What ethical ETFs in Australia can I invest in?

As the world grapples with challenges like climate change and social inequality, the importance of ethical business practices has never been greater. For investors concerned about how their portfolio impacts the world, ethical investing can be a rewarding strategy.

Check out this list of the best ethical ETFs on the ASX

ETF Name | Ticker | Share Price | 1Y Return | AUM | Expense Ratio |

|---|---|---|---|---|---|

BetaShares Global Sustainability Leaders ETF | $14.67 | +0.14% | $3.3B | 0.59% | |

Vanguard Ethically Conscious International Shares Index ETF | $92.62 | +6.45% | $1.1B | 0.18% | |

iShares Core MSCI World Ex Aus ESG Leaders ETF | $56.31 | +4.72% | $1.1B | 0.09% | |

BetaShares Australian Sustainability Leaders ETF | $19.87 | +3.17% | $1.1B | 0.39% | |

VanEck MSCI International Sustainable Equity ETF | $34.61 | -1.28% | $194.2M | 0.55% | |

VanEck MSCI Australian Sustainable Equity ETF | $30.86 | +2.90% | $171.6M | 0.35% | |

BetaShares Ethical Diversified High Growth ETF | $29.00 | +0.10% | $90.3M | 0.39% | |

Betashares Climate Change Innovation ETF | $8.28 | -4.50% | $80.5M | 0.65% | |

SPDR S&P/ASX 200 ESG Fund | $24.93 | +1.34% | $49.6M | 0.05% | |

eInvest Better Future (Managed Fund) | $4.59 | -2.85% | $44.6M | 0.99% |

Data as of 15 April 2025. Source: Stake, Google.

*The ETF list is ranked by assets under management. When deciding what funds to feature, we analyse the financials, recent news, liquidity and volume, and whether or not they are actively traded on Stake.

💡Related: ESG Investing: Top ESG U.S. stocks to watch→

Discover these sustainable ETFs worth watching

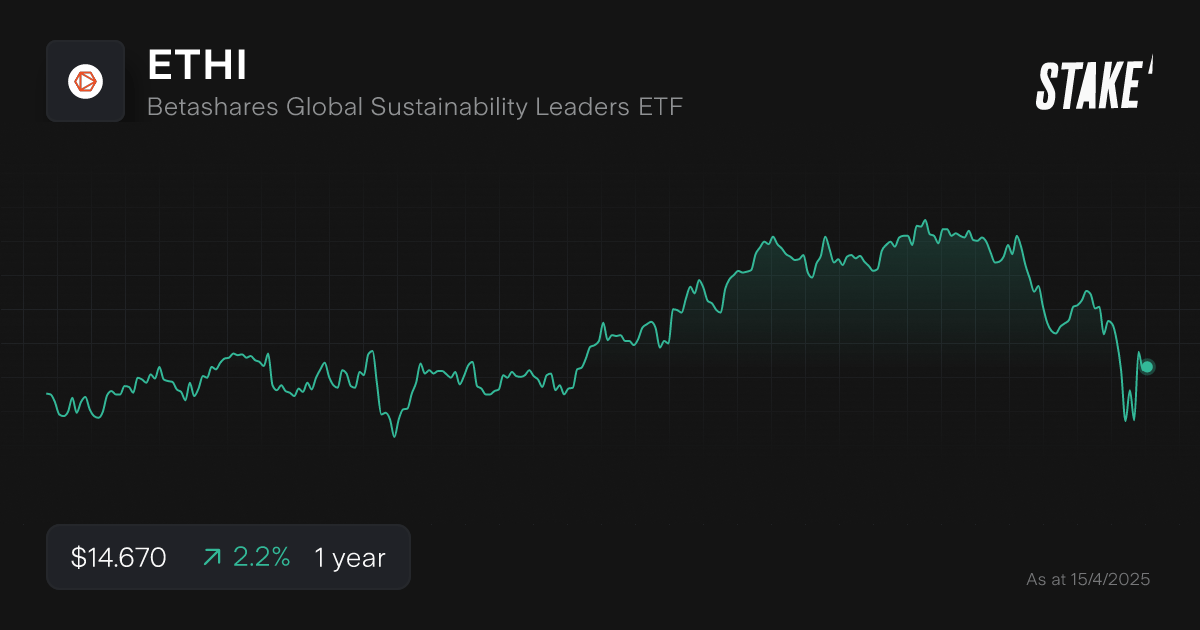

1. BetaShares Global Sustainability Leaders ETF ($ETHI)

ETHI focuses on investing in global companies that demonstrate strong sustainability credentials. It aims to track the performance of the Nasdaq Future Global Sustainability Leaders Index.

