Invest your super with an award-winning SMSF partner

A self-managed super fund lets you take control of where and how your retirement funds are invested.

Full SMSF setup, accounting, auditing and tax preparation from just $990/year

Industry-leading support from a team of in-house SMSF professionals

Invest in stocks, ETFs, property, managed funds, precious metals and more

Schedule a no-commitment chat with a Stake Super specialist who can answer your SMSF questions.

Winner - Best for SMSF

WeMoney Investment Awards 2024/2025

4.9

50+ reviews

Book a call with a Stake Super specialist

Our team of SMSF professionals are on hand to shed light on all things Stake Super and SMSF admin. Schedule a no-commitment call below.

You invest, we handle the rest

A Stake Super SMSF lets you shape your superannuation with your own investment decisions, while we do the administrative heavy lifting.

SMSF setup, accounting, auditing and tax all taken care of, starting from just $990/year.

Winner - Best for SMSF

WeMoney Investment Awards 2024/2025

4.9

50+ reviews

Our specialists take care of:

- Preparation of SMSF EOFY annual statements

- Annual investment and performance reports

- Independent annual SMSF audit

- Preparation and lodgement of SMSF annual tax return

- Preparation of annual trustee resolution and minutes

- Lodgement of activity statements (incl. PAYG & BAS)

- Annual member statements

How does Stake Super lighten the load?

“Managing my SMSF was always challenging before I moved to Stake [Super]. Their people are incredibly helpful and hardworking and the user experience with the product is fantastic. I am really amazed at how simple Stake Super has made my SMSF Tax Management & Compliance. I used to dread Tax and Compliance time and the Stake [Super] team have made my life so much easier. I feel like I get the personal attention that I need, the communication is quick and the process is seamless.”

Peter M

WHAT OTHERS ARE SAYING

4.9

50+ reviews

“Stake Super is a fantastic SMSF service and makes it so easy to control my super exactly how I want.”

Daniel

“Very impressed with the customer service and professionalism. I am 100% satisfied with this company and its staff. Highly recommended.”

Anoop

“Set up an SMSF with Stake Super recently. Easy to do, Stake staff very supportive and professional throughout process.”

Sally

“Excellent level of service - Matt and the team was incredible. They answered every one of my questions. Went over and beyond!”

Zak

“Would recommend for those ready to move to a SMSF.”

Geoff

“Stake Super - Great, simple, efficient & transparent product offering that meets my needs”

Piara

“Much less admin than I first thought… Can't understand why more people aren't talking about this.”

