Under the Spotlight Wall St: MercadoLibre, Inc (MELI)

Latin America’s biggest e-commerce platform, Mercado Libre, has transformed how retail operates in the region. But can it fend off foreign competitors? Let’s put it Under the Spotlight.

.jpg&w=3840&q=100)

The internet in the nineties represented a world of new possibilities. In the US, AuctionWeb launched a website in 1995 for people to sell their everyday items to the highest bidder. The company soared and in 1997 changed its name to eBay ($EBAY), before going public in 1998 to great fanfare.

Seeing eBay’s achievements, Argentinian Marcos Galperín, fresh from his MBA at Stanford, decided to replicate its model, not only in his home country, but throughout Latin America (LatAm). He was confident that this group of countries would quickly adapt to the digital age and offer huge growth opportunities for the retail market. So, in 1999, Mercado Libre ($MELI) was founded.

The company quickly established itself as a reliable partner and grew rapidly. Even eBay, a source of inspiration for the Argentine entrepreneur, would invest in the company in 2001, acquiring 19.5% of the business, later selling out of its position in 2016.

The auction business model didn’t last, though, and Mercado Libre would become a regular marketplace with set prices. The business model change was well received, and today Mercado Libre has a market cap almost three times the size of the company it once desired to mimic.

From Ushuaia to Tijuana

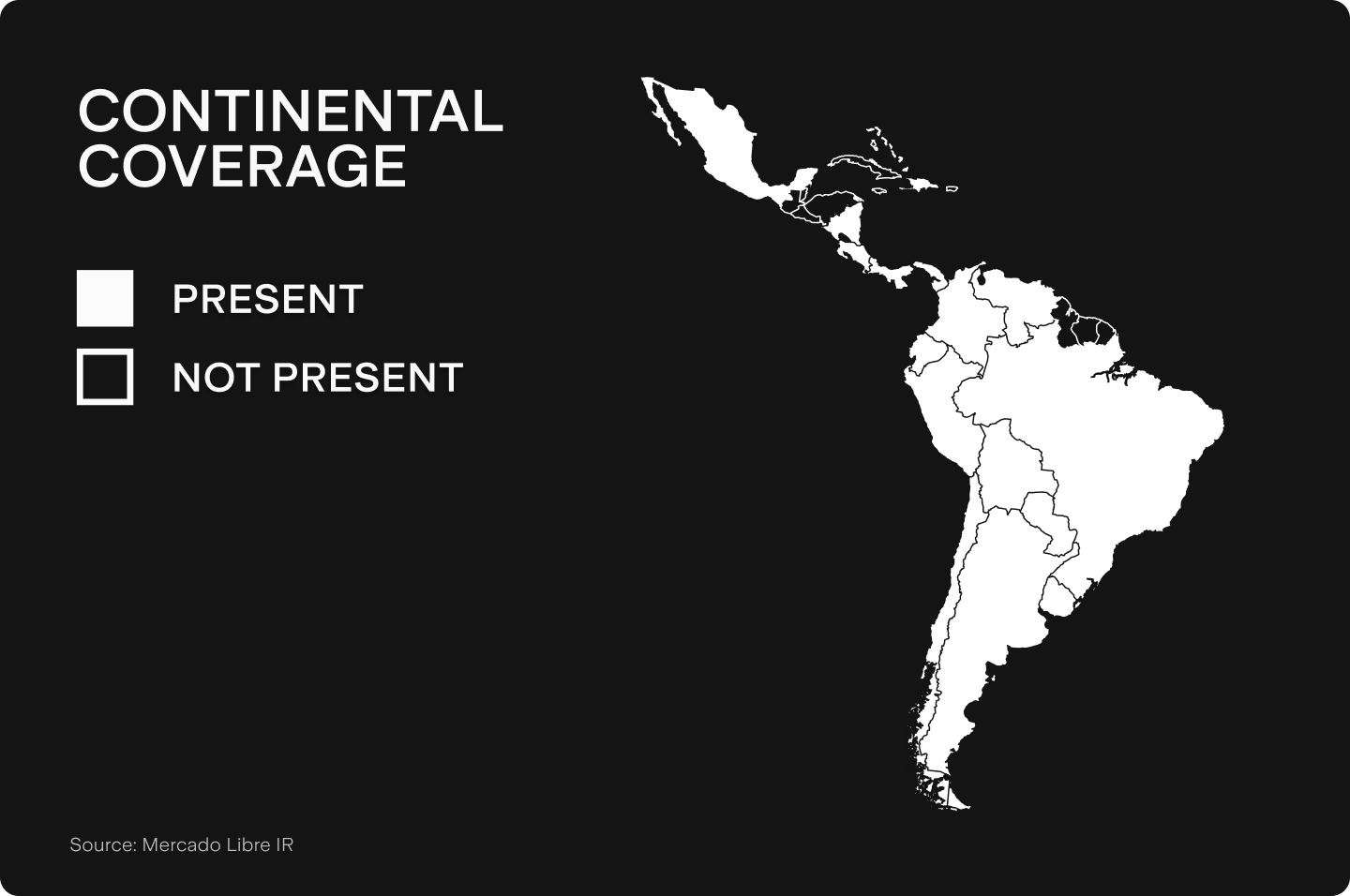

Now present in eighteen countries, Mercado Libre dominates LatAm. The company currently operates in Brazil, Argentina, Mexico, Uruguay, Colombia, Chile, Peru, Venezuela, Ecuador, Costa Rica, Dominican Republic, Panama, Bolivia, Guatemala, Paraguay, Nicaragua, Honduras and El Salvador. Operating in a region with about 660 million people, in Q2 2023 Mercado Libre had 108 million active users. In other words, roughly one in six people in the region use the services of the e-commerce giant.

In Q2 2023 alone, more than 325 million items were sold on the platform, which represents an increase of 18.2% year-on-year (YoY). In total, the platform has more than 424 million items listed. With a gross merchandise value of US$10.5b in Q2 2023, Mercado Libre’s e-commerce business is hugely successful. Notwithstanding this, the firm has also diversified as it has transformed into one of the largest enterprises in the region.

The ecosystem

Infrastructure, logistics, financial services and other business support sectors can prove to be bottlenecks for an operation's growth in developing countries. And although much of LatAm is in a privileged position relative to other emerging markets, it still lags behind the developed world in many ways. High credit risk creates a concentrated banking sector with high fees and spreads, while the region's rugged terrain creates logistical nightmares not found in much of Europe and the U.S.