This ETF invests in companies that prioritise sustainability, carbon emissions reduction, renewable energy usage, labour standards, and board diversity. Notably, the fund excludes companies with direct exposure to fossil fuels.

The fund’s largest holdings are Visa ($V), Nvidia ($NVDA), and Apple ($AAPL). ETHI is currently one of the most popular ETFs for ethically focused investors in Australia, with over $3 billion in assets.

🆚 Decide which ETF is right for you - Compare ETHI vs VESG ETFs stock comparison→

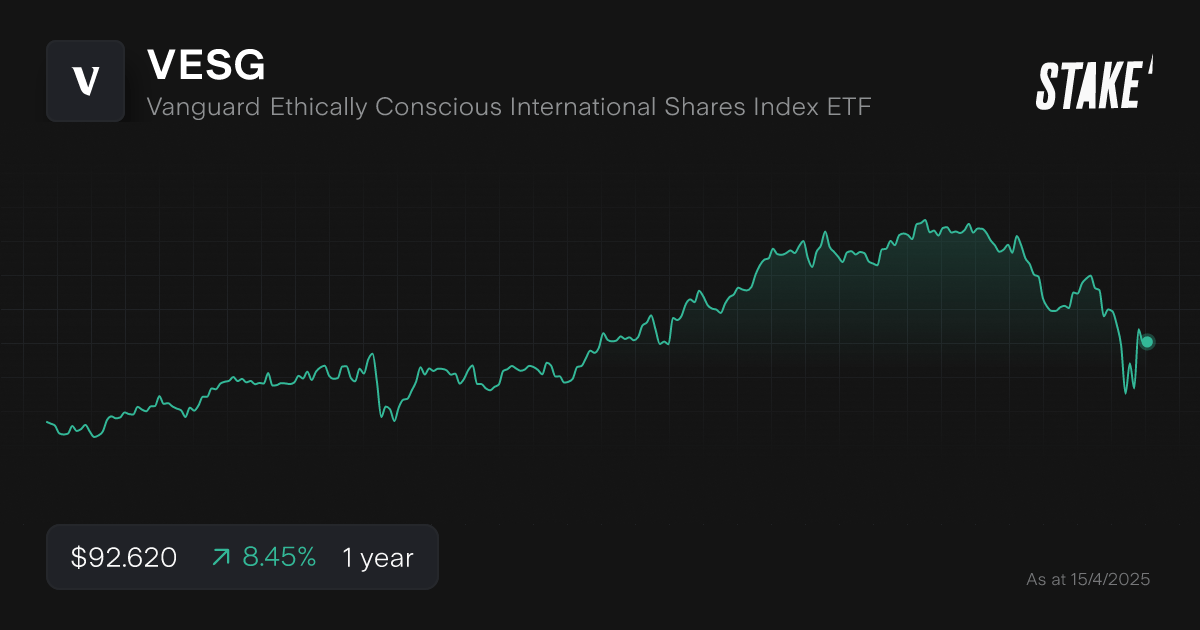

2. Vanguard Ethically Conscious International Shares Index ETF ($VESG)

VESG aims to provide investors exposure to sustainable international companies that meet strict ethical standards. It seeks to track the performance of the FTSE Developed ex-Australia Choice Index, which is an ethically screened index of non-Australian companies.

VESG’s holdings strictly exclude companies engaged in activities like fossil fuels, firearms, cannabis, gambling, and adult entertainment. As such, the fund differentiates itself by prioritising ethical business beyond just climate factors.

VESG could be a good fit for investors seeking low-cost diversified international exposure with an ethical focus. The fund’s largest holdings are Apple, Microsoft ($MSFT), and Nvidia.