Tom

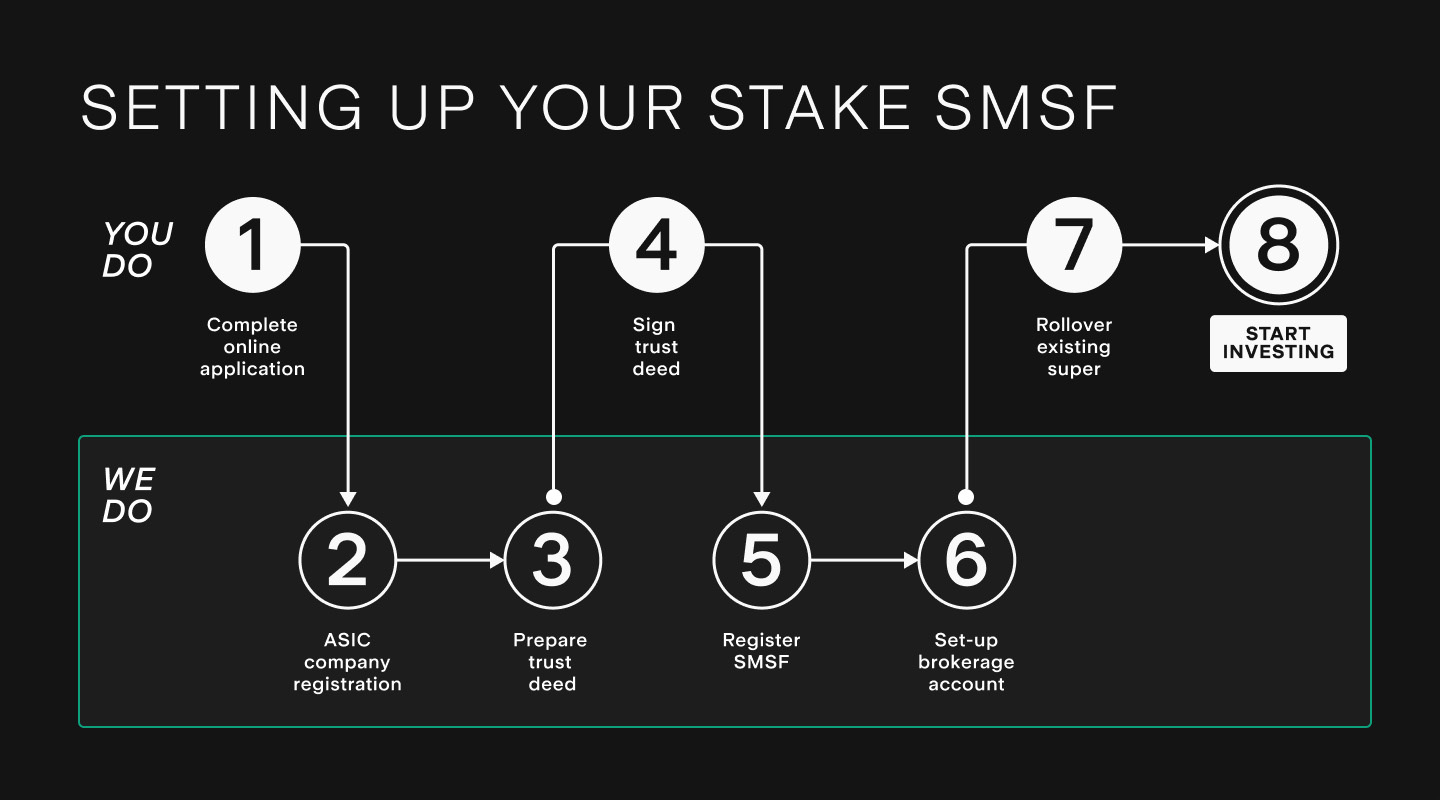

Take the reins of your retirement in just a few steps

We’re with you every step of the way, whether you’re setting up a new SMSF or transferring an existing one to Stake Super.

Submit online application

Fully digital, done in just a few minutes.

E-Sign SMSF documents

We will send you your SMSF establishment documents to sign electronically.

SMSF ATO registration

Once you have signed your establishment documents we'll register and establish your SMSF with the ATO.

Account ready

You’re now in control. Roll over any existing super and instruct your employer(s) to direct upcoming super contributions to your new SMSF.

An option for every nest egg

Full-service administration of your fund, no matter the assets, for one simple annual fee. You’ll pay your first annual fee by card, but the initial fee will be reimbursed from your super balance once it lands in your Stake Super account. So you’re not left out of pocket.

For full admin and investing on Stake:

- 9,500+ U.S. stocks and ETFs

- 2,500+ ASX stocks and ETFs

- OTC (over-the-counter) stocks

$990

/year

Property

For everything on Stake Super, as well as admin of:

- Residential property

(With or without borrowing) - Commercial property

(With or without borrowing)

$1,690

/year

Plus

For everything on Stake Super Property, plus admin of:

- Managed funds

- Precious metals

- Cryptocurrencies (on the platform of your choice)

- Venture capital funds

- Startups & VC

- And all allowable SMSF investments

$2,490

/year

For full admin and investing on Stake:

- 9,500+ U.S. stocks and ETFs

- 2,500+ ASX stocks and ETFs

- OTC (over-the-counter) stocks

$990

/year

Property

For everything on Stake Super, as well as admin of:

- Residential property

(With or without borrowing) - Commercial property

(With or without borrowing)

$1,690

/year

Plus

For everything on Stake Super Property, plus admin of:

- Managed funds

- Precious metals

- Cryptocurrencies (on the platform of your choice)

- Venture capital funds

- Startups & VC

- And all allowable SMSF investments

$2,490

/year

Incremental fees may apply depending on your fund setup.

Transparency is critical to us, so please view our full pricing details for more information.

Learn more about an SMSF

FAQs

Stake Super is a self-managed super fund (SMSF) administration service and investing platform that offers full SMSF administration and compliance support as well as seamless access to invest your super in over 12,000 ASX & U.S. stocks and ETFs, property, managed funds, and more.

To learn more about Stake Super, book a call with one of our Stake Super specialists here or email us at smsf@hellostake.com.

Unlike other self managed super fund (SMSF) administrators, at Stake Super we don't charge an SMSF set-up fee above and beyond our standard annual fee. Our annual fee ($990 for Stake Super or $2,490 for Stake Super Plus) includes the cost of setting up your SMSF as well as your first year of SMSF administration (accounting, audit, tax & year-round support).

