What crypto stocks to watch in 2025?

The cryptocurrency sector is looking strong moving into 2025, with a growing number of companies involved in the ecosystem. These companies range from cryptocurrency exchanges and crypto miners to blockchain technology companies and traditional companies adopting blockchain. Consider these stocks if your exploring the crypto market.

Watch these cryptocurrency stocks closely in 2025

Company Name | Ticker | Share Price | 1Y Return | Market Capitalisation |

|---|---|---|---|---|

MicroStrategy Inc | US$325.46 | +576.1% | US$82.13b | |

Coinbase Global Inc | US$270.37 | +129.69% | US$67.69b | |

Block Inc | US$86.08 | +28.36% | US$53.35b | |

Robinhood Markets Inc | US$53.17 | +402.78% | US$47.00b | |

MARA Holdings Inc | US$16.80 | -0.18% | US$5.70b | |

Riot Platforms Inc | US$11.61 | +8.6% | US$3.99b | |

Core Scientific Inc | US$12.53 | +288.69% | US$3.50b | |

CleanSpark Inc | US$10.38 | +18.51% | US$2.92b | |

Hut 8 Corp | US$21.10 | +202.62% | US$2.10b | |

TeraWulf Inc | US$5.15 | +198.24% | US$1.99b |

Data as of 6 February 2025. Source: Stake, Google.

*The list of crypto stocks mentioned is ranked by market capitalisation. When deciding what stocks to feature, we analyse the company's financials, recent news, advancement in their timeline, and whether or not they are actively traded on Stake.

🎓Guide: How to invest in crypto without buying crypto→

Decide which is the best cryptocurrency company to invest in

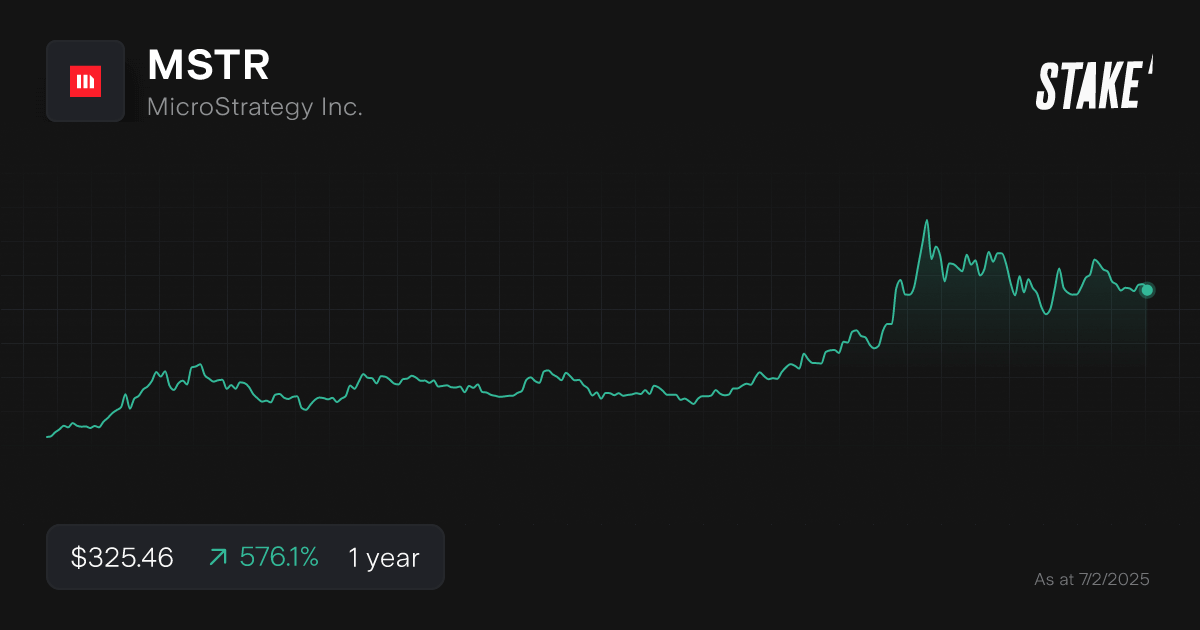

1. MicroStrategy Inc ($MSTR)

- 7,337 Stake customers watching

- 26,542 orders executed on Stake

MicroStrategy is an American software company founded in 1989 by Michael Saylor, specialising in enterprise analytics and business intelligence solutions. Today, it's better known for its Bitcoin treasury management strategy. With more than 460,000 BTC on its balance sheet, it's the largest corporate holder of Bitcoin.

