Under the Spotlight Wall St: Dell Technologies Inc. (DELL)

One of the leading PC manufacturers in the world, Dell made reliable computers available for millions of businesses and households. But can it stay competitive? Let’s put it Under the Spotlight.

The computer industry has evolved tremendously from gigantic mainframes with punch cards to devices that can sit in the palm of your hand. This rapid advancement puts technology companies under constant pressure to stay ahead of the curve. Dell Inc. ($DELL) has been keeping up, growing from a dorm room startup to a global powerhouse.

Michael Dell was studying at the University of Texas at Austin when, in 1984, he saw an opportunity to create custom-built computers that could be sold directly to consumers. Existing computer retailers added inefficiencies and costs, so Dell envisioned a company that would bypass these middlemen. He founded what was then named PC's Limited, with US$1,000 in startup capital.

In 1985, the company released its first in-house designed computer, the Turbo PC. It proved popular, with a much lower price than IBM’s ($IBM) equivalent product at the time. Staying true to the original plan, the company expanded quickly in its early years via direct sales – with a commitment to customer satisfaction and competitive pricing.

Regular upgrades

This growth trajectory continued into the late 1980s. In 1988, the company went public and raised US$30m at a valuation of US$85m to officially become Dell Computer Corporation. Dell’s ability to maintain low inventory levels and have control over the supply chain to build computers became a hallmark of its operational strategy. This setup allowed it to respond quickly to market changes and consumer demands.

Throughout the 1990s, Dell diversified its product offerings to include servers, storage systems and networking products. The introduction of the Dell Dimension desktop computer and the Latitude business-focused notebook series further solidified its position in both the consumer and enterprise markets. Dell embraced the internet in the mid-1990s by launching an e-commerce website to streamline its sales process and reach a global audience.

Beyond PCs

Dell's strategy shifted in the early 2000s to recognise the growing importance of IT services beyond hardware. The firm embarked on a series of strategic acquisitions. The takeover of technology services firm Perot Systems in 2009 provided entry to the lucrative market of IT consulting and systems integration.

Another important acquisition was Alienware in 2006, which brought the popular gaming PC brand under Dell's empire and enabled them to capture part of this emerging segment. Also in the late 2000s, the rise of mobile devices posed a significant challenge to their PC-centric business model. Dell's response involved expanding its product range to tablets and smartphones, but it had limited success. The company eventually exited the smartphone business.

Facing increasing competition from low-cost PC manufacturers, particularly in emerging markets, Dell adopted a more cost-conscious approach to manufacturing and streamlined its operations. Still, for much of the 2010s, it struggled to regain its former foothold over the sector.

Setup restructure

In 2013, Michael Dell made the bold move of taking the company private in a US$24.9b buyout. The aim was to enable Dell to focus on long-term strategies, rather than having to focus on producing results for quarterly earnings reports. Dell again planned to strengthen its position through takeovers.

The acquisition of EMC Corporation for US$67b in 2016 was one of the largest deals in tech history at the time. The move turned Dell into a leader in data storage and information management, and created Dell Technologies: a diversified tech giant encompassing Dell, EMC, VMware, Pivotal, RSA and SecureWorks. This umbrella organisation established itself as a one-stop shop for PCs, data centres, servers, data storage and other services.

However, the large debt incurred for the acquisition became a serious problem and the company ended up going public again in 2018 to access additional funding. They also sold off VMware ($VWM) in 2021, with Dell’s 81% stake in the company valued at US$64b.

