Figma IPO: How to buy Figma shares

Figma ($FIG) made a spectacular debut on its first day of trading, with shares in the cloud-based design platform soaring 250% above its IPO price.

When did Figma list?

Figma debuted on the New York Stock Exchange on 31 July. It publicly filed its IPO on 1 July, 2025.

What price did Figma sell shares in its IPO?

Figma priced its shares at US$33 each. It initially intended to sell shares at US$25-US$28, before raising the range to US$30-US$32 based on strong demand. Ultimately, the IPO cleared at US$33 a share.

Figma’s IPO raised US$1.2b, with the proceeds going to existing shareholders Greylock Partners, Kleiner Perkins, Sequoia Capital and Index Ventures.

Figma’s first trade printed at US$85, valuing the company at US$50b. By the end of the day, shares closed at $115.50, giving it a market cap of US$68b. This makes Figma roughly the same size as PayPal and Colgate-Palmolive.

What is the ticker symbol for Figma?

Figma trades under the ticker symbol $FIG.

How to buy shares in Figma

Want to start buying $FIG shares but not sure how? Learn how to buy Figma shares in 5 simple steps on the Stake stock investing platform below.

1. Open a stock investing account

If you want to buy Figma stock, you'll need to sign up to an investing platform with access to Wall Street. Lucky for you, Stake has access to U.S. stock markets.

2. Fund your account

Complete an application with your personal and financial details. Fund your account with a bank transfer, debit card or even Apple/Google Pay.

3. Search for Figma

Find the asset by searching for the name or ticker symbol $FIG. Do your own research to ensure it is the right investment product for your own circumstances.

4. Choose an order type and buy the asset

Buy on any trading day using a market order or limit order to delay your purchase of the asset until it reaches your desired price. You may wish to look into dollar cost averaging to spread out your risk, which smooths out buying at consistent intervals.

5. Monitor your investment

Once you own a stock, you should keep an eye on its performance. Check your portfolio regularly to ensure your investment is aligning with your financial goals.

Get started with Stake

Sign up to Stake and join 750K investors accessing the ASX & Wall St all in one place.

About Figma ($FIG)

