.jpg&w=3840&q=100)

Under the Spotlight Wall St: Keurig Dr. Pepper Inc. (KDP)

Keurig Dr. Pepper is a beverage colossus, boasting a portfolio of high profile brands that range from coffee to mocktails. But is the company still thirsty for more? Let’s put it Under the Spotlight.

The beverage industry is dominated by large conglomerates like The Coca-Cola Company ($KO) and PepsiCo ($PEP). While comparatively unknown outside of North America, Keurig Dr. Pepper ($KDP) is another major player there. The drinks giant was formed by the 2018 merger of Keurig Green Mountain and Dr Pepper Snapple Group, but the origins of these firms go back further.

The coffee business was initially named Green Mountain Coffee Roasters, established in 1981 as a specialty beans company in Vermont, U.S. Over time, it joined forces with Keurig, which had revolutionised the coffee industry with its single-serve pod technology, making brewing coffee fast and convenient.

On the other hand, Dr. Pepper traces its origins back to a Texan drugstore in 1885 and was one of America's first carbonated soft drinks. Like many competitors of old, Dr. Pepper was marketed as having medicinal properties. Advertising claimed the drink enhanced digestion and boosted energy, though what ultimately made it popular was its distinctive flavour.

.jpg&w=3840&q=100)

Joining forces

The deal that combined these two businesses was worth US$18.7b. Keurig Dr. Pepper (KDP) became home to some of America’s most beloved beverages, from its namesake brands to other soft drink titans that include Canada Dry, 7UP, A&W, Schweppes… plus 120 other labels either owned or operating in some kind of partnership with the business.

Expanding its products portfolio further, KDP distributes the bottled water Evian in North America, is responsible for the McCafe coffee pods and partners with C4 energy drinks. The company even sells Schweppes mocktails and non-alcoholic Athletic Brewing beer, which is the most popular option in its category in the U.S.

Despite this diversification, the core brands are still important contributors to the business. Keurig maintains its position as the best-selling single-cup coffee brand in America, keeping its lead over rivals J. M. Smucker ($SJM), as well as European heavyweight Nestlé’s ($NSRGY) Nespresso.

While Dr. Pepper had historically been North America’s third favourite soft drink, behind the cola flavours of Coke and Pepsi, it has recently overtaken Pepsi. There are two likely reasons: firstly, its 23 flavours in the U.S. caters to a wide variety of consumers. Secondly, building a strong distribution network has made it the most widely available beverage in restaurants, present in over 250,000 locations.

Growth prospects

One of the main objectives of the 2018 merger was to explore synergies between the two companies and expand the total addressable market (TAM) of the corporation. Currently, KDP estimates a TAM of US$300b in North America, split between soft drinks, bottled water, juice, energy drinks, coffee, ready-to-drink tea, sports drinks and ready-to-drink coffee – that’s in order of market size and economic importance to the firm.

Refreshing beverages are a key part of the business, accounting for US$9b in revenue in 2023. While the operational margin in beverages is 29%, the coffee unit has a higher measure of 33%, even if it ’only’ brings in US$4b in annual revenue. Luckily, the company estimates a US$42b coffee TAM for at-home coffee, not to mention ready-to-drink opportunities that could further enhance earnings.

KDP has a firm grip in North America, but its international sales remain limited. Extending only to Canada and Mexico, in 2023 these sales amounted to just US$2b in revenue, and profits are lower with operational margins of 26%. The higher purchasing power of American consumers is a major reason management focuses on expanding its operations within its home country.

Merger results

To date, KDP seems to be delivering on its merger targets. Annual revenue grew from US$11.12b in 2019 to US$14.81b in 2023, a 7.4% compound annual growth rate. The beverage giant claims to have achieved US$600m in cost synergies and improved return on invested capital by 1.8%.