Further growth

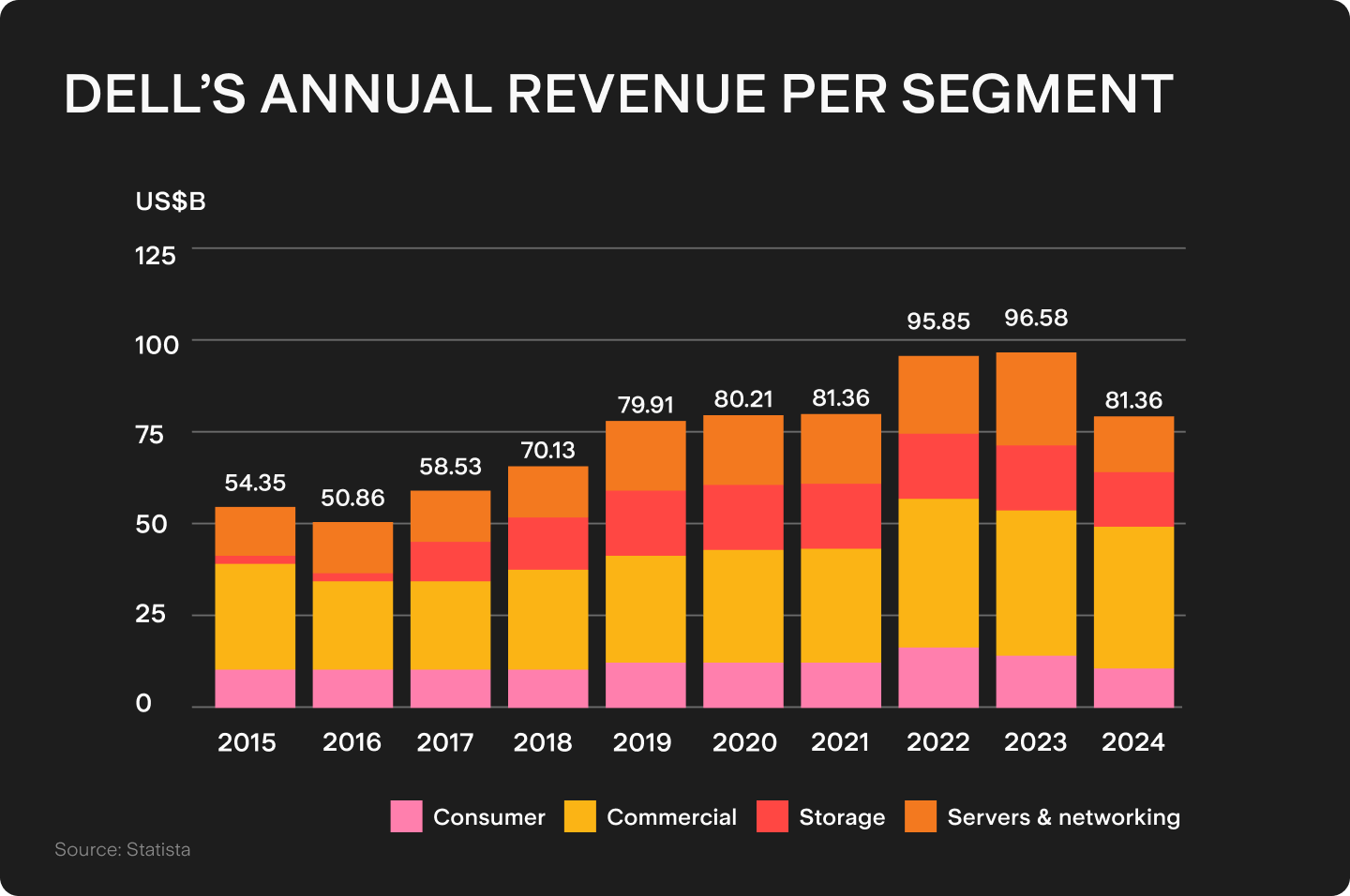

While revenues might have slumped in the mid-2010s, Dell’s numbers have improved since its second IPO. Computer sales to consumers have experienced moderate growth in the past ten years, rising from US$10.88b in 2015 to US$12.66b in 2023. Meanwhile, sales to businesses grew from US$28.75b in 2015 to US$45.56b over the same period. Storage revenue increased nearly eight-fold in that time, from US$2.35b to US$17.96b.

This has helped bolster profitability levels, with Dell reporting 23% gross margins and positive net income generation since 2020. Shareholders have benefitted from over US$2.1b in stock buybacks in the past couple of years. However, buybacks can also be taken as a signal of a lack of good investment or growth opportunities for companies.

Dell expects its total addressable market to reach US$2.1t by 2027 due to the rise of artificial intelligence capabilities, a growing demand for data centres and other software services. There are positive signs – for example, Dell’s market share in servers grew from 21% in 2012 to 31% in 2022 – but they face strong competition in this ongoing challenge to gain market share.

The firm’s debt remains a concern; despite declining significantly from the VMware days, the total still adds up to US$26b. Refinancing such a sum with current higher interest rates could be detrimental to a company’s financial health, particularly if it fails to reach growth targets. Dell’s board intends to maintain a maximum leverage rate of 1.5x and aims to deliver 3-4% annual revenue growth in the long-term. Can they continue to add to the system or will it require another reset?

This does not constitute financial advice nor a recommendation to invest in the securities listed. The information presented is intended to be of a factual nature only. Past performance is not a reliable indicator of future performance. As always, do your own research and consider seeking financial, legal and taxation advice before investing.

Rodrigo is a seasoned finance professional with a Finance MBA from Fundação Getúlio Vargas, one of Brazil's premier business schools. With seven years of experience in equities and derivatives, Rodrigo has a profound understanding of market dynamics and microstructure. Having worked for Brazil’s biggest retail algorithmic trading platform SmarttBot, his expertise focuses on risk management and the analysis, development and evaluation of trading systems for both U.S. and Brazilian stock exchanges.

.jpg&w=3840&q=100)