Under the Spotlight AUS: Amcor plc (AMC)

Amcor is a packaging giant with huge companies among its clients. Let’s put it Under the Spotlight.

Packaging plays a critical role in a product’s journey from the factory floor to the customer. It keeps goods safe, can extend their shelf life and serves as a marketing tool to help companies stand out from competition. This bridge between businesses and consumers is also shaped by various regulatory requirements and environmental concerns. However, navigating this path is not always straightforward, even for industry giants.

Consumer packaging firm Amcor ($AMC) traces its roots back to a paper making business started by Samuel Ramsden in Melbourne in 1864. He eventually bought the neighbouring mill to form the Australian Paper Mills Company. The firm became the nation’s largest paper and pulp supplier, with a monopoly on the wrapping paper and paperboard markets. In the 1960s, the firm branched into tissue products, establishing Kimberly-Clark Australia Ltd in partnership with the well-known U.S. corporation ($KMB).

The company worked on further diversifying its interests into the fields of international trading, automotives, retailing and aviation with acquisitions in the 1970s. In 1986, the company not only changed its name to Amcor, but also took over James Hardie Containers. The firm’s diversification strategy paid off, with the proportion of the business’s total sales attributed to paper falling from 57% to 19%in the decade to 1990.

Whole package

Amcor’s growth into a more well-rounded and global company involved managing multiple subsidiaries, so the company streamlined its operations, spinning off its paper business after more than a century. Orora ($ORA) was created from a 2013 demerger of Amcor’s fibre and beverage packaging division in Australia, as well as its packaging distribution sector in North America, from its core assets. Amcor then raised its profile in the plastics segment through acquisitions, with the 2019 merger with Bemis cementing its place as a global leader in the packaging space. As a result, the business is also listed on the New York Stock Exchange as $AMCR.