3. iShares Core MSCI World Ex Aus ESG Leaders ETF ($IWLD)

IWLD holds non-Australian companies screened through an environmental, social, and governance (ESG) framework. The fund focuses on investments with better ESG scores than their industry peers while avoiding firms that have been involved in major ethical controversies.

IWLD is one of the lowest cost funds on the list, making it a strong choice for ethically focused investors who prioritise low fees. The fund’s largest holdings are Microsoft, Nvidia, and Alphabet ($GOOGL).

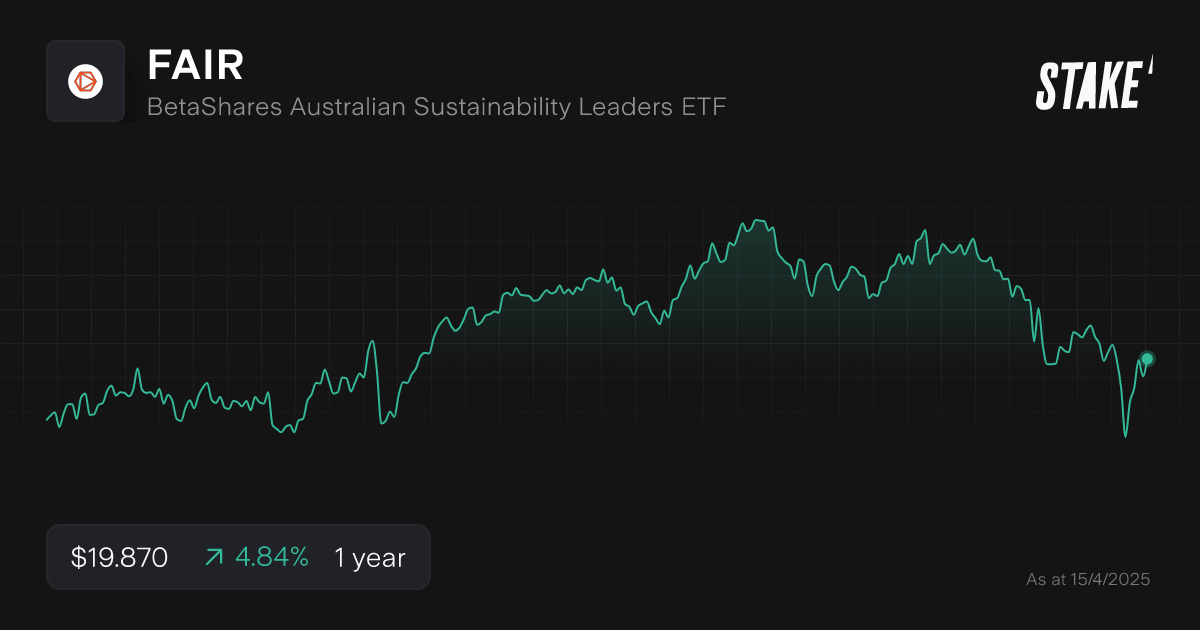

4. BetaShares Australian Sustainability Leaders ETF ($FAIR)

While the top three funds on the list focus on international markets, FAIR invests in Australia. The fund exclusively backs Australian companies demonstrating strong ESG practices, tracking the Nasdaq Future Australian Sustainability Leaders Index.

FAIR’s screening process excludes companies with direct or significant exposure to fossil fuels, and those firms whose activities fail to align with the United Nations Sustainable Development Goals.

The fund could be a strong choice for Australian investors who want to back ethical business practices in their home country. FAIR’s top holdings are Brambles ($BXB), Telstra ($TLS), and Suncorp ($SUN).

🆚 Decide which ETF is right for you - Compare FAIR vs ETHI ETFs stock comparison→

