.jpg&w=3840&q=100)

Under the Spotlight AUS: Temple & Webster Group (TPW)

Making a house feel like a home is all about adding personal touches. Shopping for furniture and homewares has become an exclusively online experience with companies such as Temple & Webster. Let’s put it Under the Spotlight.

Making furniture combines form and function, with the outcome needing to be tasteful as well as comfortable. The industry has changed significantly from individual pieces made by artisans to the mass produced products of today. In 1820, Governor Lachlan Macquarie commissioned two ornamental chairs to be made by two convicts. These men were William Temple and John Webster, and they were eventually pardoned thanks to their work.

Many years later this story of craftsmanship came to the attention of a group of former colleagues. Mark Coulter, Adam McWhinney, Conrad Yiu and Brian Shanahan knew each other from their days at eBay ($EBAY) and News Corp’s digital division. They saw the potential of the internet to change shopping habits and founded Temple & Webster (T&W) ($TPW) in 2011. The purely online furniture and homewares platform was a unique offering in the Australian market at that time and received investments from firms such as Macquarie Group ($MQG).

The acquisition of leading global player Wayfair’s ($W) local operations in 2015 was an important step for T&W. A few months later the company bought furniture retailer Milan Direct and listed on the ASX at the end of the year. However, excitement around the IPO quickly subsided and the stock price fell rapidly as the integration of various business units took longer than expected, while the firm failed to meet sales forecasts.

Reducing costs

Much like the men whose names inspired the business, the company has managed to change its fortune over time. There has been a consistent focus on cutting costs and trying to market the T&W brand. The firm had initially been a members-only website and greatly expanded the visibility of its products by becoming a general online retailer.

The company also capitalised on Wayfair’s technology platform and set up a dropshipping model. This allows T&W to avoid large inventory costs and rents for physical storage spaces as most products are sent directly to customers from suppliers. It also enables the firm to offer a greater range of items.

On the other hand, T&W has recognised that bringing some business functions under its own umbrella helps with reducing expenses. The company has launched delivery services that operate around major cities and surrounding regions to maintain control over the customer experience.

Around 40% of the revenue the company generated in FY2023 was from its own imported private label and exclusive products. Another 40% was dropshipped from house brands, which were made for T&W with particular specifications. The remaining 20% was from third parties. There’s a goal to increase the exclusive segment to 70% over the next three to five years, as products in this area tend to have higher margins.

Driving awareness

The lack of a physical presence comes with its challenges for T&W. Buying furniture is often a rather tactile experience, with customers usually wanting to feel the texture of materials themselves. This understanding is much simpler to gain in a Harvey Norman ($HVN) or Nick Scali ($NCK) showroom, for example, than on a screen, which might feel closer to a Pinterest ($PINS) vision board. Furthermore, T&W is still far from a very well known name. The company estimates 78% of Australians looking for household items haven’t visited the T&W website, while it ranked seventh among shoppers who were asked to name brands in the category without prompts. This situation is not surprising as only around 18% of Australia’s furniture and homewares market has moved online.

