Under the Spotlight Wall St: Visa Inc. (V)

From shaping the global financial landscape to revolutionising digital payments, Visa’s payment processing business is a major support structure for consumers and companies alike. Let’s put it Under the Spotlight.

Ease of payment is crucial for both businesses and consumers. Smooth transactions enhance the likelihood of a finalised purchase, reduce frustrations and can help encourage clients to buy again. Efficient operations also help minimise costs and improve administration for firms. However, creating a system that allows payments with a single tap of a card or a few clicks online hasn’t happened overnight.

Humans have dealt with the concept of credit for thousands of years, but credit cards only emerged around 1950 with the launch of Diners Club. In 1958, American Express ($AXP) introduced a charge card and Bank of America ($BAC) first sent the BankAmericard to some California residents – on which they could spend an amount up to a predetermined credit limit.

Consumer credit was in its infancy and the program came with relatively high delinquency rates, but it managed to turn a profit within four years. Several regional banks came together to establish the Interbank Card Association and create a competitor named Master Charge in 1966. This business eventually became Mastercard ($MA). Bank of America would later lease BankAmericard to financial institutions, but gave up control over the system in 1970 and saw it become its own firm: Visa Inc ($V).

Building up credit

The invention of the magnetic stripe technology in the 1960s by an IBM ($IBM) engineer was key to popularising these new cards. The small strip of tape could store the client’s information and enable it to be read by the terminal at the point of sale. Visa had built an electronic clearing and settlement system, which would transfer the payments between merchants and consumers when using credit cards.

As a payment processing network, Visa doesn’t issue cards directly to the public – they come from member banks and credit unions. These financial partners underwrite the credit for the transaction that occurs on Visa’s network, while Visa earns fees for their services and data processing capabilities. They also started offering co-branded partnerships with airlines, hotels and retailers, which aimed to encourage loyalty through specific user perks.

Visa introduced their first debit cards in 1975, but it wasn’t until 2003 that total global transaction volumes for debit surpassed credit. In Q2 FY 2024, debit programs amounted to U$2.15t, while their credit counterparts totalled US$1.62t. Along the way, the development of card chip technology enhanced security and led to the establishment of global operational standards. Founded in 1994 by Europay, Mastercard and Visa, EMV introduced the chip and PIN card that’s now the norm.

Maintaining networks

Over the decades, Visa had actually been operating as separate businesses around the world. Its Canada, International, and U.S. segments merged ahead of the 2008 IPO – which was the largest listing in U.S. history at the time, raising US$17.9b. Visa then acquired the European units in 2016, and has taken over several other firms since, strengthening its capabilities in the digital realm and cross-border payments.

