Limited Recourse Borrowing Arrangement for SMSFs

Understand the workings of a limited recourse borrowing arrangement (LRBA) for an SMSF, including the set up and managing the arrangement to enhance retirement investment strategies.

What is a limited recourse borrowing arrangement?

A limited recourse borrowing arrangement (LRBA) is a strategic financial mechanism allowing self-managed super fund trustees to borrow for investment purposes. First introduced as 'Investment Warrants' in 2007 and later refined under a legislation amendment in 2010, LRBAs enable SMSFs to sidestep a general prohibition on borrowing, offering a pathway to asset acquisition.

Central to an LRBA is the lender’s limited recourse rights. In a typical lending scenario, a borrower's default exposes multiple assets to the lender's recovery efforts.

With an LRBA, the lender's claim is strictly confined to the purchased asset, often held in a separate trust. Thus, the SMSF’s other assets remain shielded, making LRBAs a unique borrowing structure.

LRBAs must be used to purchase a single acquirable asset or a collection of identical assets of equivalent market value, primarily favouring commercial property investments but can also extend to shares and certain managed funds.

The LRBA structure ensures the SMSF retains a beneficial interest and secures legal ownership once the loan is repaid. Despite borrowing barriers, lenders frequently demand personal guarantees to mitigate risk.

What is a ‘single acquirable asset’?

A 'single acquirable asset' is an asset an SMSF trustee(s) can acquire without breaking SMSF regulations. It can be any identifiable asset, such as property, shares, or collectables that must be managed as one entity. Collections of identical assets with the same market value, like units in a trust or shares of a single class, can qualify if purchased under a single arrangement.

The key is their indivisibility in transactions or legal constraints. The term 'single acquirable asset' should be understood based on the usage perspective, rather than its legal perspective.

Example from SMSFR 2011/D1: Farmland operated over multiple titles should be viewed as a 'collection of identical assets'. It is recommended that 'multiple titles' be viewed as a 'collection of assets' and hence a 'single acquirable asset' where the asset is used as one asset.

What types of assets can be purchased through a borrowing arrangement?

Through a borrowing arrangement, a self-managed super fund can invest in various assets, such as:

- Commercial and residential property

- Shares

- Managed funds

- Bullion

- Collectables

It’s crucial to adhere to the LRBA rules. These stipulate the acquisition of a ‘single acquirable asset’. Borrowed funds are restricted to purchasing and maintaining the asset, prohibiting any enhancements or improvements.

🎓 Learn more: What can I invest in with my SMSF?→

How does the LRBA structure work?

