and cryptocurrencies. Combining traditional investing with social networking eToro allows users to interact with, follow and automatically replicate the trading behaviours of other users of the platform in real-time.

- CHESS-sponsored: No

- Brokerage fees: $0 (fees may apply on bid/ask market spread, FX conversions, withdrawal and inactivity fees)

- Markets/instruments available: Australian, U.S., UK and European stock exchanges available. Cryptocurrencies and CFDs are also available.

- Accessibility: Web, mobile and tablet

- Minimum investment: US$10

✅ Learn more in our comparison guide: Stake vs eToro

Pearler

Pearler is an Australian-owned investing app with a strong focus on simplifying long-term investing for its users. The platform provides access to shares and ETFs across Australian and U.S. markets.

The platform charges a flat, low-cost fee of A$6.50 for all ASX and U.S. trades and provides access to 6,000+ securities across both markets. Pearler offers alternative investing tools including micro-investing and family-based investing accounts.

- CHESS-sponsored: Yes

- Brokerage fees: A$6.50 (or A$5.50 with prepay) for Australian shares and A$6.50 for U.S. securities

- Available markets/instruments: Australian and U.S. stock exchanges available. Micro-investing and family-based investing (Headstart) accounts are also available.

- Accessibility: Web, mobile and tablet

- Minimum investment: A$500 for initial Australian investments as per the ASX Minimum Marketable Parcel

✅ Learn more in our comparison guide: Stake vs Pearler

nabtrade

nabtrade is an online investing platform in Australia from the National Australia Bank (NAB) offering individuals and businesses a diverse range of financial instruments. Users can access 10k+ shares, ETFs, bonds, managed funds and more across Australian, U.S., UK, German and Hong Kong markets.

Brokerage fees start at A$9.95 for domestic and international trades up to $1,000. nabtrade equips the security and reliability of an established financial institution with the convenience and flexibility of an online trading platform to offer Australians a secure investing platform.

- CHESS-sponsored: Yes

- Brokerage fee: A$9.95 brokerage on trades up to A$1,000 or 0.11% for trades over A$20,000

- Markets/instruments available: Australian, U.S., UK, Germany and Hong Kong share markets available. Capital raises, options, warrants and hybrids are also available

- Accessibility: Web, mobile, tablet and over-the-phone

- Minimum investment: A$500 for initial Australian investments as per the ASX Minimum Marketable Parcel

✅ Learn more in our comparison guide: Stake vs nabtrade

Which CMC Markets alternative should you use?

When comparing alternatives to CMC Markets, it's important to identify the platform features that align with your specific investing goals and current financial circumstances. Share trading carries risk and you are always encouraged to conduct your own research before investing.

Stake could be considered a great alternative to CMC Markets if you are looking for an affordable investing platform with accessible features and a slick user interface. Here are a few reasons why 500k+ investors choose Stake:

- Simple, transparent brokerage fees of $3 on any trade up to $30,000

- Own a slice of the world’s biggest companies like Tesla and Apple from just US$10 with fractional shares.

- A seamless, easy-to-use investing platform, whether you’re a starter or a pro.

✅ If you've made the decision to start investing with Stake, sign up here.

How Stake compares at a glance

See how different investing platforms stack up

Platform |  | CommSec | Superhero | Selfwealth | CMC Markets | eToro | Pearler | nabtrade |

|---|---|---|---|---|---|---|---|---|

AU brokerage fee (AUD) | $3 (trades up to $30k) | With CDIA: $5.00-$29.95 up to 0.12% (over $25,000) | $2 or 0.01% over $20k | $9.50 | $0 first buy order up to $1,000 | $0 | $6.50 | $9.95-$19.95 (trades up to $20k) |

U.S. brokerage fee (USD) | $3 (trades up to $30k) | $5.00 | $2 or 0.01% over $20k | $9.50 | $0 | $0 | $6.50 | $9.95-$19.95 (trades up to $20k) |

CHESS- sponsored? | ||||||||

Sign-up offer |

|

|

Last updated 29 May 2024. The information displayed is not exhaustive and is subject to changes. For up-to-date competitor pricing and product offerings, visit their website. See full pricing details for Stake.

Get rewarded when you sign up

Kickstart your portfolio with a bang. Simply signup and fund a new account and you’ll be rewarded with a full U.S. share (Stake Wall St) and/or A$10 trading credit (Stake AUS). Do both, get both!

Sign up now1000's of 5-star reviews

As a former commsec user, I love how easy the app is to navigate and with ASX now available switching between markets is easy.

I've never written an App review before, but Stake really has continued to wow me.

I started using Stake for US trading, and recently (very easily) transferred my ASX portfolio across to utilise the cheap trades.

Switched from nabtrade. Much better experience. Far cheaper.

A well designed and easy to use app to trade on the USA and AUS markets.

FAQs on CMC Markets Alternatives

Both CMC Markets and CommSec have a lot of experience in the markets. It's important to consider the specific features and offerings from both platforms that will align with your investing needs. Both platforms offer international stock markets and financial instruments with brokerage ranging from $0 - 0.12% on ASX trades and $0 - 0.12% for international trades. Each platform has its own pros and cons that can impact your individual investing experience.

Ultimately, the answer to which platform is better depends on your own investment goals and priorities. It's recommended to identify and discover the features that matter the most to you. These could be related to brokerage fees, access to multiple stock exchanges, research tools, advanced charting etc.

CMC Markets is not an Australian-owned company. They are a UK-based financial services company with a hub in Sydney. CMC Markets is authorised and regulated by ASIC in Australia.

Curious to see how Stake stacks up against other investment platforms? Have a look at the comparisons below to help you identify and decide the platform that’s right for you.