Under The Spotlight: VanEck Gold Miners AUD ETF ($GDX)

With investors chasing the gold rush, mining stocks and ETFs are another way to get both exposure to the precious metal and dividends, but they’re not without risk.

ICYMI: do your own research and make your own decisions. This article drills down on a specific company, however it is not a recommendation to invest in the company and should not be taken as financial advice. This Under The Spotlight came from a Stake trader suggestion. Got a stock you want covered? Tell us here.

Sydney's CBD is no stranger to queues for limited edition ranges, exclusive events, or must-have merch. But lines stretching around Martin Place to buy gold? With the precious metal surging over 50% this year to over $6,000 per troy ounce, investors are bullish on bullion.

But physical bullion isn’t the only way to get exposure to gold. Mining stocks also tend to move in line with gold prices – and offer dividends, unlike the physical commodity.

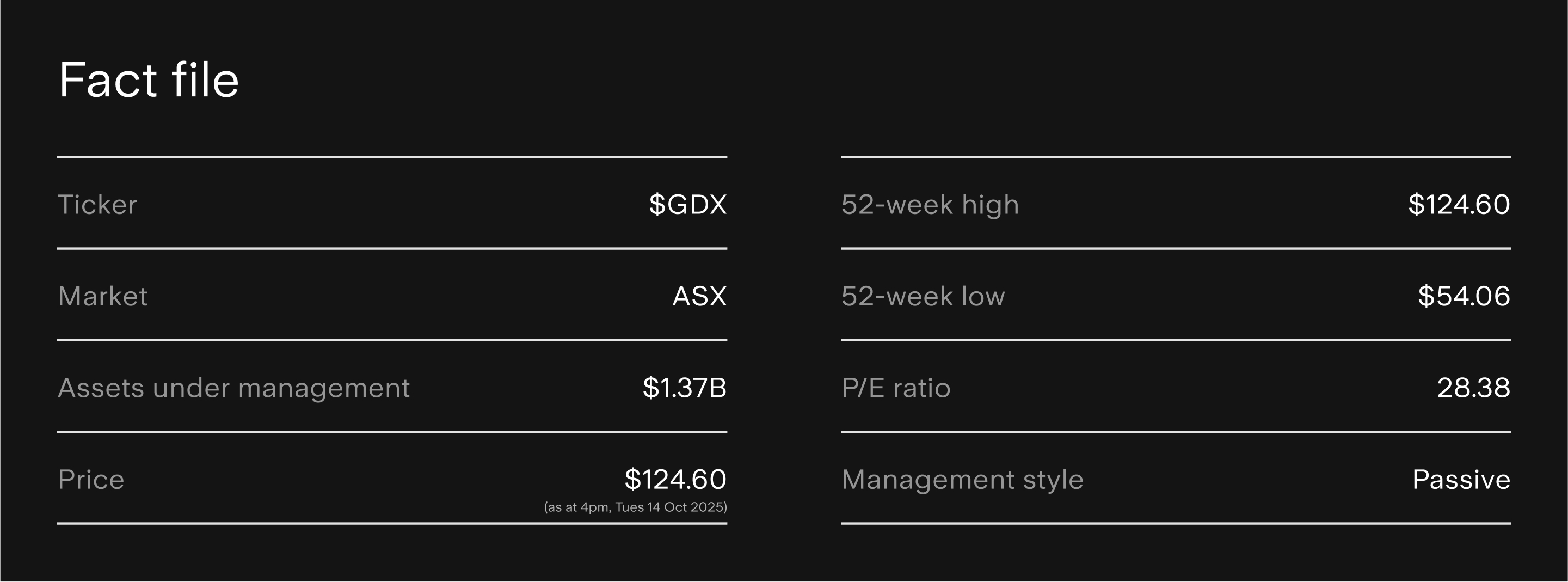

Enter the VanEck Gold Miners ETF ($GDX): up 98.55% this year, reaching $124.06

GDX tracks the NYSE Arca Gold Miners Index (AUD) and holds 82 global gold mining stocks, including Newmont Corp ($NEM) and Northern Star Resources ($NST).

It charges a management fee of 0.53% and pays out annually.

What’s driving gold’s record rally in 2025?

Gold serves a dual purpose: it’s both a consumer good and an investment. Goldman Sachs tips a 6% rise through to mid-2026. Yardeni Research suggested gold prices could reach US$10,000 before 2030.

This plays into its pricing and its demand, which shifts based on geopolitical activity, interest rates, market sentiment, mining production and use in jewellery, tech and other industrial applications.

And right now, it’s back in demand.

