SMSF PAYG Instalments: What are my PAYG obligations?

Pay-as-you-go (PAYG) refers to a kind of income tax payment made at regular intervals during the financial year to account for the expected tax on income generated by an SMSF.

What is PAYG?

Pay-as-you-go (PAYG) refers to a kind of income tax payment. They’re usually regular payments made during the financial year to account for the expected tax on income generated by an SMSF. The Australian Taxation Office (ATO) introduced PAYG to make it easier for entities to manage their cash flows, rather than having to plan for large bills after lodging an annual return.

How do PAYG instalments work?

An SMSF’s actual tax liabilities are determined at the end of the financial year as part of the fund’s annual return. The PAYG instalments paid during the year are credited against the actual amount due and then it is assessed whether more tax is payable or a refund is required.

PAYG is often paid in quarterly instalments, but some taxpayers might have options for two payments or one annual instalment.

🎓Learn more: Comprehensive guide on SMSF tax and everything you need to know

How is PAYG calculated?

The ATO relies on the most recent annual tax assessment to estimate the SMSF tax liability for the following financial year. However, it may not reflect the present financial situation of the SMSF and the numbers will vary each year depending on the performance of assets in the fund.

For example, if Smith SMSF had a tax liability of $12,000 in FY23, in FY24 each quarterly PAYG tax payment will be estimated at $3,000 (0.25 x $12,000).

If at the end of FY24 Smith SMSF generated greater income leading to a tax liability of $14,000, the fund will have an outstanding tax liability of $2,000 payable as part of their FY24 annual return.

Likewise, if Smith SMSF generated less income in FY24 than in FY23, the fund would be owed a tax refund of the difference between the $12,000 in PAYG paid and the (lower) actual FY24 tax liability.

Is PAYG applicable in the first year?

SMSFs are not required to pay PAYG in the first year. Instead, at the end of the first year SMSFs will be required to pay one annual tax bill (or receive a refund) as part of their annual return.

When the first year’s tax return is lodged, an SMSF will enter the PAYG system and moving forward, PAYG instalments will be based on the preceding year’s tax bill.

Why do I have to pay PAYG instalments?

As SMSFs usually receive employer or concessional contributions and generate investment income through capital gains, interest dividends or rent, they need to pay income tax. Earnings are generally taxed at a concessional rate of 15%, but can differ if one or more members has commenced pension phase.

While superannuation does have tax incentives, it still comes with income tax responsibilities and PAYG instalments are how an SMSF’s tax bill is paid.

Can I vary my PAYG amount or opt out?

The returns of and potential benefits paid out from an SMSF can change each year and shifts in these amounts will affect the overall annual tax liability. If you know that the current year’s tax liability is going to be different for a variety of reasons (e.g. retirement, significant change in investments/strategy), you can change your payment amount via the activity statement sent from the ATO (for non-Stake Super customers) or by contacting the Stake Super team to do so on your behalf (for Stake Super customers).

Significantly underestimating an SMSFs payments could lead to a large lump sum payment for the year or even potential financial penalties. The ATO discourages changes for those who are unsure about the impact of changes to their SMSFs financial situation, as any overpaid instalments will be refunded to the SMSF after the tax return is lodged.

☎️ If you have more questions, book a call with our SMSF specialists to get your questions answered.

Speak to a specialist

Want to know more about Stake Super or have questions? Speak to one of our SMSF professionals.

Will I receive a PAYG instalment notice?

