Under the Spotlight Wall St: Lululemon Athletica Inc. (LULU)

With its quality clothes that allow for comfort without sacrificing looks, Lululemon has become a fashion behemoth. But can its revenue continue to soar? Let’s put it Under the Spotlight.

In the constantly shifting world of sportswear, Lululemon Athletica Inc. ($LULU) stands as a testament to the power of innovation, brand authenticity and a deep understanding of its target market. From its humble beginnings in Canada, to its current status as a global athletic apparel powerhouse, Lululemon's journey is a lesson in grabbing an opportunity and making the best of it.

Before Lululemon's inception in 1998, Chip Wilson found inspiration during his yoga classes in Vancouver. Observing that women in his sessions often resorted to clothes like baggy T-shirts and cut-off tracksuit pants, Wilson identified an unmet need. Recognising the demand for functional yet sleek-looking yoga attire, Lululemon was born from Wilson's vision to blend technical expertise with fashion, addressing the unique requirements of active women seeking both performance-driven and stylish activewear.

Warming up

In its early days, Lululemon faced challenges, including limited brand awareness and competition from established sportswear brands. However, Wilson's dedication to quality, focusing on fabrics that were both breathable and supportive, and his passion for yoga, helped the brand gain traction among Vancouver's yoga community.

By the early 2000s, Lululemon was ready to expand beyond the Canadian city’s borders. The company began opening stores across North America, introducing its unique brand of yoga wear to a wider audience. Lululemon's popularity soared as the yoga movement gained mainstream attention, while the brand's contemporary and practical designs resonated with fitness enthusiasts and fashion-conscious individuals alike.

Pioneering the integration of technical features in activewear, the company invested heavily in fabric research and development, introducing innovative materials that offered superior performance, moisture-absorbing capabilities, breathability and stretch. The company’s most celebrated fabric is Luon, trademarked in 2005 and known for its extra-stretchiness due to its higher nylon content.

Stretching out

Off the back of its success in North America, Lululemon continued to expand its product offerings in the 2010s, venturing beyond yoga wear to apparel for running, fitness training and other athletic activities, as well as diversifying into footwear and male clothing. The company also expanded its global reach, opening stores in Europe, Asia, Australia and New Zealand, while the athleisure brand evolved to encompass a more lifestyle-oriented approach, appealing to a broader range of consumers.

Now boasting more than 650 stores in 18 different countries, Lululemon is unquestionably a leading player in the global athleisure market. However, despite its international presence, the clothing company is still extremely dependent on North American sales. Of its US$8.1b of revenue it registered in FY2022, only 30% (roughly US$2.4b) came from outside the region.

