Under the Spotlight AUS: CSL Limited (CSL)

The former ASX healthcare titan’s shares have fallen 25% in a month. Does it need urgent treatment or can it recover quickly?

ICYMI: do your own research and make your own decisions. This article drills down on a specific company, however it is not a recommendation to invest in the company and should not be taken as financial advice.

CSL ($CSL) topped the ASX200 at its peak. But even market titans face tough times and right now the healthcare darling is in need of its own IV drip.

Since reporting in August, the stock has shed close to 25% of its value. This comes as no shock. After all, CSL has been trending downward for over a year.

But has the market got it right or should value hunters take note?

There’s a lot in the mix. Think nearly 3,000 job cuts, a planned demerger of the vaccines division, trimmed research & development and indications of a bigger-than-anticipated threat to the plasma division.

CEO Paul Mackenzie claims the ‘transformational initiatives’ will simplify its operations and refocus on core strengths, all in the name of ‘sustainable, profitable growth’.

Analyst reactions? Mixed. But there’s one thing they agree on: despite the challenges, CSL isn’t a sell.

Still strength in the blood

The market reaction to CSL’s extensive restructure and a view that the results disappointed have overshadowed the actual numbers.

Analysts like UBS may have anticipated higher revenue and a final dividend, but arguably double-digit growth was still a solid outcome for CSL.

The business lifted profit by 17% to over $3B across the year to 30 June 2025, revenue by 5% and its final dividend by 12% to $1.62.

CEO Paul Mackenzie described the results as ‘a position of strength’ but noted ‘an unprecedented level of challenge and volatility in our external operating environment.’

