Under the Spotlight Wall St: Mattel Inc (MAT)

A toy-manufacturing behemoth, Mattel plays a part in the daily lives of millions of children around the globe. But can it expand to become an entertainment colossus? Let’s put it Under the Spotlight.

When we talk about children's toys, few names resonate with the same enduring appeal as Mattel ($MAT). Founded in 1945, the company has crafted a legacy of iconic toys that have captivated generations of young minds. From Barbie to Hot Wheels, Mattel's creations have become cultural touchstones that reflect the aspirations of children worldwide.

Having started out making picture frames, Mattel quickly pivoted to manufacturing toys, producing a child-sized ukulele in 1947. However, it wasn’t until 1959 that the company struck gold with the introduction of Barbie. Ruth Handler, observing her daughter's fascination with adult-like paper dolls, envisioned a three-dimensional adult-like doll that could assume various roles. Barbie, with her glamorous lifestyle and extensive wardrobe, became an instant sensation, transcending the boundaries of a mere toy to become a cultural icon. This marked the beginning of Mattel's ascent to dominance in the toy industry.

In 1968, Mattel created another of its best-selling products, Hot Wheels, before proceeding to go on an acquisition spree. Over the following decades Mattel purchased numerous businesses, including toddler-focused Fisher-Price and the card game sensation Uno. Having made 25 acquisitions throughout its history, Mattel now boasts 216 different brands available in more than 150 countries.

