9 Benefits of a self-managed super fund: Pros and cons [2025]

A self-managed superannuation fund has a range of unique benefits. The best known is control and flexibility, however there are also a range of other benefits.

A self-managed superannuation fund has a range of unique benefits to maximise your retirement savings.

The best known is flexibility and control however, there are also a number of other benefits of SMSFs that members can leverage, these include things like asset protection, estate planning, tax strategies, borrowing and much more.

Dive into the 9 benefits of an SMSF below to see the real value of joining Stake Super.

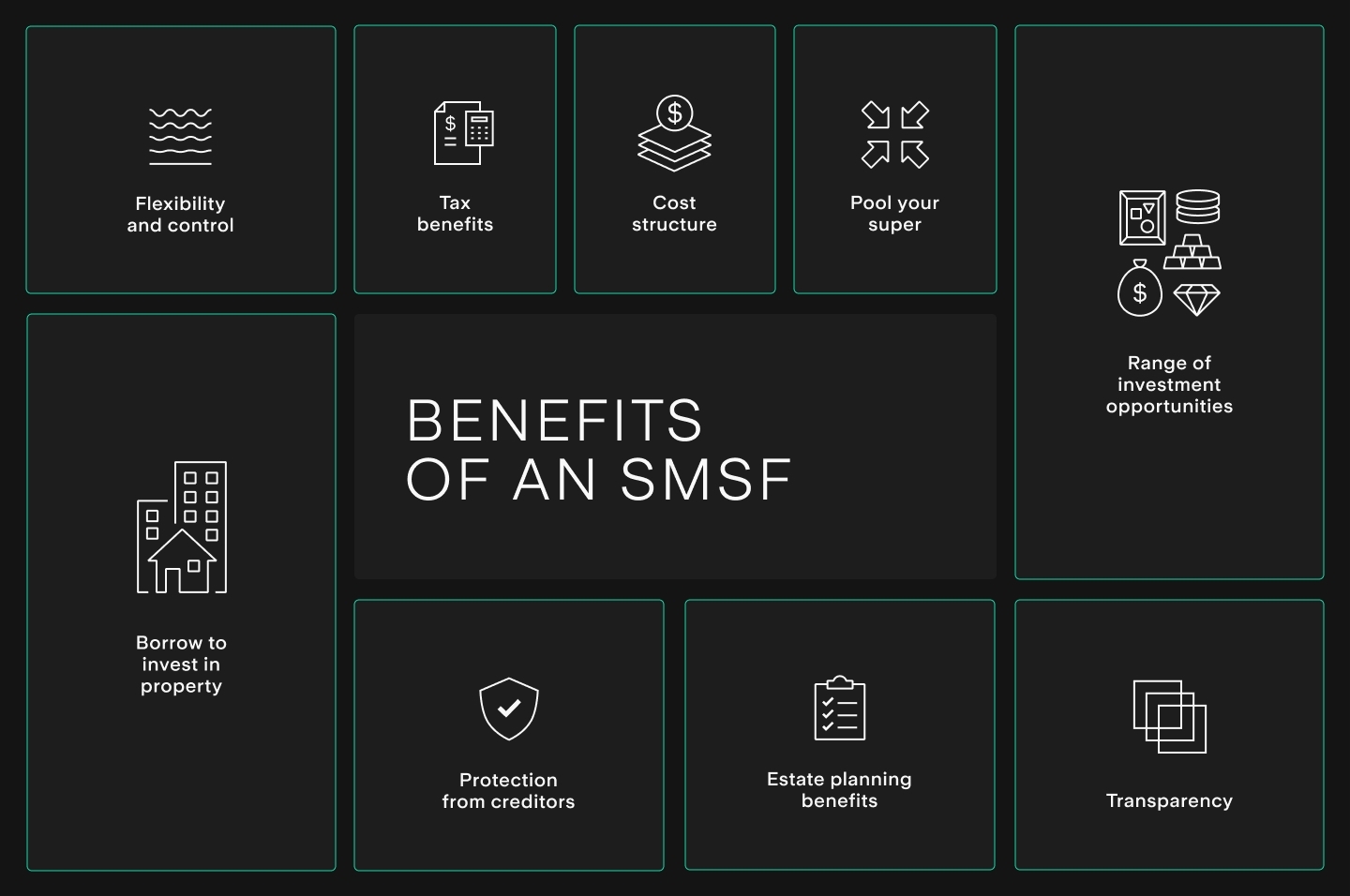

What are the benefits of a SMSF?

An SMSF unlocks much more freedom and choice for SMSF members to take control of their super. Here is a breakdown of the 9 main benefits of an SMSF:

- Flexibility and control

- Transparency

- Range of investment opportunities

- Borrow to invest in property, shares or funds

- Cost structure

- Ability to pool your super

- Tax benefits

- Protection from creditors

- Estate planning benefits

9 Benefits of a self-managed super fund (SMSF)

1. Flexibility and control

With an SMSF members have total control over where their retirement savings are invested. This means you determine what the fund invests in, and when investments are made as well as have the flexibility to change the SMSF investment strategy as you see fit. For example, you have investment control to make decisions in response to market conditions or to access a new opportunity.