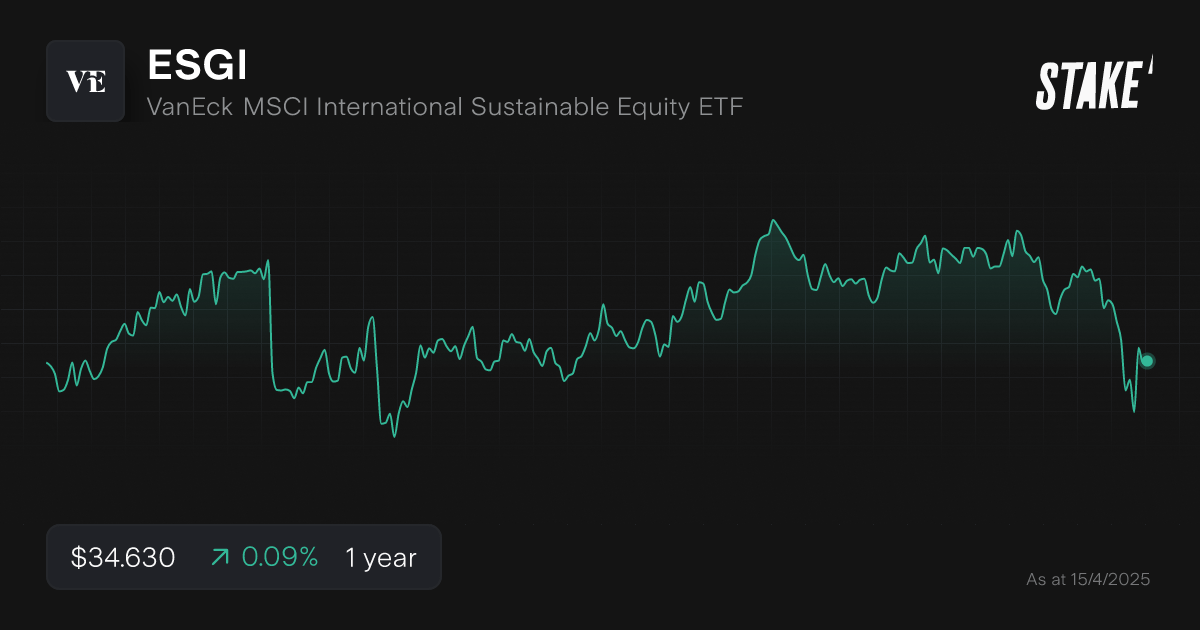

5. VanEck MSCI International Sustainable Equity ETF ($ESGI)

ESGI focuses on investing in global companies with strong ESG practices. It aims to track the performance of the MSCI World ex-Australia ex-Fossil Fuel Select SRI and Low Carbon Capped Index, which does not include Australian firms.

Based on the fund’s underlying index, ESGI’s exclusion criteria is somewhat broader than peers, including activities like GMO agriculture, soft drinks, and animal welfare. That’s in addition to avoiding firms in industries like fossil fuels, weapons, and adult entertainment.

Overall, ESGI could be a good fit for investors seeking ethical investment internationally with more stringent criteria than other funds.

