Under the Spotlight AUS: NEXTDC Ltd (NXT)

Data centres built and operated by firms like NEXTDC provide critical infrastructure for the digital devices and services that have become central to our lives. Let’s put the company Under the Spotlight.

Computers have changed the way we live, work and organise parts of society. The devices themselves have also transformed. Early models could take up most of a room and are far removed from the lightweight laptops of today. However, with more services becoming digitised, we create and process ever growing amounts of data. This makes the real assets that support our virtual worlds important parts of infrastructure.

Developing these types of resources has been of special interest to Bevan Slattery. The serial entrepreneur was a co-founder of PIPE Networks, an internet exchange and fibre network that was sold to TPG ($TPG) for over $400m in 2010. He also started Megaport ($MP1), which provides software to manage network connections, as well as Superloop ($SLC) internet and telecommunications services. Another venture, SUBCO, is building undersea cables connecting Australia to the Middle East.

Arguably his biggest success so far has been NEXTDC ($NXT). The firm takes data centres from design to operation and helps clients with digital solutions. It connects businesses to the cloud, various carriers and service platforms, with many firms outsourcing or remotely managing their IT systems. NEXTDC has hyperscale data centres, large facilities that benefit from economies of scale and custom engineering.

Always on

Due to high upfront capital requirements, there are few operators in the hyperscale space. Google Cloud Platform ($GOOGL), Amazon Web Services ($AMZN) and Microsoft Azure ($MSFT) have deep pockets and are vying for market share in cloud computing. NEXTDC presents as an independent option and likens its strategy to the software-as-a-service business model. The company still works with these tech giants, who are among its over 750 cloud, carrier and digital service provider partners.

The data centres provide a space, often referred to as a ‘co-location’, for clients to keep servers and storage devices, with costs usually including building management, power supply and network connectivity. Stability and security are paramount, as data breaches and interruptions in service can seriously damage a firm’s finances and reputation.

There are ratings and certifications that indicate the differences between centres. NEXTDC has mainly Tier III and Tier IV operations. Activities at a Tier IV asset, which is the highest rating on this scale, should not be suspended if a component fails and come with a 100% uptime guarantee. This puts the firm under constant pressure to maintain high standards and implement backup plans.

Data centres also need to be designed and outfitted to ensure temperatures and humidity levels are constant. This involves managing air flows to prevent servers overheating, and given the significant amounts of power required, there’s a general focus on energy efficiency. Customers can have their power consumption metered and charged separately, but the majority choose an all-in option. Many of these metrics and other choices can be viewed and controlled by clients through a management portal.