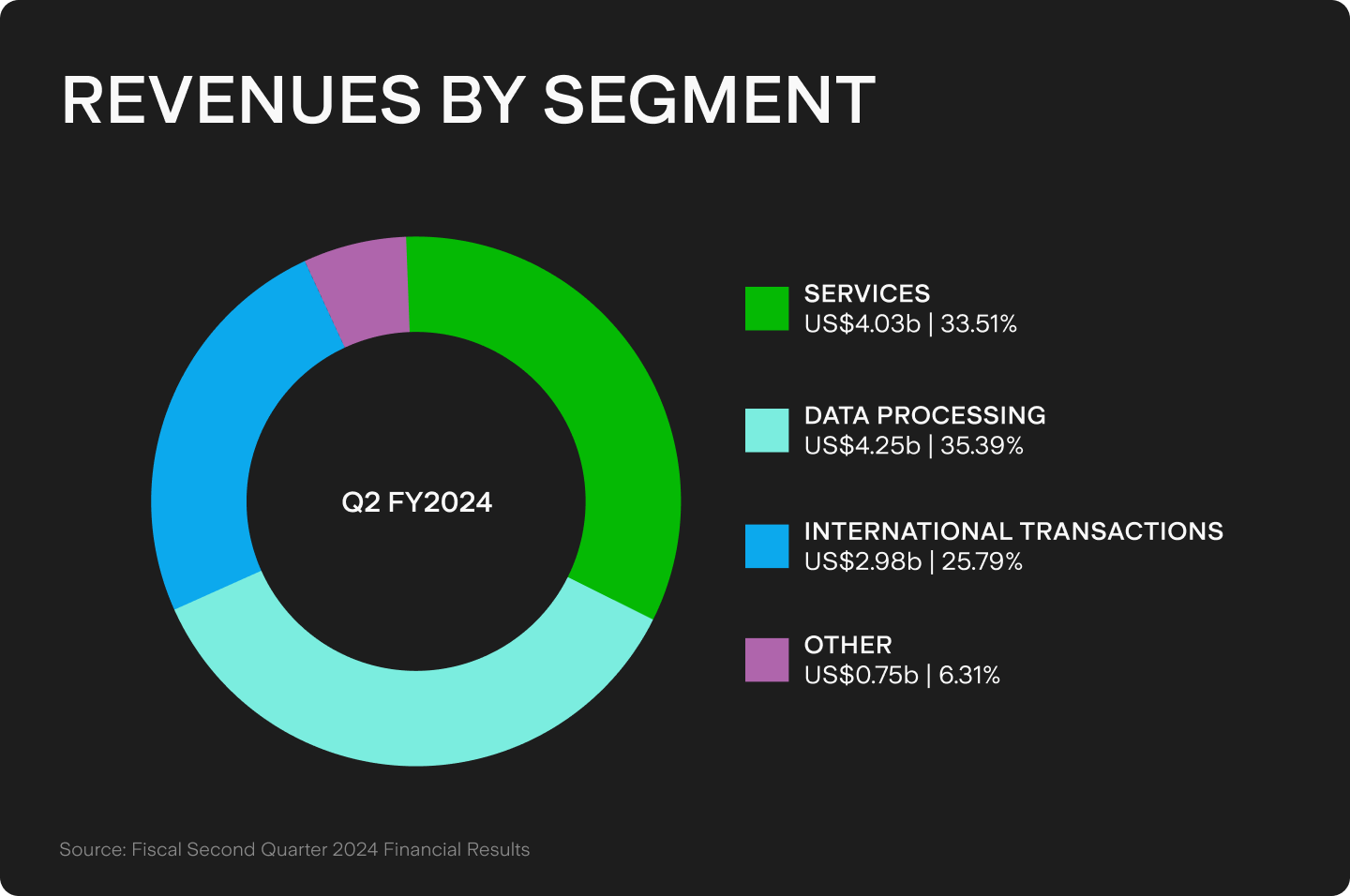

Visa benefits from the vast scale of its network, which links approximately four billion account holders to roughly 130 million merchants across over 200 countries and territories. Its operations are dependent on its partners, with the company spending US$3.25b on client incentives in Q2 FY2024 to facilitate future growth through strong relationships. The company does have high margins; compared to revenues of US$8.77b, the latest quarter’s free cash flows of US$4.53b mean that over half its earnings were profits.

However, Visa also operates in a rapidly evolving sector. Online shopping is less reliant on point of sale terminals, with the likes of Paypal ($PYPL) and Square ($XYZ) allowing direct transfers to merchants. Tech giants Apple ($AAPL) and Google ($GOOG) have signalled their financial ambitions by launching virtual wallets. The company also recognises the need to bring innovations in-house – see the B2B Connect network for international transactions being built on blockchain – and collaborate with partners to bring Buy Now, Pay Later options to users.