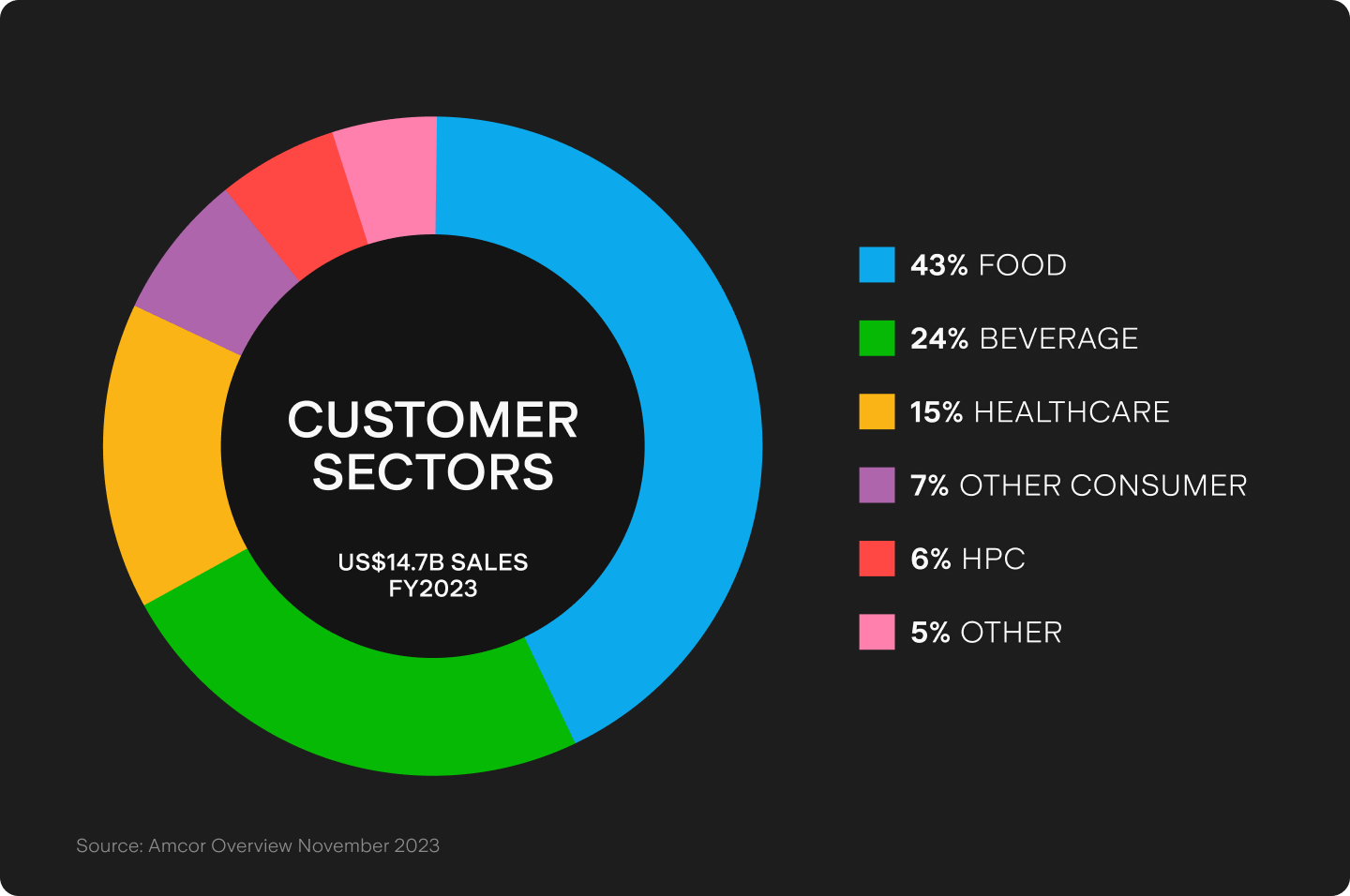

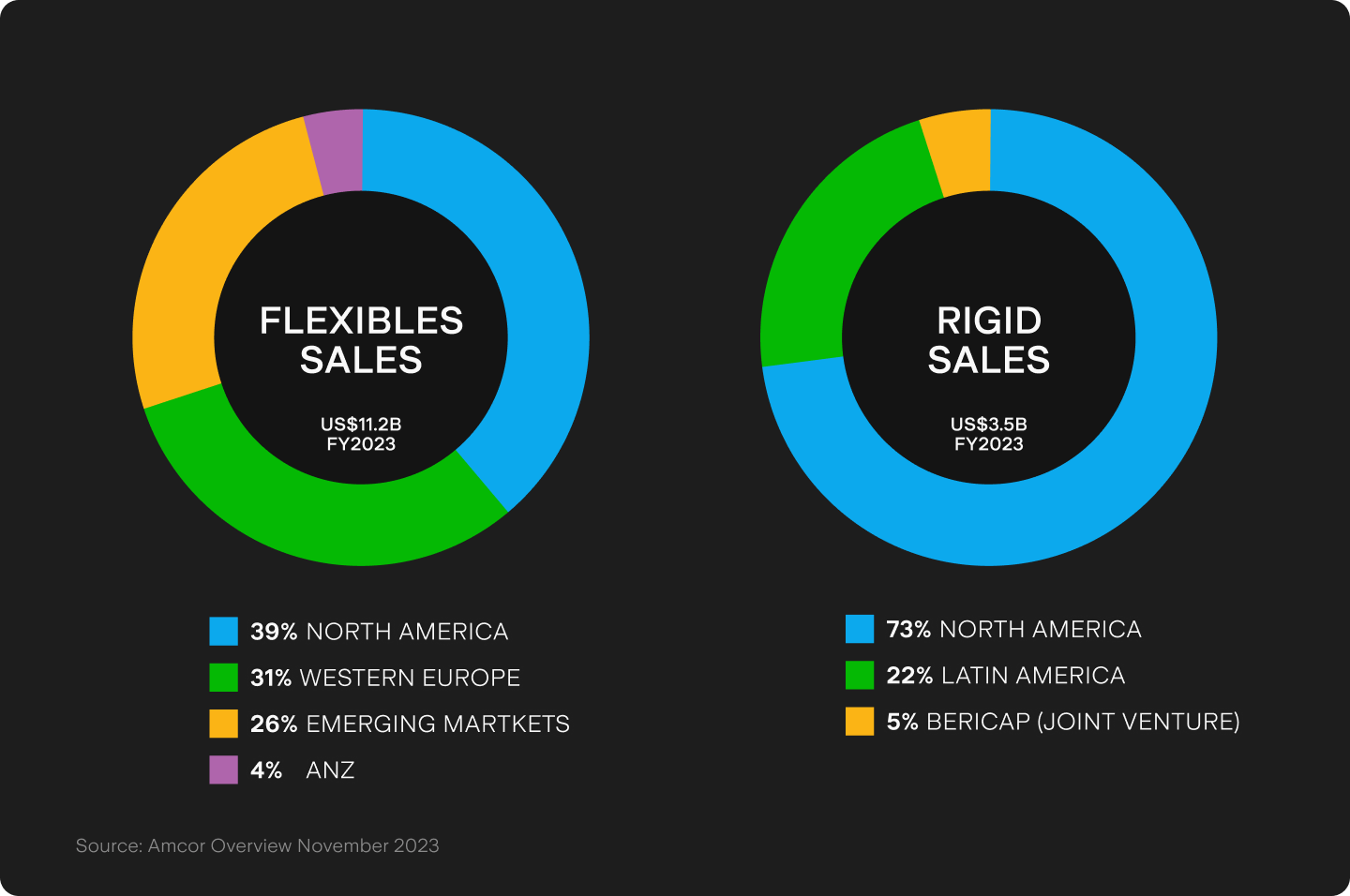

Today, the company’s activities are divided into two main segments - flexibles and rigid packaging. Flexibles are usually plastic, aluminium or fibre-based options and include speciality folding cartons made by the firm. They accounted for just over 75% of sales in H1 FY2024 and brought in US$5.09b of the half year’s total of US$6.69b. The remainder came from the more sturdy category - rigid - which generally covers plastic containers and all types of lids. Amcor provides packaging to a variety of industries, with particular strengths in consumer staples and healthcare markets. With more than 95% of its sales going to consumer end markets, the company estimates that around 10,000 people come across Amcor products every second. Johnson and Johnson ($JNJ), Unilever ($UL), Coca-Cola ($KO) and GlaxoSmithKline ($GSK) are among the firm’s clients. However, it has also managed risks by not having any individual customer account for more than 10% of its consolidated net sales over the past three financial years.

Unwrapping details

Given the company’s customer profile, Amcor’s results are often viewed as a bellwether for consumer spending. Inflation-weary shoppers have tightened the grip on their wallets in recent times and the firm is experiencing a slowdown in demand for its products. Sales volumes for flexibles and rigids fell 9% in H1 FY2024, with a particular drop in beverages in North America. A 2% gain in sales revenues due to the firm optimising its mix of products and prices has not been able to offset this trend.

Amcor was initially able to pass on increases in raw material costs to customers, but it then had to pass down savings as costs normalised. Furthermore, pharmaceutical firms have focused on running down high inventories built up during COVID-19, leading to softer demand from this sector. In response, Amcor has been cutting costs and improving productivity to save around US$200m in H1 FY2024, including reducing its workforce by about 5%, or 2,000 full-time employees, in 2023.

The company has put more focus on several categories – protein, healthcare, premium coffee, pet food and hot-fill beverages – with the goal of expanding margins. There’s also been a push into emerging markets, which represent large populations with rising incomes and urbanisation rates. To stay ahead of competition, Amcor budgets approximately US$100m annually for research and development. The company is responsible for over 3,700 patents, specific designs and trademarks.

