Under the Spotlight AUS: Insurance Australia Group (IAG)

Insurance provides a safety net for drivers and homeowners in a world of growing risks, especially climate change. IAG is a giant of that sector, and its shares have soared to their highest since 2020 after a deal with Warren Buffett. Let’s put it Under the Spotlight.

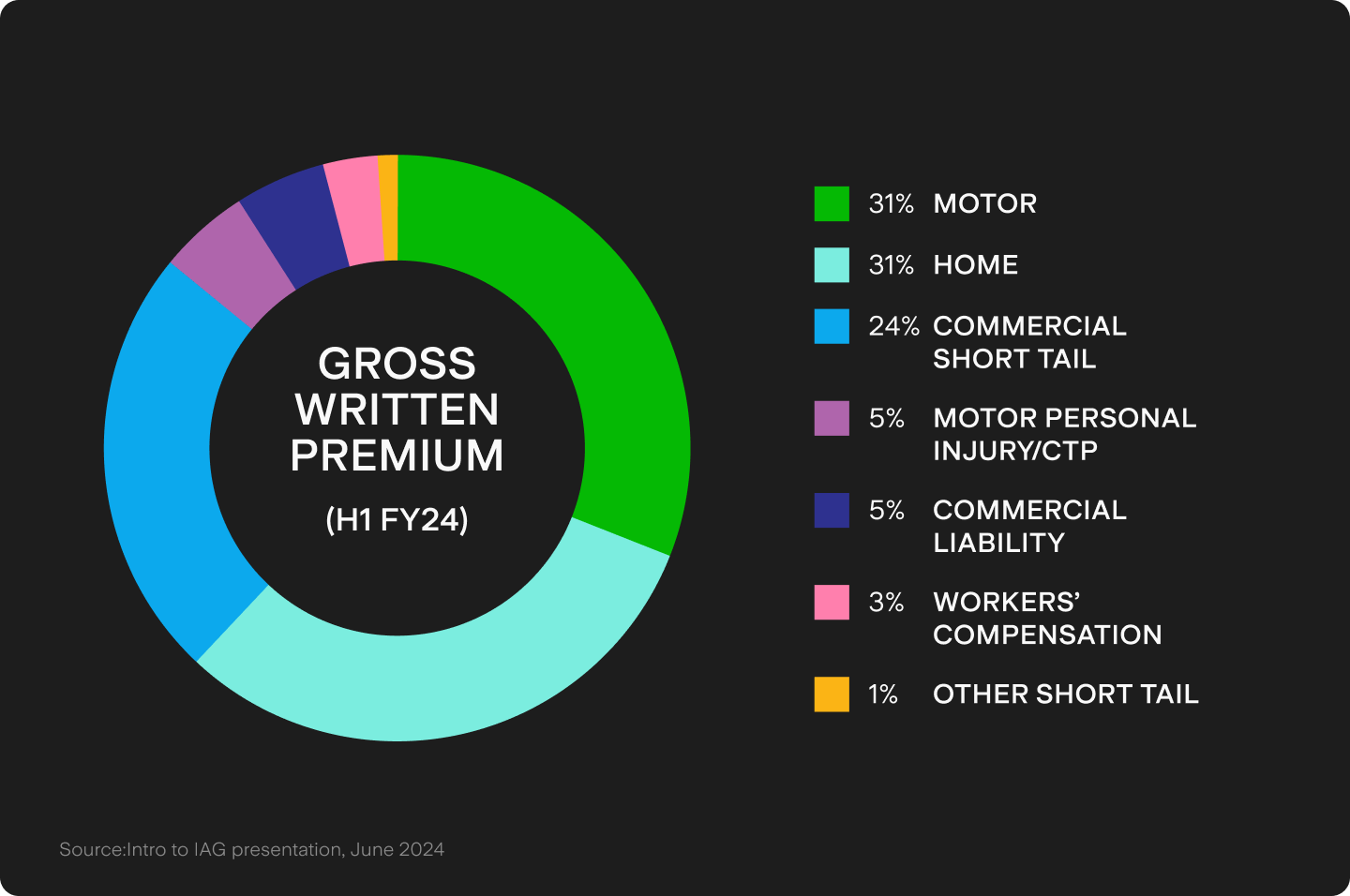

If you own a home or drive a car then your hip pocket is already well acquainted with Insurance Australia Group ($IAG). As the largest general insurer in Australia and New Zealand, it has over 6 million direct customers paying to protect their most valuable assets. As premiums have soared, this has helped drive a 25% share price rally this year.

IAG’s heritage can be traced back to the 1925 founding of NRMA, now better known for roadside vehicle assistance. NRMA Insurance was listed in 2000 after acquiring the largest insurers in Western Australia and South Australia in the late 1990s. A rebrand to Insurance Australia Group in 2002 was followed by acquisitions of CGU, NZ’s State Insurance and Wesfarmers’ insurance underwriting business over the next decade.

Enter Warren Buffett

IAG’s growth-through-acquisition strategy has delivered a one-quarter share of the Australian home and motor markets, and just under 50% of the NZ home and motor markets. With that come the risks of insuring such chunky market shares from natural perils such as storms and floods.