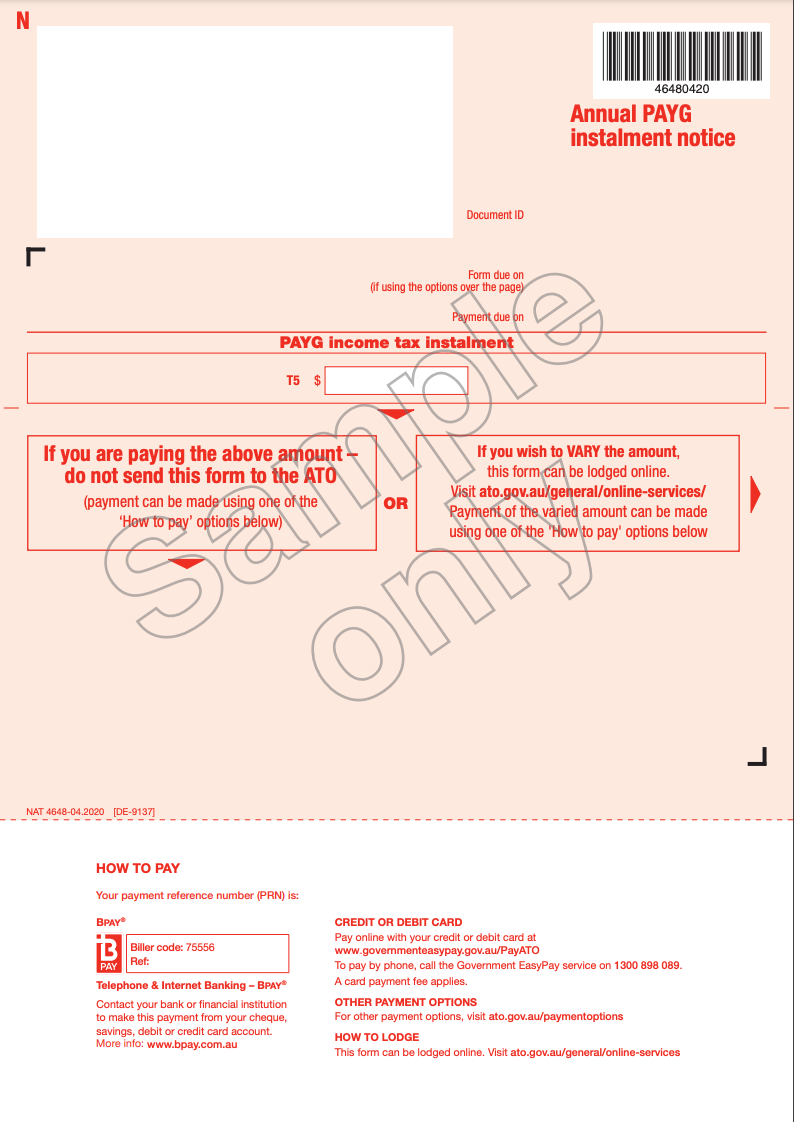

The ATO notifies those who need to pay PAYG instalments and informs them of the rates which determine the instalment amount. They will be sent quarterly activity statements (example below), which include a due date for lodgement and a PAYG instalment amount if relevant.

As Stake Super acts as the tax agent for all Stake Super customers, we will track any upcoming lodgements and lodge the SMSF activity statements on your behalf.

We will also arrange the payment of the PAYG instalment to the ATO before the due date as long as there are sufficient funds in customer accounts to cover the payment amount.

When are PAYG Instalments due?

Payment due dates for PAYG installments are generally 28 days after the end of each quarter (e.g. September quarter installment is due for payment before 28th October).

Quarter | Period | Due date |

1 | July - September | 28 October |

2 | October - December | 28 February |

3 | January - March | 28 April |

4 | April - June | 28 July |

SMSF PAYG Instalments FAQs

What's the difference between PAYG withholding and PAYG instalments?

The PAYG instalments refer to what amounts the SMSF pays through the financial year towards its income tax obligations. PAYG withholding refers to the tax withheld from benefit payments made to SMSF members when the member is under age 60, receiving an untaxed pension or has not provided TFN”. These figures could depend on their personal income tax obligations.

Can my SMSF pay PAYG instalments annually?

The option to make annual PAYG instalments is possible for SMSFs in certain situations. The SMSFs latest notional tax assessment should be estimated to amount to less than $8,000.

I received a PAYG activity statement, what do I need to do?

What to do when you receive a PAYG activity statement varies depending on if you are responsible for managing the administration of your SMSF or if you are a Stake Super customer.

If you are a Stake Super customer

You will receive activity statements from the ATO by mail or email via your MyGov inbox, however, you DO NOT need to do anything with these.

We will track any upcoming lodgements and lodge your SMSF activity statement as well as arrange the payment of the PAYG instalment to the ATO before the due date on your behalf.

The only requirement is to ensure adequate funds are available in your Stake AUD account to cover the PAYG payment.

If you are NOT a Stake Super customer

If you are responsible for managing the administration of your SMSF, you are required to complete the quarterly PAYG activity statements and also make the PAYG instalment payments prior to the due date.

Information correct as of 10 March 2025, you should always refer to the Australian Taxation Office website for any changes to the administering of PAYG tax.

This is not financial product advice, nor a recommendation that a self-managed super fund (‘SMSF’) may be suitable for you. Your personal circumstances have not been taken into account. SMSFs have different risks and features compared to traditional superannuation funds regulated by the Australian Prudential Regulation Authority (‘APRA’). Stake SMSF Pty Ltd, trading as Stake Super, is not licensed to provide financial product advice under the Corporations Act. This specifically applies to any financial products which are established if you instruct Stake Super to set up an SMSF. When you sign up to Stake Super, you are contracting with Stake SMSF Pty Ltd who will assist in the establishment and administration of an SMSF under a ‘no advice model’. You will also be referred to Stakeshop Pty Ltd to enable your trading account and bank account to be set up in order to use the Stake Website and/or App. For more information about SMSFs, see our SMSF Risks page.

Ciara is a Commercial Manager at Stake Super, with over 10 years of experience in the SMSF industry and an MA in Accountancy and Finance from Heriot-Watt University in Edinburgh, United Kingdom. Having previously worked at a chartered accounting firm and one of the largest SMSF administrators in Australia, Ciara has extensive knowledge of SMSF compliance. She is also a current member of the SMSF Association.

.jpg&w=3840&q=100)

.jpg&w=3840&q=100)