Under the Spotlight AUS: Breville Group (BRG)

From the early morning coffee to the lunchtime sandwich, through to heating up dinner, kitchen appliances are essential to fuelling the daily grind. Making food preparation faster, but still maintaining taste, is the aim of companies like the Breville Group. Let’s put it Under the Spotlight.

In 1932 a radio salesman and an engineer went to the Melbourne Cup, but luckily for them they didn’t leave with empty pockets. Bill O’Brien and Harry Norville decided to use their winnings to start a new firm that would make radios. By combining their names, they landed on Breville Radio. After briefly manufacturing mine detectors during World War Two, they realised they needed to shift focus.

Television began to take over as a popular form of entertainment in the 1950s and, for a few years, they sold TV sets under the ‘Precedent Televisions’ brand. The pair also looked into small kitchen appliances. By the 1960s, Bill’s son John had become involved in the business and founded the ‘Breville Research & Development Centre’, which set the standard for Breville Group’s ($BRG) reputation in food and beverage preparation.

In 1974, Australians were quickly won over by the scissor action ‘Snack n Sandwich’ toaster. It would replace the old-fashioned jaffle iron and is estimated to have achieved 10% market penetration within one year of its launch. Cutting cheesy toasted sandwiches diagonally and sealing the edges proved an extremely popular but simple homemade treat.

Simple recipe

The ‘Kitchen Wizz’ food processor and ‘Scraper Mixer Pro’ arrived soon afterwards, while, in the 1980s, Breville launched one of the first heated walled electric woks. These types of devices helped people to improve the quality and variety of their meals, while reducing preparation times. As such, the company was able to cater to the general trends of a fast-paced society, people becoming more health conscious and an emerging foodie culture.

Today Breville has a greater range of products, some of which are meant for use outside of the kitchen. Cooling fans, air purifiers, dehumidifiers and electric blankets are a few of these offerings. However, its core strategy remains tied to premium kitchen appliances via two main business segments.

Global product includes the goods being created by the firm itself, generally through its brands such as Breville, Sage and Baratza. The distribution unit involves those products that come from third parties, via various licensing agreements or that are sourced directly from manufacturers.

The company’s appliances are sold in over 80 countries, with global product sales outside of Australia increasing from 79% in FY2018 to 85% in FY2023. In the UK and Europe, the firm primarily operates as Sage, as another business owns the Breville brand in the region.