Future instalments

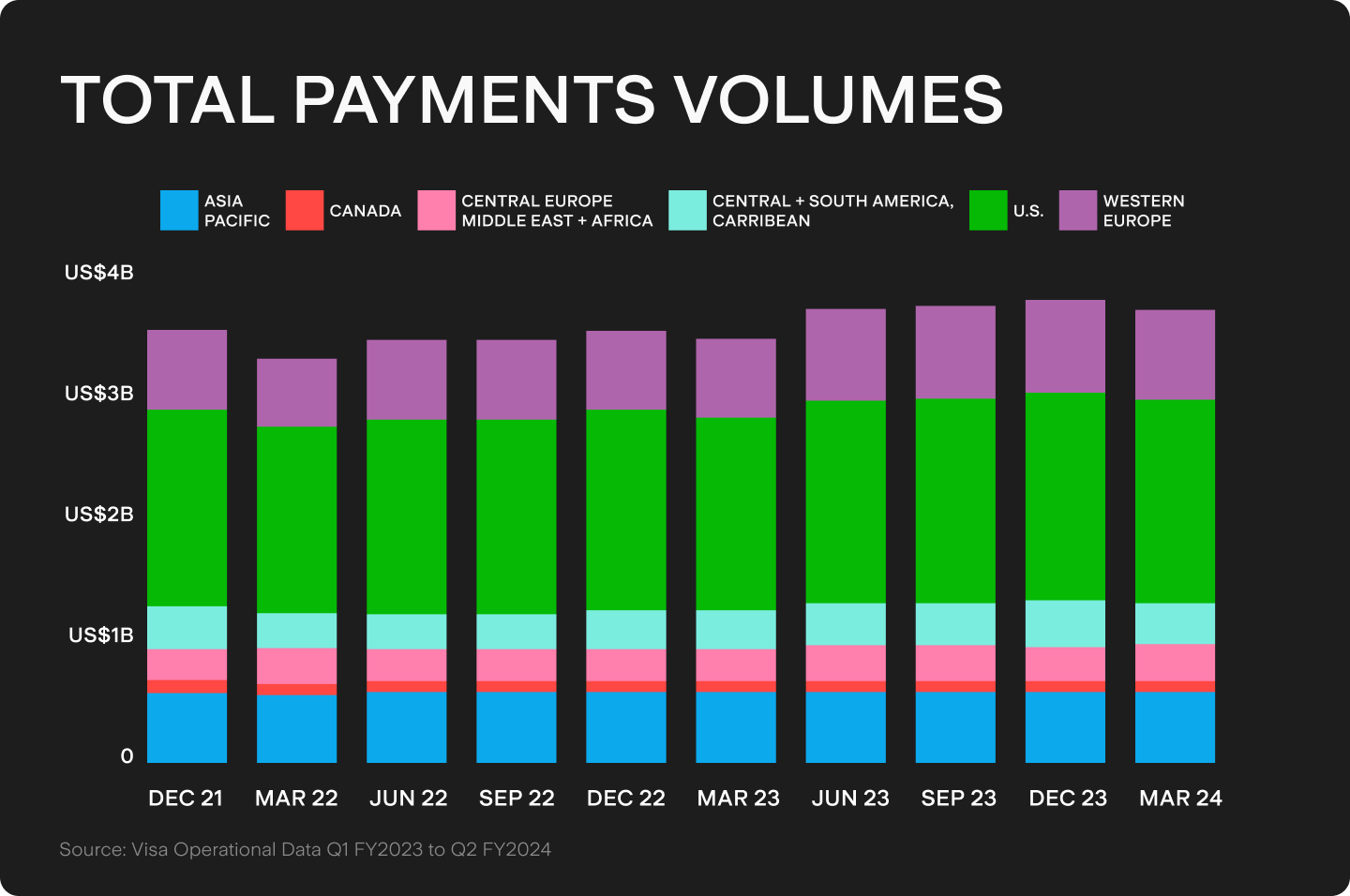

Despite a strong position in the industry, Visa is still affected by consumer spending patterns. Payment volumes in the U.S. and for cross-border actions appear to slow from February 2024. When considering the impacts of exchange rates, total growth in payment volumes fell 2% over the last quarter. A strong USD will continue to impact its international growth volumes, as well as country specific regulations for financial institutions.

Since 2023, Visa cards can be linked to China’s major mobile payment platforms, namely UnionPay, Alipay and WeChat Pay, but UnionPay is a clear leader in the country. India’s Rupay is another state-owned operator with a fighting chance. For most challengers, though, Visa’s vast existing infrastructure is very hard to compete with.

The dominance of Visa and Mastercard (which is only slightly smaller) over the payments sector brings its own concerns. The duopoly’s interchange fees are a sore spot, with many merchants complaining it costs too much to accept their cards. This has even been an issue for e-commerce titan Amazon ($AMZN). The current US$30b court case around swipe fees remains unresolved, but could shape Visa’s future. After all, to paraphrase their rival, a good reputation can be priceless.

This does not constitute financial advice nor a recommendation to invest in the securities listed. The information presented is intended to be of a factual nature only. Past performance is not a reliable indicator of future performance. As always, do your own research and consider seeking financial, legal and taxation advice before investing.

Megan is a markets analyst at Stake, with 7 years of experience in the world of investing and a Master’s degree in Business and Economics from The University of Sydney Business School. Megan has extensive knowledge of the UK markets, working as an analyst at ARCH Emerging Markets - a UK investment advisory platform focused on private equity. Previously she also worked as an analyst at Australian robo advisor Stockspot, where she researched ASX listed equities and helped construct the company's portfolios.

.jpg&w=3840&q=100)