The company began acquiring Bitcoin in 2020, and currently holds around 2.3% of the digital asset’s circulating supply. The firm funds these purchases primarily through stock sales and debt leveraging and has devised the BTC Yield metric to measure its BTC growth relative to share dilution. As of January 2025, MicroStrategy’s BTC Yield was 1.69% YTD.

MicroStrategy’s core software business is not profitable. In Q3 2024, the company’s total revenues decreased by 10.3% YoY to US$116.1m, while its gross profit margin reduced to 70.4%. But the company’s stock price is more correlated with the price of Bitcoin than its BI software counterparts. MicroStrategy shares outperformed Bitcoin by a margin of five times in 2024.

2. Coinbase Global Inc ($COIN)

- 16,373 Stake customers watching

- 58,017 orders executed on Stake

Coinbase is a leading cryptocurrency exchange platform founded in 2012 by Brian Armstrong and Fred Ehrsam. The platform offers users the ability to buy, sell, and trade over 250 different cryptocurrencies, making it the largest U.S.-based crypto exchange. Its US$86b Wall St debut via a direct listing on the Nasdaq was considered a ‘watershed moment’ for the crypto industry.

In 2023, Coinbase grew its subscription and services revenue by 78% YoY to US$1.4b and strengthened its balance sheet by reducing debt and increasing dollar-denominated resources. The exchange has been focused on growing its subscription revenue to reduce its reliance on trading volume, which takes a hit when the crypto traders are less active during market slumps.

In Q3 2024, Coinbase reported its seventh-consecutive quarter of positive adjusted EBITDA of US$449m. It recently brought back Bitcoin-back loans for U.S. users (outside the state of New York) and is likely to be on more product rollouts under a pro-crypto Trump administration.

3. Block Inc ($XYZ)

- 1,914 Stake customers watching

- 66 orders executed on Stake

Block, Inc. is a technology company founded in 2009 by Jack Dorsey and Jim McKelvey that provides financial services and digital payment solutions. Originally established as Square, Inc., the company rebranded to Block in December 2021 to reflect its expanded business portfolio and technological ambitions, which include its ambitions in digital asset infrastructure.

Dorsey, a well-known Bitcoin advocate, once said that he believes Bitcoin will ‘ultimately become the native currency of the internet.’[1] The firm has implemented a Bitcoin dollar cost average (DCA) purchase program, investing 10% of its gross profit from Bitcoin products into Bitcoin purchases. It has also made strides in crypto mining hardware through a partnership with mining firm Core Scientific.[2]

In Q3 2024, gross profit reached US$2.25b, marking a 19% YoY increase, with adjusted EBITDA growing US$477m over the same period to US$807m. However, its Bitcoin revenue (what it earns in fees from customers buying Bitcoin) was somewhat flat in the quarter. Bitcoin revenue accounted for $US$2.43b of the $5.98b in total revenue for Q3.

4. Robinhood Markets Inc ($HOOD)

- 62,279 Stake customers watching

- 13,006 orders executed on Stake

Robinhood Markets is a financial services company that revolutionised retail investing by offering commission-free trading to everyday investors. Founded in April 2013 by Vladimir Tenev and Baiju Bhatt, the company emerged from a mission to democratise financial markets and provide access to investing for people regardless of their wealth or background.

The Robinhood Crypto platform was launched in February 2018 and quickly became a popular destination for both newcomers and more experienced investors to trade crypto. Investors can start with as little as $1 for most cryptocurrencies, with the exception of Dogecoin which has a minimum purchase of 1 DOGE.

