Under the Spotlight AUS: Pilbara Minerals (PLS)

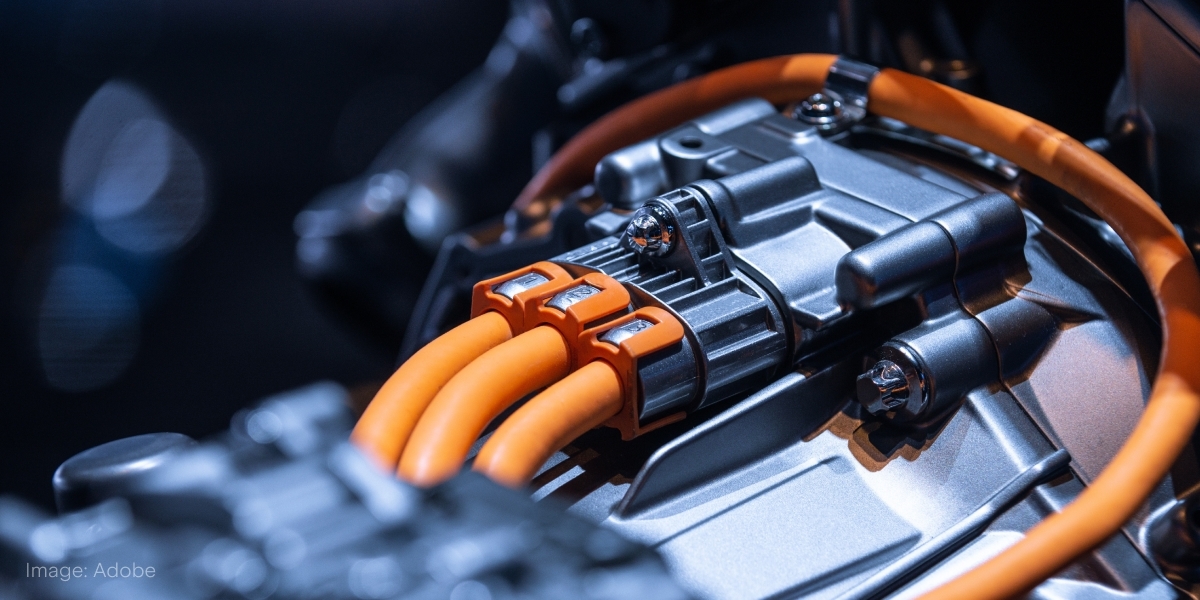

Lithium is key to powering our future, but demand for the battery metal appears to be losing charge. How can miners such as Pilbara Minerals adapt to the industry’s ups and downs? Let’s put it Under the Spotlight.

Named after the Greek word for stone, lithium first found its place in the pharmaceutical industry, with it used to treat mood disorders. The cure-all nature of the element associated with mineral water even made it into the soft drink 7Up and its applications were soon expanded into other industries, such as lubricants and ceramics. Scientists only seriously started looking at the potential of the least dense metal for use in rechargeable batteries in the 1970s.

