Under the Spotlight AUS: BHP (BHP)

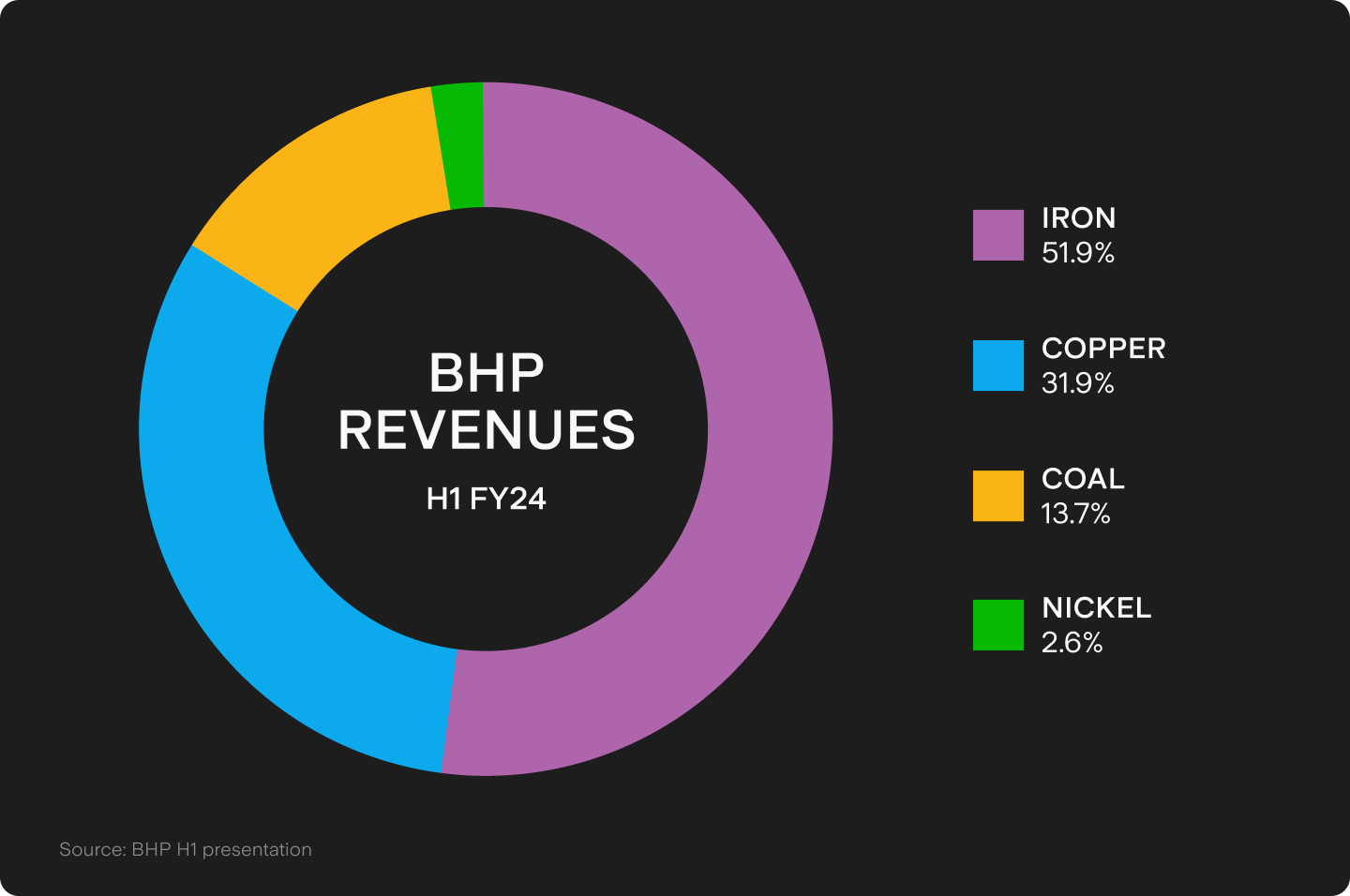

BHP is the world’s largest miner, but its shares are down 15% this year as concerns about China’s economy weigh on iron ore. Let’s put it Under the Spotlight.

BHP ($BHP) may be known as the Big Australian, but its share price hasn’t lived up to the moniker lately. Amid concerns about China’s economy and a bumpy ride for its base metal strategy, it’s been a tough year for CEO Mike Henry – reflected in a 15% fall in BHP’s share price.

Henry has watched Anglo American reject a $75b takeover that would have transformed BHP into a copper powerhouse, while its troubled Nickel West business has been mothballed. And that’s just the past two months.

China Syndrome

Beijing’s faltering attempts to revive China’s growth have weighed on BHP shares, which peaked around $50 in December.

A property slump has stoked fears China’s annual steel production has peaked at around 1 billion tonnes. Iron ore prices have retreated from US$140 a tonne in January to around US$110 a tonne, as stockpiles at Chinese ports hit two-year highs. Market sentiment is tied to the success of Beijing’s policies in restoring housing demand and additional investment in infrastructure.