A friendlier approach to crypto regulation in the U.S. could see Robinhood expand its crypto offerings, potentially opening up new revenue streams. In Q3 2024, Robinhood reported a 72% YoY increase in transaction-based revenues to US$319m – revenue from crypto increased 165% YoY to US$61m.

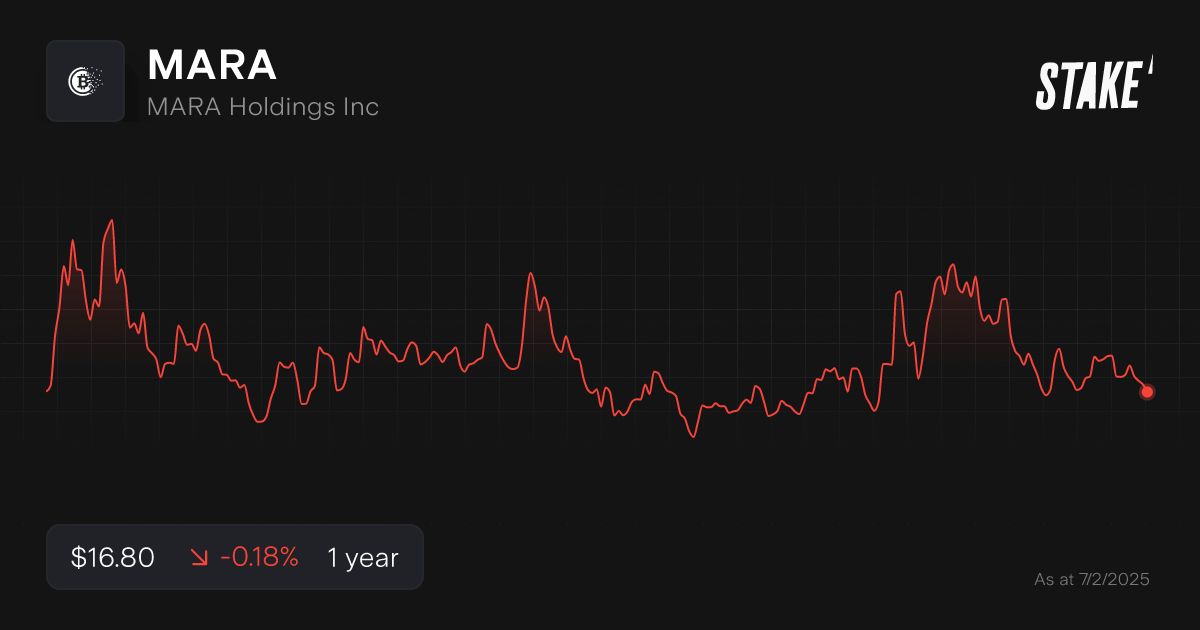

5. MARA Holdings Inc ($MARA)

- 6,455 Stake customers watching

- 62,010 orders executed on Stake

MARA Holdings, Inc. is a digital asset technology company headquartered in Fort Lauderdale, Florida. Founded in 2010, the company has evolved from its initial focus on uranium and vanadium exploration to become a prominent player in the Bitcoin mining industry.

MARA operates a large fleet of Bitcoin mining machines, boasting over 19,000 mining rigs with a hash rate of 3 EH/s (exahashes per second). It is recognised as one of the world's largest Bitcoin miners and holds the position of the second-largest corporate holder of Bitcoin after MicroStrategy. As of the end of Q3 2024, MARA owned 26,747 BTC.

In Q3, the firm also reported US$131.6m in revenue, up 35% YoY. However, it posted a net loss of US$124.8m, marking a significant decline compared to the US$64.1m in net profit earned in the same period the year before. MARA has also been diversifying into the AI sector, introducing a two-phase immersion cooling technology to slash the water consumption needed to cool AI infrastructure.

