The SMSF audit process: What's involved?

SMSF accounts need to be checked by an auditor on an annual basis to ensure they comply with the relevant superannuation laws and regulations. It’s an important annual task required for all SMSF.

Why are SMSF audits necessary?

To ensure compliance with the rules, the Australian Taxation Office (ATO) as the regulator of SMSFs places reliance on the work of SMSF auditors.

An SMSF audit is a legal requirement that provides an independent opinion on whether your SMSF is keeping records correctly and that its assets are maintained solely for members’ retirement benefits. The auditor checks if your SMSF remains compliant with the law.

The compliance status of your SMSFs can affect their ability to make new investments. SMSF tax concessions on contributions, income on your investments and the payment of lump sums or benefits can be disallowed if your SMSF doesn't comply with the law.

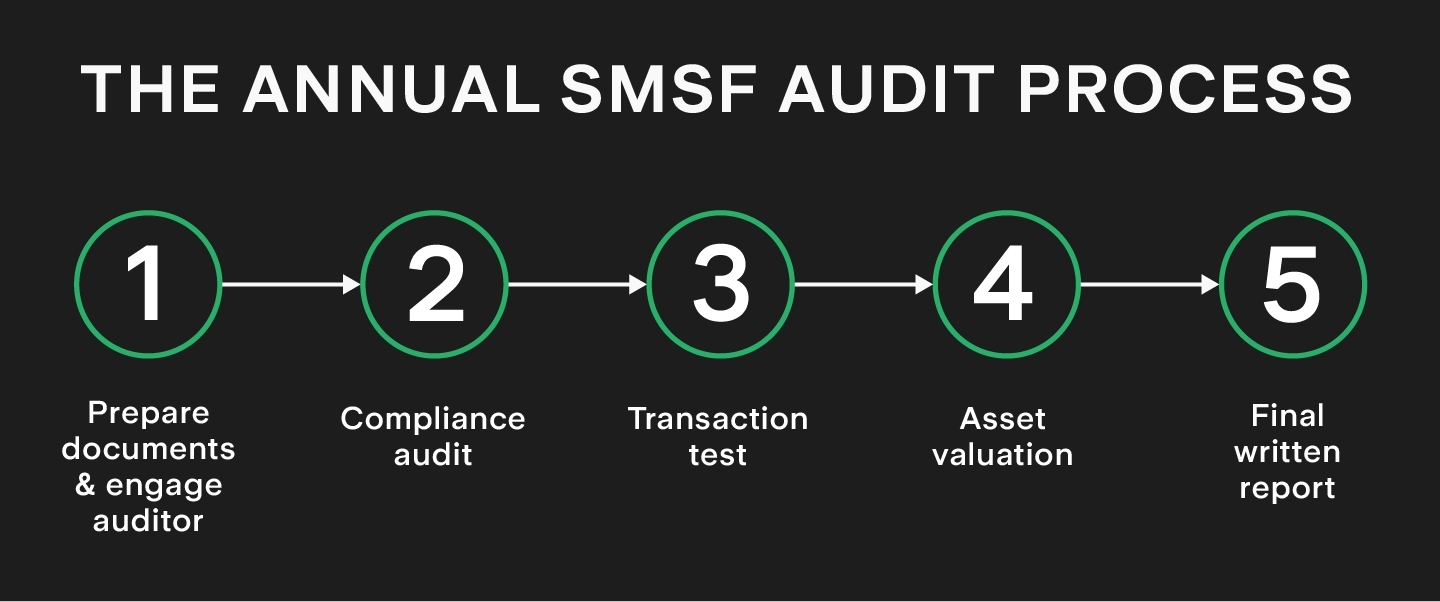

Steps in the SMSF audit process

The SMSF audit involves a comprehensive review of the financial statements and operational aspects of the fund. Auditors need to confirm that the information in the SMSF’s documents is an accurate reflection of reality.

The audit process usually encompasses two main aspects: financial and compliance.

The financial audit focuses on the SMSF’s financial statements to make sure they meet Australian Auditing Standards and represent the financial position of the fund.

The compliance audit confirms that the fund adheres to superannuation legislation.

The steps for the auditing process are broken down below:

1. Preparation

The independent SMSF auditor will ask the fund trustees (or administrator) for the necessary financial and supporting documents.

2. Compliance audit

The SMSF auditors check whether the information in these documents follows the relevant superannuation rules. Some elements they will assess are the fund structure, record keeping, ownership of assets, if all transactions are on standard commercial terms, SMSF investment strategy, contribution rules and benefit payments.

3. Transaction test

The auditor then examines the SMSF's financial records in detail, including the transaction register, bank statements, and investment portfolios. The transaction records need to be accurate and valid to comply with the relevant legislation and adhere to the SMSF's investment strategy.

4. Asset valuation

The auditor will work through relevant documentation and perform their own independent testing to ensure assets within the fund are accurately valued and exist. For listed equities this process is straightforward however for property and unlisted assets the process is more complex with a range of documentation required to prove the accuracy of the stated asset value.