N.B. If you are looking to transfer your SMSF to Stake Super, there is no transfer cost involved. You can see a breakdown of Stake Super fees here.

For more information, book a call with one of our SMSF specialists here or email us at smsf@hellostake.com

To set up a self-managed super fund with Stake Super, simply complete our online application form. Once completed, we will prepare and send the establishment documents to you to digitally sign, register the special purpose company and apply for your SMSF ABN & TFN. See below for a breakdown of the SMSF set-up steps with us:

You can read more about SMSF set-up here or alternatively, book a call with one of our SMSF specialists here.

Once you complete the online application and pay, the average time it takes to get your self managed super fund (SMSF) established and Stake trading account set up is 1-3 weeks*.

*N.B. This timeframe may vary depending on individual circumstances, ATO registration time, and the time it takes for your current super fund to process your super transfer to your SMSF.

For more information on the SMSF set-up process, book a call with one of our SMSF specialists here or email us at smsf@hellostake.com.

Stake is an investing platform offering access to invest in shares & ETFs across the ASX and US markets.

Stake Super is a self managed super fund (SMSF) administration service. This means Stake Super will help with the set-up and ongoing compliance and other administration obligations of running an SMSF. If you choose Stake Super as your SMSF administrator, you will also be set-up with a Stake trading account to enable your SMSF to seamlessly invest in over 12,000 ASX or U.S. stocks and ETFs.

For more information, book a call with one of our SMSF specialists here or email us at smsf@hellostake.com.

There is no minimum super requirement to set up a self-managed super fund (SMSF), however, setting up an SMSF comes with responsibilities and trustees should be confident in their ability to meet them. Before making a decision, you can learn more about SMSF compliance here and SMSF risk here.

For more information, book a call with one of our SMSF specialists here or email us at smsf@hellostake.com.

Yes. You can use your self-managed super fund (SMSF) with Stake Super to invest in over 12,000 ASX or U.S. stocks and ETFs on the Stake investing platform. Should you wish to invest in any stocks & ETFs not available on the Stake platform (for example equities listed on the London Stock Exchange), you can easily do so via our Stake Super Plus package.

For more information on SMSF investments, book a call with one of our SMSF specialists here or email us at smsf@hellostake.com

Yes. You can use your self-managed super fund (SMSF) to invest in both residential and commercial property via our Stake Super Property package. Should you wish to obtain a loan within your SMSF for a property purchase, we can support by setting up a Bare Trust & creating the Bare Trust Deed as part of a Limited Recourse Borrowing Arrangement (LRBA) for a one-off fee of $1,199. A complete breakdown of our fees can be reviewed here.

For more information on buying a property with an SMSF, book a call with one of our SMSF specialists here or email us at smsf@hellostake.com.

N.B. Stake Super is not a lender however we will set up the LRBA structure in order for you to seek financing via your SMSF from an appropriate lender.

Yes. You can use your self-managed super fund (SMSF) with the Stake Super Plus package to invest in cryptocurrency outside of the Stake platform.

Yes. Like all superannuation funds, income derived from investments held by a self-managed super fund (SMSF) may be subject to income tax, however self-managed super funds can provide tax-efficient solutions for investors. Learn more about SMSF tax benefits here.

For more information on SMSF tax obligations, book a call with one of our SMSF specialists here or email us at smsf@hellostake.com.

Stake Super fees are paid on an annual basis and are withdrawn directly from the SMSF Stake AUS account (which acts as your SMSF bank account). The renewal date is 1 year from when your Stake trading account is set up and not necessarily tied to EOFY.

N.B. All SMSFs are required to pay an annual ATO supervisory levy (currently $259) which is incorporated into the annual tax return. SMSFs with a corporate trustee are also required to pay an ASIC company management fee (currently $65) due annually on the anniversary of when the SMSF special purpose company was set up. Similarly to the Stake Super annual fee, this ASIC fee is also withdrawn directly from the SMSF Stake AUS account.

For more information on our annual fees, book a call with one of our SMSF specialists here or email us at smsf@hellostake.com.

Yes, our annual (ongoing) Stake Super annual fee is generally tax deductible at 15%*.

*N.B. For SMSFs with a corporate trustee, the company establishment fee (currently $597 and is included in your first-year Stake Super, Stake Super Property or Stake Super Plus annual fee) is not tax deductible.

For more information, book a call with one of our Stake Super specialists here or email us at smsf@hellostake.com.