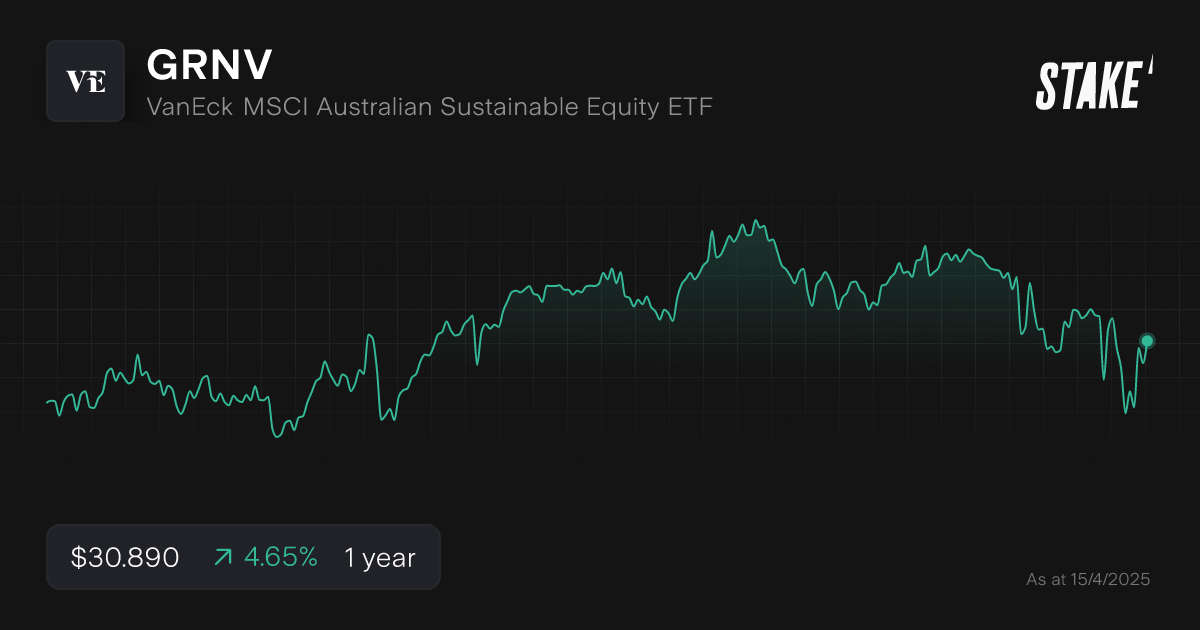

6. VanEck MSCI Australian Sustainable Equity ETF ($GRNV)

GRNV invests in Australian companies in the green energy sector. It seeks to track the performance of the MSCI Australia IMI Select SRI Screened Index, which focuses on companies within Australia practising sustainable business processes.

Like its sister fund ESGI, GRNV has a broad remit to exclude unethical companies. Compared with FAIR, GRNV has a slightly lower management fee, and might be a more cost-effective way to back Australian sustainability. The fund’s largest holdings are Telstra, Transurban ($TCL), and CSL ($CSL).

7. BetaShares Ethical Diversified High Growth ETF ($DZZF)

DZZF is unique compared to other ETFs on the list since this fund doesn’t make direct investments itself. Instead, DZZF invests in BetaShare’s other sustainability-focused ETFs, building out a multi-fund ethical portfolio for investors seeking diversified growth.

As of April 2025, DZZF’s two largest holdings are ETHI and FAIR, comprising over 70% of the portfolio. DZZF also incorporates some of BetaShare’s smaller ethically focused funds, including Australian and international bonds.

Overall, DZZF could be a good choice for an investor who wants an easy way to access a diversified portfolio of sustainable investment strategies.

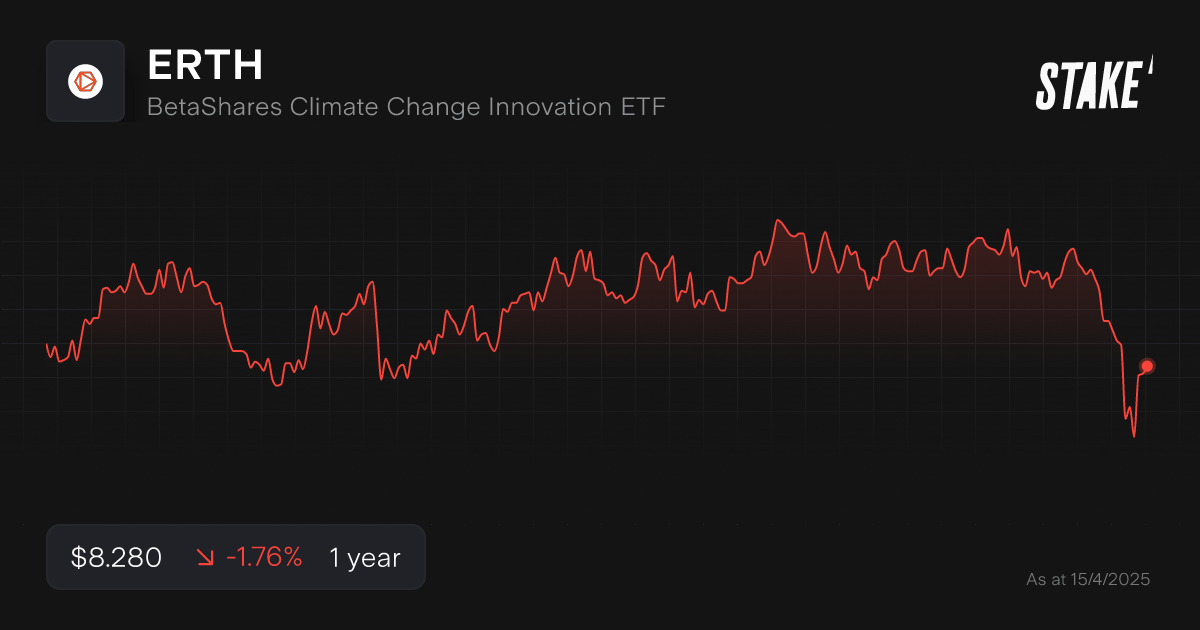

8. Betashares Climate Change Innovation ETF ($ERTH)

Most funds on this list take an exclusion approach, filtering out companies that don’t follow sustainable practices. ERTH works differently – this fund actively includes companies leading the transition to the global green economy.