🆚 Compare MARA vs RIOT stock comparison→

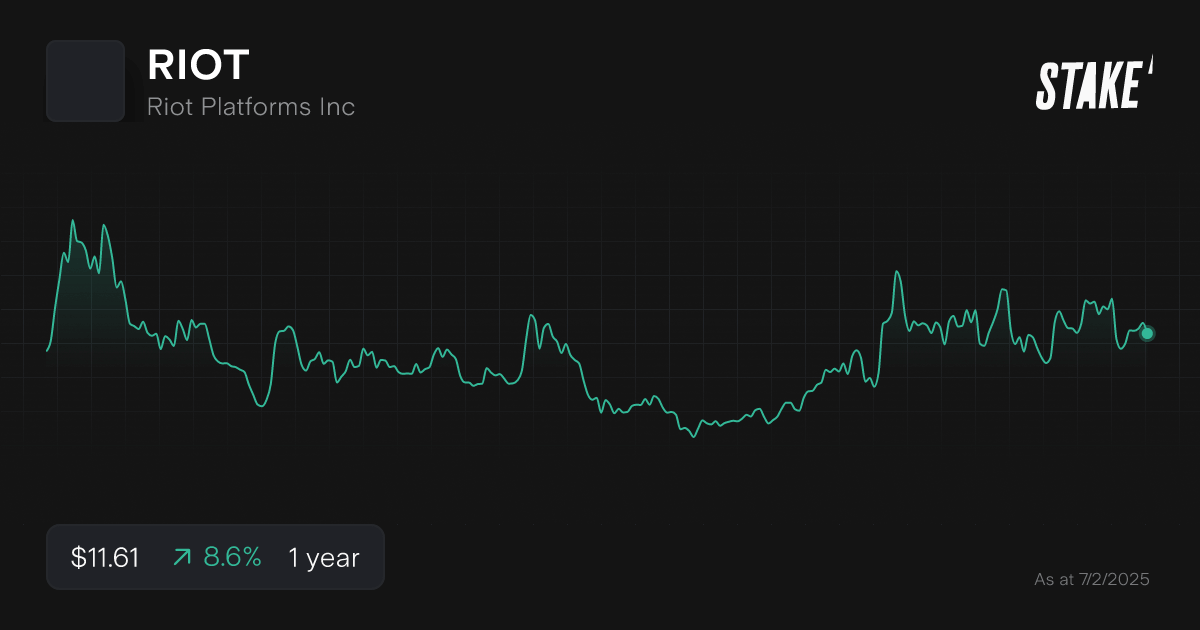

6. Riot Platforms Inc ($RIOT)

- 6,828 Stake customers watching

- 42,309 orders executed on Stake

Riot Platforms is a Bitcoin mining and digital infrastructure company headquartered in Castle Rock, Colorado. It was originally founded in 2000 as a biotech company called Bioptix, but made a dramatic pivot in October 2017 to the crypto mining industry, rebranding itself as Riot.

Riot Platforms uses application-specific integrated circuit (ASIC) chips to mine Bitcoin and provides critical mining infrastructure for institutional-scale clients. In Q3 2024, the firm reported US$84.8m in revenue, marking a 65% increase compared to the same quarter in 2023.

Like MARA, the highly competitive nature of Bitcoin mining has weighed on profit margins. The firm reported a net loss of US$154.4m, which represents a 241% widening of losses from the third quarter of 2023. Riot is also opting to diversify its operations outside Bitcoin mining alone, and has started repurposing existing infrastructure for high-performance computing (HPC) initiatives.

7. Core Scientific Inc ($CORZ)

- 260 Stake customers watching

- 458 orders executed on Stake

Core Scientific is a digital infrastructure company specialising in Bitcoin mining and high-performance computing. It operates nine data centres across North America and has been one of the top Bitcoin producers among publicly traded self-mining peers since 2021.

As of December 2024, Core Scientific operated approximately 164,000 owned bitcoin miners, representing a total energised hash rate of 19.1 EH/s. It has been transitioning some of its data centres to support AI-related workload. CEO Adam Sullivan said that the company expects ‘a relatively equal split’ between crypto mining and AI operations by 2025.