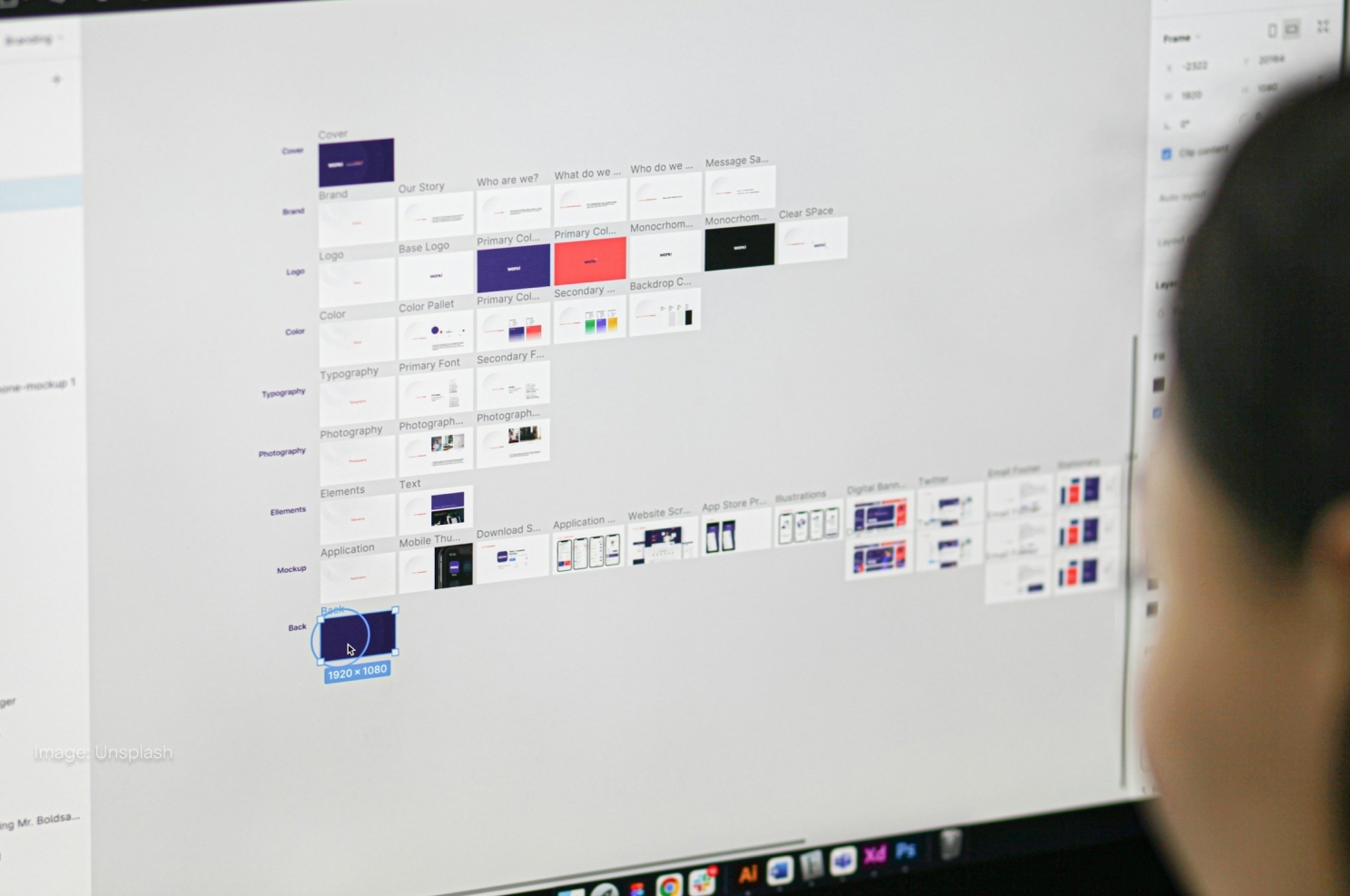

Figma is a cloud-based software company focusing on digital design and team collaboration. It was founded by Dylan Field and Evan Wallace in 2012. It is based in San Francisco, with Field currently serving as CEO.

Figma allows users to create and collaborate in real time, all via a web browser—making it a fast, efficient go-to tool for teams at Google, Amazon, Netflix and more.

Its platform supports a wide range of tasks, from building user interfaces and prototypes to gathering feedback and preparing assets for developers. It also introduced AI features to streamline routine design work while integrating with other product development software tools.

Figma has 13 million monthly active users and reported revenue of US$749 million in FY24, up 48% year-on-year (YoY). Revenue grew 46% YoY to US$228m in Q1 FY25. Competitors include Adobe and Canva.

In 2022, software giant Adobe proposed a $20 billion acquisition of Figma. But a year later, the two companies called off the merger following regulatory concerns in multiple regions. Adobe paid Figma a breakup fee of US$1b.

Who owns Figma?

Figma remains partly founder-owned, with substantial stakes held by Dylan Field and Evan Wallace. It’s also backed by major venture capital firms including Andreessen Horowitz, Greylock Partners, Index Ventures and Sequoia Capital.

FIG IPO details

Ticker symbol | $FIG |

Company Name | Figma |

Exchange | NYSE |

Share price at IPO | US$33 |

Shares offered | 37 million shares |

🎓 Learn more: What is an initial public offering and how do they work?→

Disclaimer

The information contained above does not constitute financial product advice nor a recommendation to invest in any of the securities listed. Past performance is not a reliable indicator of future performance. When you invest, your capital is at risk. You should consider your own investment objectives, financial situation and particular needs. The value of your investments can go down as well as up and you may receive back less than your original investment. As always, do your own research and consider seeking appropriate financial advice before investing.

Any advice provided by Stake is of general nature only and does not take into account your specific circumstances. Trading and volume data from the Stake investing platform is for reference purposes only, the investment choices of others may not be appropriate for your needs and is not a reliable indicator of performance.

$3 brokerage fee only applies to trades up to $30k in value (USD for Wall St trades and AUD for ASX trades). Please refer to hellostake.com/pricing for other fees that are applicable.