Under the Spotlight AUS: Altium Limited (ALU)

Going beyond sleek looks, electronic devices are powered by carefully designed internal components. Creating the blueprints for those is made easier by software from companies such as Altium. Let’s put it Under the Spotlight.

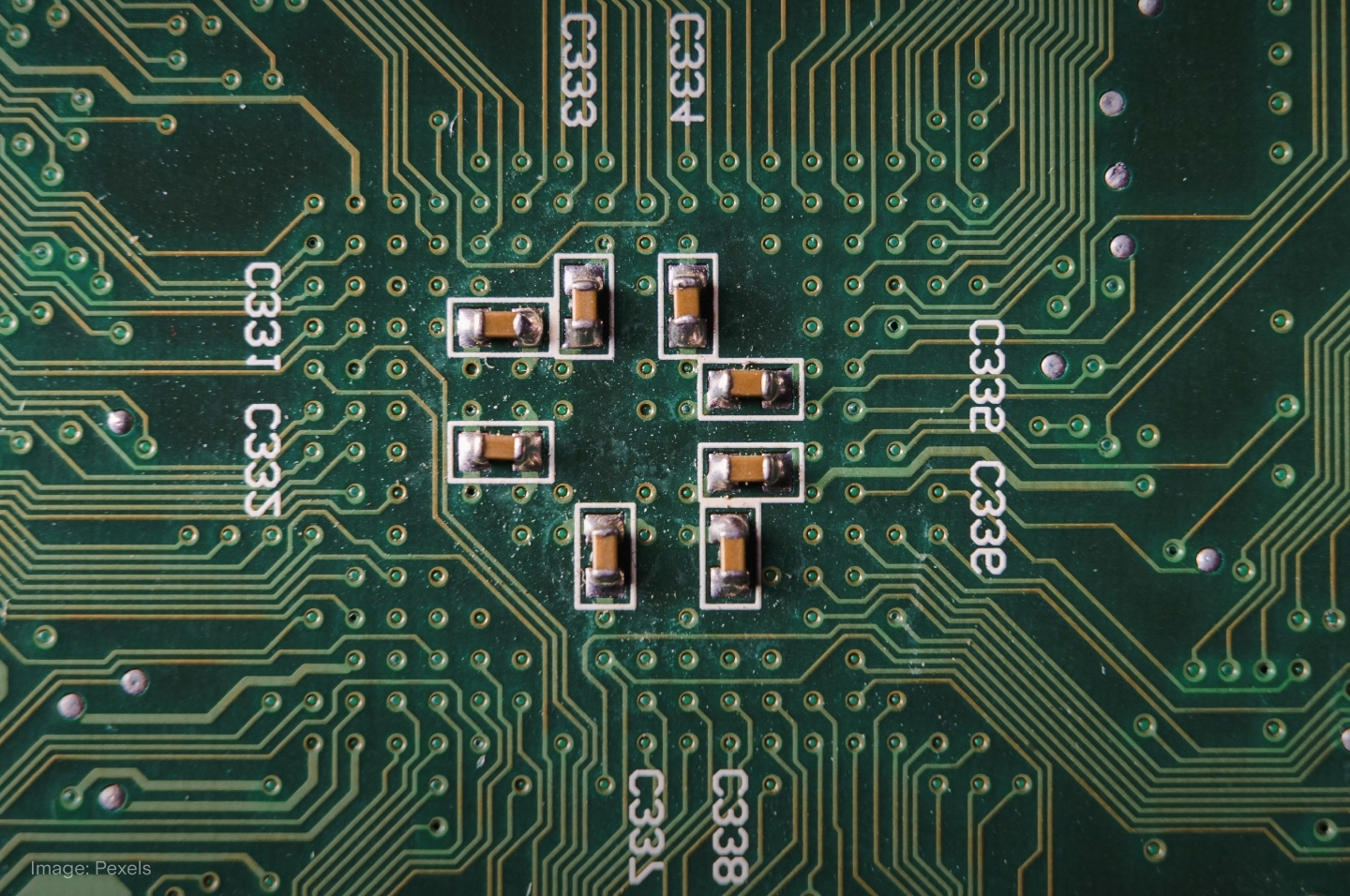

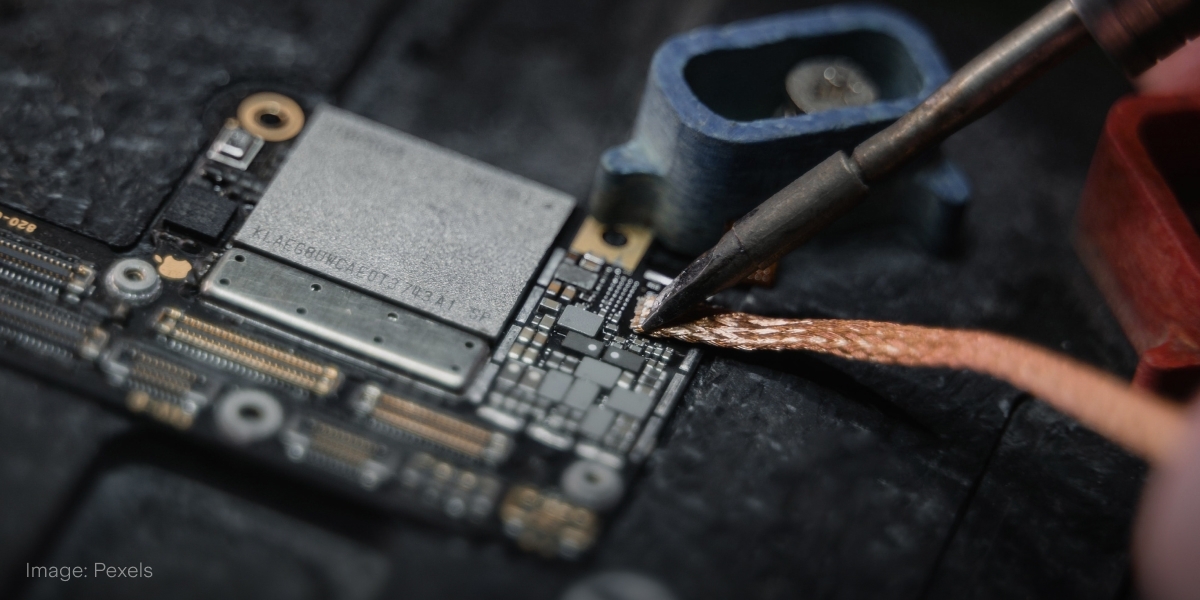

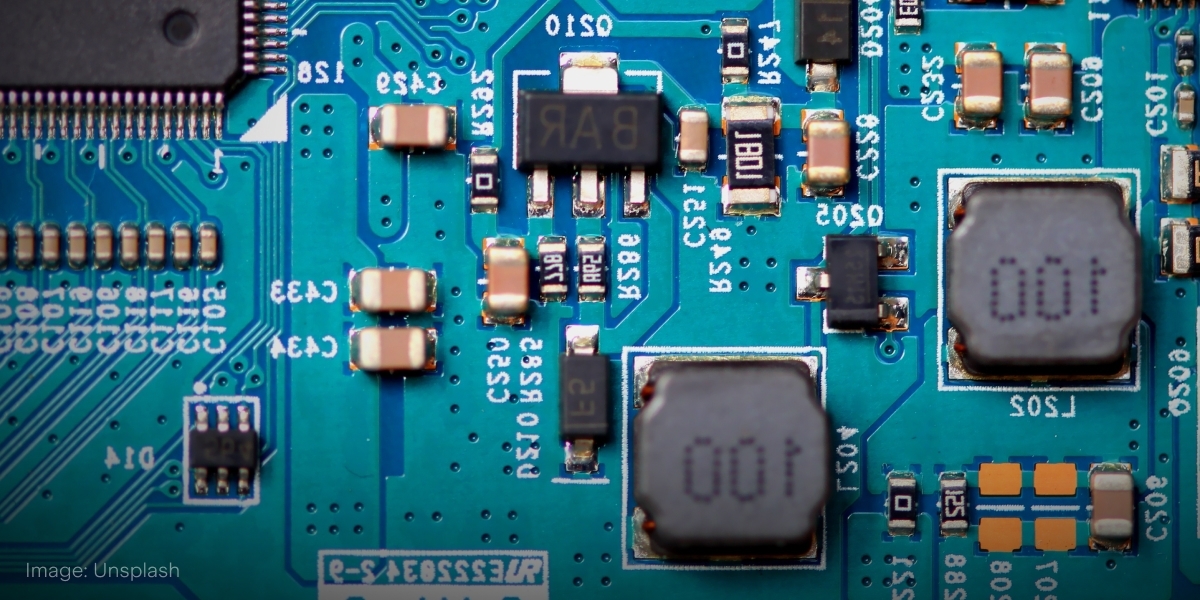

Most electronic devices of today contain Printed Circuit Boards (PCBs), the small green or blue panels found inside the likes of computers, phones and cars. PCBs can be compared to a city’s power grid, providing the means to connect the electrical signals between various locations. The boards are usually made of a non-conductive material, while copper pathways run to elements such as switches or transistors that enable the device to execute tasks.

There are several types of PCBs, with options ranging from rigid to flexible, single to multiple layers and sides depending on what’s best suited for the product. Before PCBs came along, the various circuits and components of electronics were attached with individual wires. This method is no longer practical for current standard designs, as technologies advanced and the number of parts increased significantly.