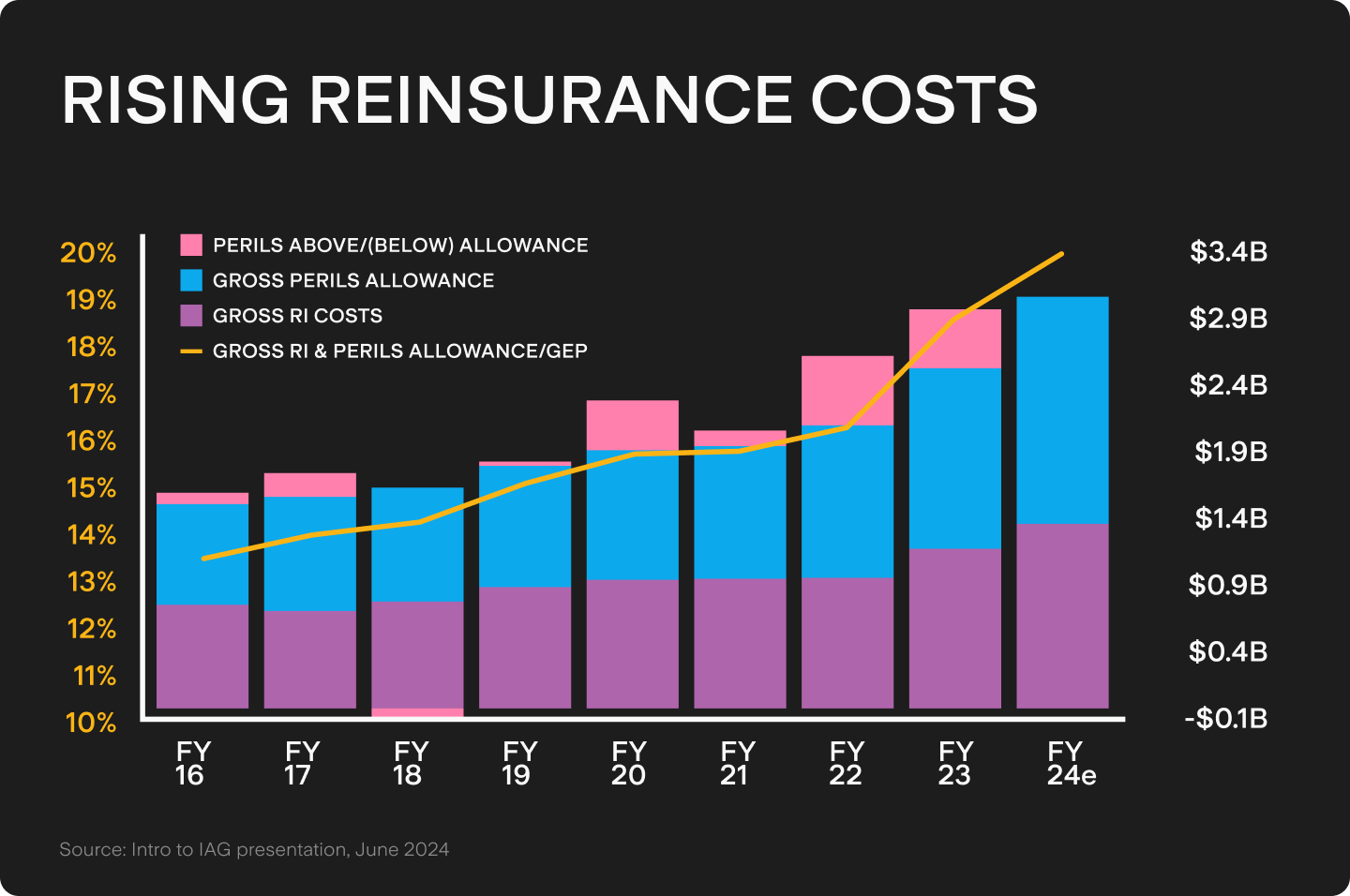

That has proved a tough job as storms, floods and bushfires forced insurers to pay out more than $16.8b in natural disaster claims since the 2019-2020 Black Summer bushfires, according to the Insurance Council of Australia.

IAG seeks to lay off that risk through reinsurance, or insurance for insurers. Enter Warren Buffett and Berkshire Hathaway ($BRK.B), the world’s fifth largest reinsurer. There is a long – and ongoing – history between IAG and Buffett. The Oracle of Omaha made his first investment in Australia when Berkshire Hathaway struck a strategic partnership with IAG in 2015, taking a 3.7% stake in the Aussie insurer.

Less risk, more certainty

Now Buffett’s Berkshire Hathaway has emerged again in a deal that has lifted shares in the $16b insurer to their highest levels since early 2020. IAG rallied hard on the last day of FY24 after it inked five-year natural perils reinsurance agreements with a subsidiary of Berkshire Hathaway and Canada Life Reinsurance that provide additional protection of up to $2.8b over five years.

The TL;DR is that even though IAG will pay out some premiums to reinsurers, it will be able to deliver more stable net profits as it rides a wave of rising premiums and possibly more benign weather.

It’s little wonder investors liked the deal, given IAG said its full year reported insurance profit would be at the upper end of its $1.2b to $1.45b guidance range. Its reported insurance margin is expected to be at the upper end of its 13.5% to 15.5% guidance.

Additionally, its return on equity ‘through the cycle’ target will increase to between 14% and 15%, up from between 13% and 14%. But wait, there’s more: $350m of capital will be freed up, which could find its way back to investors in the form of capital management.

Improved, but work needed

While a range of brokers have lifted their price targets on IAG, many remain concerned about its valuation given its trades at around 17 to 18 times prospective 2025 earnings – a premium to its longer-term average of around 15.5 times.

Many want to see the team led by CEO Nick Hawkins deal with market share losses and control costs. Another challenge is managing risks from litigation related to the Greensill collapse and a home insurance class action backed by Slater and Gordon.

The next catalyst for IAG shares will be the release of full year results on 21 August. Hawkins and Co will hopefully give analysts what they want to hear and deliver the momentum needed to drive the share price closer to $8 – a level last seen before the pandemic. With rival Suncorp ($SUN) set to sharpen its focus as an insurer after selling its banking division to ANZ, IAG will need to prove it’s ready for the unexpected.

This does not constitute financial advice nor a recommendation to invest in the securities listed. The information presented is intended to be of a factual nature only. Past performance is not a reliable indicator of future performance. As always, do your own research and consider seeking financial, legal and taxation advice before investing.