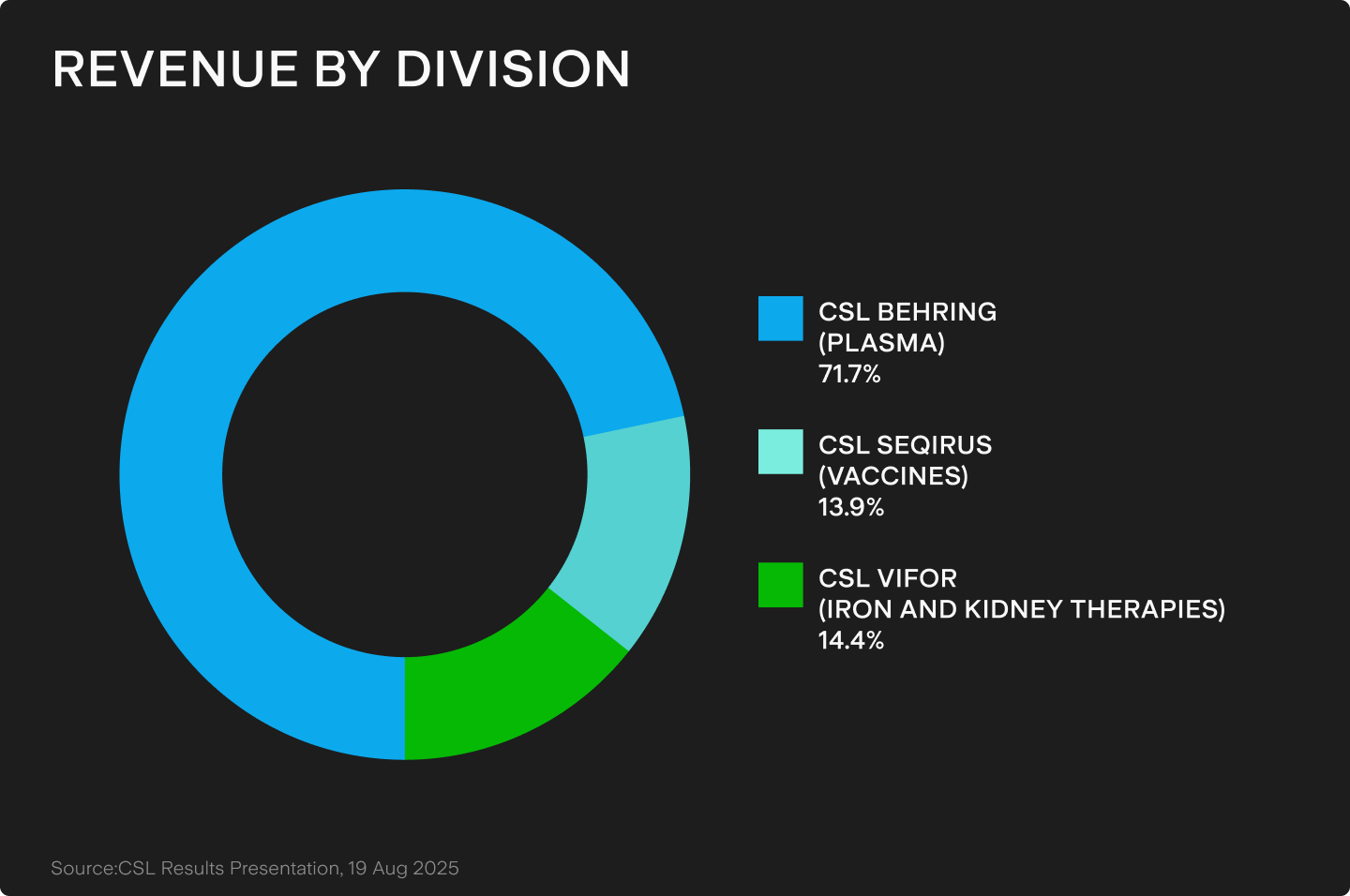

CSL’s crown jewel? Plasma. But the CSL Behring sub-businesses is under pressure from increased competition.

Wilson Advisory’s analyst Dr Shane Storey sees competition coming from ‘non-traditional places where a competitor is offering alternative treatments’. Storey highlights ArgenX ($ARGX) as a new threat. ‘[It’s] offering new therapeutics with success for patients who have previously seen little benefit from immunoglobulins.”

But Dr Storey also sees advantages in CSL’s position as the dominant player in the market. Plasma competitors like Grifols Plasma ($GRFS) or Takeda Pharmaceuticals Company ($TAK) have underinvested in expansion compared to CSL.

BCC Research backs this view, pointing out CSL holds nearly 33% of the global US$38B plasma industry.

Demand is expected to grow at an annual compound rate of 7.1% over the next decade as plasma is essential for therapies and personalised medicines.

In short, plasma still has the ability to be a long-term driver of growth.

Innovation in its veins

CSL has long been known for innovation beyond plasma.

A recent win was FDA approval for Garadacimab (sold as Andembry) – a treatment for hereditary angioedema (HAE), a rare disease where patients suffer from recurrent severe swelling in the arms, legs, face, intestinal tract and airway.

Storey describes Andembry as a drug that could be ‘transformative for the business’, in the same way that CSL’s Idelvion revolutionised haemophilia treatment.

‘It could single-handedly change CSL’s income statement,’ says Storey.

But there have been setbacks as well as successes. In 2024, its much touted CSL112 drug for reducing the risk of heart attacks failed its phase 3 clinical trials. It was CSL’s largest trial to date, and hit their share price in the short-term.

But despite a strong pipeline and a history of R&D success, investors are concerned about CSL’s plans to cut back on R&D spend in favour of more targeted M&A activities. The key question? Does CSL have the right skillset in place to find the right targets at the right valuations.

CSL’s last major acquisition, iron deficiency and kidney disease business Vifor, received criticism at the time as to whether CSL had overspent. But with a plan to fully integrate Vifor into the CSL Behring division, Wilson Advisory’s Dr Storey believes the acquisition will pay off in the long run.

