How to buy Reddit stock in Australia [2024]

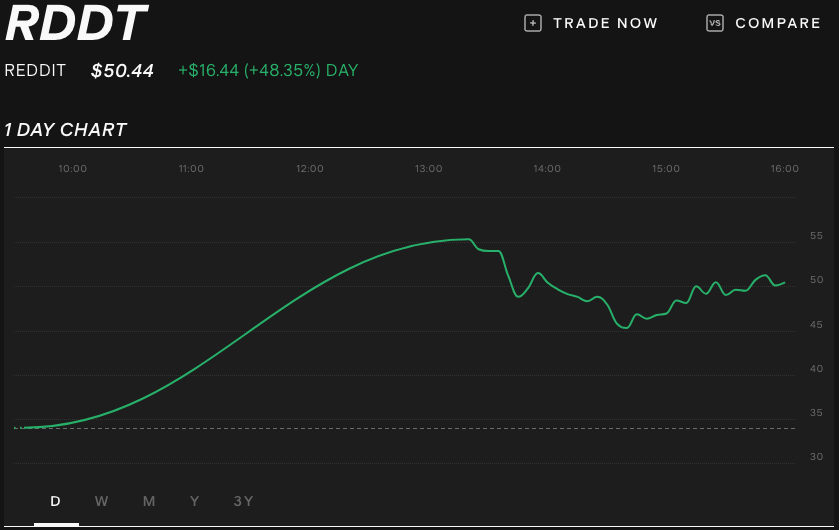

Reddit debuted on Wall Street on 21 March 2024, reaching US$52.29 on the first day of trading. The stock price soared far above the projected IPO range of US$34.

How to buy Reddit stock?

Want to start buying $RDDT shares but not sure how? Learn how to buy Reddit shares in 5 simple steps on the Stake stock investing platform below.

1. Open a stock investing account

If you want to buy Reddit stock, you'll need to sign up to an investing platform with access to the New York Stock Exchange. Stake has access to U.S. stock exchanges.

2. Fund your account

Complete an application with your personal and financial details. Fund your account with a bank transfer, debit card or even Apple/Google Pay.

3. Search for Reddit

Find the asset by searching for the name or the ticker symbol $RDDT. Do your own research to ensure it is the right investment product for your own circumstances.

4. Choose an order type and buy the asset

Buy on any trading day with a market, limit or stop order. Look into dollar cost averaging to spread out your risk, which smooths out buying at consistent intervals.

5. Monitor your investment

Optimise your portfolio by tracking how the security performs with an eye on the long term. You may be eligible for dividends and shareholder voting rights that affect your shares.

What is the Reddit IPO date?

Reddit started trading on 21 March 2024 to much success, soaring as high as US$54 on its first day active on Wall Street.

What is the expected Reddit IPO share price?

The debut share price of Reddit was reportedly expected to be between US$31- $US34, which is in line with a valuation of roughly US$6.5 billion. The business was valued at around US$10 billion in August 2021.

After starting in the projected range at US$34, $RDDT gained over US$16 to end its first trading day at US$50.44.

What is the ticker symbol for Reddit?

The ticker symbol for Reddit is $RDDT.

About Reddit

The social media platform has put forward detailed plans for an IPO in March 2024, several years after confidentially filing for a listing in December 2021. Concerns about the company’s profitability and general market volatility leading to declining IPO numbers have resulted in these plans being delayed.

Reddit is known for its discussion groups, which often cover niche topics. They allow users to post anonymously and let the community vote for responses, with those that receive the highest amount of 'up' votes getting more views. The website has also become a hub for retail investors to discuss investment ideas.

The company primarily generates revenue through advertising. However, its lack of user data makes targeted advertising challenging when compared to Facebook ($META). Premium memberships are available that provide an ad-free experience, access to additional areas and other benefits. Users can also purchase coins to reward others for their contributions.

Reddit is focused on gaining profitability, which has been affected by the amounts of cash that have gone towards investing in the platform. It could be the first major social media company to list since Pinterest ($PINS) in 2019. Increased screen time has made the industry attractive for advertisers, but established giants like Instagram and newcomers such as TikTok present strong competition.

Who owns Reddit?

Reddit was founded by Steve Huffman and Alexis Ohanian in 2005 and sold to global media firm Condé Nast Publications in 2006. Reddit is now a subsidiary of the parent company of Condé Nast, Advance Publications. Steve Huffman returned as CEO in 2015.

Reddit has had several rounds of investment and has received funding from the likes of Fidelity Investments, Andreessen Horowitz, Sequoia Capital and Tencent Holdings ($TECHY).

Reddit IPO details

Proposed ticker symbol | |

Company Name | |

Exchange | New York Stock Exchange |

Share price | US$50.44 (at close of first trading day) |

Market capitalisation | US$9.5b |

We’ll update this article when more information becomes available.

🎓 Learn more: What is an initial public offering and how do they work? →

Disclaimer: This does not constitute financial advice nor a recommendation to invest in the securities listed. The information presented is intended to be of a factual nature only. Past performance is not a reliable indicator of future performance. As always, do your own research and consider seeking financial, legal and taxation advice before investing.

Megan is a markets analyst at Stake, with 7 years of experience in the world of investing and a Master’s degree in Business and Economics from The University of Sydney Business School. Megan has extensive knowledge of the UK markets, working as an analyst at ARCH Emerging Markets - a UK investment advisory platform focused on private equity. Previously she also worked as an analyst at Australian robo advisor Stockspot, where she researched ASX listed equities and helped construct the company's portfolios.