Greener growth

Amcor prioritises innovation and has been under long-standing pressure to become more sustainable as a major manufacturer of plastic products. The material is likely to remain at the centre of the firm’s operations though, with the company pointing to its lower lifecycle greenhouse gas emissions compared to glass and aluminium. Amcor has made a pledge for all its packaging to be recyclable, reusable or compostable by 2025, but it remains unclear whether this goal will be met.

The company’s environmentally-friendly strategy will affect many aspects of its supply chain. Amcor has joined forces with Licella and Mondelez ($MDLZ) to build Australia’s first advanced recycling facility to revert plastics into a material suitable to manufacture new packaging, instead of using imported sources. The company is hoping such ventures will improve efficiencies and management has suggested that early data showing sales volumes picking up in January 2024 could be the start of a more positive year.

Despite the downturn in business in H1 FY2024 and a relatively stagnant share price, Amcor still provided investors with returns. It gave around US$390m to shareholders through share repurchases and a non-franked dividend of 12.5 U.S. cents per share. As Amcor looks to the future, the need to protect and preserve products won’t go away. But building a firm that’s the whole package is a much tougher task.

This does not constitute financial advice nor a recommendation to invest in the securities listed. The information presented is intended to be of a factual nature only. Past performance is not a reliable indicator of future performance. As always, do your own research and consider seeking financial, legal and taxation advice before investing.

Megan is a markets analyst at Stake, with 7 years of experience in the world of investing and a Master’s degree in Business and Economics from The University of Sydney Business School. Megan has extensive knowledge of the UK markets, working as an analyst at ARCH Emerging Markets - a UK investment advisory platform focused on private equity. Previously she also worked as an analyst at Australian robo advisor Stockspot, where she researched ASX listed equities and helped construct the company's portfolios.