Under the Spotlight AUS: Silex Systems (SLX)

Silex Systems is working on laser enrichment technology that could transform the nuclear power, quantum computing and medical industries. Let’s put it Under the Spotlight.

The world is made up of tiny units of matter known as atoms. We can tell the difference between them via the number of protons, electrons and neutrons they hold. When protons and neutrons are not equal, the atoms are known as isotopes.

Stable isotopes don’t emit radiation and were the first area of interest for the team at Silex Systems ($SLX). However, the firm began to focus on unstable isotopes that do emit radiation. In particular, it concentrated on the isotopes in uranium, due to the chemical element’s large commercial potential.

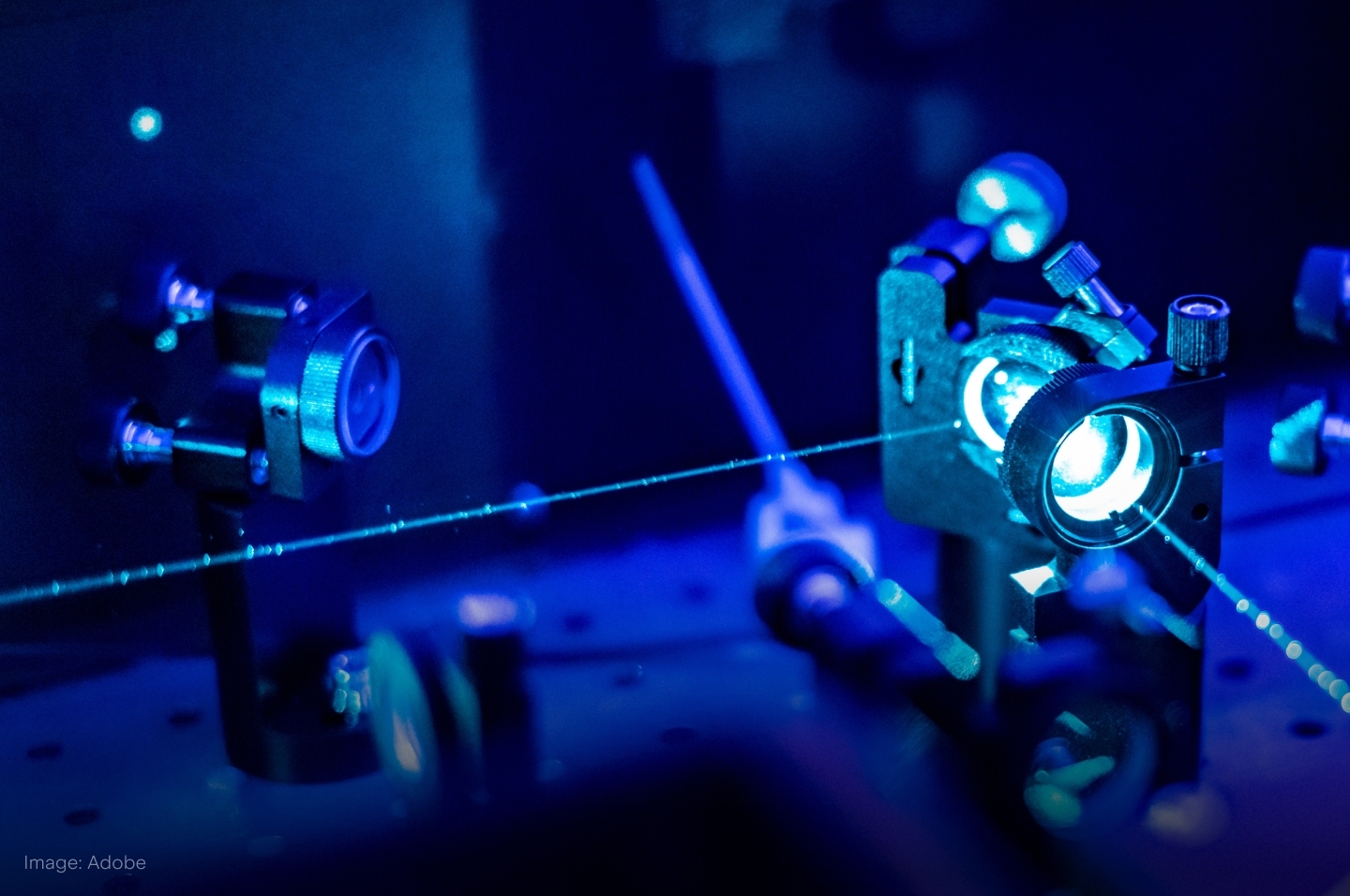

In the early 1990s, Dr Michael Goldsworthy and Dr Horst Struve started working on laser isotope separation techniques at the Lucas Heights reactor just outside Sydney. The research was initially funded by Sonic Healthcare ($SHL), before Silex branched off to eventually became its own company in a 1998 ASX listing.

