Under the Spotlight Wall St: The Kraft Heinz Company (KHC)

Born out of a merger between two food giants, Kraft Heinz produces kitchen staples for millions of households and restaurants. But in the last few years, the company seems to have stalled. Can it be squeezed for more? Let’s put it Under the Spotlight.

Currently one of the biggest food conglomerates on the planet, Kraft Heinz ($KHC) has a history that spans over 100 years. The companies that make up its name, Kraft and Heinz, separately showed high levels of innovation and today the business is known for being at the cutting edge of the food industry.

Building empires

In 1876, Henry J. Heinz and a business partner started to produce horseradish, vinegar and pickles, and the company quickly gained a reputation for delivering high-quality products. Henry Heinz’s commitment to cleanliness and innovation became evident with the introduction of the iconic clear ketchup bottle in 1888, which showcased the purity of its ketchup.

The famous ‘57 varieties’ slogan solidified the brand’s identity, from a time when the company already had far more than 57 products (turns out that 5 and 7 were simply lucky numbers at the Heinz household). By the turn of the 20th century, Heinz had further expanded its product line and distribution, setting the stage for its ascent as a leading condiment manufacturer in the U.S.

Meanwhile the story of Kraft, the dairy side of the business, which was incorporated in 1909, started when James L. Kraft founded a small cheese distribution business in Chicago. James Kraft played a pivotal role in transforming the cheese industry by introducing processed cheese, a revolutionary dairy product mixed with emulsifiers that offered a longer shelf life compared to traditional cheese. This innovation not only distinguished Kraft from its competitors but also laid the foundation for the company’s future success.

Joining forces

The turning point in the history of both companies came in 2015 when 3G Capital, a Brazilian investment firm known for its aggressive cost-cutting measures, and Berkshire Hathaway ($BRK.B), the multinational conglomerate headed by Warren Buffett, orchestrated the merger of Kraft Foods Group and H.J. Heinz Company. This monumental deal resulted in the formation of The Kraft Heinz Company, one of the largest food and beverage companies in the world.

In the process, Berkshire Hathaway invested around US$24b in the company, then valued near the US$80b mark. This colossal operation was meant to capitalise on the synergies of the giants, consolidating operations, streamlining supply chains and integrating corporate culture across each of the new megacorp’s brands. In reality, however, there were not only pros, but also a fair amount of cons.

Full menu

The merger brought dozens of famous and beloved brands under the same umbrella, most notably Heinz, Kraft, Oscar Mayer, Philadelphia, Golden Circle, Kool-Aid, Jell-O and Grey Poupon. Through its world-famous ketchup and other condiments, Heinz is the top selling sauce brand according to Euromonitor, while nearly 45 million Americans eat Kraft’s mac and cheese at least once a month.

.png&w=3840&q=100)