With this in mind, and with an attitude of embracing challenges as opportunities, Mercado Libre created a robust ecosystem of services to verticalise its operations in order to allow for greater growth in its retail operation.

These services are split across two overarching business verticals that ladder up to the main parent company. The first vertical shares the same name as the parent company and is called Mercado Libre. The other vertical is called Mercado Pago.

.png&w=3840&q=100)

Under the umbrella of the Mercado Libre vertical, there’s the retail marketplace (also called Mercado Libre); Mercado Tiendas, which provides front-end solutions for the creation of e-commerce businesses within its ecosystem; Mercado Libre Ads, an online advertising platform; Mercado Envios, which takes care of logistics; and Mercado Libre Clasificados, for vehicle and real estate advertisements.

The financial businesses of the company sit under the Mercado Pago fintech, which facilitates payments and financial transactions, as well as offering credit and providing insurance.

Make no mistake, all of these services are not just trinkets or appendages for the retail sector. In Q2 2023, Mercado Envios was responsible for the distribution of more than 319 million products, an increase of 21% over the previous year, while the total volume of payments made via Mercado Pago was more than US$42b in the same period, up 96.6% YoY.

The company's financial arm is not restricted to payments and transfers, it also has a money market fund called Mercado Fondo, with US$3.1b in custody and more than 45.3m active users. In addition, there is also Mercado Credito, which offers cash advances to merchants and currently has more than US$3.25b in its portfolio, growing about 21% YoY.

This powerful ecosystem makes Mercado Libre a giant cash generator. In Q2 2023, its net revenue was US$3.41b, an increase of 31.4% YoY. The Mercado Libre vertical was responsible for US$1.93b, while the Mercado Pago vertical also brought important gains, generating US$1.47b in net revenue for the period, an increase of 23.9% compared to the same period last year.

Local risks

These mammoth revenues do not mean there are no obstacles to the company's growth. On the contrary, operating in a politically and economically unstable region, Mercado Libre is subject to regulatory and exchange risks that cannot be ignored. For example, earlier this year, the Argentinian Peso, the currency used in one of its biggest markets, devalued more than 50% against the U.S. dollar, and these fluctuations in the currency could impact the company's overall revenue.

In addition, the company also faces fierce competition from efficient and well-capitalised competitors, such as international giants Alibaba ($BABA), Sea Group’s ($SE) Shopee, and of course, Amazon ($AMZN). Amazon is apparently still just warming up for its heavy entry into LatAm, but it has enough experience, know-how and cash to intimidate any other competitor that might cross its path.

