.png&w=3840&q=100)

Under the Spotlight AUS: Pilbara Minerals (PLS)

Pilbara Minerals has soared 90% since June as the lithium market rebounds on China supply cuts.

.png&w=3840&q=100)

Pilbara Minerals ($PLS) shares have gone into overdrive, surging 90% since June as China unexpectedly hit pause on lithium production.

The surge in Australia’s largest lithium producer included a 19% spike on Monday after Chinese battery maker CATL said it would suspend production at one of its mines.

That pause means optimism is creeping back. The lithium market had been drowning in excess supply, even outpacing fast-growing demand from electric vehicles and battery storage systems.

That’s led to a sharp turnaround for PLS investors, who’ve weathered a brutal 75% slide between late 2022 and June this year. Its Pilgangoora mine in Western Australia accounts for about 8% of global lithium supply and has felt the brunt of a 90% price slump.

So is the worst over for lithium?

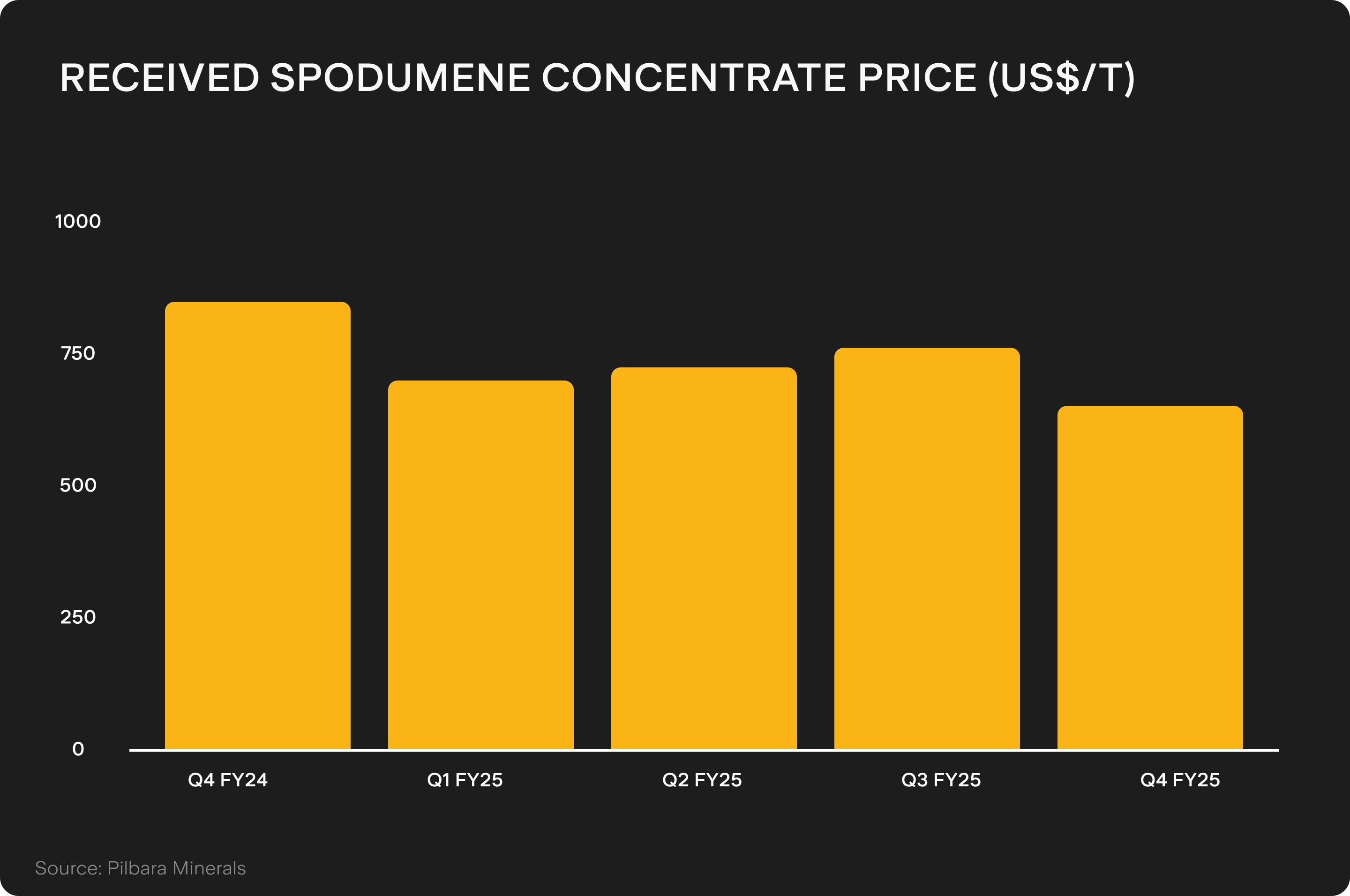

Prices for the type of lithium produced by PLS rose to US$990 a tonne this week, well up from a low of US$575 a tonne in June.

Analysts say this may lead to higher earnings for PLS (more on this later), which has been one of the most traded ASX stocks on the Stake platform this year. But there’s a potential rocky ride ahead.

Rock bottom

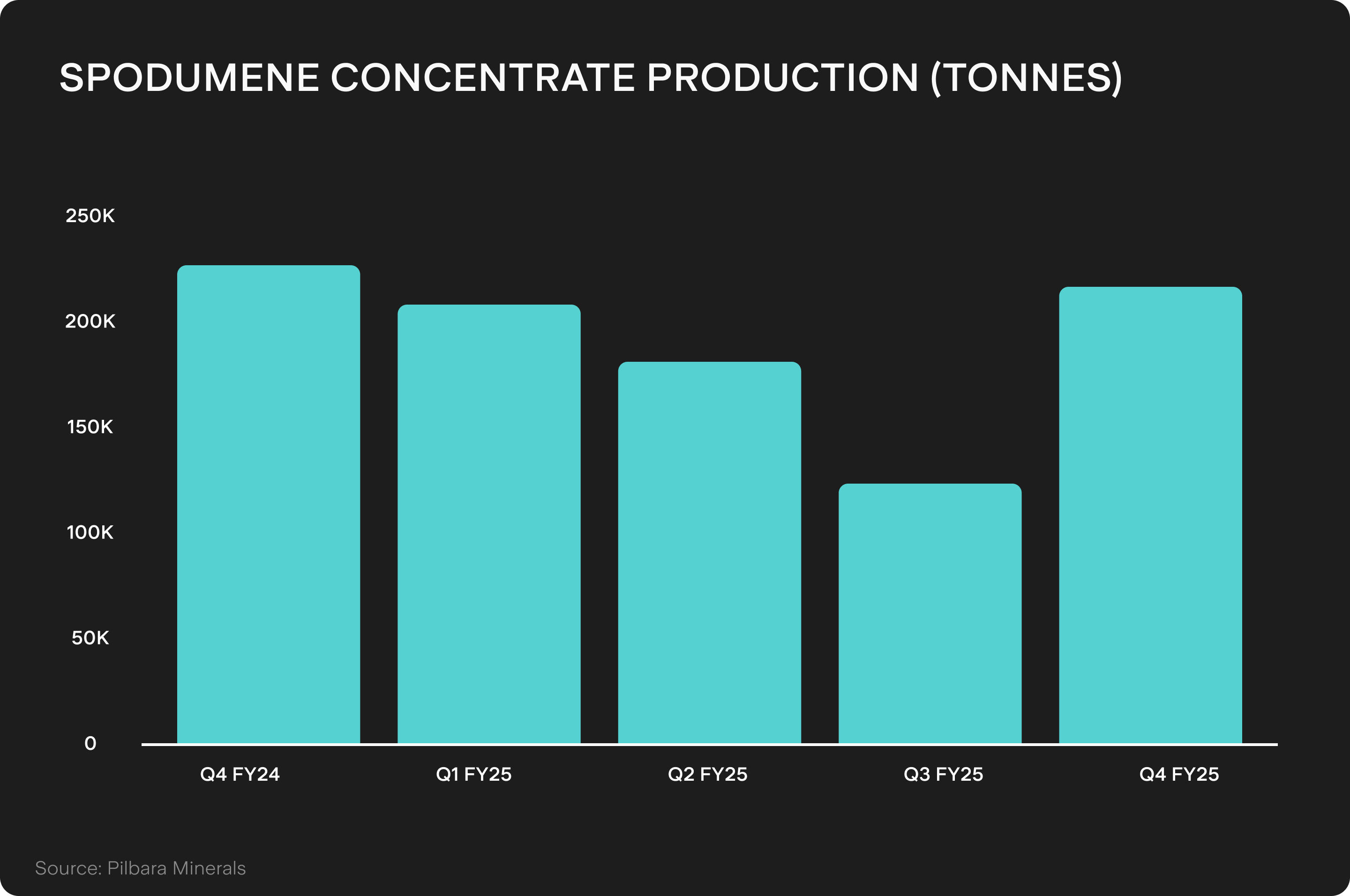

PLS produced 755,000 tonnes in FY25 and will hope the recent price jump marks the end of the lithium winter.

