SMSF Investment Strategies: Types of SMSF portfolios

An SMSF investment strategy is a plan that outlines how the trustees of the SMSF (you) intend to invest the money within the fund. Investment strategies will vary depending on the objectives of the members, and it is important to choose the right one for you.

What is an SMSF investment strategy?

SMSFs can invest across a wide range of asset classes. An SMSF investment strategy provides the framework for the investment decisions trustees will make in order to reach the investment objectives of the fund. It is legally required for trustees to prepare a written investment strategy and review at least annually.

What do you need to include in your SMSF investment strategy?

The SMSF investment strategy may include details on the fund's investment objectives, risk tolerance and investment mix.

Each SMSF member should be able to understand the risks involved with SMSF investments and plan accordingly.

There is no required format in creating the investment strategy, however, the superannuation laws in Australia set out that it does need to be detailed in writing and should consider asset allocations, calculated risks and returns, the ability of the fund to cover ongoing costs, life insurance for members, liquidity of the fund's investments and the members' needs and circumstances.

Types of different SMSF investment strategy portfolios

Like any other investment portfolio, members can choose a strategy based on their investment objective. Some of the most common ones are growth, balanced, and defensive portfolios.

Growth Portfolio

Growth portfolios have an asset allocation geared towards the objective of capital growth. Typically, this portfolio targets a mix of 70-80% growth assets and the remainder in defensive assets. Examples of growth assets are equities, real assets (i.e. property and infrastructure) and high-yield securities.

A growth investment strategy may have a greater chance of generating higher returns, however, it generally also carries higher investment risk.

This strategy is often implemented by investors who have a longer investing time horizon, higher risk appetite, and lower sensitivity to short-term price fluctuations.

Balanced Portfolio

Balanced portfolios have a mix of both growth and defensive assets (for example, 60/40), with the objective of both income and capital growth. Examples of the income-producing asset class are fixed-income securities (e.g. bonds and term deposits) and dividend-paying stocks. Additionally, balanced portfolios generally invest in lower-risk growth assets such as large-cap stocks and properties with high rental yields.

This type of portfolio is generally adopted by investors with a medium-term investment horizon, willing to accept moderate long-term capital gains in exchange for less short-term price volatility.

Typically, those who choose this investment strategy are in the latter half of their working careers and are looking for growth while protecting previous gains.

Defensive Portfolio

A defensive portfolio is one with the least exposure to growth assets. This investment strategy is more focused on capital preservation, with 70-80% of the SMSF's investments in defensive assets like bonds, as well as holding a significant amount of cash. While capital gains are limited, the fund's investments are less sensitive to market downturns.

As SMSF members move towards retirement, their investment mix tends to shift from allocated portions in growth assets to higher allocation in defensive assets.

Speak to a specialist

Want to know more about Stake Super or have questions? Speak to one of our SMSF professionals.

Diversifying your SMSF investment allocation

The beauty of SMSFs is that they allow the members to invest in a wide range of assets including but not limited to: equities, properties, bonds, term deposits, overseas investments, businesses, cryptocurrency, managed funds, and even material assets such as artwork and jewellery.

You are free to choose what type of assets you invest in, provided these investments are permitted by your fund’s trust deed and meet the requirements of superannuation laws.

While an SMSFs investment strategy can focus on a limited range of assets, inadequate diversification carries higher risk for the overall portfolio. Diversifying across a wide range of asset classes is a well-used strategy to ensure different parts of the portfolio are primed to do well, or better weather, in different economic environments.