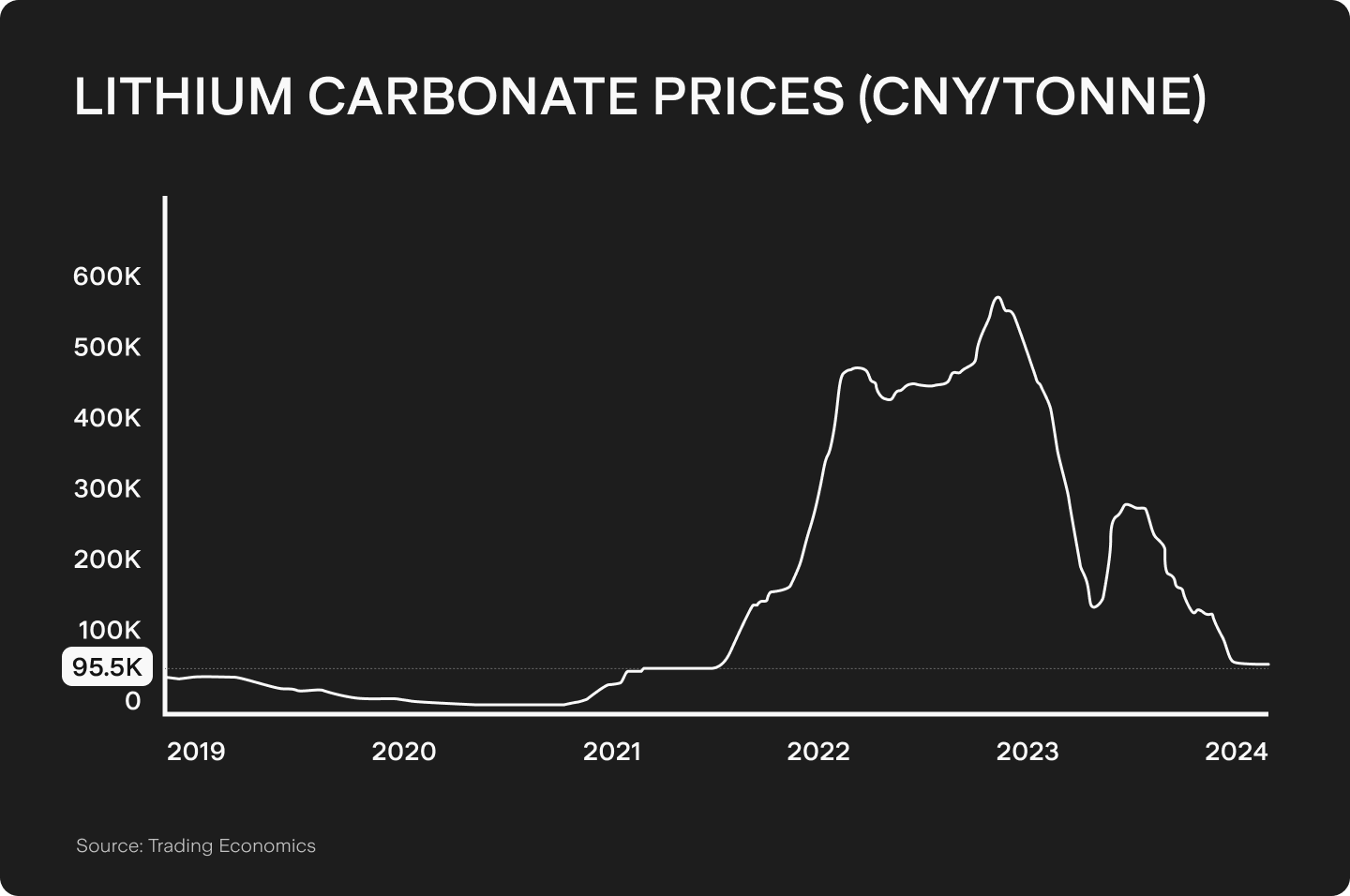

In spite of the recent rush for lithium due to heightened consumer demand for electric vehicles (EVs), the path of mining companies hasn’t been smooth. Pilbara Minerals ($PLS) explored several prospects before officially opening its Pilgangoora Project in 2018. Located in Western Australia’s Pilbara region, which had historically been better known as the stronghold of the nation’s iron ore giants, the firm has navigated through some turbulent times. The business started production during a ‘lithium winter’. Low prices for the commodity between 2018 and 2020 put pressure on mining companies, with some of Pilbara’s competitors losing funding and forced to put operations on hold. But Pilbara managed to raise $240m in equity to purchase a neighbouring mine and the Ngangaju processing plant from Altura Mining. With a similar setup and focusing on the same ore body, this decision put strong foundations in place for future growth.

Boom times

The first lithium concentrate was produced at the Ngangaju plant in 2021. During the same year EV demand almost doubled and lithium prices skyrocketed 550%. Pilbara was a natural benefactor of the trend and its share price went on a record run that continued into late 2022. Pilbara also benefited from being 100% owned by a single entity and from being conveniently located only 120km from Port Hedland, one of the largest bulk ports in the world. These are factors that would help it become the largest miner on the ASX that produces lithium as its main product.

Since the late 2022 peak, Pilbara has opened a chemical facility to produce battery grade lithium hydroxide as part of a joint venture with South Korea’s POSCO, which can help the business capture more of the downstream value chain. Battery grade materials tend to command higher prices and supply chain options are limited outside of China.