To help understand the lithium market, here’s a quick primer: PLS produces spodumene concentrate, which is mining-speak for hard rock lithium. Lithium is also produced from brines – similar to salt pans – and from lepidolite, a lower grade source popular in China.

New tech helped China ramp up its lepidolite output. But shutting CATL’s mine – a lepidolite source – due to an expired permit and a government audit has removed around 5,000 tonnes of lithium carbonate equivalent (LCE) a month.

Good news for Pilbara, but there’s more supply coming. Australia’s government forecasts lithium extraction to grow at an average of 14% a year, topping 1.8m tonnes of LCE by 2027. But prices are expected to rebound in 2027 as demand starts matching supply.

And that growth in demand is clear: global EV sales grew 24% YoY in June, while battery energy storage systems (BESS) saw global deployed capacity grow 54% YoY in the same period.

That momentum is shaping analyst outlooks. UBS upgraded its lithium price forecasts this week, lifting 2026 and 2027 forecasts by 27% to US$950 and US$1,050 a tonne respectively, on the assumption the worst has passed.

Powering up

PLS is positioning for the next upswing in lithium prices by expanding production. It unveiled a 23% increase in Pilgangoora’s mineral resource estimate in June.

It’s targeting production of between 820,000 and 870,000 tonnes in FY26, with plans to spend AU$300m-AU$330m on capex. The ramp-up of its Pilgan processing plant, part of its P1000 expansion, aims to lift annual production to 1m tonnes.

PLS is focused on cost control amid the weak pricing environment. FY26 operating costs are forecast at AU$560-AU$600 a tonne, down from AU$627 in FY25. The Ngungaju processing plant remains on care and maintenance, but provides rapid capacity should prices improve.

The company is also eyeing a doubling of production under its P2000 plans. A feasibility study is due in FY27, with the timing of any development dependent on an improvement in lithium market conditions.

But PLS does more than smash rocks. It’s also expanding its Posco Pilbara Lithium Solution joint venture in South Korea, investing $40m into a business that produces lithium hydroxide used in batteries. It also continues to undertake studies on its Colina project in Brazil, part of its $560m acquisition of Latin Resources.

Rapid recharge

The rally in PLS shares is welcome relief for investors who have backed the long-term lithium demand story. And it’s also a blow to short sellers. PLS has been one of the ASX’s most shorted stocks, with short interest climbing from 10% in February to 16% in late July.

This lift in sentiment may lead analysts to raise their earnings forecasts – if they can be sustained. But it’s a big if.

Macquarie estimates PLS’ FY26 and FY27 EBITDA at around $130m and $180m, respectively, based on a lithium price of US$800 a tonne. At US$1,200 a tonne, PLS’s EBITDA could be $600m-$770m across FY26-FY28. Macquarie has a price target of $1.90 a share.

However, many analysts calculate PLS shares are pricing in a lithium price well above the spot price. Citi estimates the stock is pricing in US$1,200 a tonne, while Macquarie reckons PLS is trading on an implied lithium price of around US$1,000 a tonne.

UBS rates the stock a sell with a price target of $1.60 a share, warning oversupply remains a risk. It believes PLS shares may have run ahead of themselves after doubling since June.

Hot metal

PLS has rewarded lithium true believers with its high-speed rally since June.

But while China has restricted supply and jolted prices upwards, the road to recovery may be bumpy with growing EV and battery demand ready to soak up whatever comes out of the ground.

This is not financial advice nor a recommendation to invest in the securities listed. The information presented is intended to be of a factual nature only. Past performance is not a reliable indicator of future performance. As always, do your own research and consider seeking financial, legal and taxation advice before investing.

.png&w=3840&q=100)

.png&w=3840&q=100)

.png&w=3840&q=100)