Why? Typically, when we enter uncertain times, investors look to gold as a safe haven. That’s one reason why it’s outperformed most major asset classes in the past 20 years.

And the World Gold Council sees volatility around trade policies, global unrest and pressure on central banks fuelling this uncertainty.

Gold demand jumped to US$132B in Q2 2025, with central banks snapping up 166 tonnes in total – China’s central bank alone accounted for 39.2 tonnes over the past year.

It’s not just safe havens though. Rising prices have investors jumping in for their piece of the action, pushing prices higher again.

This week’s record gold price highs were fuelled by a cocktail of catalysts:

The US government shutdown.

Ongoing tension in the Ukraine, as well as political unrest in France and Japan.

Expectations for interest rate cuts.

Central bank buying

Several brokers are bullish that gold could even climb further.

Diversified gold exposure, explained

“Gold miners provide leveraged exposure to gold, with gold miners tending to outperform gold bullion when the price rises and underperform if the gold price falls,” says Russel Chesler, Head of Investments and Capital Markets for VanEck Australia.Barrick Mining ($B) trades atUS US$32.72. Analyst price targets range between US$17 to US$57. It’s gained 63.86% for the year.

Chesler also notes the appeal of miners to income investors. In GDX’s case, it’s. GDX has delivered a 0.93% dividend yield over the past year.

But just because they mine gold, it doesn’t mean mining stocks always glitter. They’re more volatile as they’re tied to equity markets and have company specific risks.

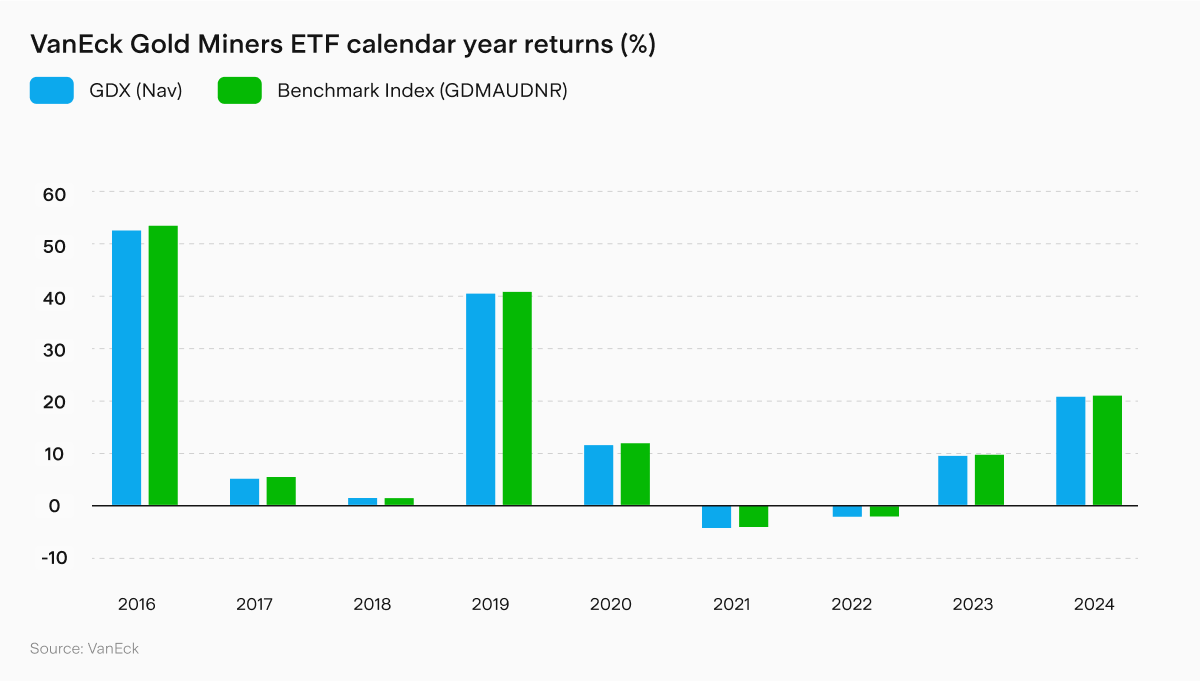

Gold miners have outperformed for the last year, with a 95.81% gain compared to gold’s 52.79%, even if over five years their respective gains even out.

And while gold equities are trading at a discount to gold bullion, analysts see more room to run. UBS reckons miner valuations could climb 150% if gold prices hold.