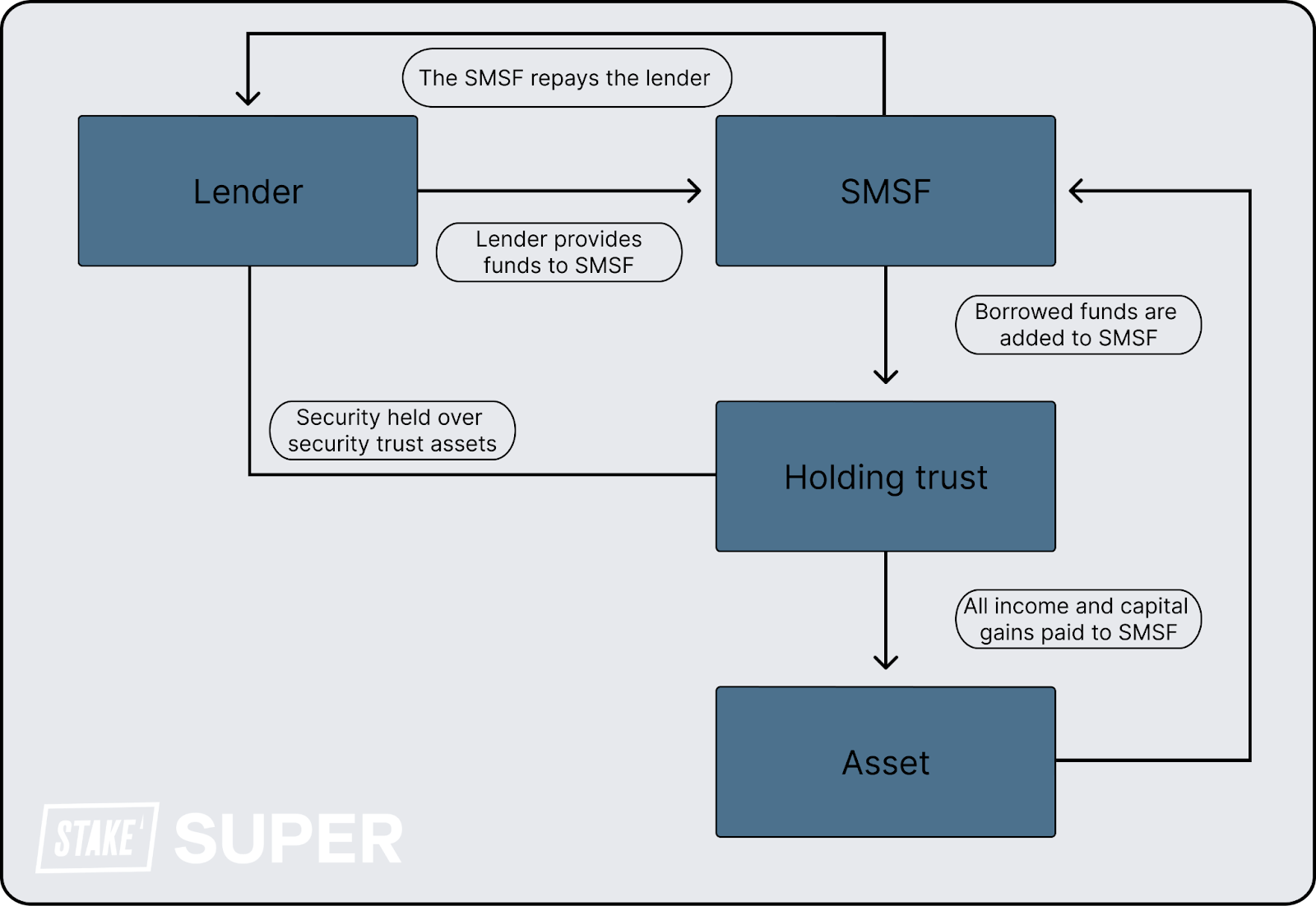

An LRBA structure is broken down into these roles:

SMSF Trustee

- Chooses an investment to be acquired

- Secures the limited recourse loan with a lender

- Sets up a holding trust

- Manages the investment's finances and loan repayments e.g. pays a deposit on the chosen investment from the bank account of the SMSF

Holding Trustee

- Buys the asset under the holding trust

- Is the legal owner and holds the asset until the asset has been sold or the loan is paid off

Lender

- Offers financing which could be from either related or commercial entities

An LRBA ensures that only the asset acquired is secured for the loan, safeguarding other SMSF assets. This is the sole method for SMSFs to borrow within the legal framework, specifically as governed by the Superannuation Industry (Supervision) Act 1993.

This diagram provides an overview of how the average structure of an SMSF limited recourse borrowing arrangement is set up:

Establishing the bare trust

When establishing a bare trust for a limited recourse borrowing arrangement, compliance with specific legal requirements is important. The SMSF trustee(s) must possess a beneficial interest and the right to acquire legal ownership of the asset upon repayment. This asset should be the lone property of the holding trust, often known as a custodian or bare trust.

Complex trust structures like discretionary or unit trusts don't meet these criteria. The holding trust's role is purely custodial – it holds the property's legal title without operational responsibilities, such as lodging tax returns or maintaining assets like bank accounts.

Typically established by deed, its trustees can be individuals or a company, distinct from the SMSF trustee. Companies acting as trustees reduce administrative hassles during trustee changes.

Lenders often insist on a corporate trustee for both the SMSF and the holding trust, ensuring streamlined operations and compliance.

Maintaining, repairing and improving an asset under a LRBA

With specific rules governing what funds can be used for each process, an understanding of maintaining, repairing and improving an asset under an LRBA is essential.

Maintaining

Maintaining an asset within an LRBA involves performing necessary actions to ensure the asset remains in functional order. Maintenance is distinct from repair as it refers primarily to prevention – anticipating and addressing defects, damage, or deterioration before they occur.

While both maintenance and repair activities can utilise borrowed funds, any action beyond restoring the original state – such as enhancements significantly altering function or value – could be deemed improvements, which different rules govern.

Repairing

When assets require restorative work, repair intervention is permissible under an LRBA. Repairs focus on bringing an asset back to a state of operational integrity, correcting issues caused by wear and tear, damage, or decay. The primary rule here is that borrowed funds can be used for such restorative activities, provided they do not transform the asset into something fundamentally different from its initial acquisition.

Improving

Improvements cannot be financed with borrowed money under an LRBA. Instead, such upgrades must be covered by the SMSFs cash resources or additional contributions made to the SMSF. Improvements might include extensive renovations that alter a property's utility or value – adding a new room, installing a swimming pool, or upgrading facilities.

