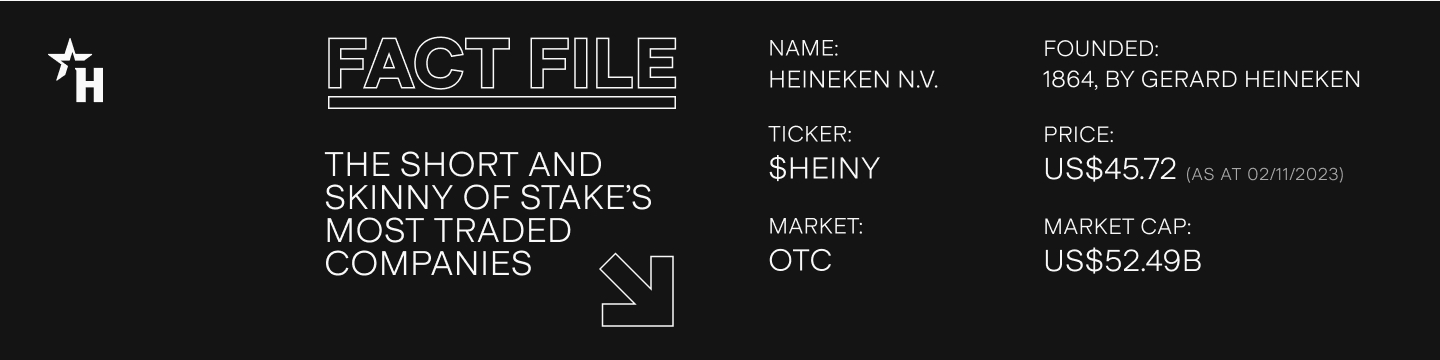

Under the Spotlight Wall St: Heineken N.V. (HEINY)

With more than 150 years of history, Heineken is now Europe’s biggest brewer and the second-largest beer conglomerate on the planet. Let’s put it Under the Spotlight.

If you search for emojis, you will surely come across the image of glasses full of beer. The golden colour looks a lot like lager, reflecting the popularity and prevalence of that type of beer in many cultures across the globe. However, there was a time when lager was in lower demand and a lot less common. In fact, back when Gerard Heineken founded the beer company Heineken ($HEINY) in 1864 in Amsterdam, the Dutch city was better known for its ales, porters and other types of dark beer.

Nonetheless, Gerard still decided his company would only produce lagers. And it proved to be a seminal decision. Less than 10 years after the opening of his first factory, Heineken established a second premises in Rotterdam. And more than 150 years later, the company has grown to be among the biggest beer corporations in the world.

Thirsty for success

The brewery market is extremely competitive, with large, well-capitalised players seeking growth, mainly through mergers and acquisitions. This was how the largest brewer in the world, the Belgian-Brazilian company Anheuser-Busch (AB) InBev ($BUD), the Danish firm Carlsberg and the Canadian-American business Molson Coors ($TAP) all grew to be so big. Heineken took the same route, but curiously, most of its major acquisitions occurred relatively recently.

In 2003, the company acquired Brau Union, expanding its portfolio in Europe. In 2010, it acquired the Mexican company FEMSA, adding the Dos Equis and Sol labels to its portfolio. In 2012, it acquired the Tiger brewery in Singapore, increasing its penetration in Southeast Asia, and in 2017 it acquired Brasil Kirin, consolidating the business as the second-largest brewery in the world.

The emerald empire

Today, Heineken is present in 190 countries via more than 300 different brands. Annually, the group produces 256 million hectolitres of beer (with one hectolitre the equivalent of 100 litres) in 160 factories spread across the planet.

Heineken and AB InBev dominate two of the main beer markets in the world. The Dutch company is the leader in Europe, while AB InBev reigns in North, Central and South America with well-known brands like Budweiser, Bud Light, Corona and Modelo. Nonetheless, the Americas are still Heineken's main money-making markets, together accounting for 31.6% of its profits. Asia accounts for 28.1% and Europe 27.7%. Even though European beer sales volumes are higher than Asia’s, the continent has a much more competitive market, shrinking profit margins for the company. On the other hand, Heineken, Tiger and Kirin are some of the most popular beer brands in Asia, thus enabling a higher profit margin in the region.

