Guide to buying property with a SMSF: Pros and Cons [2025]

Having the opportunity to purchase property using super funds is one of the perks of having an SMSF. Read through the advantages and potential drawbacks of buying property with an SMSF, the types of properties you can buy, how financing works and tax considerations.

Investing in property with a self-managed super fund (SMSF) can be a tax-effective way to build your retirement savings. The Australian Taxation Office (ATO) reports that in 2020, 10% of SMSFs invested in residential properties, while 11.5% of them held commercial properties.

In this blog we'll walk you through the potential advantages and drawbacks of buying property with an SMSF, the types of properties you can buy, how financing works and the taxation involved.

How does buying property in an SMSF work?

SMSFs allow you the freedom to invest in either residential or commercial property. To decide on which one suits your SMSF investment strategy, it is essential to have an understanding of the specific opportunities and limitations associated with each option.

Residential property vs. Commercial property

An SMSF is able to purchase any residential property, provided that the trustees remain at arm's length from the investment – that is the property cannot be purchased from or rented to, entities that any of the trustees may have a personal relationship with.

Additionally, trustees cannot move an already-owned residential investment property into an SMSF – even by way of the SMSF purchasing it at fair market value.

On the other hand, SMSF commercial property investment does not adhere to all the residential property regulations. Trustees are permitted to buy and sell commercial real estate to their SMSF at market value, and also have the option to rent it to their own business or any related party, as long as it is set at market rate rent and paid in full by the due dates.

Whether you ultimately choose to invest in commercial or residential property within your SMSF, the primary objective should be to achieve long-term financial gains that support members' retirement goals.

How much money do I need in my SMSF to buy property?

Like buying property outside a self-managed superannuation fund, trustees are allowed to purchase it either with the cash accumulated in the SMSF or by a combination of cash and debt.

Contrary to popular belief, there is no minimum SMSF balance to be eligible to buy property provided the fund can cover any necessary upfront and ongoing property expenses (e.g. stamp duty, loan repayments, other taxes, etc).

In the case of borrowing to invest in property within an SMSF, there are often additional requirements or hurdles to clear given the unique nature of the SMSF loan known as the limited recourse borrowing arrangement (LRBA).

✅ Related: What is the First Home Super Saver Scheme?

What is a Limited Recourse Borrowing Arrangement (LRBA)?

A limited recourse borrowing arrangement is a lending structure requirement by the ATO for any situation where SMSF trustees choose to borrow money from a third party for the purpose of purchasing an asset. While this may sound intimidating or complex, LRBAs actually exist to protect the assets of SMSF trustees.

A separate property trust and trustee are established to hold the property on behalf of the SMSF, outside of the SMSF structure. This helps to ensure that the asset purchased with borrowed funds is held separately from the SMSFs other assets, providing an additional layer of protection for the SMSF and its members in the event of a default.

Once the property purchased using the LRBA is fully paid off, the legal ownership of the property may be transferred to the SMSF. At this point, the separate property trust and trustee established for the LRBA are no longer required and can be closed.