Renovations or improvements altering an asset’s essential qualities violate LRBA rules, especially transforming it into a 'different asset'.

Setting up an LRBA for your self-managed super fund

An LRBA can give you a chance to increase your retirement funds but it’s not something to dive into without proper planning and guidance. Below is a step-by-step guide on how to set up an LRBA to ensure you navigate the process correctly.

Evaluate borrowing suitability Begin by determining if acquiring the asset through an LRBA aligns with your SMSF's strategy. Ensure the borrowing won't compromise your fund’s liquidity and its ability to meet ongoing obligations.

Check your trust deed Confirm that your SMSF trust deed permits borrowing. If it doesn’t, you may need to amend it—consult a legal expert if necessary.

Revise the SMSF investment strategy Review and, if required, revise your investment strategy to accommodate the acquisition and borrowing. The strategy should reflect the fund's objectives, risk appetite, and liquidity issues related to the new investment.

Identify the investment asset Pinpoint an investment that complies with the Superannuation Industry (Supervision) (SIS) Act's regulations. If buying from a related party, get an independent valuation to confirm the market value.

Arrange loan pre-approval Secure a pre-approval from a lender, which might require confirmation from a financial advisor affirming that the LRBA strategy suits your circumstances. Most commercial lenders prefer a corporate trustee for the SMSF and holding trust.

Seek legal and tax advice Before signing any contracts or paying deposits, obtain advice from a legal or tax professional in the asset’s location. This prevents unexpected stamp duty issues and ensures compliance with local procedures.

Prepare LRBA documents Have your LRBA documents prepared, which will include forming a security trustee, drafting contracts for the asset purchase, creating the security trust deed, and drawing up a loan agreement.

Execute the purchase contracts Exchange contracts in the name of the security trustee. Double-check with a legal advisor that all documents are correctly executed and reference the appropriate parties.

Complete the purchase Finalise the asset's purchase using funds from the SMSF and the borrowed amount. Make sure this transaction meets LRBA rules.

Stamp the holding trust deed If necessary, have the holding trust deed stamped by the appropriate stamp duty authority to ensure legal compliance.

In the lifecycle of your LRBA, remember that loan repayments will come out of the SMSF's account, and you should maintain a cash flow sufficient to cover these obligations. Once the loan is repaid, you can transfer legal ownership of the asset to the SMSF.

Through careful management and professional guidance, an LRBA can prove to be a strategic move towards broadening your SMSF's portfolio and optimising your investment outcomes.

What does Stake Super provide for the LRBA set-up?

Stake Super provides support during the set-up, handling the borrowing arrangement documents including:

- Stake Super provides support with the preparation of Officers’ and Members’ consents to establish a corporate trustee company for the bare trust.

- Registration of the corporate trustee company with ASIC, prepare constitution and associated minutes and resolutions.

- Amendment to Investment Strategy, Deed of Establishment for the Holding Trust, Trust Establishment Minutes, and LRBA Explanatory Document.

What is not included in the LRBA set up?

Stake Super does not provide the following services:

- Stamping of the signed deed.

- Certification of the signed deed.

What is checked when auditing an SMSF with an LRBA?

Auditors will request and check these documents. Since we handle the full annual audit, Stake Super will request these documents:

Document | Description |

|---|---|

Signed fund trust deed | Auditor will check that borrowing is allowed |

Signed bare trust deed | Auditor will check that the contents covers the LRBA requirements |

Signed loan agreement | Auditor will check that the conditions in the contract meet the LRBA rules |

Signed personal guarantees | Auditor will check limited to recourse of the asset being bought |

Signed lease agreements | Auditor will check that the rent is at market rate on an arm’s length basis |

Expenses invoices where material | Auditor will check if improvements were made through drawdowns |

Loan statements | Auditor will look at the account in debit balance or evidence of more drawdowns |

Purchase contract | Auditor will check the single acquirable asset |

Property title search | Auditor will check that the mortgage exists to financier only and is in the holding trust name |

Independent valuation | Auditor will check if purchased from a related party vendor |

Insurance policy | Auditor will check if the correct property is insured at reasonable value |

What are the benefits of an LRBA?

Chance to improve returns

LRBAs can enhance an SMSF’s potential returns by enabling investment in high-growth assets. With a smart investment strategy, LRBAs contribute to a robust financial portfolio that supports income generation during retirement.

Option to transfer a business premises

A solid option for small and medium-sized business owners wanting their business premises within their SMSF. Provides control over the investment and the chance to earn market rate rent, potentially with concessional tax benefits.