ERTH tracks the Solactive Climate Change and Environmental Opportunities Index, which tracks up to 100 global firms that earn at least half their revenue from practices that address climate change.

The fund’s top holdings are BYD ($BYDDY), Saint-Goban, and DSM-Firmenich.

9. SPDR S&P/ASX 200 ESG Fund ETF ($E200)

The E200 ETF aims to provide an ESG-focused alternative to Australia’s benchmark ASX 200 index. The fund invests in leading Australian companies screened with an ESG framework.

E200 is particularly notable for its rock-bottom expense ratio of 0.05%.

Overall, the fund could be a strong choice for investors who want sustainable and ethical exposure to the ASX 200. E200’s top holdings are Commonwealth Bank ($CBA), CSL, and National Australia Bank ($NAB).

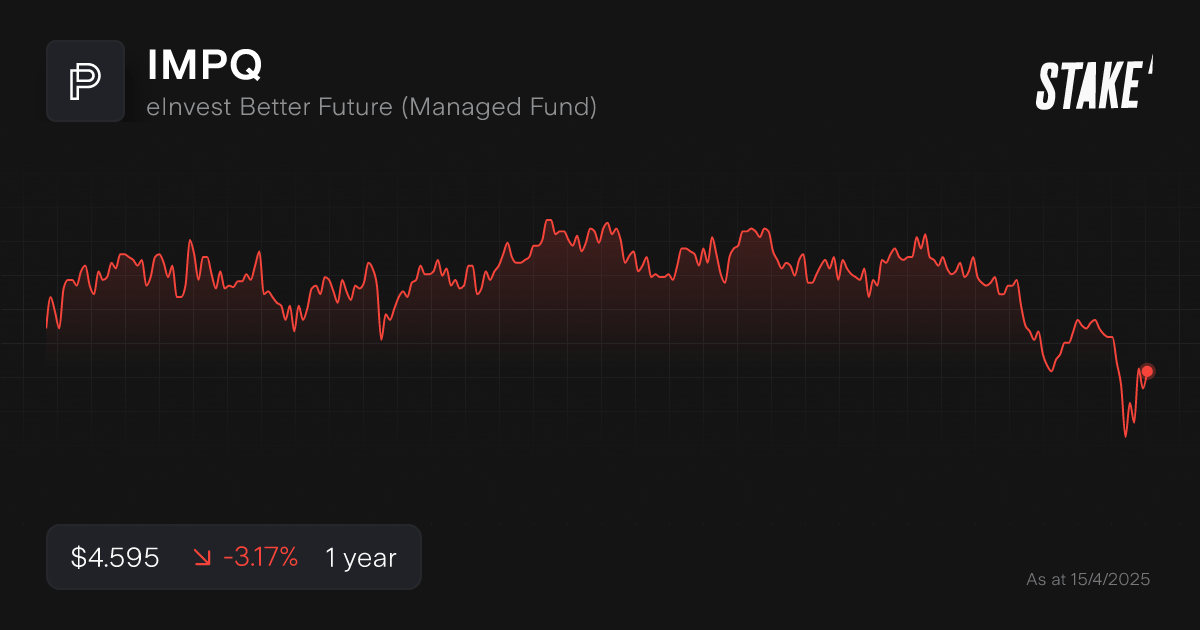

10. eInvest Better Future (Managed Fund) ($IMPQ)

Unlike other funds on the list, IMPQ is an actively managed fund. While this makes the fund more expensive than its peers, it can also create the potential for outperformance due to manager research and due diligence.

IMPQ invests in small cap firms operating in sectors with sustainable impact. The fund is worth considering for investors looking for active management of their impact-focused holdings.