Tax implications on buying property with your SMSF

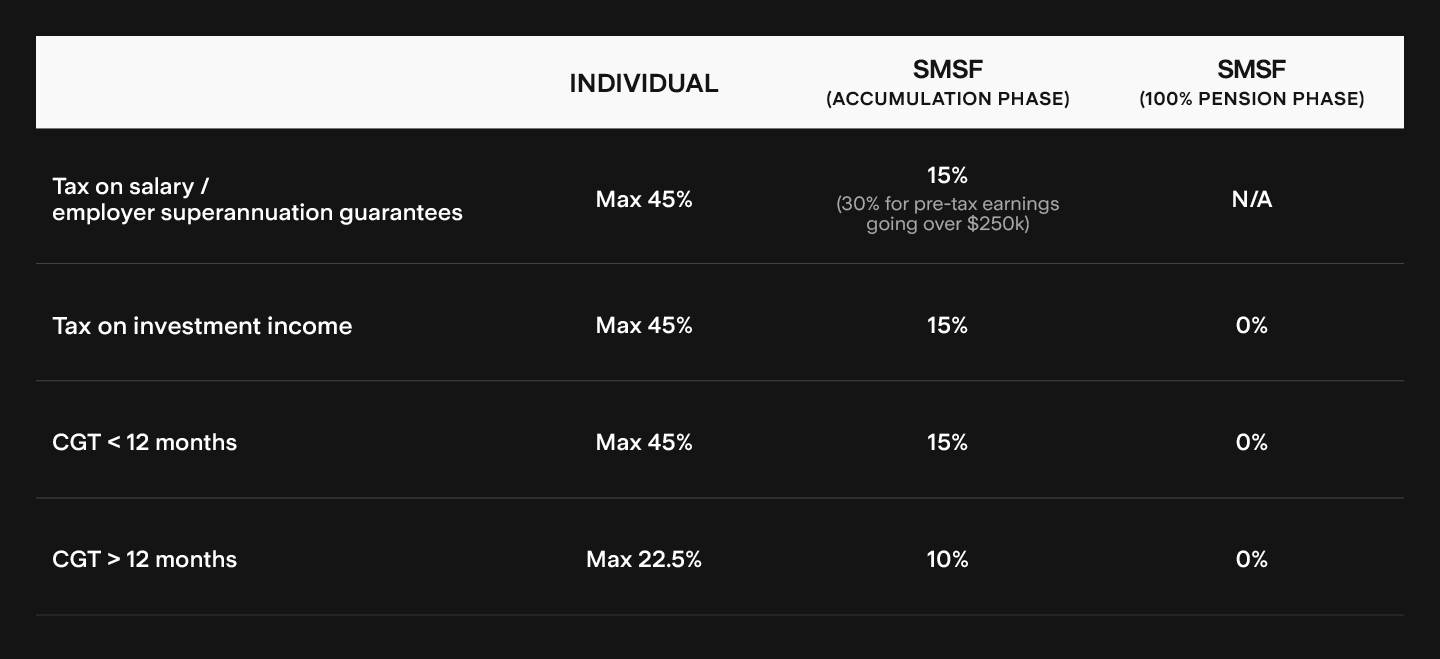

One of the primary tax implications of an SMSF property investment is rental income. Any rental income received from the property is considered taxable income for the SMSF, and is taxed at the SMSFs applicable tax rate - typically 15% for the accumulation phase and 0% for the pension phase (refer to the table below).

Another tax consideration is capital gains tax (CGT). If the SMSF sells the property at a profit, CGT will be payable on the gain. If the property is held for at least 12 months, the SMSF is eligible for a CGT discount of 1/3, lowering the contribution tax rate from 15% to 10%. The SMSFs applicable tax rate applies to any capital gain. Similar to the taxation on rental income, capital gains on the sale generally become tax-free if the property is sold during the pension phase. See the table below for details.

Certain expenses associated with owning the property, such as interest payments on the loan used to purchase the property, property management fees, and repairs and maintenance costs, are generally tax deductible for the SMSF.

However, it's important to note that any expenses that are not considered necessary or reasonable may not be deductible.

N.B. This is general information only and does not take into account your personal tax needs, circumstances or objectives. We recommend seeking independent tax advice before making any investment decisions.

Speak to a specialist

Want to know more about Stake Super or have questions? Speak to one of our SMSF professionals.

What are the pros and cons of investing in property with a SMSF?

Having read through the above, you may already have an idea of the different opportunities and limitations of SMSF property investment. Nonetheless, below are some general pros and cons of purchasing properties using an SMSF.

Pros:

- Investment opportunities: SMSF property investing allows you the control to specifically select the property you want to purchase.

- Limited recourse: ATO-mandated LRBAs when taking out a loan for your asset purchase offer strong legal protection for your other SMSF assets.

- Potentially lower tax: This factor is highly dependent on your circumstances, however, the tax concessions on super, including but not limited to: super concessional contribution tax capped at 15%, discount on capital gains tax and tax-free income and capital gains during pension phase, is hard to beat outside of super.

Cons:

- Challenges in obtaining financing: Due to their highly regulated and specific nature, LRBAs have become relatively difficult to obtain compared to property financing outside of super. The big 4 banks in Australia for example, have not offered SMSF lending since 2018. The limited selection of lenders may have higher loan-to-value ratios, higher interest rates, and even restrictions on the specific property they would issue a loan for.

- Exposure to regulatory risk: Most super benefits revolve around government regulations, which means that trustees have more exposure to the effects of their changes. For example, the continuing increase in pension age. Other factors relying on regulation include super taxation, LRBA, concessional contribution caps and mandatory employer contributions.

- Less flexibility: Other than the arm’s length transaction and LRBA requirements, trustees may also find less freedom in the ability to alter the structure of their SMSF mortgage and may also be prohibited from altering their investment property until the loan is paid off. Additionally, all costs associated with purchasing and maintaining the property must come from within the SMSF, potentially becoming a challenge if the SMSF lacks the necessary funds.

Can I purchase a property with a Stake Super SMSF?

Yes! Our Stake Super Property package ($1,690/year) allows an SMSF to hold property - including residential and commercial property. Our specialist SMSF accountants and tax agents are well versed in managing the administration of SMSFs that hold property on both an ongoing basis and also managing the end of financial year process including accounting, auditing & tax.

For trustees looking to purchase a property using a loan, we can also provide a Bare Trust deed and company registration services as required for an LRBA. For more information on this or any other questions about investing an SMSF in property, book a call with one of our specialists here.

This is not financial product advice, nor a recommendation that a self-managed super fund (‘SMSF’) may be suitable for you. Your personal circumstances have not been taken into account. SMSFs have different risks and features compared to traditional superannuation funds regulated by the Australian Prudential Regulation Authority (‘APRA’). Stake SMSF Pty Ltd, trading as Stake Super, is not licensed to provide financial product advice under the Corporations Act. This specifically applies to any financial products which are established if you instruct Stake Super to set up an SMSF. When you sign up to Stake Super, you are contracting with Stake SMSF Pty Ltd who will assist in the establishment and administration of an SMSF under a ‘no advice model’. You will also be referred to Stakeshop Pty Ltd to enable your trading account and bank account to be set up in order to use the Stake Website and/or App. For more information about SMSFs, see our SMSF Risks page.

Ciara is a Commercial Manager at Stake Super, with over 10 years of experience in the SMSF industry and an MA in Accountancy and Finance from Heriot-Watt University in Edinburgh, United Kingdom. Having previously worked at a chartered accounting firm and one of the largest SMSF administrators in Australia, Ciara has extensive knowledge of SMSF compliance. She is also a current member of the SMSF Association.