How to set up an SMSF in Australia?

Setting up an SMSF can seem like an unappealingly involved and complicated process. However, it doesn’t have to be.

Setting up your own SMSF can seem like a daunting and confusing task.

Continue reading to understand the basic steps the Australian Taxation Office (ATO) set out and then how Stake Super can support and significantly streamline the process.

What is an SMSF?

A self-managed super fund, or SMSF, is a trust run for the sole purpose of providing retirement benefits to its members. Essentially, it's a private super fund managed by you.

🎓Learn more: Comprehensive guide on what an SMSF is and how it works

How to set up an SMSF?

Setting up a self-managed super fund can seem like a very complicated and involved process. However, the partner you choose to provide professional advice helping you set up and manage your SMSF can lead to significantly varied customer experiences - some far more seamless than others.

See how Stake Super does the SMSF set-up heavy lifting for you below.

How do I open a self-managed super fund?

Below is a brief summary of the steps to set up an SMSF as detailed by the ATO:

1. Choose an SMSF structure

SMSFs can be a single member fund or a multi-member fund (up to 6 people) and have an individual or corporate trustee structure.

2. Appoint trustees

Individual trustee structure must have two trustees whereas a corporate trustee structure has a company that acts as the SMSF trustee, of which one or two members act as directors of the trustee.

3. Create a trust deed

Your trust deed is the foundational legal document that forms the fund’s governing rules however importantly, it cannot override the law.

4. Check your fund qualifies as an Australian super fund

Your SMSF needs to be an Australian super fund by satisfying 3 residency conditions regarding set-up, central control and member residence.

5. Hold assets

To be legally established, an SMSF needs to hold some initial assets.

6. Register your SMSF

Once legally established, a fund must register by applying to the ATO for an ABN and TFN.

7. Set up a bank account

Set up a fund bank account that will keep all money and assets separate from any personal or business finances.

8. Get an electronic service address (ESA)

An ESA ensures that employers know where to send contributions to correctly reach your fund.

9. Create an investment strategy

Prepare and follow an investment strategy for your SMSF.

Speak to a specialist

Want to know more about Stake Super or have questions? Speak to one of our SMSF professionals.

How does Stake Super manage the SMSF set-up process?

Stake Super is a full-service SMSF administrator that significantly streamlines all administrative requirements - especially the above steps to setting up an SMSF.

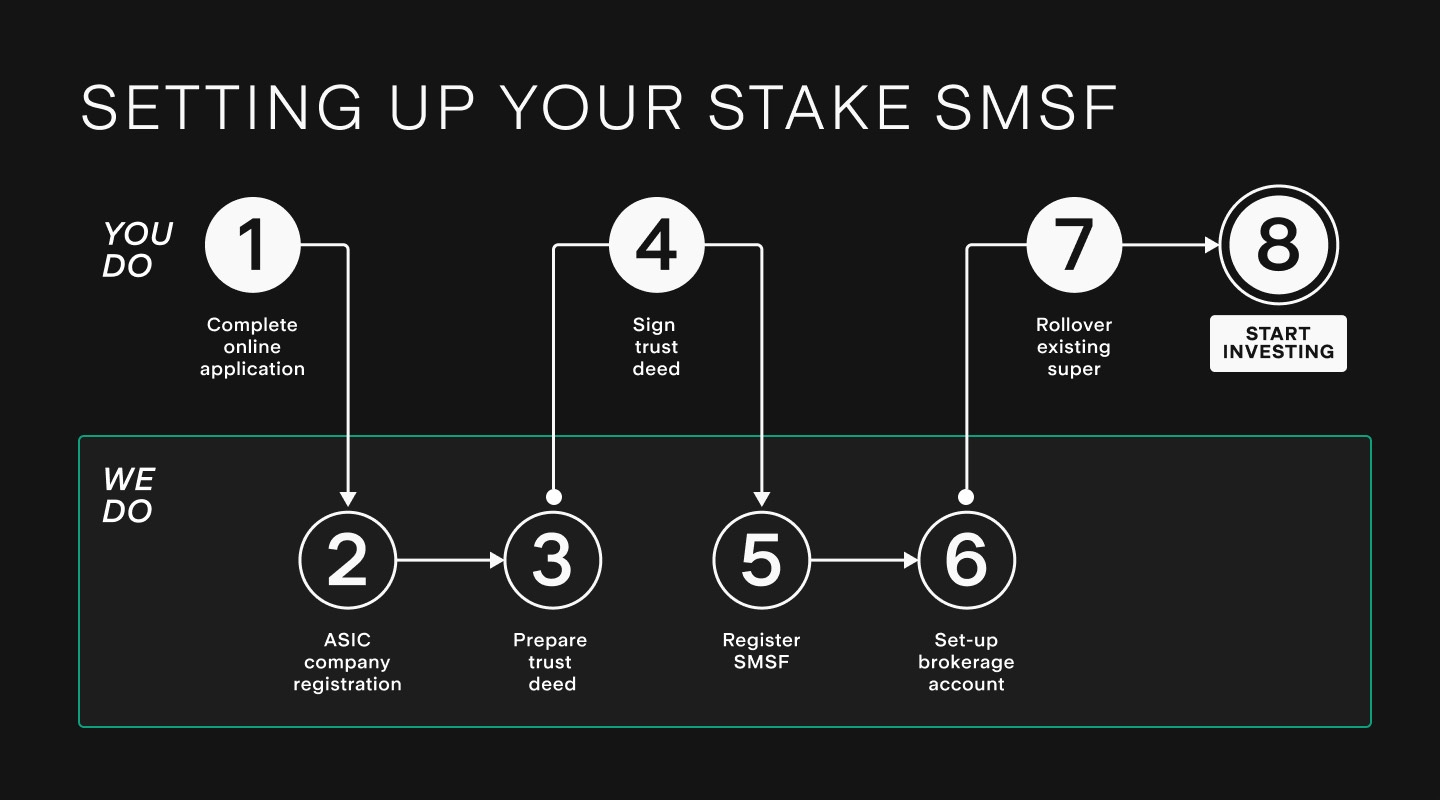

So how does set up work with Stake Super*?