Yes. For example, if you wish to invest your self-managed super fund (SMSF) in assets beyond the Stake platform, you can upgrade to Stake Super Property or Stake Super Plus at any time. The same flexibility applies when switching from, or to, Stake Super and Stake Super Property. Note, the difference in fees between the packages will apply at your next annual payment date.

For more information about our packages, book a call with one of our SMSF specialists here or email us at smsf@hellostake.com.

Yes. You can bring your self-managed super fund (SMSF) administration and ASX & Wall St investing under one roof by seamlessly transferring your existing SMSF to Stake Super. We can administer all funds and in the first year our annual fee is $990, irrespective of the assets held. From year 2, SMSFs that hold only ASX & Wall St equities on the Stake platform will remain on our Stake Super package (billed at $990/year), and SMSFs that hold assets off the Stake platform (e.g. property, managed funds, etc.) will be upgraded to our Stake Super Plus package (billed at $2,490/year).

Head to our SMSF transfers website here for more information or alternatively, book a call with one of our SMSF specialists here.

The super contribution caps for self-managed super funds (SMSF) in FY25 are $30,000 per year for concessional (pre-tax) and $120,000 per year for non-concessional (after tax).

N.B. If you have unused concessional cap amounts from previous years, you may be able to carry them forward to increase your contribution caps in later years.

You may be eligible to do this if you have a total super balance of less than $500,000 at 30 June of the previous financial year and have unused concessional contributions cap amounts from up to 5 previous years. For more information on super contributions, book a call with one of our Stake Super specialists here or email us at smsf@hellostake.com.

When you reach 60 years old or older, any lump sum withdrawal from your self-managed super fund (SMSF) is tax-free. However, just because you've reached 60 doesn't mean you can automatically withdraw your superannuation. You also need to meet a condition of release.

For more information on self-managed super fund (SMSF) retirement structures, book a call with one of our SMSF specialists here or email us at smsf@hellostake.com.

Our self-managed super fund (SMSF) accountants and tax agents look after your annual SMSF administration- including accounting, independent audits, EOFY reporting and tax lodgement.

Learn more about the self-managed super fund accounting process when you book a call with one of our SMSF specialists here.

If your SMSF exclusively holds assets invested on the Stake platform (Stake Super customers), you will not need to provide any documentation to complete the end of financial year process as we have access to all the relevant information.

If your SMSF holds any assets that are held off the Stake platform (Stake Super Property or Stake Super Plus customers), you will need to provide relevant statements associated with those investments (valuation statements, transaction reports, etc.) in order to complete the end of financial year process.

As above, any assets that are held on the Stake platform will not require documentation. For more information, book a call with one of our Stake Super specialists here or email us at smsf@hellostake.com.

All Stake Super self-managed super funds (SMSFs) which are set up using a corporate trustee structure allows your fund to have up to 6 members (including yourself) to your SMSF.

For more information about SMSF members, book a call with one of our SMSF specialists here or email us at smsf@hellostake.com.

Yes. The process to add a member to your self managed super fund (SMSF) is straightforward and can be done at any time. Members can be added during the application process free of charge, or you can add additional members to your fund after it is set up for fee of $199.

N.B. The Stake Super annual fee remains the same no matter the number of members your SMSF has (maximum of 6).

For more information about adding SMSF members, book a call with one of our SMSF specialists here or email us at smsf@hellostake.com.

Once we have set-up your SMSF and activated your Stake investing account, follow the steps in onboarding to rollover your existing super.

N.B. All relevant rollover information is provided via email to all new Stake Super accounts at the relevant point of the onboarding journey.

For more information about the super rollover process, book a call with one of our SMSF specialists here or email us at smsf@hellostake.com.

In partnership with Australian Group Insurance (AGI), you are able to purchase AIA Life Insurance - that is death cover and total & permanent disability (TPD) - through your Stake Super SMSF. Avoid out of pocket premiums by having them paid directly from your SMSF.

What’s more, Life Insurance and TPD Insurance premiums are generally tax deductible if the policies are held in your SMSF.

For more information about SMSF insurance click here or you can book a call with one of our SMSF specialists here.

N.B. Stake Super receives a referral commission equal to 30% per annum of the insurance premium paid by customers who sign up for SMSF life risk insurance with AGI.

If for any reason, you decide to close your SMSF or switch to another SMSF administrator, we do not charge a wind down fee or a transfer of administration fee.

For more information, book a call with one of our SMSF specialists here or email us at smsf@hellostake.com.