Overcoming setbacks

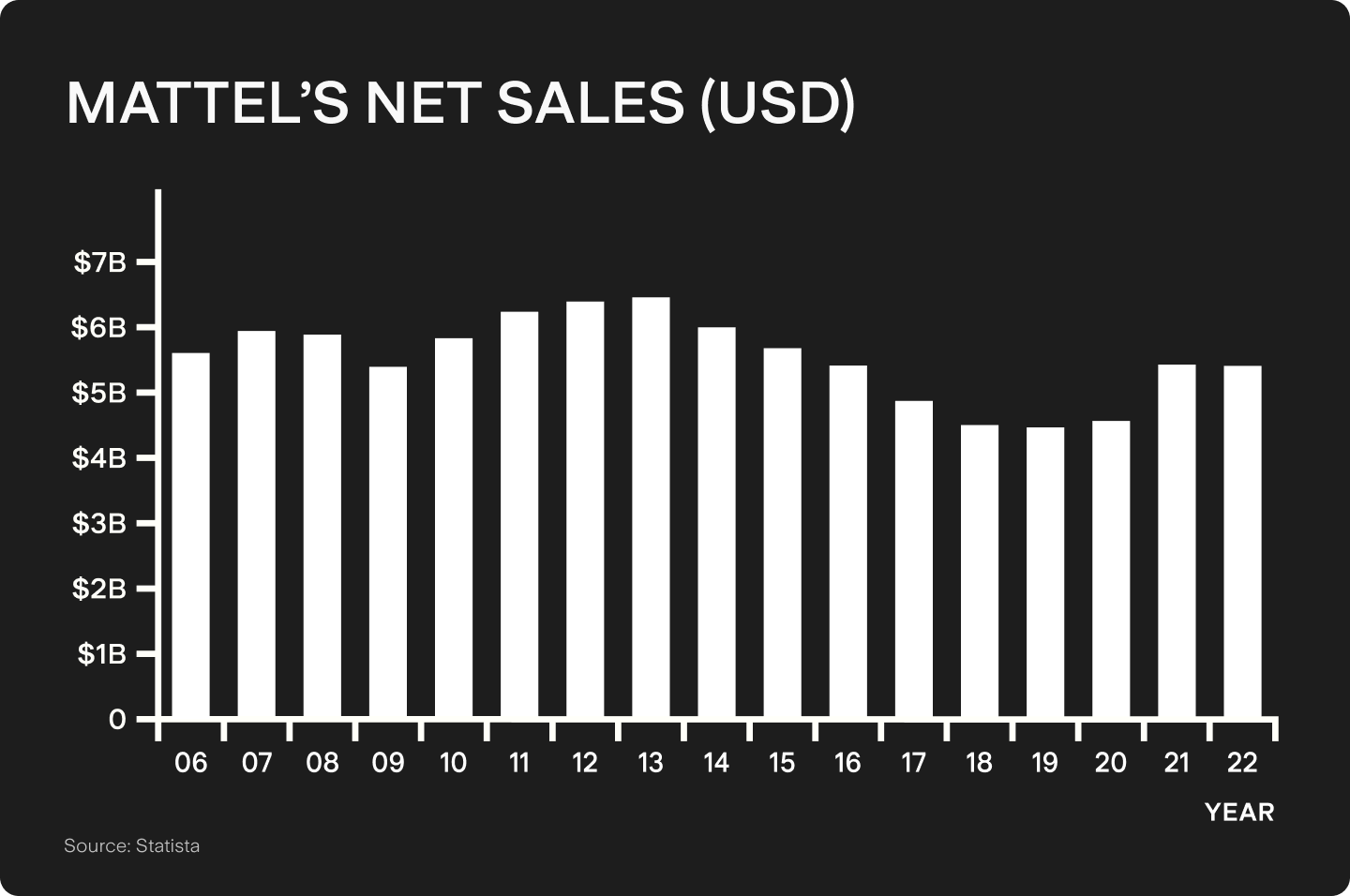

The global toy-manufacturing industry had revenues of more than US$107b last year. Mattel is one of the leading players in the sector, its net sales not dropping below US$4.5b since 2006. But staying successful has not been child’s play.

In 2009, Mattel received a record fine and trust was eroded in its brand after excessive levels of lead were found in the paint used on millions of its toys. Five years later, Mattel was dethroned as the world’s leading toy maker by Lego as the success of The Lego Movie, which made US$468m at the box office globally, helped the Danish company increase its sales significantly. And in 2016, Mattel lost the rights to produce Disney ($DIS) princess dolls to its competitor Hasbro ($HAS), severely hampering its sales. Notably, Mattel won back these rights last year.

Move into movies

Mattel has a long-standing association with the entertainment industry, and although many of its forays into this field haven’t borne fruit, it has had its fair share of successes. For instance, the Masters of the Universe cartoon, with its protagonist He-Man, became an eighties classic, and there was even a spin-off action movie starring Dolph Lundgren.

But after Lego’s astonishing success with The Lego Movie, it was clear that Mattel, having spent many decades carefully constructing its brands, needed to capitalise on them. Releasing a series of animated movies in the mid-2010s, Mattel set itself up for its biggest entertainment product launch ever. Earlier this year, the Barbie movie premiered, grossing more than US$1.44b at the box office. Mattel predicts that the movie, along with dolls and related merchandise, will generate US$125m in revenue for the company once all figures are known.

Shattering records worldwide with the Barbie movie, Mattel believes in the potential of its brands to generate cinema hits that can not only sell tickets, but also improve the firm’s toy sales. That’s why the manufacturing giant is now currently developing 14 other movies focused on its brands, including Hot Wheels, Barney, Matchbox and even Uno.

Repeating the success of the Barbie movie would be stunning, and there appear to be signs it could potentially be attainable. For instance, the disappointingly low attendance numbers for The Marvels premiere suggest the days of blockbuster superhero flicks could be nearing an end, while the success of films like The Emoji Movie indicate the audience could appreciate a different spin on what they see on the big screen.