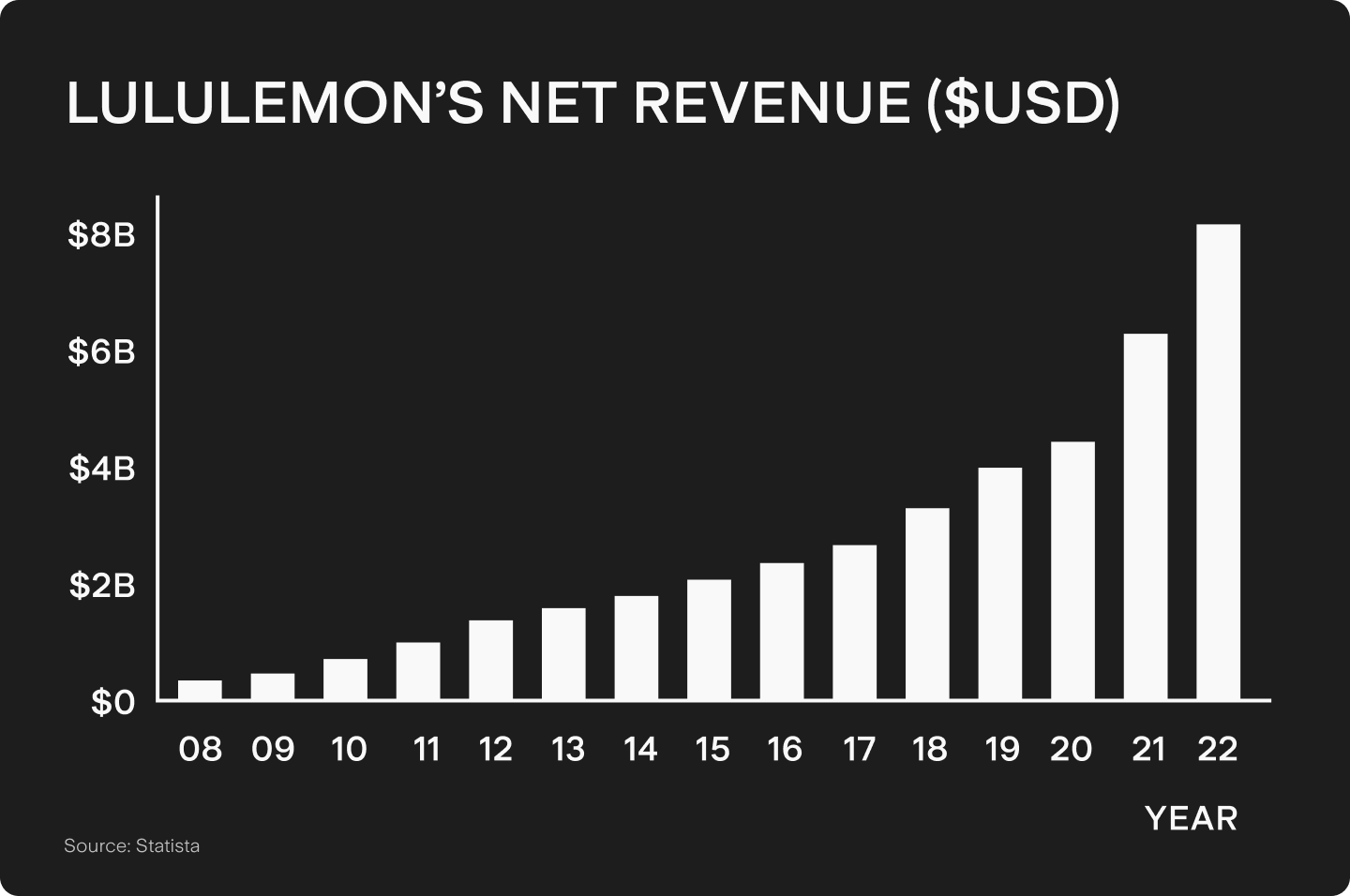

Though the regional concentration of its stores is unquestionably a risk, business is booming. Since the company went public in 2007, its revenue has grown by nearly 23 times, not dropping even for a single year. And while most apparel manufacturers have to sell their garments at a discount for retailers - hence leaving some profit margin for the middleman - Lululemon leaves barely any money on the table: 91% of its revenue comes from either its company-operated stores or through its own website.

.png&w=3840&q=100)

Lululemon stores often serve as more than retail spaces; they function as community hubs that host fitness classes, workshops and events. These programs have been a key ingredient in how the brand has connected to customers. However, the company took a financial hit on these initiatives in FY2002, registering a US$442m loss. It’s also not clear whether the firm’s new app, where customers can access fitness content for a monthly fee, will foster the same level of engagement as the in-person sessions.

Being one of the most premium brands within its segment, Lululemon rarely has majorsales, which helps in maintaining high profit margins. While competitors like Nike ($NKE) and Under Armour ($UA) had net margins of 9.82% and 7% respectively in the past four quarters, Lululemon’s net margin sat at 11.4% in the same time period. It should be noted, however, that these brands have diverse product mixes, which could also contribute to this difference.

Seeking balance

Lululemon’s seemingly ever-growing revenue, combined with high profitability, has led to investors paying a premium for the firm’s shares, which currently trade at 35x the forward price/earnings ratio. That’s more than Nike, arguably the world’s biggest sports apparel brand, with its shares trading at 29x. Under Armour stocks are trading at 16x.

The forward price/earnings ratio alone should not be enough to infer which stocks are over or underpriced, as growth companies usually trade at higher prices than those that are stalling or even declining. But if the market believes Lululemon is no longer growing and therefore should be priced like its competitors, the underperformance of its shares could well be more stark relative to its peers.

While revenue and earnings have yet to drop, such an occurrence is not inconceivable, with Lululemon no stranger to troubles over the years. It had to recall some of its reusable shopping bags due to the potential presence of lead in 2010, while in 2013, it had to recall 17% of all women's pants sold in its stores due to poor design and quality control. While the firm’s products are less affected by seasonality, investors are wary of rising inventories for any retail stock and Lululemon’s increased 14% to US$1.7b at the end of Q2 2023.

Furthermore, there’s always the risk of fashion tastes changing and competition stepping up. The popularity of Lululemon’s yoga pants now seem unparalleled, but that’s not a position to be taken for granted. Much like Under Armour snuck up on Nike by signing massive deals with NFL star Tom Brady and NBA hotshot Steph Curry, partnerships with famous yoga and wellness personalities could be used by competitors to kick-start market share gain, especially considering Lululemon usually favours local ambassadors, rather than celebrities, for its sponsorships.

Lululemon leadership revealed in its Q2 2023 earnings call that the number of people who expressed knowledge of the brand without prompting was only 25% in the U.S. and that this figure was in single digits in all the firm's other markets besides the UK and Australia. The company caters to a smaller range of activities in the sportswear market than global giant Nike and does not receive the same level of media exposure due to Nike’s affiliation with high profile professional sports leagues such as the NFL.

For the moment, however, everything seems to be on track for both the third quarter and the full year of 2023 to be periods of growth and rising profits. For Q3, Lululemon expects revenues between US$2.165b and US$2.19b. For the whole year, the company estimates revenues in the US$9.51b - US$9.57b range, growth of about 17%-18% year-on-year. The company reports its Q3 earnings on 07 December 2023.

This does not constitute financial advice nor a recommendation to invest in the securities listed. The information presented is intended to be of a factual nature only. Past performance is not a reliable indicator of future performance. As always, do your own research and consider seeking financial, legal and taxation advice before investing.

Rodrigo is a seasoned finance professional with a Finance MBA from Fundação Getúlio Vargas, one of Brazil's premier business schools. With seven years of experience in equities and derivatives, Rodrigo has a profound understanding of market dynamics and microstructure. Having worked for Brazil’s biggest retail algorithmic trading platform SmarttBot, his expertise focuses on risk management and the analysis, development and evaluation of trading systems for both U.S. and Brazilian stock exchanges.