It can be challenging for an already established player like Heineken to achieve significant further growth in what is a highly-concentrated sector. Therefore, the company is careful when making forecasts in the medium and long term and believes that focusing on the advancement of its premium brands could be its best bet to increase revenue.

In an already consolidated beer market, there are two other growth avenues available to the company. These are non-alcoholic drinks and other alcoholic beverages, such as ciders and seltzers, sectors in which Heineken believes it is possible to deliver growth of around 550% in its produced volume, an amount that currently sits at over five million hectolitres per year.

Not hungover

In 2022, the company achieved revenues of €28.6b, which marked a new all-time high, with an annual increase of 30.59%. According to management, the focus in 2020 and 2021 was risk mitigation, while 2022 and 2023 were supposed to be years of recovery and build up for the growth that was expected to occur from 2024 onwards. However, as economies quickly rebounded from COVID-19, Heineken was able to deliver on its targets in a shorter time period than anticipated.

Deleveraging has also been progressing and the company's debt profile is currently relatively balanced. Historically, Heineken usually operates with a leverage of 3x when measuring net debt against earnings before income, taxes, depreciation and amortisation. In 2020, this sum rose significantly, reaching 4.97x due to new financing and lower cash generation in an adverse economic scenario. In 2021 and 2022 there were no new issues and leverage dropped to 2.7x.

In 2025, €1.6b in bonds, most of which were issued by the company in 2020, will mature. The maturation is not likely to present a problem for the firm, as the brewing giant usually holds more than €2b in cash to secure periodical bond payments. It will reduce Heineken’s amount of debt and allow the firm to refinance with more ease, although a higher interest rate would presently apply.

For the entire fiscal year 2023, the company expects to cut more than €2b in costs. Around €1.7b of that amount was reached in the first six months alone, as the brewer gained efficiency and further reduced its leverage. Heineken also expects operational profit to grow up to 5%, nearing roughly €4.5b. This is lower than the company’s initial outlook for 2023, where it hoped for growth of up to 9%. Expectations had to be lowered due to the shutdown of the firm’s operations in Russia and an economic downturn in Vietnam, which is one of its biggest markets in Asia.

.png&w=3840&q=100)

Over the past five years, Heineken has had a net profit margin of 8%, against an industry average of 4%. This is still below its major rival AB InBev, which usually sits around the 9% range. The higher profit margin these two giants have relative to their smaller peers is largely considered to be related to economies of scale. However, smaller competitors do still present a threat to their bigger counterparts.

As large brewers try to upsell premium beers to their customers, those same consumers could steer away from these big brands and look to craft beer. Some of this change has already happened, with AB InBev seeing lower beer sales volumes, but still managing to hit its revenue targets due to higher prices on its premium range. Changing customer tastes can also mean cheaper and long-time favourites of the public might fall out of style, much like Budweiser fell behind Modelo in the U.S.

Perhaps the biggest risk Heineken faces is the rise of Novo Nordisk’s ($NVO) Ozempic and other GLP-1 drugs, which reportedly lower both the desire and tolerance for alcohol consumption. Being the leading player in zero alcohol beer might not be enough to retain its demand for the firm, since these drugs also lower cravings for carbs. However, having overcome a variety of challenges in more than 150 years of history, it’s hard to imagine that the brewing colossus won’t figure its way out of this one too.

This does not constitute financial advice nor a recommendation to invest in the securities listed. The information presented is intended to be of a factual nature only. Past performance is not a reliable indicator of future performance. As always, do your own research and consider seeking financial, legal and taxation advice before investing.

Megan is a markets analyst at Stake, with 7 years of experience in the world of investing and a Master’s degree in Business and Economics from The University of Sydney Business School. Megan has extensive knowledge of the UK markets, working as an analyst at ARCH Emerging Markets - a UK investment advisory platform focused on private equity. Previously she also worked as an analyst at Australian robo advisor Stockspot, where she researched ASX listed equities and helped construct the company's portfolios.