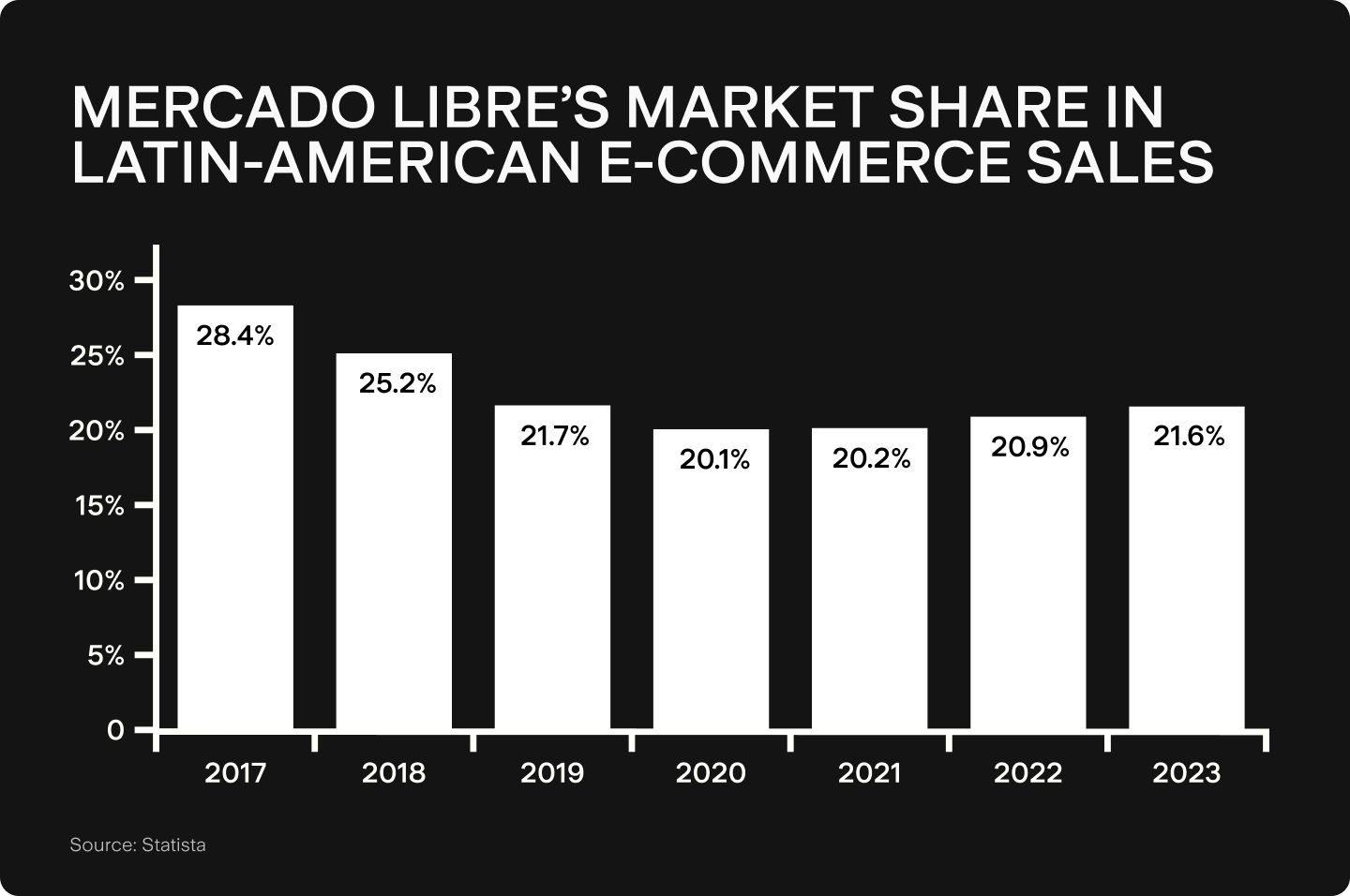

There are already signs that Mercado Libre’s local dominance has been falling, as even though its sales have been climbing, from 2017 its market share in LatAm e-commerce sales has dropped from 28.48% to a low of 20.1% in 2020. However, the bottom seems to have already been reached, as they have regained 150 bps since then.

The possibility of the arrival of a powerful rival is always scary, but it is important to bear in mind there are always regulatory and cultural barriers that can make it difficult for a foreign competitor to enter a new market. It was only in 2018 that one of the biggest retail giants in the world, Walmart ($WMT), abandoned Brazil.

Operating in a market with few entry barriers such as retail, it remains to be seen whether the free market will allow Mercado Libre to stomp over the competition or whether its fate will be as tragic as a good Argentinian tango.

This does not constitute financial advice nor a recommendation to invest in the securities listed. The information presented is intended to be of a factual nature only. Past performance is not a reliable indicator of future performance. As always, do your own research and consider seeking financial, legal and taxation advice before investing.

Megan is a markets analyst at Stake, with 7 years of experience in the world of investing and a Master’s degree in Business and Economics from The University of Sydney Business School. Megan has extensive knowledge of the UK markets, working as an analyst at ARCH Emerging Markets - a UK investment advisory platform focused on private equity. Previously she also worked as an analyst at Australian robo advisor Stockspot, where she researched ASX listed equities and helped construct the company's portfolios.