Core Scientific incurred a net loss of US$455.3m in Q3 2024, but has shown resilience by completing a US$460m convertible note offering and reducing its interest rates.

8. CleanSpark Inc ($CLSK)

- 1,424 Stake customers watching

- 11,002 orders executed on Stake

CleanSpark Inc. is a Bitcoin mining company that has positioned itself as a leader in the cryptocurrency and renewable energy technology sectors. The firm distinguishes itself through a strategic focus on sustainable and efficient Bitcoin mining operations. Its portfolio of mining facilities across the U.S. are predominantly powered by renewable energy sources like solar and wind.

The firm reported a 125% revenue increase in fiscal year 2024, while continuously investing in state-of-the-art mining technologies and strategic energy partnerships. It also managed to expand its hashrate from over 10 EH/s in early 2024 to more than 37.5 EH/s by year end, despite increased competition in the Bitcoin mining space.

The company reported a significant rise in adjusted EBITDA to US$245.8m, up from US$25m the previous fiscal year. Beyond Bitcoin mining, it also provides innovative energy technology solutions, including microgrid engineering and energy storage for military, commercial, and residential clients.

9. Hut 8 Corp ($HUT)

- 844 Stake customers watching

- 7,407 orders executed on Stake

Hut 8 Corp operates at the intersection of digital asset mining, high-performance computing, and energy infrastructure. It has a unique business strategy focused on profitable digital asset mining, high-performance computing, and yield programs that enhance the value of its self-mined Bitcoin reserves.

The firm operates eleven facilities across Canada using renewable energy sources like hydro and nuclear power. It also reported strong financial results for the third quarter of 2024, with revenue of US$43.7m. Net income of US$900,000, compared to a net loss of US$4.4m in the prior year period. Adjusted EBITDA for Q3 2024 was US$5.6m.

The energy cost per MWh to mine Bitcoin decreased to US$28.83, marking a 33% reduction from US$42.73 in the prior year period. Improved energy efficiency was a big contributing factor in the company's profitability.

10. TeraWulf Inc ($WULF)

- 242 Stake customers watching

- 1,781 orders executed on Stake

TeraWulf Inc. is a digital asset technology company focused on sustainable Bitcoin mining. Founded in 2021, the company has positioned itself as a leader in environmentally conscious cryptocurrency operations, focusing on leveraging zero-carbon energy sources for its mining activities.

It has recently expanded into AI and High-Performance Computing (HPC) sectors. It sold its stake in the Nautilus crypto mining facility for US$93m and formed a strategic alliance with Core42 to enhance its AI-driven computing capabilities.

In Q3 2024, the firm’s revenue reached US$27.1m, marking a 42.8% increase YoY. Operational self-mining capacity also doubled over the period to 10.0 EH/s. The company has been actively managing its capital structure, issuing US$122.5m in common stock, boosting equity but potentially diluting existing shareholders.

How to invest in crypto stocks in Australia?

The primary way to invest in cryptocurrency-focused companies is through shares listed on the Nasdaq and NYSE stock exchanges, using an online investment platform. Follow our step by step guide below:

1. Find a stock investing platform

To invest in crypto shares on the U.S. stock market, you'll need to sign up to an investing platform with access to Wall St. There are several share investing platforms available, of which Stake is one.

Get started with Stake

Sign up to Stake and join 750K investors accessing the ASX & Wall St all in one place.

2. Fund your account

Open an account by completing an application with your personal and financial details. Fund your account with a bank transfer, PayTo, debit card or even Apple/Google Pay.

3. Search for the company

Find the company by name or ticker symbol. It is advised to conduct your own research to ensure you are purchasing the right investment product for your individual circumstances.

4. Set a market or limit order and buy the shares

Buy on any trading day using a market order, or a limit order to delay your purchase of the asset until it reaches your desired price. You may wish to look into dollar cost averaging to spread out your risk, which smooths out buying at consistent intervals.