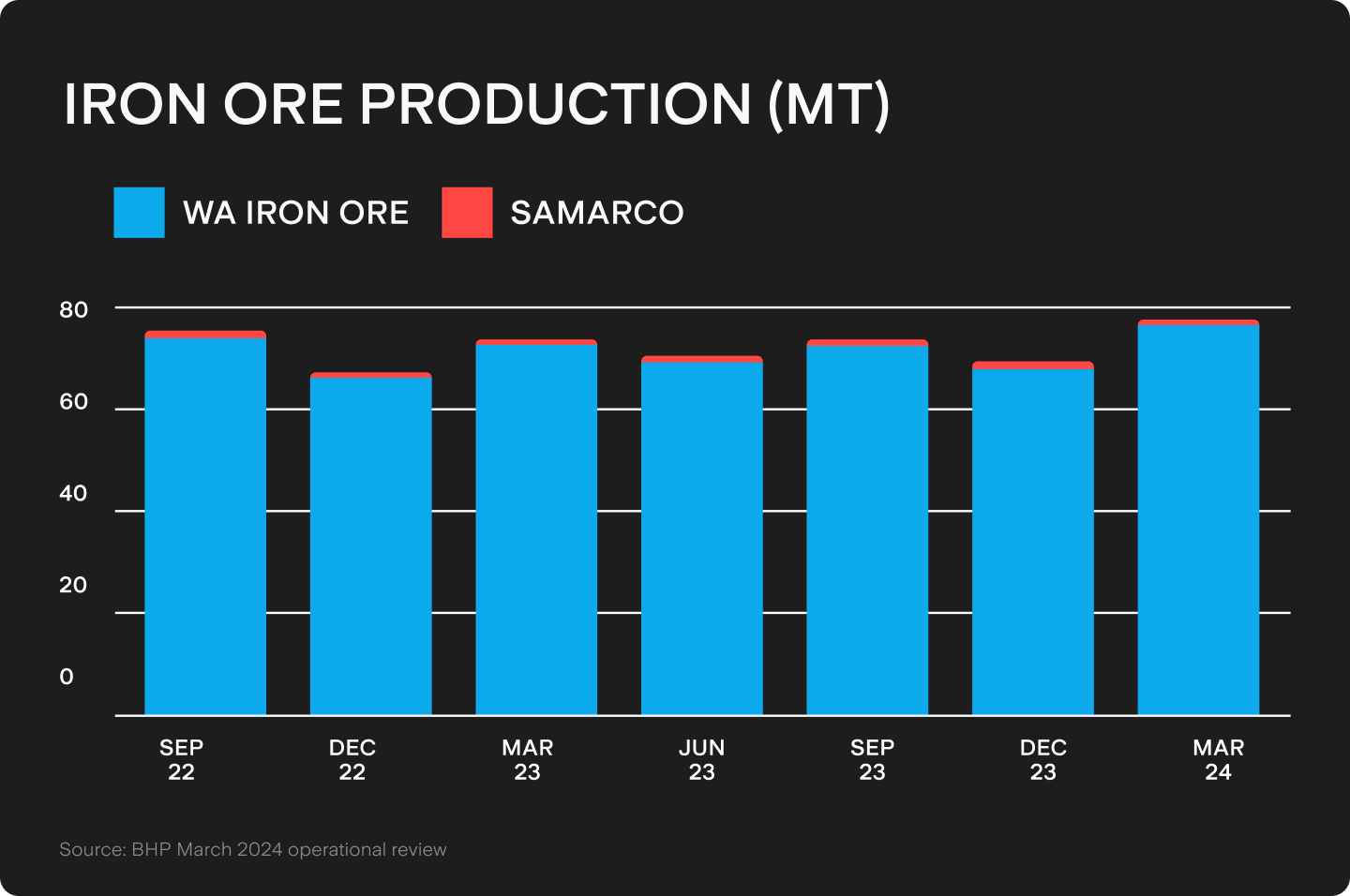

BHP’s big mines allow it to produce a tonne of iron ore for less than US$19, protecting margins should prices fall. And despite China’s woes, BHP wants to expand production from around 287 million tonnes to 305 million tonnes over the medium term, as it sees room for its low-cost product to replace high-cost supplies produced by rivals. That bet hinges on new demand from emerging Asia partly offsetting lower Chinese demand.

No deal

As the sun sets on the golden age of iron ore, BHP has turned its attention to the next big thing – copper. The red metal is vital to the energy transition and BHP has shown it’s willing to spend to get bigger quickly.

It already owns the world’s largest copper mine, Escondida, in Chile. But the hefty bid for Anglo American offered a fast track to true copper supremacy, by adding its South American mines into BHP’s portfolio. Unfortunately, Anglo American wouldn’t play ball and BHP wouldn’t pay more.

That leaves BHP relying on Escondida, which is on track to produce 1.2 to 1.3 million tonnes a year by FY25. It will also push ahead with plans to lift South Australian copper production by 50% to 500,000 tonnes a year, by integrating the assets acquired through the $9.6b takeover of OZ Minerals in 2023. That could be easier said than done, with a $1b expansion at Prominent Hill facing cost and schedule pressures.

Nickel and dimed

BHP’s bets on future-facing metals don’t always pay off. The recent mothballing of its troubled WA nickel project, after a $5.4b pre-tax write-off, shows how quickly the best laid plans can come unstuck.

Only five years ago, nickel was viewed as a winner from the transition to electric vehicles, given the metal’s use in batteries. But a combination of Chinese technology and Indonesia’s low-quality ore and cheap electricity have created an oversupplied market.

Now BHP will spend $450m a year to enable a Nickel West restart if the market improves, with a reassessment scheduled for 2027. Management will have to forget about this black mark on its capital allocation strategy and focus on creating a significant copper business to offset a waning iron ore demand.

Big spender

BHP’s long-life, low cost assets should allow it to deliver an eighth consecutive year of net operating cash flows above US$15b, providing the means to continue calibrating its portfolio.

Around 70% of a targeted US$11b in capex will be spent on future-facing commodities. Besides copper, this includes the potash from its Jansen project in Canada, used as a fertiliser to address rising food demand. A diet rich in iron, copper and potash could grow BHP into an even bigger Australian.

This does not constitute financial advice nor a recommendation to invest in the securities listed. The information presented is intended to be of a factual nature only. Past performance is not a reliable indicator of future performance. As always, do your own research and consider seeking financial, legal and taxation advice before investing.