1. (You) Complete online application

Complete our online application in minutes including anyone's details beyond yourself who will also be a member of the fund.

2. (We) Set-up & register company with ASIC

All Stake Super SMSFs are set up as corporate trustees in order to provide the maximum flexibility for fund members and the protection of SMSF assets.

3. (We) Prepare trust deed

Once we receive your Australian Company Number (ACN) from ASIC, we prepare your SMSF trust deed which includes the information provided by you in the application form to ensure the fund qualifies as an Australian super fund.

4. (You) Receive and sign trust deed

The trust deed is sent to you and any other directors of the corporate trustee electronically for review and e-signature.

5. (We) Register SMSF with the ATO

Once we receive the signed trust deed, we register the SMSF with the ATO by applying for an Australian Business Number (ABN) and Tax File Number (TFN).

6. (We) Set-up your brokerage account

Once the ATO confirms the fund has been registered we will go ahead and set up your Stake Super brokerage account which plays two roles:

- The account AUD holdings is your SMSF bank account

- The account gives you access to seamlessly invest your super in over 12,000 stocks and ETFs on the Stake platform.

7. (You) Rollover existing super

We will prompt you to complete a rollover request via our online request form. Once we receive this, we will work with your existing super provider(s) to process the rollover.

8. (You) Start investing

As mentioned above, as soon as your Stake Super brokerage account is set up you are free to take control of your super and invest in over 2,500 ASX stocks & ETFs and over 9,500 US stocks & ETFs.

*Some SMSF applications may require additional documentation or information based on your individual circumstances and any requests from ASIC or the ATO however the above is the set up process the vast majority of Stake Super SMSF funds experience.

What investment options are available in an SMSF?

With some limited exceptions, an SMSF provides you with the freedom to invest in almost anything. Start with the more common investments such as:

- Cash

- Stocks

- ETFs

- Managed funds

- Property

Through to less common investments including:

- V/C funds

- Start-ups

- Precious metals

- Cryptocurrency

- Collectables and much more.

🎓 Learn more: See how you can use your SMSF to buy an investment property→

What are the advantages and disadvantages of an SMSF?

A self-managed superannuation fund has a range of unique benefits.

The best known is flexibility and control however, there are also several other benefits of SMSFs that members can leverage to maximise their retirement savings, this includes things like asset protection, estate planning, tax strategies, borrowing and much more.

Read more about the SMSF benefits to see if setting up an SMSF is the right investment decision for you.

What are the rules and regulations of an SMSF?

Self-managed super funds are regulated by the Australian Taxation Office (ATO) and the Australian Securities and Investment Commission (ASIC). Running an SMSF comes with a lot of administrative tasks which is generally why most SMSF trustees appoint SMSF-trained accountants or specialised administrators like Stake Super to manage the administration and compliance of their funds.

Make sure you are across the rules and regulations and understand the SMSF compliance responsibilities.

How is a SMSF audited each year?

An ASIC registered auditor must audit an SMSF on an annual basis. An independent auditor examines the validity and accuracy of an SMSF's financial records and makes sure that the fund is compliant with the rules and regulations that SMSF trustees are required to adhere to. The SMSF audit process also provides an independent opinion on whether the fund’s records are kept correctly and satisfies the sole purpose test.

Is a SMSF right for you?

Historically SMSFs were seen as only being relevant for the older and very wealthy. Today however, thanks to increased access, financial knowledge and lower costs, there is a shifting trend toward younger people looking to take control of their financial future - of which their superannuation forms a significant chunk.

They may not be for everybody, however, so it's important to understand the associated responsibilities and seek financial advice if necessary to determine if the product is right for you.

If you don't think you have enough super to open a SMSF, then refer to our article about how much you need to start an SMSF.

This is not financial product advice, nor a recommendation that a self-managed super fund (‘SMSF’) may be suitable for you. Your personal circumstances have not been taken into account. SMSFs have different risks and features compared to traditional superannuation funds regulated by the Australian Prudential Regulation Authority (‘APRA’). Stake SMSF Pty Ltd, trading as Stake Super, is not licensed to provide financial product advice under the Corporations Act. This specifically applies to any financial products which are established if you instruct Stake Super to set up an SMSF. When you sign up to Stake Super, you are contracting with Stake SMSF Pty Ltd who will assist in the establishment and administration of an SMSF under a ‘no advice model’. You will also be referred to Stakeshop Pty Ltd to enable your trading account and bank account to be set up in order to use the Stake Website and/or App. For more information about SMSFs, see our SMSF Risks page.

Ciara is a Commercial Manager at Stake Super, with over 10 years of experience in the SMSF industry and an MA in Accountancy and Finance from Heriot-Watt University in Edinburgh, United Kingdom. Having previously worked at a chartered accounting firm and one of the largest SMSF administrators in Australia, Ciara has extensive knowledge of SMSF compliance. She is also a current member of the SMSF Association.