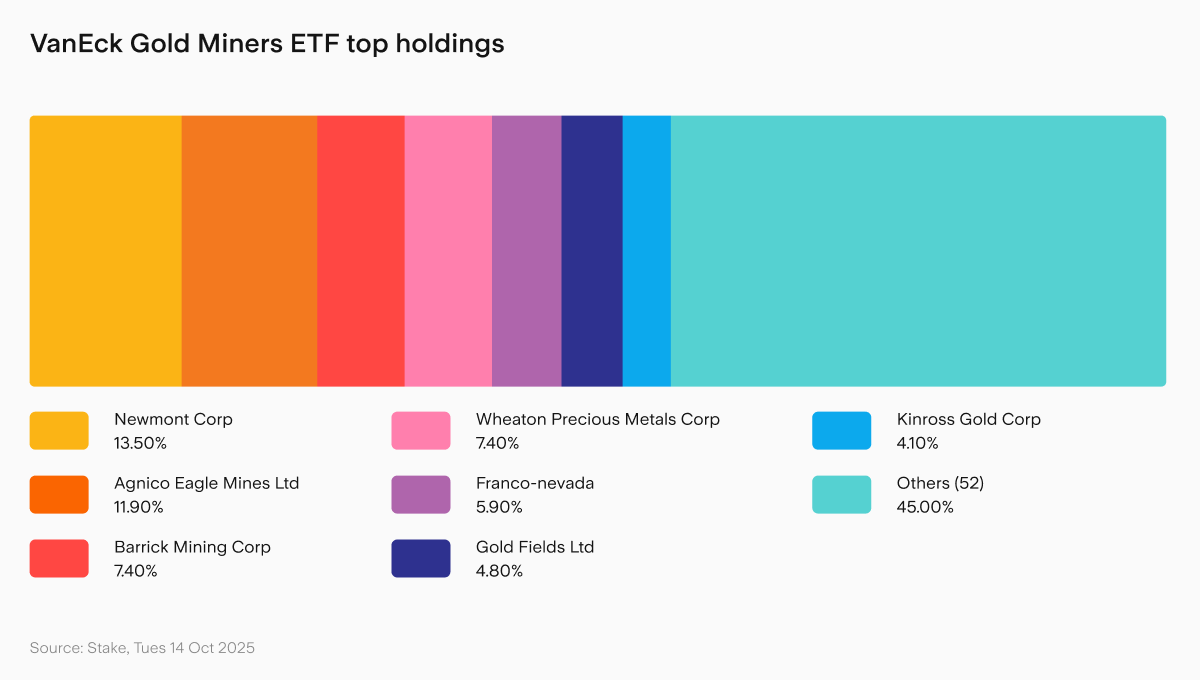

Consider a few of the top 10 stocks in GDX:

Newmont Mining ($NEM) trades at US$85.14. Analyst price targets range between US$58 to US$112. It’s gained 55.31% for the year.

Agnico Eagle Mines ($AEM) trades at US$164.28. Analyst price targets range between US$88 to US$231. It’s gained 105.94% for the year.

- Barrick Mining ($B) trades atUS US$32.72. Analyst price targets range between US$17 to US$57. It’s gained 63.86% for the year.

Should you invest in gold ETFs?

Mining can be a risky sector to invest in. All it takes is for one exploration to make or lose a fortune, while there’s plenty of mergers and acquisitions.

So how do you play the sector? Invest in a big established miner or take a chance on an untested junior? Or use an ETF to diversify companies while still gaining exposure to the sector?

In GDX’s case, it spreads exposure across 82 miners, weighted by market cap. It has global diversification with 44.6% in Canada, followed by the US at 20.1%.

Top holding? Newmont Corp at 11.42%. And the smallest? Collective Mining at 0.09%. While it’s primarily focused on gold, there’s a small exposure to silver at 3.7%.

Should you buy the VanEck Gold Miners ETF?

As markets grow more uncertain and investors look for safe havens, gold’s record highs have put mining stocks back into focus.

GDX is one way to ride the wave, as well as offering income, unlike the physical asset. But mining equities have different risks than gold bullion.

Yes, the performance of the two can be largely in line over time, but gains and losses of miners are magnified. Stocks that sparkle can also lose their shine.

This is not financial advice nor a recommendation to invest in the securities listed. The information presented is intended to be of a factual nature only. Past performance is not a reliable indicator of future performance. As always, do your own research and consider seeking financial, legal and taxation advice before investing.

Sara is a passionate finance writer with more than 15 years’ experience in the Australian finance industry. She has worked in marketing and content with Macquarie Group, Westpac, ETF Securities (now Global X ETFs) and Livewire Markets across investments, insurance, financial advice and superannuation.

.png&w=3840&q=100)

.png&w=3840&q=100)

.png&w=3840&q=100)