How to Buy EBTC on ASX?

For the first time, investors can purchase Bitcoin and Ethereum ETFs with real cryptocurrency as the underlying asset. Here is what you need to know about the latest offering by ETF Securities and 21Shares.

This article focuses on how to buy specific securities, however it is not a recommendation to invest in them and should not be taken as financial advice. Do your own research and make your own decisions, or even consider getting advice from a licensed financial adviser before investing.

Key highlights:

- EBTC and EETH became available to trade on the ASX from 12 May 2022.

- EBTC is a cryptocurrency ETF that tracks the price of Bitcoin, while EETH tracks the price of Ethereum.

- It takes under five minutes to buy EBTC and EETH on the Stake platform.

The promise of a cryptocurrency ETF has been headline news for years. What started with a crusade by the Winklevoss twins developed into a futures-backed $BITO listing on the U.S. market. Now, the Australian market will be the first to debut real crypto ETFs with real Bitcoin and Ethereum as the underlying assets. Find out more below about the first Australian ETFs based on the two most popular cryptocurrencies in the world.

How to buy EBTC?

Want to start buying cryptocurrency ETFs but not sure how? Learn how to buy EBTC and EETH on the Stake stock trading platform below.

1. Download the Stake mobile trading app or sign up on your desktop

If you’re ready to jump into the markets, create your account with Stake and sign in.

2. Fund your Stake AUS account

Go to the Funds and Balances screen, and make a deposit into your account. See all the payment methods available.

3. Search for EBTC

Find the crypto ETF by searching for the name ‘Global X 21Shares Bitcoin ETF’ or simply by the ticker symbol ‘EBTC’.

4. Click ‘Buy’ and choose your order type

Select either a ‘Marker Order’ or ‘Limit Order’, the amount you’d like to buy and place the trade.

5. Monitor your investment

You now hold a position in EBTC. Monitor your investment and the performance of the ETF.

What is EBTC ETF?

EBTC is a cryptocurrency ETF that has been released in the Australian market (Cboe Australia) by ETF issuer Global X and 21Shares.

EBTC will track the price of Bitcoin. Essentially, every dollar of the EBTC ETF entitles holders to an Australian dollar of Bitcoin, since it’s denominated in Australian dollars.

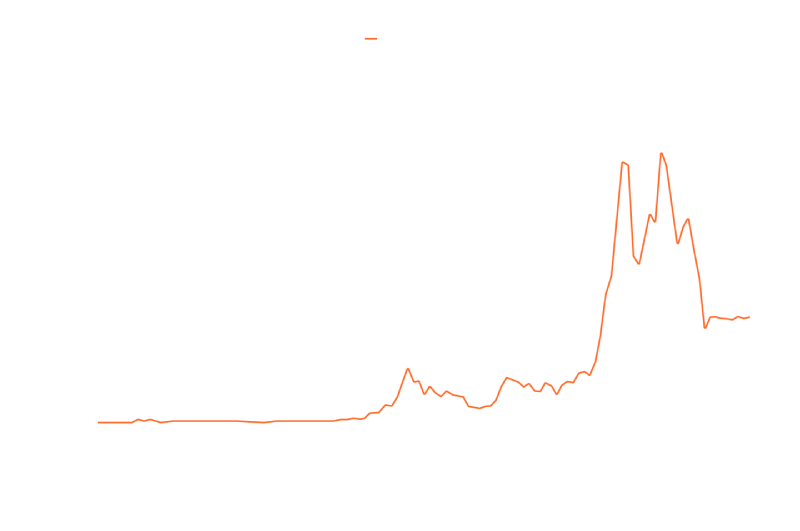

Bitcoin has been the best performing asset according to Charlie Bilello, and the most talked about for the past decade, with a current market capitalisation of U$384,815,149,414 (as of 1 September 2022).

Data source: Statista

How to buy EETH?

Follow the same steps below if you want to know how to buy EETH on Stake.

1. Download the Stake mobile trading app or sign up on your desktop

If you’re ready to jump into the markets, create your account with Stake and sign in.

2. Fund your Stake AUS account

Go to the Funds and Balances screen, and make a deposit into your account. See all the payment methods available.

3. Search for EBTC

Find the crypto ETF by searching for the name ‘Global X 21Shares Ethereum ETF’ or simply by the ticker symbol ‘EETH’.