A two-for-one vaccines play

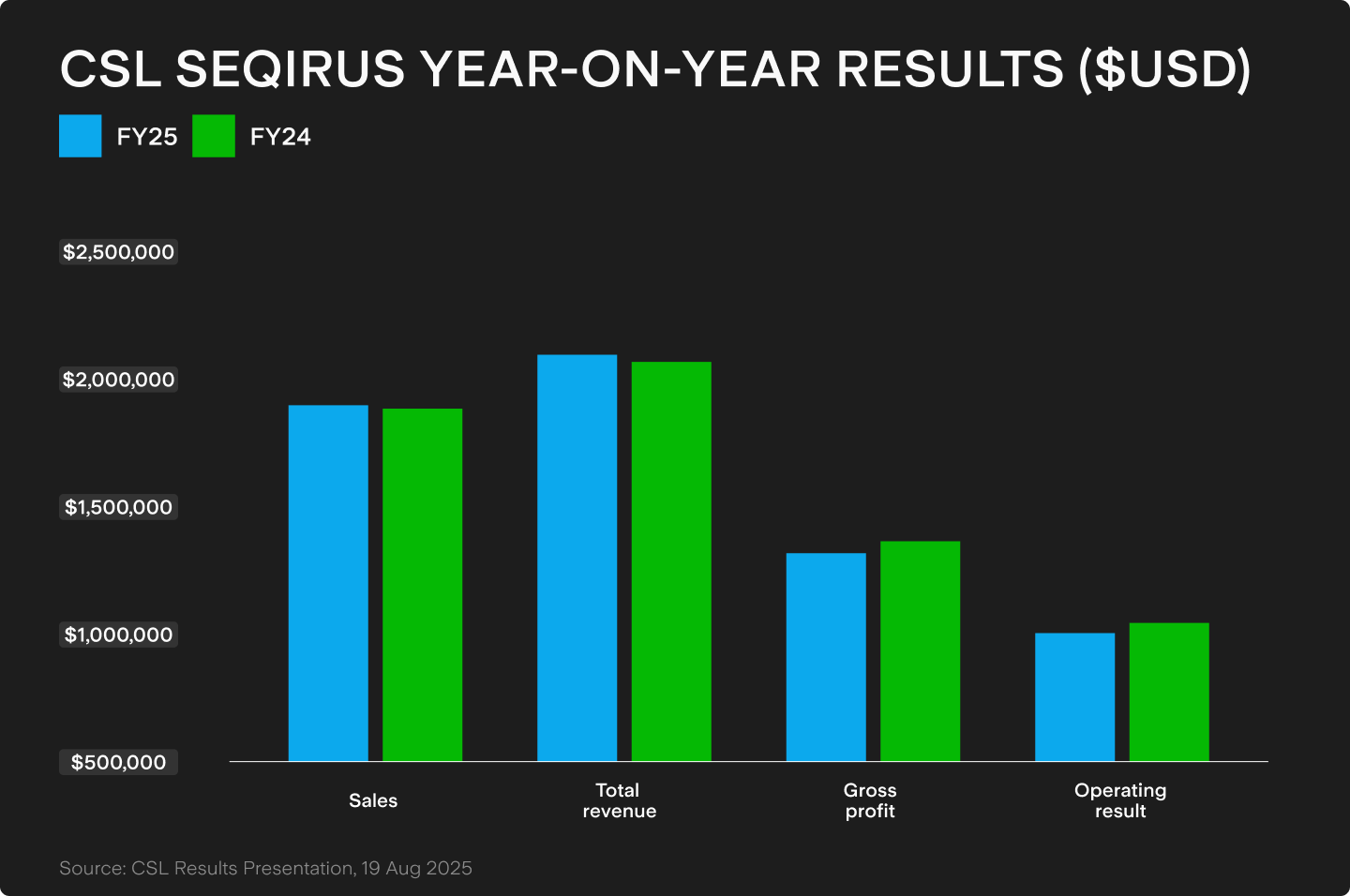

CSL announced its intention to demerge vaccines division Seqirus in 2026 after what’s been a mixed year.

On one hand, growing scepticism of vaccines, particularly in the US, meant influenza vaccinations had a lower than expected uptake this year despite a tough flu season. On the other hand, Seqirus could celebrate after being awarded the majority of global avian flu contracts.

CSL expects the industry to stabilise and vaccine seasonality still makes for a predictable revenue stream. And Seqirus is a strong business in its own right, generating $2.2B in revenue in the last financial year and is second in terms of market share for flu vaccines.

So what are the benefits to CSL of a demerger?

A cash injection for one. The ability to focus on core capabilities. Better yet, the potential of a shot in the arm for CSL’s own multiples. Vaccine businesses generally trade at lower multiples and some analysts think that Seqirus is diluting CSL.

The healthcare sector is typically seen as defensive, being a place of relative stability during volatile periods in the stock market. Yet this characteristic has not been as obvious in 2023, with labour shortages, inflation and high competition affecting firms.

Long-term diagnosis

Even more cautious analysts are maintaining positions in the healthcare giant.

CSL’s balance sheet remains solid, the plasma business looks set for growth – despite competition and tighter margins – and opportunities from its clinical pipeline, like the newly approved Andembry, can open up new revenue streams

Even with concerns of the restructure, the main question is less about quality and more about value opportunity.

There’s little consensus on price targets, which range from as low as $209 to above $300. That means investors will be looking closely at the wider market environment and whether CSL can successfully pivot from an R&D strategy to M&A.

This does not constitute financial advice nor a recommendation to invest in the securities listed. The information presented is intended to be of a factual nature only. Past performance is not a reliable indicator of future performance. As always, do your own research and consider seeking financial, legal and taxation advice before investing.

Sara is a passionate finance writer with more than 15 years’ experience in the Australian finance industry. She has worked in marketing and content with Macquarie Group, Westpac, ETF Securities (now Global X ETFs) and Livewire Markets across investments, insurance, financial advice and superannuation.

.png&w=3840&q=100)

.png&w=3840&q=100)

.png&w=3840&q=100)