How to choose a sustainable ETF?

The best way to choose a sustainable ETF is to find a fund that aligns with both your personal values and financial objectives. Here are some key questions to ask yourself when comparing the options:

Where do you want to invest geographically? |

|

What ethical screening approach aligns with your values? |

|

What investment strategy do you prefer? |

|

How important is cost? |

|

What company size are you targeting? |

|

How can I invest ethically in Australia?

Ethically conscious investing involves aligning your investment choices with your values and supporting companies with sustainable practices. Here are some steps you can take to invest ethically in Australia:

- Take the time to understand your values and priorities. Identify the ethical or sustainable principles that matter most to you. This could include avoiding industries like fossil fuels, tobacco, or weapons. It could also mean promoting renewable energy, supporting gender equality, or prioritising environmental conservation. Clearly defining your values will guide your investment decisions.

- Research ethical investment options available in Australia. Look for investment vehicles focused on ethical or sustainable investing. These can include socially responsible ETFs, managed funds, or individual stocks. Look for options that have a clear investment strategy aligned with your values.

- When reviewing ethical funds, carefully assess their criteria for selecting investments. Each fund may have its own set of guidelines and exclusions. Understand how they define and evaluate companies based on environmental, social, and governance (ESG) factors. This will help you determine if their approach aligns with your values.

- Consider how ethical ETFs fit into your overall investment strategy. Some ethical ETFs are designed for investors with a greater risk tolerance, while others are more focused on stability and income.

- Find a broker that offers ethically focused funds and companies in Australia. Stake is one such broker, offering access to a range of ETFs that can support your ethical investment journey.

Remember, ethical investing is a personal choice, and what may be considered ethical can vary from person to person. Conduct thorough research and ensure your investment decisions align with your values and long-term financial objectives.

Get started with Stake

Sign up to Stake and join 750K investors accessing the ASX & Wall St all in one place.

Ethical ETFs FAQs

Yes, ethical investing is indeed growing. As investors become increasingly concerned about the long-term impact of climate change and consider social goals within their investment framework, interest in ethical investment is rising.

By 2026, the volume of global assets allocated to ESG strategies is expected to climb to $34 trillion.

In fact, according to a Morgan Stanley survey, 77% of individual investors are now interested in incorporating ethical investing with their financial strategy, far higher than in previous years.

This data highlights a growing awareness and demand for investments that align with investors' ethical values and considerations. As more individuals and institutions recognise the importance of sustainable and socially responsible practices, ethical investing is expected to continue its upward trajectory.

‘Greenwashing’ occurs when businesses attempt to promote their products or services as more sustainable than they really are.

For instance, firms may attempt to purchase dubious carbon credits on the secondary market in order to claim that they have net zero emissions. Greenwashing is unfortunately prevalent, making it important for asset managers to conduct strong due diligence with a rigorous framework.

Many ethical and sustainability-focused ETFs brand themselves as ‘ESG’ investments, which can be a useful keyword to search for when researching these funds. To fully understand how an ETF incorporates ethics into their investment strategy, conduct detailed due diligence on their exclusion criteria and ethical scoring framework. If you still have questions, consider contacting the asset manager directly.

Ethical funds can potentially be a good investment, but it depends on your investment strategy. An ethical ETF that invests in risky climate tech firms may not be a good choice for an income-focused, risk-averse investor.

Overall, it’s important to consider how a particular ethical ETF aligns with both your personal values and your financial strategy.

Disclaimer

The information contained above does not constitute financial product advice nor a recommendation to invest in any of the securities listed. Past performance is not a reliable indicator of future performance. When you invest, your capital is at risk. You should consider your own investment objectives, financial situation and particular needs. The value of your investments can go down as well as up and you may receive back less than your original investment. As always, do your own research and consider seeking appropriate financial advice before investing.

Any advice provided by Stake is of general nature only and does not take into account your specific circumstances. Trading and volume data from the Stake investing platform is for reference purposes only, the investment choices of others may not be appropriate for your needs and is not a reliable indicator of performance.

$3 brokerage fee only applies to trades up to $30k in value (USD for Wall St trades and AUD for ASX trades). Please refer to hellostake.com/pricing for other fees that are applicable.