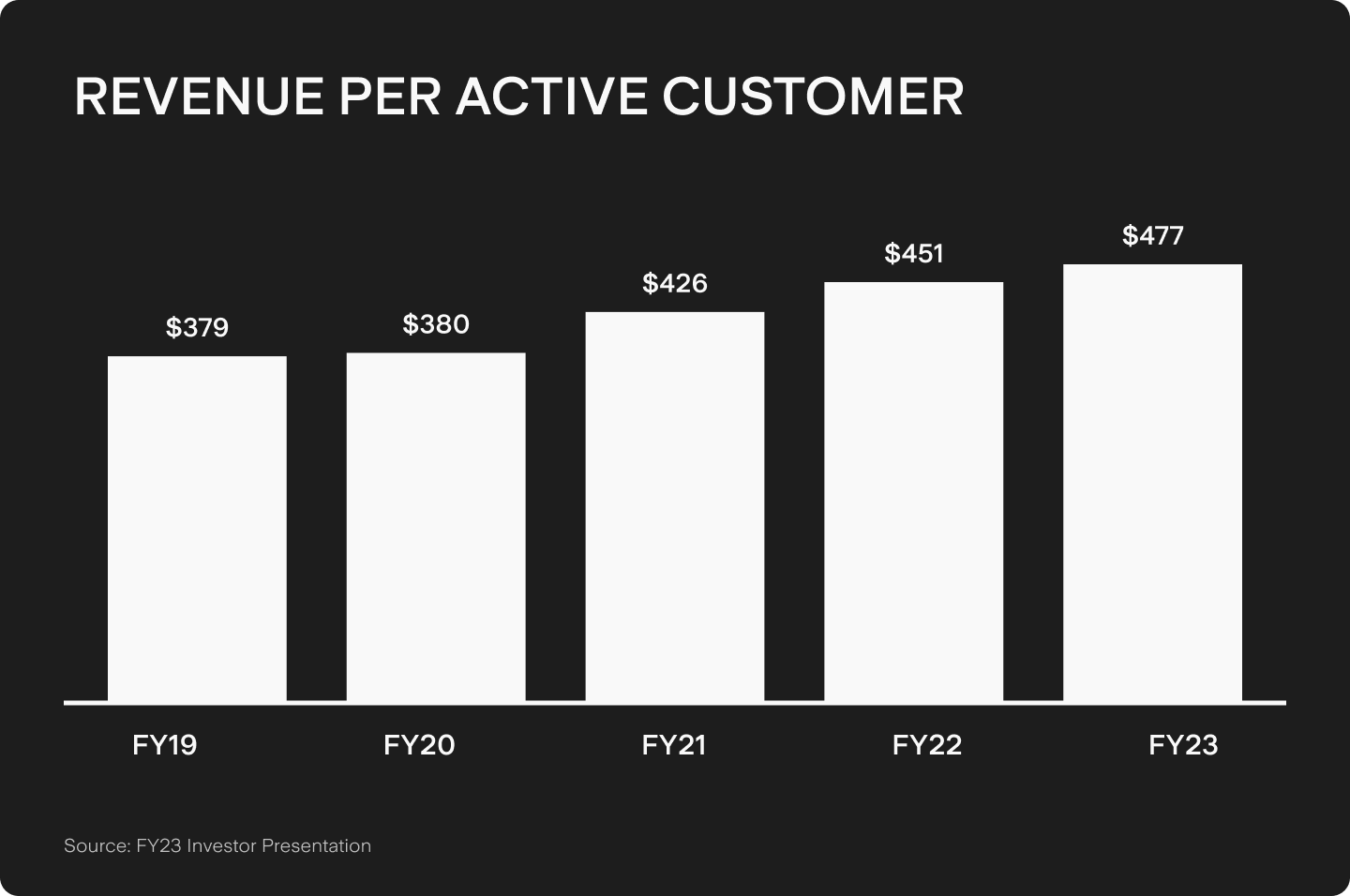

While T&W acknowledges it’s got a significant amount of work ahead in raising its profile, the firm also views its online exclusivity as an opportunity. The size of the online furniture market is about 27% to 28% in the U.S. and UK, indicating there’s a lot of room to expand in Australia. T&W also points out how the shift online during COVID-19 accelerated growth for e-commerce businesses. For T&W, the challenge has been trying to recover its high sales figures from the pandemic period. The firm has managed to retain around 90% of its active customers – 832,000 in FY2023 from a peak of 941,000 in FY2022. Increasing revenues from $451 to $477 per active customer over the same time is a positive trend. However, another key performance indicator, the total amount of online visits converted to transactions, fell from 3.2% to 2.8%.

T&W has taken a data driven approach to planning its ranges to try to stay ahead of new trends and avoid having excess stock. The company has a partnership with an AI startup, Renovai, the aim of which is to improve its conversion rates and customer engagement levels. Renovai is also developing an augmented reality interior design tool that could add to the experience. These innovations are still in their early stages and there aren’t enough results yet to tell if T&W’s investment will pay off.

Seasonal patterns

Like any retailer, T&W is facing some headwinds as consumers deal with financial pressures from the rising cost of living. The firm has shifted strategy to focus on entry-level prices and smaller sizes in its new ranges. It has incorporated new production methods and re-designed bulky products to be easier to transport. T&W has also been trying to diversify against pressured household budgets by expanding to other segments.

The company earned 16% of its FY2023 revenue, amounting to approximately $63m, from channels outside its core business of selling furniture and homewares. Approximately 10% of this came from business to business sales, while the other 6% came from the home improvement category. T&W is aiming to capture large-scale projects with services such as design, procurement and installation for accommodation providers and small office spaces. With bathroom, kitchen, laundry and lighting items, the home improvements sub sector opens up a $20b market.

However, these growth areas aren’t immune to economic downturns either and these types of projects can often be delayed. T&W is targeting annual revenue of $1b in the next three to five years, an ambitious goal when compared to the FY2023 figure of $396m. Some think there’s more room for the company to grow, but others are worried it could come up against a full house. Only time will tell whether it all goes to plan.

This does not constitute financial advice nor a recommendation to invest in the securities listed. The information presented is intended to be of a factual nature only. Past performance is not a reliable indicator of future performance. As always, do your own research and consider seeking financial, legal and taxation advice before investing.

Megan is a markets analyst at Stake, with 7 years of experience in the world of investing and a Master’s degree in Business and Economics from The University of Sydney Business School. Megan has extensive knowledge of the UK markets, working as an analyst at ARCH Emerging Markets - a UK investment advisory platform focused on private equity. Previously she also worked as an analyst at Australian robo advisor Stockspot, where she researched ASX listed equities and helped construct the company's portfolios.