4. Click ‘Buy’ and choose your order type

Select either a ‘Marker Order’ or ‘Limit Order’, the amount you’d like to buy and place the trade.

5. Monitor your investment

You now hold a position in EETH. Monitor your investment and the performance of the ETF.

What is EETH (Ethereum ETF)?

EETH is a crypto ETF just like EBTC mentioned above, but instead of tracking the price of Bitcoin, EETH tracks the price of Ethereum. As the ‘king of altcoins’, it’s no surprise that Ethereum would also get its own ETF available to trade on the ASX.

The Ethereum ETF is denominated in Australian dollars.

Both $EBTC and $EETH commenced trading on the Australian market (Cboe Australia) at the market open on 12 May 2022.

When opening a new position in a stock, the first purchase must be over $500. This is inline with the market’s minimum marketable parcel rules for the ASX.

If you would like to learn more about the first crypto ETF, check out our guide on buying shares in the $BITO ETF.

What are the benefits of buying cryptocurrency ETFs?

Getting exposure to cryptocurrency can increase the diversification of your portfolio. The question then is, why is a crypto ETF worth considering instead of directly owning the underlying cryptocurrency? We outline below the main benefits of buying crypto ETFs:

- Accessibility

- Convenience of investments all in one place

- Security

Though it may sound simple to hop on a crypto exchange and buy Bitcoin, many people find it tricky. Accessing crypto ETFs through an easy-to-use platform like Stake makes these securities more readily available to users who are not very crypto-savvy.

Many investors also place a high value on being able to gather their investments in the same platform where they already trade shares.

But security is arguably the biggest benefit. With the $EBTC and $EETH ETFs, the ETF issuers ensure that all underlying crypto is held in cold storage with Coinbase (COIN). Cold storage involves taking crypto off the internet and storing it in a physical wallet (like a USB). In contrast, crypto investors who leave their holdings on an exchange or app are more vulnerable to hacks. It’s not a common occurrence, but the downside is vast.

💡Related: How to buy Bitcoin ETFs in Australia [2024]→

What are the risks of buying crypto ETFs?

ETFs are generally considered a safer investment option than individual stocks, but it’s not quite the same with these crypto ETFs. While most ETFs are diversified by nature, the EBTC and EETH ETFs track the price of a single asset each. Although the security-related risk mentioned above will be reduced, here are some risks to consider before investing in EBTC and EETH:

- EBTC and EETH are not diversified ETFs

- Since these crypto ETFs track the price of the coins, they are exposed to the same price volatility

- EBTC and EETH will be impacted by any regulation that the Bitcoin and Ethereum cryptocurrencies come to face

Learn more: What is an ETF?

What's the difference between BITO and EBTC?

The main difference between BITO and EBTC is that BITO tracks Bitcoin futures, while EBTC tracks the price of Bitcoin itself.

Another notable difference is that BITO is available for trading on NYSE, and EBTC is available on the ASX. BITO was the first Bitcoin ETF and commenced trading in late October 2021.

Should I buy EBTC over buying Bitcoin directly?

Providing a cryptocurrency ETF like EBTC to our users gives them the opportunity to access Bitcoin from the trading platform they already use. Buying EBTC over Bitcoin directly may also make sense when you consider security risks, low exchange quality, management and potential loss of private keys and custody arrangements, to name a few. As always, we recommend that you do your own research before making any investment decisions.

How is the net asset value (NAV) of EBTC calculated?

According to Global X ETFs, the NAV is calculated ‘by multiplying the coin entitlement of every outstanding EBTC unit by the price of Bitcoin, as measured by CryptoCompare at 3pm Central European time. We then convert that amount into AUD using the WM/Refinitiv London 4pm AUD rate. We use European time as our partner, 21Shares, is based in Switzerland’.

The Net Asset Value (NAV) is the net value of an ETF less its liabilities, divided by the number of shares outstanding. The NAV is usually calculated at the end of each trading day but since cryptocurrencies trade 24/7, there is no close.

Ready to buy ETFs with Stake?

Sign up with Stake and invest in 8,000+ Australian shares and U.S. stocks and ETFs.

With Stake, you can be in the Australian market in under 5 minutes. You can apply for an account in your own name (Individual Account) or in the name of a Company or SMSF.

What’s more, when you sign up for an Individual Account, you also get a A$10 headstart on us. All you need to do is fund your Stake AUS account within 24 hours of it being ready.