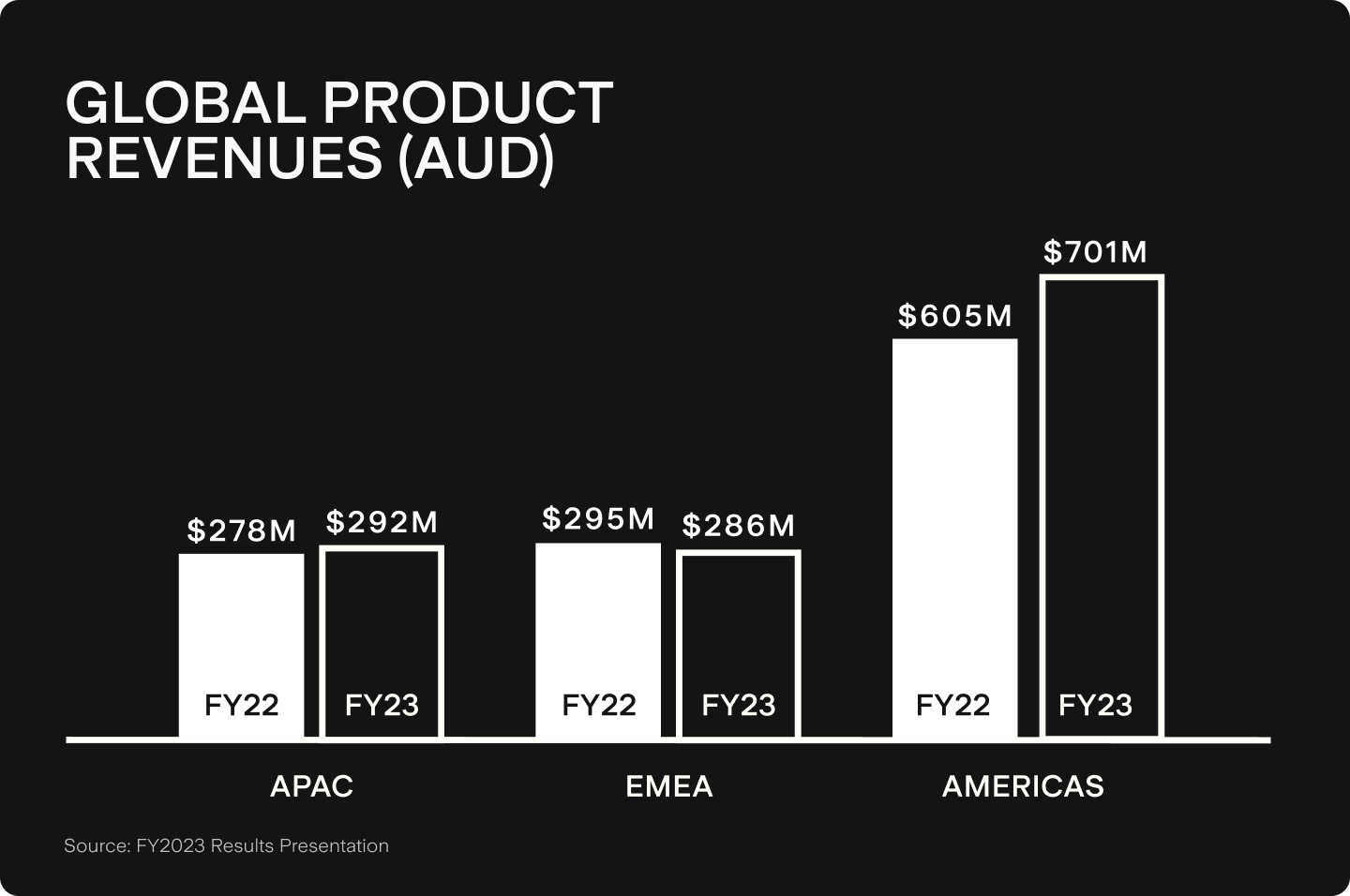

While the U.S. is the business’ largest market, there’s a drive for diversification and the firm has entered seven new nations since 2020. Just under 55% of revenues come from the Americas, with the remaining inflows closely split between the Asia-Pacific and Europe, the Middle East and Africa regions.

There are many moving parts in Breville’s process of delivering products to customers, which comes with its own risks. Breville was caught up in the Bed Bath & Beyond bankruptcy and has now shifted its operations to sell from Target ($TGT) in the U.S. In addition, the firm has built a manufacturing plant in Mexico to expand sourcing capabilities outside of China, with goods built across the U.S. border not affected by U.S. tariffs. These actions have helped the company, but they still came at a cost.

Hot shots

Breville is active in the coffee industry. It has a longstanding partnership with Nespresso, while the acquisition of the Italian speciality espresso machine manufacturer Lelit in 2022 suggests the company is expecting demand for coffee to increase. However, it’s not yet clear whether Breville’s subscription service for coffee beans will follow a similar trend.

The firm also continues to innovate through its Food Thinking initiative. This is a strategic stream of work with input from internal teams, such as designers and developers, professional chefs and consumers. One of the success stories is the Turbo Sous Vide, which brings the restaurant cooking technique into the home.

Other products have evolved with the times. For example, the Joule Oven is now accompanied by an app with a library of optimised content. This includes step-by-step videos of recipes and guidance from renowned chefs and culinary partners.

Adjusting settings

As a premium brand Breville benefits from relatively high margins and pricing power. The firm managed to increase gross margins from 34.4% to 35% over FY2023. It did this in part by cutting down on the volume of goods it manufactured, while also avoiding applying discounts on its products in market. While satisfied customers might add more gadgets from the brand to their collection, the nature of Breville’s products means that repeat purchases are infrequent. Growth depends on finding new clients, and on creating new appliances or improving them.

Breville’s increasing revenues have not translated into significant stock price growth, as inflation has led to persistent worries about a potential decline in consumer spending. The trend remains a general concern for the consumer discretionary sector, with sales figures from competitors Whirlpool ($WHR) and Newell Brands ($NWL), as well as retailers Best Buy ($BBY), JB Hi-Fi ($JBH) and Harvey Norman ($HVN), being watched closely. However, increased prices at restaurants and for home deliveries have meant that home cooking remains a cheaper option.

.png&w=3840&q=100)

Over the years Breville’s shareholders have been rewarded with dividends, but capital gains have been more volatile. The company paid out a dividend of 30.5 cents per share in FY2023, in line with management’s target ratio of 40% of earnings per share.

Breville has established a strong reputation for serving up household hits, but is also facing some headwinds. Investors will be watching and wondering what’s next on the menu.

This does not constitute financial advice nor a recommendation to invest in the securities listed. The information presented is intended to be of a factual nature only. Past performance is not a reliable indicator of future performance. As always, do your own research and consider seeking financial, legal and taxation advice before investing.

Megan is a markets analyst at Stake, with 7 years of experience in the world of investing and a Master’s degree in Business and Economics from The University of Sydney Business School. Megan has extensive knowledge of the UK markets, working as an analyst at ARCH Emerging Markets - a UK investment advisory platform focused on private equity. Previously she also worked as an analyst at Australian robo advisor Stockspot, where she researched ASX listed equities and helped construct the company's portfolios.