5. Reporting

After completing all these checks, the auditor will provide a written report to the SMSF trustees. The report will detail if the SMSF is compliant with the relevant legislation or if not, should identify any non-compliance issues and provide recommendations on how to rectify them if needed.

🎓 Related: Learn more about what is required to manage SMSF compliance

How long does the audit process take?

Providing all required documentation to an auditor will be unique to each SMSF however once the auditor receives all the required documentation, they have 28 days to complete a report that will be submitted to the Australian Taxation Office (ATO).

What documents will I need for an SMSF audit?

The final list of documents will vary depending on the specific circumstances of an SMSF (including the investments held) however here are a few items that are generally needed:

- Financial statements that provide an overview of the fund's positions. These include the balance sheet, income statement, and cash flow statement.

- Bank statements to verify the accuracy of transactions in the financial statements.

- Investment statements that give details of the fund's holdings and ownership, usually for shares, managed funds and in some cases, property.

- Evidence to support the market value of investments, for instance, a valuation report for property.

- Minutes of trustee meetings that record their decisions and show the fund's being managed in accordance with the relevant regulations.

- A trustee declaration demonstrating that they’re compliant with superannuation laws.

- Member statements summarising the contributions and withdrawals made by members during the financial year, and their current balances.

It’s best to consult with your auditor to determine the exact requirements for your SMSF.

For example, SMSFs that have both accumulation and pension accounts also require an actuarial certificate that shows the income allocated to each member. According to the ATO, if your SMSF auditor requests more information, it must be provided within 14 days.

Who can audit an SMSF?

SMSF audits need to occur every year by an ASIC-registered SMSF auditor that meets Australian auditing standards. The auditor needs to be independent of the tax accountant and fund administrator preparing the financial statements.

Trustees also can't audit their own SMSF fund or that of an immediate family member.

SMSF audit and your SMSF annual return

SMSFs must lodge an Annual Return which includes a regulatory and tax return for the fund. It should include the details of contributions received from members and the fund balance. It's still required even if you've made no contributions and the fund hasn't paid out any benefits during a financial year.

The SMSF trustees must appoint an approved auditor at least 45 days before the fund’s annual return to the ATO is due. Some information from the audit report is required to complete your SMSF's annual return. The ATO can also reject annual returns that are completed incorrectly and financial penalties may apply when lodging the tax return late.

How much does an SMSF audit cost?

The cost of an SMSF audit varies depending on your provider and which auditor is used. Some providers will charge a separate annual audit fee and annual accounting fee, others include the audit fee within the latter cost. The degree to which the process is automated and the complexity of your investments can affect the final fee.

According to the latest data from the ATO, the average SMSF audit fees in 2022-2023 were $640. Comparatively for Stake Super customers, the audit fee is included in our annual administration fee of $990 which also includes SMSF set-up, ongoing administration and annual accounting and submission of the tax return.

How does the audit process work with Stake Super?

At Stake Super, we have streamlined the audit process to significantly reduce the administrative burden on trustees.

For customers that hold all of their SMSF investments on the Stake investing platform, we manage all of the above administrative tasks including the preparation of documents and engagement of an independent auditor so you are only engaged once the audit has been completed and the audited EOFY statements are ready for review and approval to be submitted as part of the fund’s annual return (which we also manage on your behalf).

For customers that hold some of their SMSF investments off the Stake platform (Stake Super Property and Plus customers), the process is the same however we will request that members provide the relevant documentation for any off-platform assets (for example, equities not on Stake, unlisted investments, property, etc).

Speak to a specialist

Want to know more about Stake Super or have questions? Speak to one of our SMSF professionals.

This is not financial product advice, nor a recommendation that a self-managed super fund (‘SMSF’) may be suitable for you. Your personal circumstances have not been taken into account. SMSFs have different risks and features compared to traditional superannuation funds regulated by the Australian Prudential Regulation Authority (‘APRA’). Stake SMSF Pty Ltd, trading as Stake Super, is not licensed to provide financial product advice under the Corporations Act. This specifically applies to any financial products which are established if you instruct Stake Super to set up an SMSF. When you sign up to Stake Super, you are contracting with Stake SMSF Pty Ltd who will assist in the establishment and administration of an SMSF under a ‘no advice model’. You will also be referred to Stakeshop Pty Ltd to enable your trading account and bank account to be set up in order to use the Stake Website and/or App. For more information about SMSFs, see our SMSF Risks page.

Ciara is a Commercial Manager at Stake Super, with over 10 years of experience in the SMSF industry and an MA in Accountancy and Finance from Heriot-Watt University in Edinburgh, United Kingdom. Having previously worked at a chartered accounting firm and one of the largest SMSF administrators in Australia, Ciara has extensive knowledge of SMSF compliance. She is also a current member of the SMSF Association.

.jpg&w=3840&q=100)