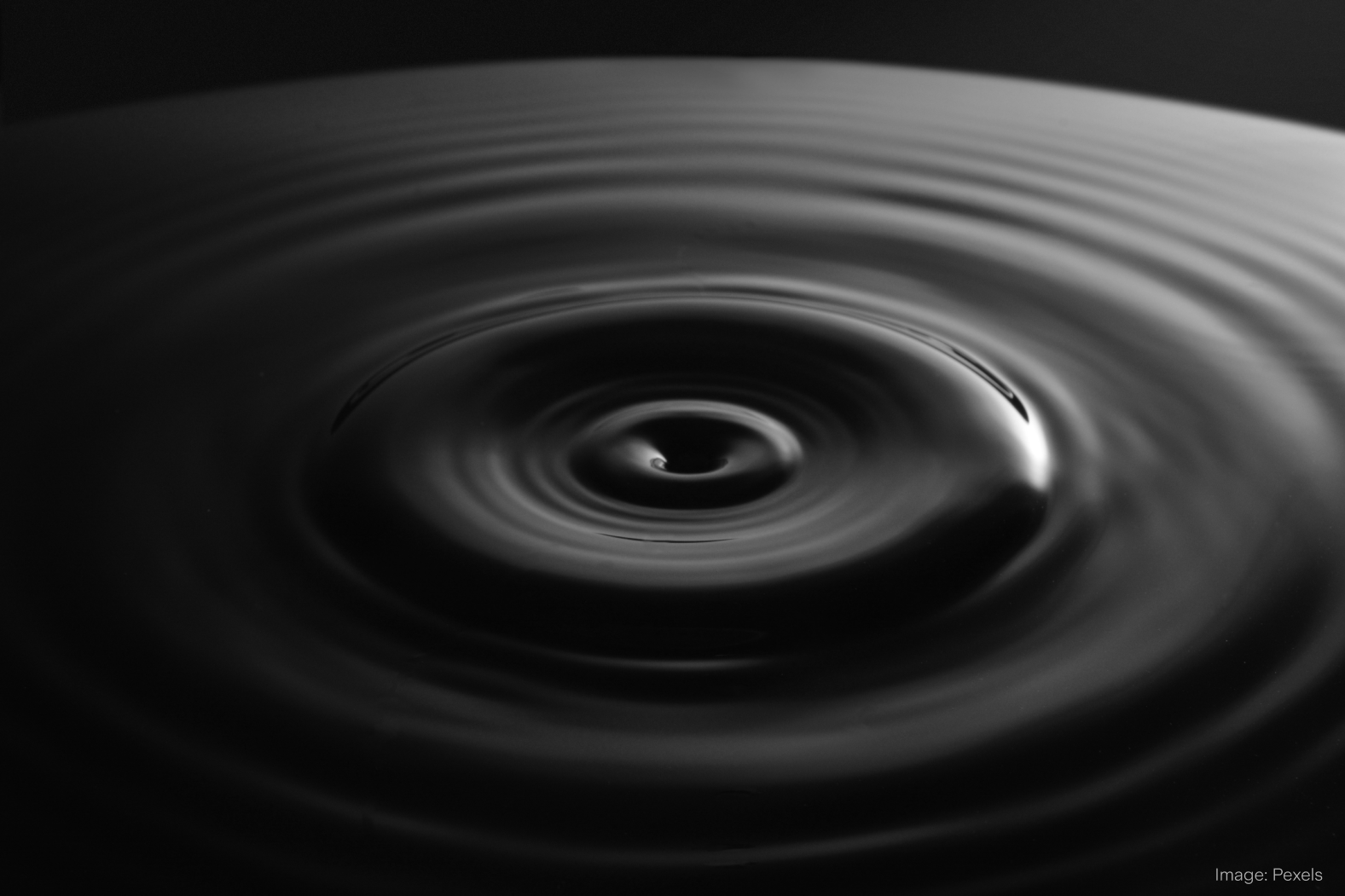

Darkpool

The biggest moves on Wall Street aren’t made in plain sight.

Here’s something you might not know about U.S. equity markets: dark pools account for a big chunk of trading activity. How big? As high as 51.8% in January 2025. But what is a dark pool, exactly? Sounds like a spooky swim spot, but it's just Wall Street doing its thing… in the shadows.

Dark pools are private trading venues where large investors, like hedge funds, can buy or sell sizable blocks of stock away from the public eye. The idea is to avoid tipping off the broader market and causing prices to move against them before the trade is completed.

If a major institution wants to unload a massive position in Apple ($AAPL) or Nvidia ($NVDA), doing so on a public exchange like the NYSE could trigger a sharp drop in price as traders catch wind and react. In a dark pool, that same trade can be executed with minimal market disruption.

It’s lucrative business for firms that operate these behind-the-scenes trading venues. So it's no surprise that major investment banks are running the show. Goldman Sachs ($GS) runs Sigma X2, often considered the largest bank-operated dark pool by volume. Morgan Stanley ($MS) operates the MS Pool and JPMorgan ($JPM) runs JPM-X. The list is out there, but what happens inside them is a little less transparent.

We don’t know who’s trading, but disclosure requirements now give us an insight into what gets traded at these discreet venues, albeit with a little lag. In 2017, FINRA mandated that dark pools – aka U.S. Alternative Trading Systems – report their trading volumes weekly, with a publication delay of about two weeks.

The latest data is telling, even if the order flow is obscured. Lucid Group ($LCID) saw the most volume, with 139 million shares traded as of 8 August. That same week, the EV maker lowered its full-year production guidance and shares fell 7% in premarket trade.

Also heavily traded was Warner Bros ($WBD), with 55 million shares moved. It’s almost as if institutional players knew the company would soon miss earnings expectations, as per last week’s report… Which was followed by a stock slide despite a revenue beat of US$9.81b.

Nvidia and Advanced Micro Devices ($AMD) featured second and tenth on the list respectively, ahead of announcing their plans to pay 15% of the revenue from certain AI chip sales in China to the U.S. government.

Dark pools may not be widely discussed, but they’re a central part of how today’s markets work. For retail investors, their existence is a reminder that there’s more to the supply-and-demand mechanics of trading than meets the eye.

So the next time a stock moves mysteriously, it might just be a billion-dollar whisper from the deep end.

This is not financial advice nor a recommendation to invest in the securities listed. The information presented is intended to be of a factual nature only. Past performance is not a reliable indicator of future performance. As always, do your own research and consider seeking financial, legal and taxation advice before investing.