Tax benefits

Super tax concessions mean only 10% tax if a property is sold before the pension phase, dropping to no tax once the pension phase begins. Interest and borrowing expenses are typically tax deductible, lowering the SMSF’s tax burden.

Refinancing

An existing LRBA can be refinanced. This may reduce default risk if a fund struggles to meet repayment obligations, such as due to benefit payments. Additionally, refinancing offers the opportunity to secure more favourable terms as conditions evolve. Seeking professional advice is recommended when dealing with refinancing.

Asset protection

Super is a protected asset in cases of bankruptcy or business downturn, offering additional financial security.

Diversification

LRBAs enable SMSFs to hold a mix of assets, reducing risk and potentially increasing returns. By borrowing, SMSFs can access broader asset classes like commercial or residential property, larger volumes of shares, land and more.

Flexible lender options

Flexibility in lender choice; loans can come from banks, family, partners, or even fund members. Repayments are typically covered by contributions and investment earnings within the SMSF, maintaining financial flow.

Considerations of setting up an LRBA

Limited resource borrowing arrangements come with their own set of risks that SMSF trustees must evaluate carefully. Here's a breakdown of things to consider:

Legislation and technicalities

- Ensure the fund's trust deed permits LRBA borrowing.

- Be clear on what qualifies as a 'single acquirable asset'.

- Understand how lending affects super thresholds and member balances.

- Navigate the nuances between repairs, improvements, and maintaining the asset's character.

- You can utilise the property for business purposes, paying market rent to your SMSF.

Financial and personal

- Events like death, disablement, or divorce could result in the necessity to sell the asset or risk default.

- Market downturns or property-specific depreciation can diminish asset value.

- SMSF regulations evolve, potentially impacting borrowing conditions, asset ownership, and tax obligations.

- Maintain enough fund liquidity to ensure loan repayments.

- Losses can't offset taxable income external to the fund.

Borrowing guidance

- Only one asset or identical assets batch can be acquired per borrowing arrangement.

- Assets serve as loan security and are held in a trust until repayment.

- Borrowing funds cannot be used for asset improvements, only repairs.

Loan conditions

- Expect lower loan amounts and higher interest rates compared to personal loans.

- Incorrectly set loans might necessitate asset sale or cause losses to the SMSF.

It’s important to seek professional LRBA advice

If you need further information apply via the ATO and request specific SMSF advice.

You can also speak to a Stake Super professional to learn more about setting up an LRBA with your SMSF, book a call below.

Speak to a specialist

Want to know more about Stake Super or have questions? Speak to one of our SMSF professionals.

LRBA FAQs

When the LRBA loan has been completely repaid, an SMSF trustee is able to acquire legal ownership of the asset from the bare trustee/relevant custodian. The arrangement will need to be finalised and the SMSF trustee will need to initiate transfer of the property title to the SMSF.

The laws regarding this transfer are different from state to state. Since it’s a more complex issue, it is recommended that you seek advice from a property lawyer in the correct jurisdiction for this process.

If the loan is provided by a commercial lender, this lender will set the interest rate. If the loan is provided by a related party lender, the ATO provides rates as part of their LRBA guidelines.

For the 2024/25 financial year, the interest rate for real property is 9.35% and 11.35% for listed shares or units (source: ATO).

No, an SMSF can’t use an LRBA to buy land and develop on the property. This would change the original asset, which is an empty block of land.

By building on top of the land, this would ‘improve’ the originally purchased asset which would violate LRBA rules.

This is not financial product advice, nor a recommendation that a self-managed super fund (‘SMSF’) may be suitable for you. Your personal circumstances have not been taken into account. SMSFs have different risks and features compared to traditional superannuation funds regulated by the Australian Prudential Regulation Authority (‘APRA’). Stake SMSF Pty Ltd, trading as Stake Super, is not licensed to provide financial product advice under the Corporations Act. This specifically applies to any financial products which are established if you instruct Stake Super to set up an SMSF. When you sign up to Stake Super, you are contracting with Stake SMSF Pty Ltd who will assist in the establishment and administration of an SMSF under a ‘no advice model’. You will also be referred to Stakeshop Pty Ltd to enable your trading account and bank account to be set up in order to use the Stake Website and/or App. For more information about SMSFs, see our SMSF Risks page.

Ciara is a Commercial Manager at Stake Super, with over 10 years of experience in the SMSF industry and an MA in Accountancy and Finance from Heriot-Watt University in Edinburgh, United Kingdom. Having previously worked at a chartered accounting firm and one of the largest SMSF administrators in Australia, Ciara has extensive knowledge of SMSF compliance. She is also a current member of the SMSF Association.