Scaling growth

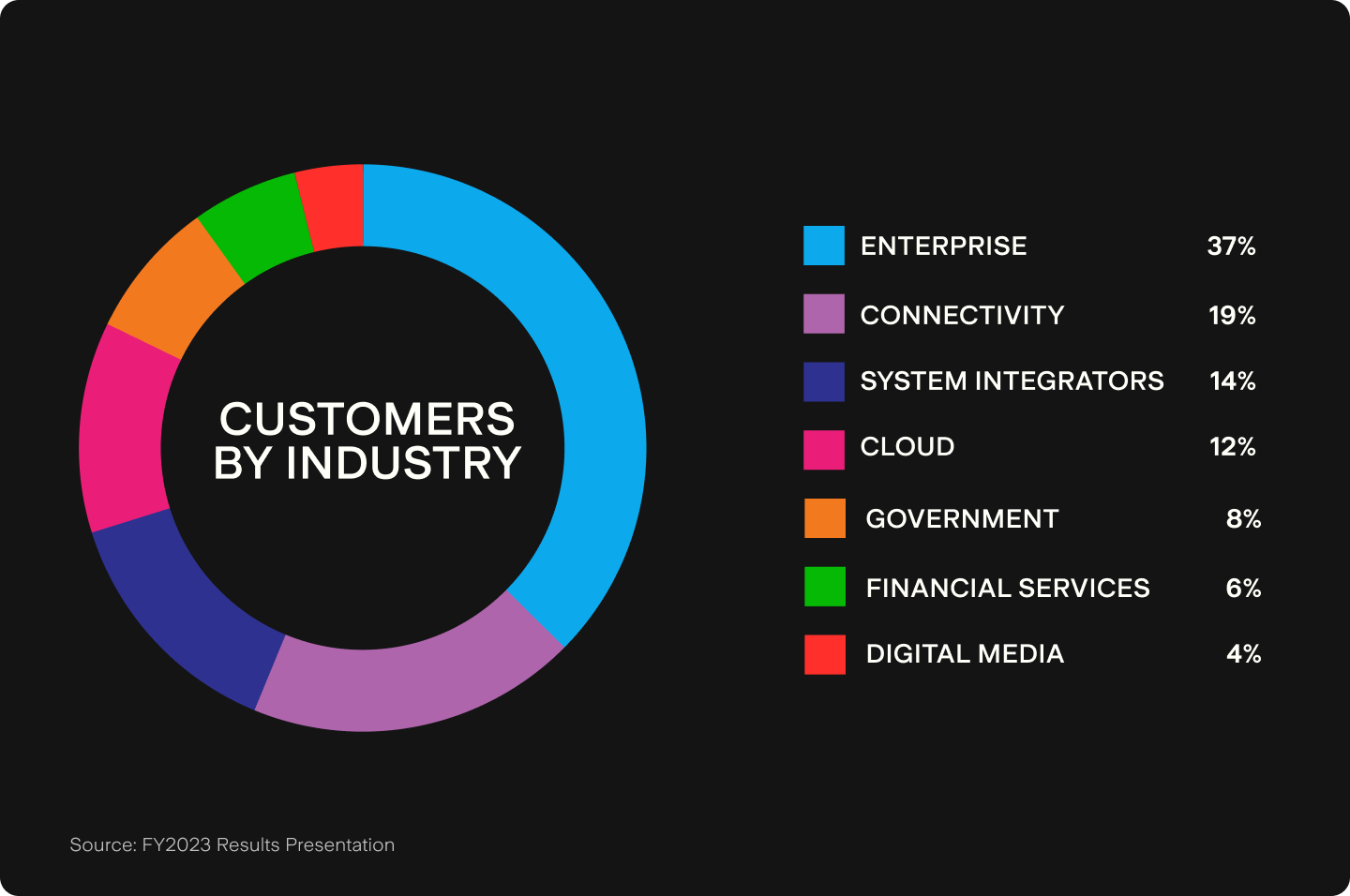

NEXTDC’s existing client base appears to be satisfied, with 93% of revenues being recurring in FY2023. But client numbers will need to grow rapidly to fill up new developments. NEXTDC has managed to gain the Australian government’s Certified Strategic status as a stamp of quality approval, but the government only accounted for around 8% of customer revenues in the last financial year. In mid-2023, NEXTDC had 13 data centres in operation, five in development and three in the planning stage.

With 51% of revenues coming from New South Wales and the Australian Capital Territory in FY2023, expanding into other regions would help diversify the business. The firm is currently developing a facility in Auckland, New Zealand and putting $1b into another in Kuala Lumpur, Malaysia. Options in Tokyo, Japan and Singapore are under evaluation.

However, for some customers it’s not just about creating a secure location and they want more specific services. Those in gaming, virtual reality and ‘the internet of things’ have a high sensitivity to data transfer times. These firms prefer edge data centres that are located close to end users, which often involves more expensive real estate. NEXTDC is spending substantial sums on these facilities and there will be a lag before receiving income from clients.

