Strava IPO: How to buy Strava shares?

Strava’s IPO appeal lies in its strong community and growth potential, but recent clashes with Garmin highlight the risks of platform dependencies. For investors, it appears to be a promising ride that might have some bumps along the way. Here’s everything you need to know about Strava and how to buy shares in the company.

What does Strava do?

Strava is a fitness‑tracking platform that lets users record, analyse and share a wide range of physical activities, including running, cycling, swimming, hiking and even gym workouts. It combines this tracking functionality with social features: users can follow each other, post photos, give ‘kudos’ or comment, and also compete via ‘segments’.

The platform supports integrations with popular athlete-focused devices like Garmin and Apple Watch, with support for users to manually enter their workout data as well. It also offers features for urban planners and municipalities through Strava Metro, which provides anonymised cycling and movement data for infrastructure planning.

Strava has built a global community of over 120 million athletes across 190 countries. It was valued at around US$2.2B in 2025 after acquiring fitness platforms Runna and The Breakaway.

How does Strava generate revenue?

Strava generates revenue primarily through a freemium model. While the app is free to use for basic tracking and social sharing, it offers a premium subscription called Strava Summit that unlocks certain advanced features.

The subscription-based model is the firm’s main source of monetisation, complemented by partnerships and licensing data for city planning purposes. Here is a breakdown of Strava’s revenue model:

- Subscriptions / Premium plans: Strava’s core features are free, while advanced tools like analytics, training plans and route building are paid. Pricing is around US$11.99 per month or US$79.99 per year.

- Brand partnerships & sponsored content: Strava collaborates with fitness, nutrition, and gear brands on sponsored challenges and segments to reach active users.

- Data & analytics licensing: The firm sells anonymised, aggregated data via Strava Metro to cities and planners, although this is a smaller but strategic revenue stream.

- Subscription partnerships: Strava offers bulk and discounted subscriptions to organisations and bundles with partner services.

Note: Details on revenue segments and profitability will be made public once Strava files an S-1 ahead of its IPO.

What is the Strava IPO date?

Strava’s initial public offering is unconfirmed, but speculation is building for an IPO as early as 2026. Reuters reported that Strava has invited investment banks Goldman Sachs, JPMorgan and Morgan Stanley for roles in the IPO.

What is the ticker symbol for Strava?

Strava does not have a stock ticker symbol because it is a private company and is not publicly traded just yet. When the firm officially files for an IPO, it will name the ticker symbol it intends to list under on its designated exchange.

What is the expected Strava IPO share price?

The expected share price for Strava's IPO has not yet been officially announced as the IPO date and final pricing remain unconfirmed.

Strava was valued at around US$2.2B in a May 2025 fundraising round. Based on an estimated 250 million shares outstanding (as per private market data), this suggests an approximate share price of US$9.88 per share.

How to buy shares in Strava?

Investors can buy Strava shares on Stake when the company goes public. Follow the steps below to open an account with Stake and be able to invest in the newest stock when listed on U.S. stock exchanges.

1. Open a stock investing account

If you want to buy Strava stock, you'll need to sign up to an investing platform with access to the Nasdaq or New York Stock Exchange. Lucky for you Stake has access to U.S. stock exchanges.

2. Fund your account

Complete an application with your personal and financial details. Fund your account with a bank transfer, debit card or even Apple/Google Pay.

3. Search for Strava

Find the asset by searching for the name or ticker symbol. Do your own research to ensure it is the right investment product for your own circumstances.

4. Choose an order type and buy the asset

Buy on any trading day with a market, limit or stop order. Look into dollar cost averaging to spread out your risk, which smooths out buying at consistent intervals.

5. Monitor your investment

Optimise your portfolio by tracking how the security performs with an eye on the long term. You may be eligible for dividends and shareholder voting rights that affect your shares.

Sign up in minutes and get access to this company when it enters the market.

Who is underwriting the IPO?

Goldman Sachs, JPMorgan and Morgan Stanley are reportedly pitching for roles in Strava’s IPO.

Who owns Strava?

Strava is a privately held company founded in 2009 by Mark Gainey and Michael Horvath. Both of them remain involved with the company, with Gainey currently serving as Chairman.

The company’s current CEO is Michael Martin, a former executive at YouTube and Nike, who took over leadership in early 2024.