The company has also been working with Calix ($CXL) to attempt to reduce the intensity of carbon emissions during the refining process of creating an enriched lithium product. However, it will still take time until this project is fully realised.

Pilbara has also recently announced it will increase the amount of material sold to chemical converter company Ganfeng. With the partnership dating back to 2017, Pilbara has been supplying 160,000 tonnes per annum (tpa) and it now intends to provide an additional 150,000 tpa in 2024 at current market prices.

Pilbara’s total sales equalled 306,300 tonnes in H1 FY2024. And with the company hoping to keep those numbers strong in H2 FY2024, this extra supply to Ganfeng could be a useful buffer against the softening demand for lithium. Waning enthusiasm for EVs in China has seen the lithium price fall dramatically, more than 80% in the past 12 months, and it’s having major impacts on mining companies around the globe.

Processing changes

Pilbara claimed to provide 8% of the world’s lithium supply in FY2023 and still has plans for expansion. Its P680 Project would increase the capacity of its Pilgan processing plant by 100,000 tpa and its P1000 Project could push mining production at Pilgan up to 1,000,000 tpa, depending on the former’s success. With the commodity sector being no stranger to periods of boom and bust, being able to stick to plans and potentially gain market share ahead of a future upturn could be valuable.

But financial realities might make it difficult to keep up with original strategies. Pilbara saw revenues drop from $493m to $264m between the September and December quarters of 2023. This was due to a 50% fall in the realised price of its lithium materials and occurred in spite of a 9% increase in sales volumes. Higher production levels helped the company reduce its FOB unit operating costs (the expense incurred to produce the lithium, excluding transportation costs and royalties), with a 14% decrease from $747 to $639 per tonne. The company benefits from being a relatively low cost producer and has been able to withstand lower lithium prices better than others to this point.

However, Pilbara is not immune to the pressures of the downturn. Its cash balance has gone from $3.04b to $2.14b in the last quarter and management has announced that a dividend is unlikely to be paid out for H1 FY2024. Non-essential activities have been deferred, which could save between $55m and $100m in capital expenditures.

Digging deep

The prolonged slump in prices that has been ongoing since late 2022 has affected multiple players in the market. Core Lithium ($CXO) has put its Grants open pit mine on hold and is only processing stockpiles. Global player Albemarle ($ALB) scaled back plans for a lithium hydroxide refinery, while the amount of debt available for Liontown ($LTR) has been reduced. The world’s largest hard rock lithium mine, IGO’s ($IGO) Greenbushes, is able to produce the mineral at $357 a tonne and is adapting to lower order levels.

The record high lithium prices of late 2022 were likely not entirely sustainable either. They caused the first cost increase in EV batteries in over a decade, reversing a trend that’s seen as crucial to the vehicles’ mass market adoption. This cost hike was also an incentive for manufacturers to try to develop more energy-dense options and use lower cost materials instead. CATL and BYD ($BYDDY) have created EVs with sodium-ion batteries, a cheaper alternative that’s not flammable.

While lithium is still key to most battery chemistries and has entrenched production processes in place, the industry will continue to evolve. Improvements in direct extraction technologies could make lithium brine deposits a more attractive choice compared to Australia’s hard rock options, including that of Pilbara’s Pilgangoora Project.

Finding a way of managing the large upfront costs of mining’s capital intensive projects and varying earnings from volatile commodity prices is an ongoing challenge for those in the sector. Pilbara might have solid foundations in place, but could still have to spend some time between a rock and hard place.

This does not constitute financial advice nor a recommendation to invest in the securities listed. The information presented is intended to be of a factual nature only. Past performance is not a reliable indicator of future performance. As always, do your own research and consider seeking financial, legal and taxation advice before investing.

Megan is a markets analyst at Stake, with 7 years of experience in the world of investing and a Master’s degree in Business and Economics from The University of Sydney Business School. Megan has extensive knowledge of the UK markets, working as an analyst at ARCH Emerging Markets - a UK investment advisory platform focused on private equity. Previously she also worked as an analyst at Australian robo advisor Stockspot, where she researched ASX listed equities and helped construct the company's portfolios.