2. Transparency

As a function of having full control over investment decisions, one of the other key benefits of a self-managed super fund is having complete clarity on the fund's investment portfolio, past investment decisions as well as the current and intended future investment strategy.

3. Range of investment opportunities

The Australian Taxation Office (ATO) sets out key principles for allowable superannuation assets within an SMSF to ensure 'arm's length' transactions are made. Provided these are met, an SMSF can invest in almost anything.

Some of the investment assets include direct listed securities, direct property, managed funds, cash & term deposits or rarer investments including v/c's, start-ups and collectables. A self-managed super fund provides members with the ability to invest in a wide range of investment options. Of course, different investment opportunities come with differing levels of risk and SMSF trustees should have sufficient knowledge and skills to make informed investment decisions.

🎓 Learn more: Find out how to buy property with your super→

4. Borrow to invest in property, shares or funds

An SMSF is allowed to borrow money to buy commercial property, shares or funds via a Limited Recourse Borrowing Arrangement (LRBA). It is termed limited recourse because if you are the trustee default on the loan, the lender's recourse is limited to the asset acquired thus protecting the other assets in the fund. Funds with an LRBA could stand to benefit from increased investment income and capital growth which are both taxed at a maximum of 15% within an SMSF as opposed to a maximum of 45% outside of an SMSF. However, as with all loans, investors will be repaying the principal sum borrowed as well as interest so SMSF trustees must manage these obligations carefully.

5. Cost structure

In the vast majority of cases, SMSF management costs are fixed. Meaning that the fees as a percentage of the total portfolio will decrease as the portfolio increases. This can have a significant impact over time when compared to other superannuation funds which typically charge fees as a percentage of total portfolio balance. This structure can also have a dramatic effect when pooling super via a SMSF with multiple members (see below).

6. Ability to pool your super

Self-managed super funds allow up to six members to pool their super within one fund, thereby significantly reducing the relative size of fees and also increasing the investing capital.

7. Tax benefits

Like all super funds, SMSFs benefit from a lower tax rate of 15% on investment income and capital gains tax as well as no tax on assets wholly supporting an income stream such as a pension. SMSF trustees are responsible for meeting the tax obligations of the SMSF and Stake Super helps with this by providing accounting and external auditing as part of its full-service SMSF administration.

8. Protection from creditors

Asset protection is the process of using a legal structure to keep your assets safe from legal action, including action from creditors and hostile beneficiaries. In some cases, SMSFs provide you with an effective way to protect your assets from any future claims from creditors or bankruptcy.

9. Estate planning benefits

SMSFs can be a highly effective way for distributing your wealth with superior tax outcomes. This includes being able to leave your taxable pensions to dependents who are able to receive them as a lump sum, pension or a combination tax free, or substantially tax free for non-dependents.

Speak to a specialist

Want to know more about Stake Super or have questions? Speak to one of our SMSF professionals.

What are the disadvantages of an SMSF?

While there are many benefits of an SMSF, they are not for everyone. Find below some of the key considerations that need to be taken into account when determining if an SMSF is preferable to other types of super funds.

Investing knowledge

Given SMSF trustees have full control over the fund's investing decisions (and thus performance), they should have a good understanding of financial markets and investing.

Responsibilities of being a trustee

SMSF trustees have the responsibility of ensuring that the fund is managed in a way that complies with all relevant superannuation legislation and regulations. SMSF administrators such as Stake can do all of the administrative heavy lifting however the trustees are always legally responsible for the fund to meet SMSF compliance.

Can't live permanently overseas

SMSF trustees must reside in Australia on a permanent basis. Trustees can live and work overseas for up to 2 years. However, as a general rule, if a trustee resides outside of Australia beyond this time the SMSF would no longer be compliant.

Can be time consuming

Setting up and managing an SMSFs can be a time-consuming process however this has significantly decreased with administrators such as Stake Super who manage all compliance obligations (accounting, auditing, taxation, etc.) leaving trustees to focus on managing the investments of the super fund.

This is not financial product advice, nor a recommendation that a self-managed super fund (‘SMSF’) may be suitable for you. Your personal circumstances have not been taken into account. SMSFs have different risks and features compared to traditional superannuation funds regulated by the Australian Prudential Regulation Authority (‘APRA’). Stake SMSF Pty Ltd, trading as Stake Super, is not licensed to provide financial product advice under the Corporations Act. This specifically applies to any financial products which are established if you instruct Stake Super to set up an SMSF. When you sign up to Stake Super, you are contracting with Stake SMSF Pty Ltd who will assist in the establishment and administration of an SMSF under a ‘no advice model’. You will also be referred to Stakeshop Pty Ltd to enable your trading account and bank account to be set up in order to use the Stake Website and/or App. For more information about SMSFs, see our SMSF Risks page.

Ciara is a Commercial Manager at Stake Super, with over 10 years of experience in the SMSF industry and an MA in Accountancy and Finance from Heriot-Watt University in Edinburgh, United Kingdom. Having previously worked at a chartered accounting firm and one of the largest SMSF administrators in Australia, Ciara has extensive knowledge of SMSF compliance. She is also a current member of the SMSF Association.

.jpg&w=3840&q=100)