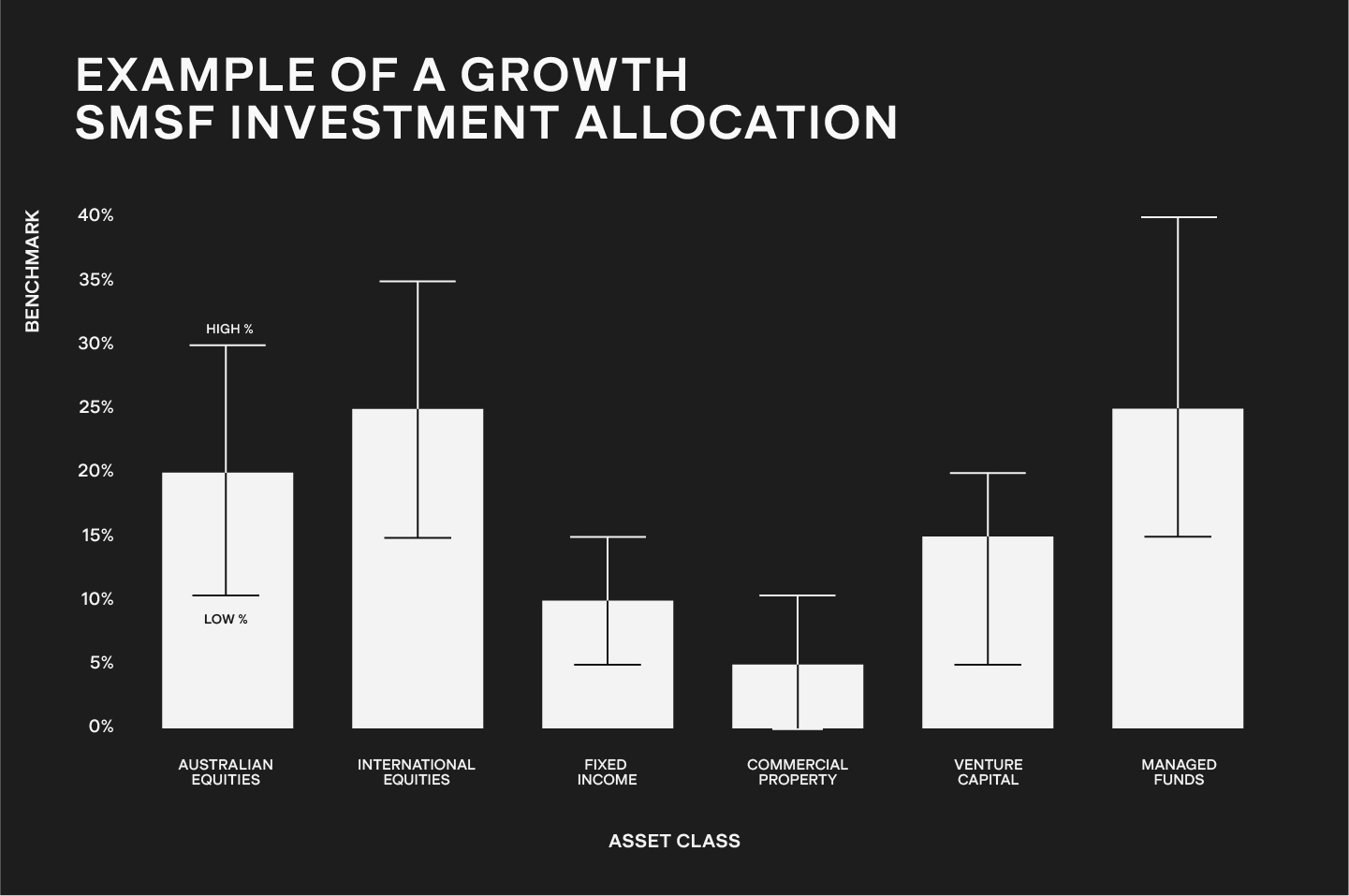

Example* of a Growth SMSF investment allocation:

*This example is hypothetical in nature and should not be relied upon. It is for demonstrative purposes to show various examples of diversification of investment classes of a growth portfolio. There are factors that can cause significant variation, including without limitation market conditions and your personal financial circumstances, objectives and needs.

Risks to be aware of

An SMSF investment strategy provides direction on how funds are invested, however, it doesn't mitigate all types of risk.

For example, there may be a broader market correction or significant events such as war and pandemics that can happen, and investing in an asset means exposing your funds to downturns that may result from these. As such, SMSF trustees should be well-versed in the assets and industries they are investing in to ensure they are empowered to make decisions to benefit the SMSF.

For more information about SMSFs and investment strategies from the ATO, read here.

This is not financial product advice, nor a recommendation that a self-managed super fund (‘SMSF’) may be suitable for you. Your personal circumstances have not been taken into account. SMSFs have different risks and features compared to traditional superannuation funds regulated by the Australian Prudential Regulation Authority (‘APRA’). Stake SMSF Pty Ltd, trading as Stake Super, is not licensed to provide financial product advice under the Corporations Act. This specifically applies to any financial products which are established if you instruct Stake Super to set up an SMSF. When you sign up to Stake Super, you are contracting with Stake SMSF Pty Ltd who will assist in the establishment and administration of an SMSF under a ‘no advice model’. You will also be referred to Stakeshop Pty Ltd to enable your trading account and bank account to be set up in order to use the Stake Website and/or App. For more information about SMSFs, see our SMSF Risks page.

Ciara is a Commercial Manager at Stake Super, with over 10 years of experience in the SMSF industry and an MA in Accountancy and Finance from Heriot-Watt University in Edinburgh, United Kingdom. Having previously worked at a chartered accounting firm and one of the largest SMSF administrators in Australia, Ciara has extensive knowledge of SMSF compliance. She is also a current member of the SMSF Association.