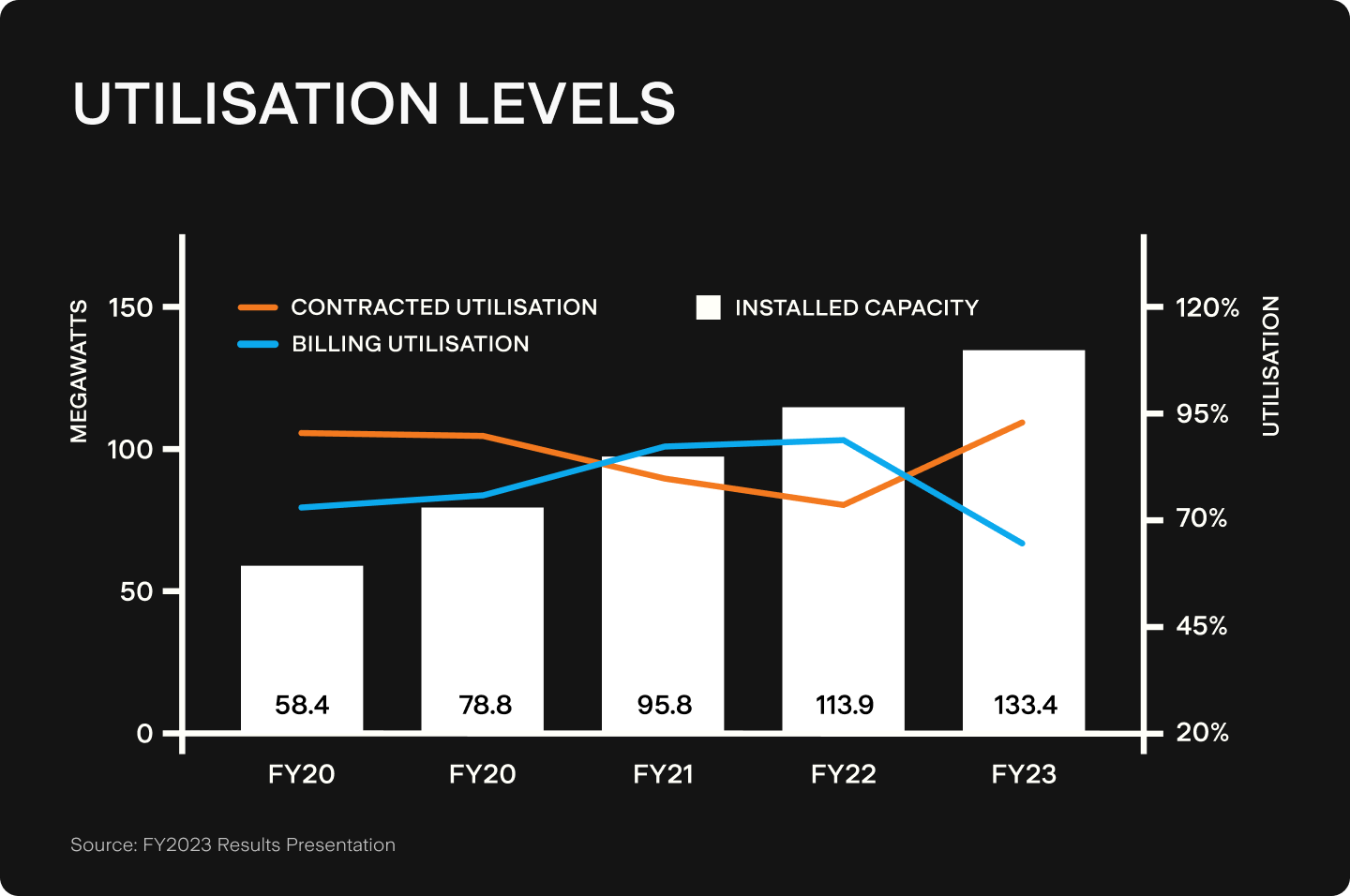

The size of these facilities is shown related to their electricity usage, with the firm having a total of 133.4 megawatts (MW) installed capacity by the end of FY2023. Approximately 122.2MW of this amount had been contracted to be used by clients, a 47.2% annual increase and a clear recovery after two slower years. However, this includes those later start dates and the percentage of megawatts for services that have actually commenced has declined. Boosting this rate will be a key challenge for future profitability.

Network hubs

Since its founding in 2010, NEXTDC has established itself as a strong player in the Australian market. Demand for data centres is expected to increase as high performance computing power and data storage become embedded across industries, and the importance of data centres to implementing AI capabilities grows. However, NEXTDC’s future will depend on carefully managing its load and ensuring it is not overwhelmed by volumes.

The firm also faces strong competition. AirTrunk, founded by former NEXTDC employee Robin Khuda, is one of the largest developers in the Asia-Pacific region and is considering listing on the ASX. While the two companies have generally not competed directly for areas to build data centres, this could well change in the future. Others are also putting efforts into the space, with Macquarie Technology Group ($MAQ) raising $160m to pursue data centre opportunities in June 2023. Multinational Equinix ($EQIX) also operates locally as part of a global ecosystem of 250 data centres. With signs that new capacity in Sydney has kept pace with demand, investors will be watching the outcomes of NEXTDC’s expansion plans closely.

This does not constitute financial advice nor a recommendation to invest in the securities listed. The information presented is intended to be of a factual nature only. Past performance is not a reliable indicator of future performance. As always, do your own research and consider seeking financial, legal and taxation advice before investing.

Megan is a markets analyst at Stake, with 7 years of experience in the world of investing and a Master’s degree in Business and Economics from The University of Sydney Business School. Megan has extensive knowledge of the UK markets, working as an analyst at ARCH Emerging Markets - a UK investment advisory platform focused on private equity. Previously she also worked as an analyst at Australian robo advisor Stockspot, where she researched ASX listed equities and helped construct the company's portfolios.