5. Monitor your investment

Once you own the shares, you should monitor their performance. Check your portfolio regularly to ensure your investment is aligning with your financial goals.

💡 Related: Explore the huge list of cryptocurrency ETFs

Types of crypto stocks

The crypto industry is still in its early stages, but an increasing number of publicly traded companies are becoming involved in some capacity. This involvement ranges from directly contributing to the ecosystem by developing infrastructure, to more passive engagement, such as storing a portion of their cash reserves in Bitcoin. These are some of the different types of crypto stocks:

Cryptocurrency exchanges: Companies like Coinbase that operate platforms for buying, selling, and trading cryptocurrencies.

Crypto mining companies: Firms such as Riot Platforms that are involved in the process of creating new cryptocurrency tokens through mining operations.

Blockchain technology companies: Businesses that develop and implement blockchain solutions for various industries.

Companies holding significant crypto assets: For example, MicroStrategy which has invested heavily in Bitcoin as part of its corporate strategy.

Crypto-focused investment funds: Exchange-traded funds (ETFs) that provide exposure to crypto-related companies, such as the Schwab Crypto Thematic ETF ($STCE)

Traditional companies adopting blockchain: Established firms integrating blockchain technology or cryptocurrencies into their operations. Recently, Morgan Stanley ($MS) said it was exploring the possibility of introducing crypto offerings.[3]

List of crypto ETFs

Here is a list of popular ETFs that engage in the cryptocurrency world in some capacity:

- Betashares Crypto Innovators ETF ($CRYP): This ASX fund that aims to track the performance of the Bitwise Crypto Innovators Index, providing exposure to global companies at the forefront of the crypto economy.

- Schwab Crypto Thematic ETF ($STCE): This U.S-based ETF provides exposure to companies that may benefit from crypto-related activities, including mining, investing, or trading cryptocurrencies.

- VanEck Digital Transformation ETF ($DAPP): This ETF tracks the MVIS Global Digital Assets Equity Index, focusing on companies involved in the digital transformation of the global economy.

- BlackRock iShares Bitcoin Trust ($IBIT): This spot Bitcoin ETF broke several ETF-related records and clocked US$38b inflows worth of inflows since launch.

- Fidelity Wise Origin Bitcoin Fund ($FBTC): This ETF ranks second after IBIT and remains popular because of its low expense ratio of 0.25%.

💡 Related: 12 Spot Bitcoin ETFs to Watch Right Now

Crypto stocks FAQs

Investing in cryptocurrency carries higher risk due to the highly volatile nature of some tokens, lack of regulatory clarity in certain geographies and a lack of the same level of consumer protections that traditional financial instruments typically have.

Crypto is a high-risk, high-reward investment. While it has the potential for outsized returns, it’s important to do thorough research, understand the risks, and only invest money you can afford to lose. Diversifying your investments and not putting all your money into crypto can help mitigate some of the risks.

Disclaimer

The information contained above does not constitute financial product advice nor a recommendation to invest in any of the securities listed. Past performance is not a reliable indicator of future performance. When you invest, your capital is at risk. You should consider your own investment objectives, financial situation and particular needs. The value of your investments can go down as well as up and you may receive back less than your original investment. As always, do your own research and consider seeking appropriate financial advice before investing.

Any advice provided by Stake is of general nature only and does not take into account your specific circumstances. Trading and volume data from the Stake investing platform is for reference purposes only, the investment choices of others may not be appropriate for your needs and is not a reliable indicator of performance.

$3 brokerage fee only applies to trades up to $30k in value (USD for Wall St trades and AUD for ASX trades). Please refer to hellostake.com/pricing for other fees that are applicable.

Article sources

[1] Block Q1 2024 Shareholder Letter

[3] Morgan Stanley CEO Ted Pick says bank will work with U.S. regulators on offering crypto

Samy is a markets analyst at Stake, with seven years of experience in the world of investing, working across roles in private banking, venture capital and financial media. She has a Master’s degree in Finance and Data Analytics from The University of Sydney Business School.