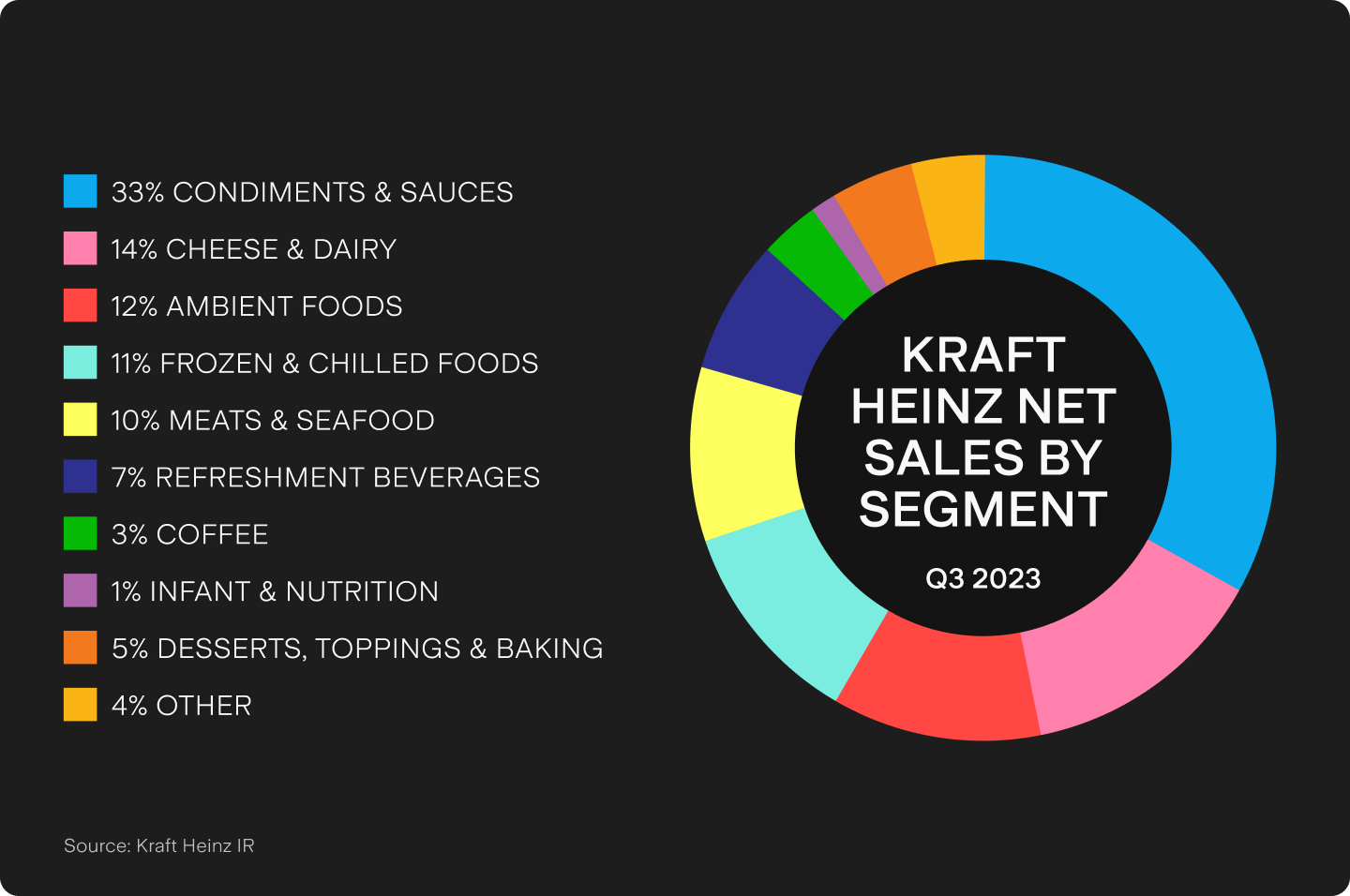

The new food behemoth also benefited from decreasing capital expenditures, as well as more revenue diversification. Though condiments and sauces still bring in most of Kraft Heinz’s revenue, that only accounts for 33% of its sales – the rest comes from a diverse range of products such as cheese, dairy products, meats, seafood, beverages and other categories.

Despite 3G Capital’s famous cost-cutting culture, Kraft Heinz’s cost of goods sold never really consistently plummeted, while annual revenue seemed to stagnate at around the US$26b mark. This led to stalling earnings per share, and investors began to penalise the company’s shares.

To make matters worse, consumer preferences seemed to be changing. Increased competition and a failure to adapt to evolving market dynamics led to a massive US$15.4b write-down of the Kraft and Oscar Mayer brands. Shares dropped 20% instantly and continued to fall for the following months. Berkshire Hathaway copped a multibillion-dollar loss, and Warren Buffett himself admitted he believed he had overpaid for the company.

Tasting opportunities

Despite the challenges faced by KHC, Berkshire still held on to its stake. As it doesn’t usually shy away from shunning an investment thesis no longer likely to play out, this signals Berkshire could believe in a possible turnaround. And although Kraft Heinz has struggled to increase its profits, it has been consistently reducing its long-term debt, which has declined from US$30.02b in mid-2016 to US$19.27b by 30 September 2023. This not only reduces financial expenses but reduces company leverage, better positioning it for possible acquisitions that could lead to higher revenues.

Kraft Heinz has also been investing heavily in expanding its reach on emerging markets. While only 10% of the company’s revenue comes from those markets (vs 76% still coming from North America), sales are growing twice as fast as elsewhere. KHC market share also has more room to grow there, currently at 5% vs 13% globally – it’s a chance to get a bigger slice of a US$60b food and beverage market (annual revenue) in those regions.

In North America, the company expects to expand primarily through B2B sales, in what it calls its ‘away from home’ division. Its initiatives in this sector involve partnering with luxury and aspirational brands before cascading down to restaurant chains and quick service restaurants – or even innovations like a customisable sauce dispenser that can create over 200 different sauces. A limited edition tomato vodka pasta sauce made in collaboration with Absolut even became the company's top selling item during its product lifetime.

Risky business

Though Kraft Heinz is unquestionably one of the leading players in the processed foods industry, that’s not a position to be taken for granted. Changes in consumer behaviour have threatened it before, and competitors like Unilever ($UL), Nestlé ($NSRGY) and General Mills ($GIS) are always lurking for ways to increase their market share.

As core inflation refuses to cool down in many parts of the world, the rising cost of raw materials could be another risk – especially if the company can’t pass those costs down to consumers. Foreign exchange fluctuations can also wreak havoc in its emerging markets operations.

One risk that Kraft Heinz shouldn’t face, though, is ketchup going out of fashion. With annual growth rates around 5% to 6%, demand for tomato sauce doesn’t look like it’s going anywhere but up. And the option with the ‘57 varieties’ motto in a see-through bottle reigns as the most iconic brand.

This does not constitute financial advice nor a recommendation to invest in the securities listed. The information presented is intended to be of a factual nature only. Past performance is not a reliable indicator of future performance. As always, do your own research and consider seeking financial, legal and taxation advice before investing.

Rodrigo is a seasoned finance professional with a Finance MBA from Fundação Getúlio Vargas, one of Brazil's premier business schools. With seven years of experience in equities and derivatives, Rodrigo has a profound understanding of market dynamics and microstructure. Having worked for Brazil’s biggest retail algorithmic trading platform SmarttBot, his expertise focuses on risk management and the analysis, development and evaluation of trading systems for both U.S. and Brazilian stock exchanges.