Strava is majority owned by its founders and venture capital investors, including Sequoia Capital, TCV, Jackson Square Ventures, Dragoneer Investment Group, Sigma Partners and Madrone Capital.

Why is Strava suing Garmin?

Strava is suing Garmin over patent infringement and breach of contract related to shared fitness-data features that both companies have used for years.

According to Strava, Garmin’s actions violated their Master Cooperation Agreement (MCA), which barred Garmin from copying or distributing Strava’s segment and mapping technology outside of approved integrations. Despite warnings issued in June and July 2025, Strava says Garmin continued to deploy features infringing on its intellectual property.

The feud escalated after Garmin implemented stricter API branding rules in mid‑2025, requiring all partner apps, including Strava, to display the Garmin logo on activity uploads, a move Strava publicly opposed.

Strava made a Reddit post titled ‘setting the record straight on Garmin’ laying out its side of the story around Garmin’s branding demands. That post drew intense backlash. Many Reddit users in the subreddits r/Strava and r/Garmin criticised Strava’s approach, calling it hypocritical, threatening and tone-deaf.

For a few months now, third-party developers on Strava have been required to attribute Strava when using its data. As of 16 October 2025, Strava has told developers it will comply with Garmin's attribution requirements.

How will Strava perform post-IPO?

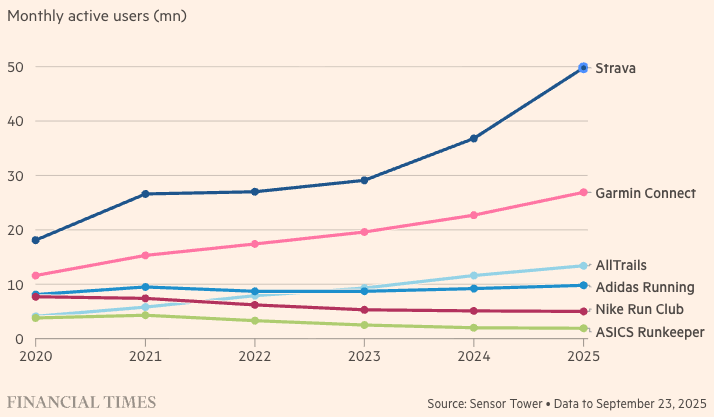

Strava’s performance after going public will likely hinge on its ability to balance fast growth with profitability, maintain strong user engagement and stand out in an increasingly competitive digital fitness market.

Source: Financial Times, Sensor Tower

Investor enthusiasm will likely depend on whether Strava is perceived as a ‘social network for athletes’ or simply a ‘fitness app.’ The former narrative could justify higher valuations akin to consumer-tech firms like Spotify.

‘It’s remarkable that Strava has lasted this long. Fitness apps almost always fail, or get bought and then never meaningfully updated again,’ said one user on Reddit.

Still, Strava’s monetisation challenge remains: converting its vast free-user base into paying subscribers is still a work in progress, and the company’s profitability metrics won’t be confirmed until it files IPO paperwork.

Analysts suggest the stock could see a post-IPO surge, followed by a more performance-driven evaluation as investors measure user retention, subscription growth, and profitability against broader market trends.

Strava IPO details

Proposed ticker symbol | Undisclosed |

Company Name | Strava |

Exchange | Undisclosed |

Share price | Undisclosed |

Shares offered | Undisclosed |

We’ll update this article when more information becomes available.

🎓 Learn more: What is an initial public offering and how do they work?→

Disclaimer

The information contained above does not constitute financial product advice nor a recommendation to invest in any of the securities listed. Past performance is not a reliable indicator of future performance. When you invest, your capital is at risk. You should consider your own investment objectives, financial situation and particular needs. The value of your investments can go down as well as up and you may receive back less than your original investment. As always, do your own research and consider seeking appropriate financial advice before investing.

Any advice provided by Stake is of general nature only and does not take into account your specific circumstances. Trading and volume data from the Stake investing platform is for reference purposes only, the investment choices of others may not be appropriate for your needs and is not a reliable indicator of performance.

$3 brokerage fee only applies to trades up to $30k in value (USD for Wall St trades and AUD for ASX trades). Please refer to hellostake.com/pricing for other fees that are applicable.

Samy is a markets analyst at Stake, with seven years of experience in the world of investing, working across roles in private banking, venture capital and financial media. She has a Master’s degree in Finance and Data Analytics from The University of Sydney Business School.