Today, Silex holds 51% ownership of Global Laser Enrichment LLC (GLE), a company through which Silex intends to commercialise its laser-based uranium enrichment technology. Uranium producer Cameco Corporation ($CCJ) owns the other 49%.

GLE operates between Lucas Heights and facilities at the GE-Hitachi Nuclear Energy complex in North Carolina, USA, with the primary aim of providing fuel for nuclear power plants. The industry has strict regulations and high barriers to entry, but also comes with very high stakes.

Sourcing power

Uranium occurs naturally in the Earth’s crust, primarily in the form of U238 isotopes, which constitute approximately 99.3% of the element’s composition. The remaining 0.7% consists of U235 isotopes.

The production of nuclear energy relies on splitting the atoms in the U235 isotopes. However, to utilise uranium as fuel in conventional power plants, the proportion of U235 must be increased, typically being enriched from its natural level of 0.7% to between 3 and 5%.

Uranium is usually processed from a powdery ‘yellowcake’ form into a gas, before being separated to gather more of the U235 proportion. Historically, this separation was done through gaseous diffusion. Nowadays, centrifuge technology is the only approach used at a large scale. But Silex, via GLE, is offering a potential third-generation method for processing uranium. The procedure uses lasers, which are believed to be more efficient and could result in lower costs.

The laser-based approach still needs to go through further testing and a key milestone for 2024 is a pilot program that is being run at GLE’s Test Loop facility in North Carolina. If it proves successful, GLE intends to construct a laser enrichment facility in the U.S. state of Kentucky, with an optimistic timeline suggesting that commercial operations could start there by 2028, three years earlier than originally planned.