This progress continues and means that smaller devices – meaning even tinier PCBs – are in demand. Components such as semiconductors are also decreasing in size, while maintaining the same capabilities. There’s pressure on PCB designers to use space efficiently and create a well laid out board before it goes to the mass manufacturing stage. This is where software from Altium ($ALU) comes into play.

Starting signals

Altium started off with the Protel PCB in 1985, which was the first version of Altium Designer. This was one the early tools that could be used on personal computers to design PCBs. In 1991, the firm launched the world’s first PCB design system for Microsoft Windows ($MSFT), focusing on the large U.S. market. Altium’s approach involved beginning with a prototype and then amending the details to reach a final version, while the industry had traditionally built PCBs from a blank canvas.

This helped streamline the process and let professionals focus on the specifics required for the electronic device. Altium’s aim was developing a unified system that could keep all of the data in one place, which they worked towards with their own team as well as acquiring other firms in the space, such as Accel Technologies. The company listed on the ASX in 1999 and officially changed its name from Protel to Altium in 2001.

Altium’s share price saw little change for many years, until a few events in 2014 signalled a change in fortunes. The business raised A$44m of capital, moved its headquarters to California and appointed a new CEO. They continued to gain new capabilities by taking over other firms. These included Octopart, a world-leading search engine for electronics parts, and a cloud-based management software for electronics parts called Ciiva.

Complex paths

Altium made moves to extend its user base beyond trained electrical engineers. In 2017, the company acquired computer-aided design (CAD) software Upverter, a collaborative design tool for hardware that emphasises an intuitive user experience. They’ve also expanded into manufacturing, after buying PCB assembler PCB:NG and computing hardware producer Gumstix.

Despite the shopping spree, the company is still up against large players such Cadence ($CDNS), and Mentor, which is owned by Siemens ($SIEGY), not to mention free alternatives such as KiCad. Altium itself rejected a A$5.25b takeover offer from Autodesk ($ADSK) in 2021. Revenues reached US$263.3m in FY 2023 and subscribers grew 7.5% annually to 61,159. With targets of US$500m in revenues and 100,000 subscribers by FY 2026, there’s plenty of work ahead for the company.

There’s also pressure to push up margins from the 35-37% range to 38-40% This could prove difficult as the percentage has remained between 34.8% and 36.7% in the past five years. Altium has seen operating expenses rise 20.2% to US$167.9m, over the past financial year alone. Employees are their biggest cost, but are crucial for research and development functions to help the business to ahead.

However, converting more customers to subscriptions rather than perpetual licences has seen recurring revenues rise from 57% in FY 2019 to 77% in FY 2023. Another positive sign is the growth in Pro and Enterprise accounts, particularly in their largest market of the U.S. Their Octopart platform has managed to increase its average revenue per click gained from advertisers (though the number of clicks has declined with the normalisation of the supply chain for electronic components, after COVID-19 disruptions).

Planning ahead

These factors counterbalance some of the Altium’s headwinds. Operations in China underperformed, with lower new licence sales and slower macroeconomic conditions. This highlights the risk of the firm being affected by lower demand for electronics due to negative consumer sentiments and shrinking company budgets. Cash flows have also been affected by an ongoing dispute with the Australian Taxation Office about potential liabilities.

The shift to cloud-based operations has been a key element of Altium’s growth strategy in recent years. In 2020, the cloud business was separated from CAD software and the company launched digital collaboration platform Altium 365. For the latter, the number of monthly active users has grown from 2,735 in Q4 2020 to 35,741 in Q4 2023.

Cloud platform revenues have also increased from US$18.5m of a US$151.9m total in FY 2019 to US$60.3m of the US$263.3m total in FY 2023, while the rest of earnings come from the design software segment. The share price jumped on the back of these positive results in August 2023, but they’ve also set high expectations. Altium is trying to establish its place in the design supply chain, which is a complicated and rapidly changing area. Only time will tell whether they’re mapping the right path and can stay on it.

This does not constitute financial advice nor a recommendation to invest in the securities listed. The information presented is intended to be of a factual nature only. Past performance is not a reliable indicator of future performance. As always, do your own research and consider seeking financial, legal and taxation advice before investing.

Megan is a markets analyst at Stake, with 7 years of experience in the world of investing and a Master’s degree in Business and Economics from The University of Sydney Business School. Megan has extensive knowledge of the UK markets, working as an analyst at ARCH Emerging Markets - a UK investment advisory platform focused on private equity. Previously she also worked as an analyst at Australian robo advisor Stockspot, where she researched ASX listed equities and helped construct the company's portfolios.

.jpg&w=3840&q=100)