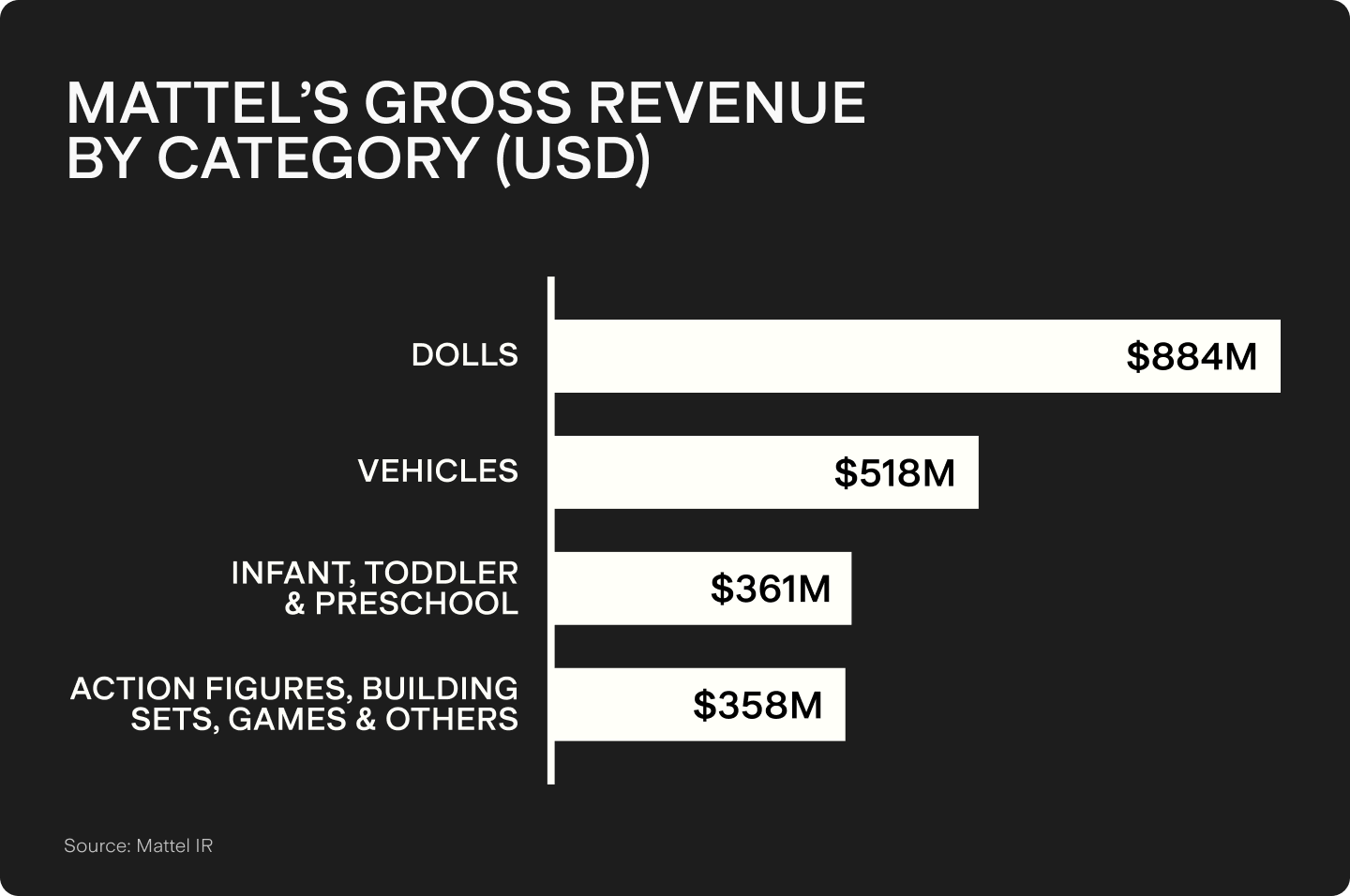

On the other hand, Barbie is Mattel’s most celebrated product by a large margin, responsible for nearly a quarter of the company’s sales, and other brands might lack the popular appeal to drag viewers to the cinema.

Toy titan

There’s an argument to be made that maybe entertainment shouldn’t be a major part of Mattel’s focus at all. If the Barbie movie is potentially bringing in US$125m in revenue, that pales in comparison to the firm’s toy sales. In Q3 2023 alone, Mattel registered gross revenues of US$2.12b. Doll sales alone accounted for US$884m, while vehicles brought another US$518m.

Net sales rose +9% relative to the same period the previous year, gross profit margins increased +2.7%, totalling 51%, and savings also improved, with the toy manufacturer on track to hit its US$300m savings target for FY2023.

The company updated its guidance in its latest earnings report, upgrading its gross profit margin outlook from 47% to the 47%-48% range. Mattel also upgraded its expectations for earnings before interest, taxes, depreciation and amortisation from US$900-US$950m to US$925-US$975m, despite the fact it said it was expecting the toy industry to retract around -5% during this period. It just goes to show that when it comes to making money, Mattel is not playing around.

This does not constitute financial advice nor a recommendation to invest in the securities listed. The information presented is intended to be of a factual nature only. Past performance is not a reliable indicator of future performance. As always, do your own research and consider seeking financial, legal and taxation advice before investing.

Megan is a markets analyst at Stake, with 7 years of experience in the world of investing and a Master’s degree in Business and Economics from The University of Sydney Business School. Megan has extensive knowledge of the UK markets, working as an analyst at ARCH Emerging Markets - a UK investment advisory platform focused on private equity. Previously she also worked as an analyst at Australian robo advisor Stockspot, where she researched ASX listed equities and helped construct the company's portfolios.