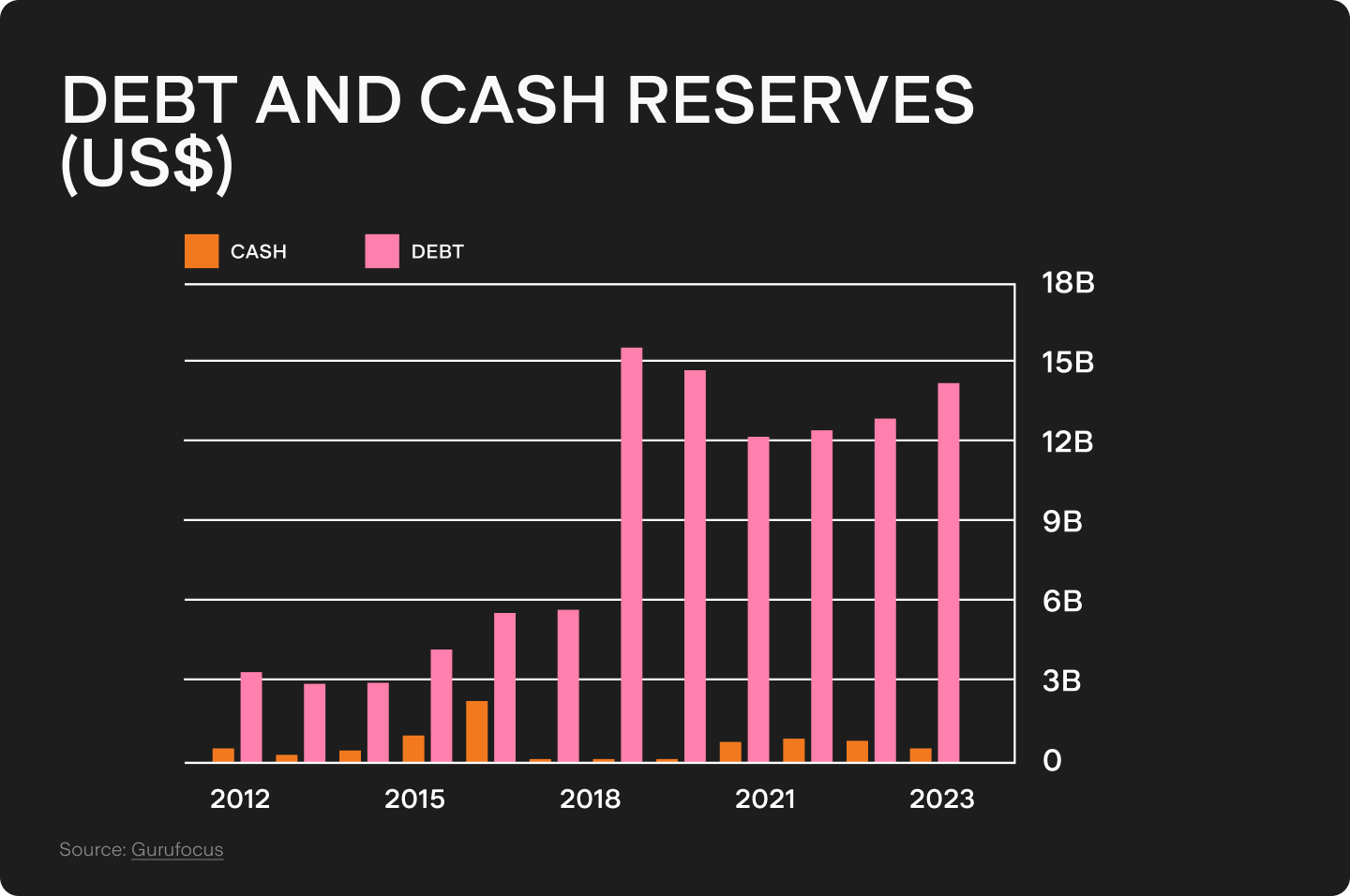

However, the deal also created a highly leveraged balance sheet. The US$15.99b debt incurred in 2018 has only slightly declined to US$14.82b in 2023. That’s despite increased income, with the net debt to EBITDA (earnings before interest, taxes, depreciation and amortisation) ratio going from 6.1x to 3.1x over the same period. Management aims to drop it even further in the long term, targeting the 2-2.5x range. Growing expenses, especially from marketing activities, could challenge this goal.

KDP is thirsty for more: for 2024 the company expects net sales to grow in the mid single digits, and earnings per share to rise to high single digits. But the biggest risk the company faces (besides their balance sheet) could be changing consumer behaviour. Carbonated soft drinks and sugary beverages are still a significant part of Keurig Dr. Pepper’s portfolio, but there is a growing shift towards healthier options with fewer artificial ingredients.

Further innovation and variety are likely to be needed to enable future growth. Perhaps even looking back to their roots of tasty drinks with health benefits, and making that more of a reality.

This does not constitute financial advice nor a recommendation to invest in the securities listed. The information presented is intended to be of a factual nature only. Past performance is not a reliable indicator of future performance. As always, do your own research and consider seeking financial, legal and taxation advice before investing.

Rodrigo is a seasoned finance professional with a Finance MBA from Fundação Getúlio Vargas, one of Brazil's premier business schools. With seven years of experience in equities and derivatives, Rodrigo has a profound understanding of market dynamics and microstructure. Having worked for Brazil’s biggest retail algorithmic trading platform SmarttBot, his expertise focuses on risk management and the analysis, development and evaluation of trading systems for both U.S. and Brazilian stock exchanges.

.jpg&w=3840&q=100)