Splitting paths

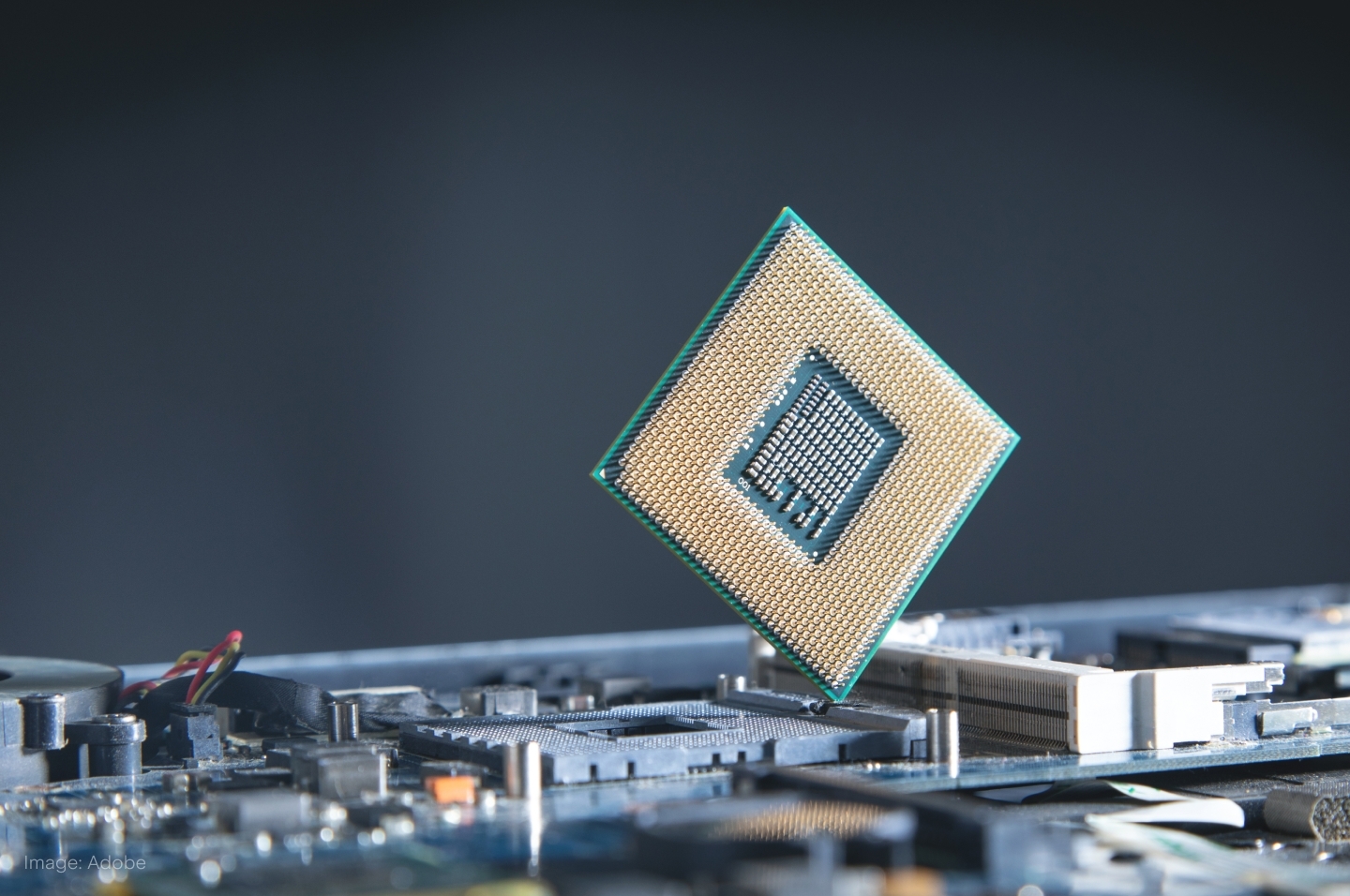

The company is also exploring two other opportunities related to its laser technology. It is working on enriching silicon to be used in processor chips for the quantum computing industry. The firm embarked on a three-and-a-half year project with Silicon Quantum Computing and The University of NSW in August 2023 with A$5.1m of government funding. Potential products that could be commercialised in the future include solid and gas forms of silicon materials.

Furthermore, Silex is studying medical isotopes. The business is trying to establish a prototype and scale up a venture that involves enriching Ytterbium to produce Lutetium, which could be used to diagnose and treat some cancers.

These two areas of focus provide the company with a degree of diversification away from the uranium segment and general volatility associated with commodity cycles. However, these are much smaller components of the firm, and Silex’s success will largely depend on an increase in the use of nuclear energy.

Future outlook

While the Australian government (along with its U.S. counterpart) has provided grants to Silex to develop its laser-based technology, nuclear power is not currently permitted in Australia. Several Australian states have also banned uranium mining. Furthermore, the Fukushima nuclear accident in 2011 had a significant impact on the uranium enrichment market, with it shrinking from around US$10b in annual sales to US$4b by 2015. Silex’s share price slumped, only recently recovering to its 2011 levels.

However, there has been renewed interest in nuclear power of late, with the Russia-Ukraine conflict highlighting the former’s role as a major supplier of nuclear fuel to global utility firms and the need for other countries to be more competitive in this space. Nuclear power has also been highlighted as an energy source with limited carbon emissions.

.png&w=3840&q=100)

The production of high-assay low-enriched uranium could bring new funds to Silex, while future demand could be driven by small modular reactor technology, which presents a smaller and less expensive alternative to traditional nuclear power plants.

Ultimately politics will continue to shape the nuclear industry in the years ahead and the company's success could depend on successfully navigating the evolving regulatory landscape. But with its multi-faceted approach and laser focus, Silex could pave its own way to a more enriched future.

This does not constitute financial advice nor a recommendation to invest in the securities listed. The information presented is intended to be of a factual nature only. Past performance is not a reliable indicator of future performance. As always, do your own research and consider seeking financial, legal and taxation advice before investing.

Megan is a markets analyst at Stake, with 7 years of experience in the world of investing and a Master’s degree in Business and Economics from The University of Sydney Business School. Megan has extensive knowledge of the UK markets, working as an analyst at ARCH Emerging Markets - a UK investment advisory platform focused on private equity. Previously she also worked as an analyst at Australian robo advisor Stockspot, where she researched ASX listed equities and helped construct the company's portfolios.

.jpg&w=3840&q=100)