Under the Spotlight AUS: Johns Lyng Group (JLG)

The construction industry is just as much about repairs and renovations as it is about new builds. And it’s firms like Johns Lyng Group that aim to provide integrated solutions for the sector. Let’s put it Under the Spotlight.

‘There’s no place like home’, so the saying goes. Some even describe it as their castle. But while lots of people feel very settled in their properties, many others are less so, with major work required to repair and restore their damaged residences. And that’s where building and property maintenance companies like Johns Lyng Group ($JLG) come in.

Founded by the trio of Leigh Lyng, Gary Johns and Scott Johns in 1953, the company formerly known as Johns & Lyng Builders used to cater to just Melbourne and its wider region. But after serving Victorians for decades, entrepreneur Scott Didier bought the business in 2003 and oversaw its national expansion.

The firm’s stronghold is in insurance-related repair and restoration work on Australia’s east coast. Johns Lyng has established strong relationships with insurance companies, which has helped to streamline processes, while the firm and its subsidiaries have branches in multiple locations, enabling a quick response.

The company also has a small army of contractors that can be dispatched depending on the needs of its projects, which often come about as a result of natural disasters such as fires, storms and floods. This means Johns Lyng places considerable trust in its network of over 14,500 independent workers.

Building foundations

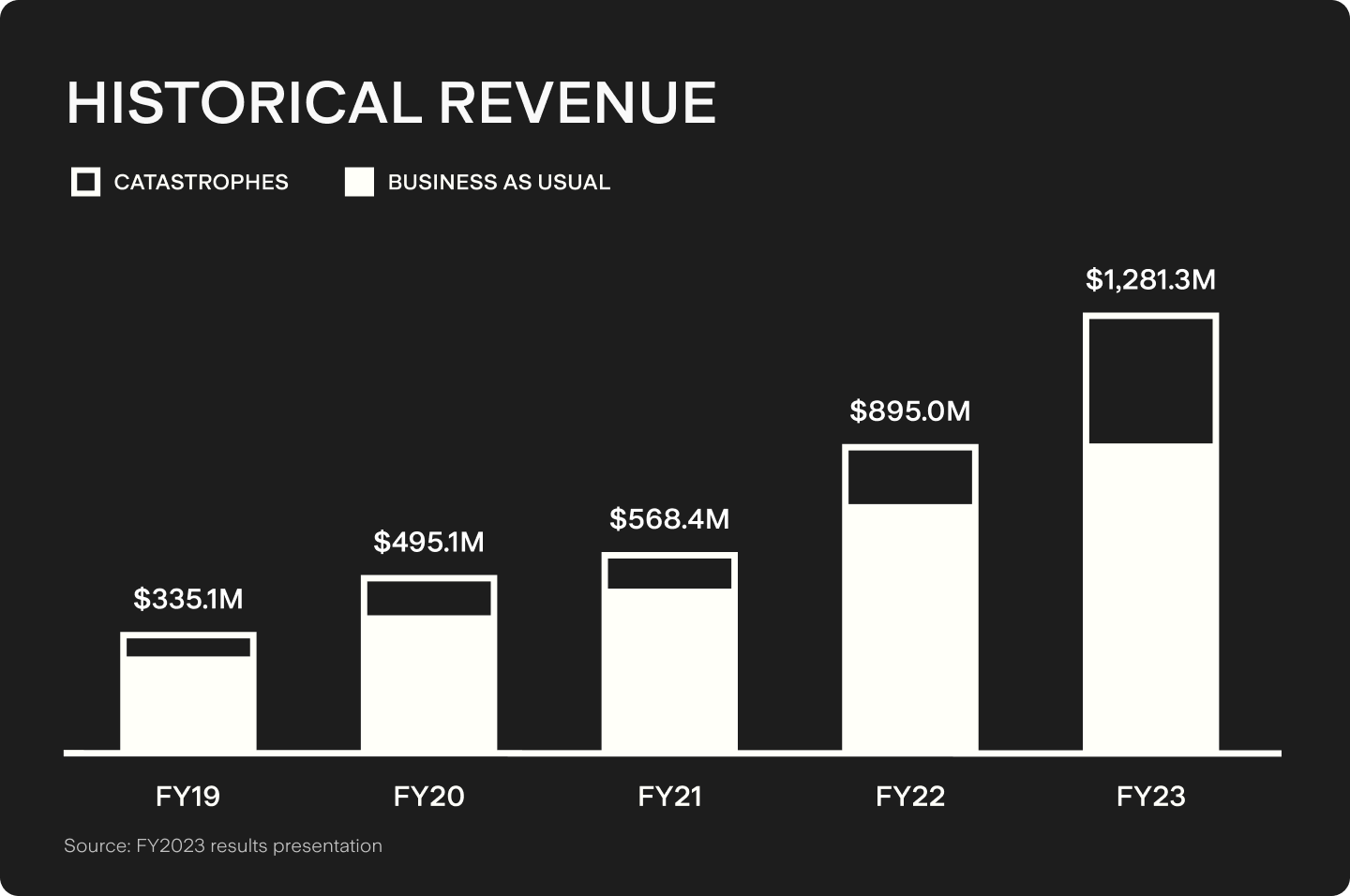

Reacting to risk is a big part of Johns Lyng’s business. The company is a leader in natural disaster responses in Australia, with a growing proportion of revenue coming from the catastrophe (CAT) segment of the company rather than the business as usual (BAU) portion.

CAT revenue experienced a year-on-year increase of 125.3% in FY2023, growing from $164.8m to $371.3m. Climate change is expected to lead to more frequent and severe catastrophic events, potentially benefitting the company’s bottom line in this area. However, it’s hard to plan budgets when the exact timing and scale of events are not predictable, while the prices of materials and labour shortages also tend to spike in affected locations.

As such, Johns Lyng hopes to convert clients to BAU customers when possible. In Australia, multi-phase contracts with the Victoria, Queensland and South Australia state governments, covering tasks such as clean-up, assessment and temporary accommodation, provide some stability and BAU accounted for $910.1m out of the company’s FY2023 total revenue of $1.28b.

Growth mindset

In the pursuit of growth, the business has made several acquisitions and has looked to diversify into new areas. Today, Johns Lyng provides a wider range of integrated building solutions, from rebuilding and restoration, to body corporate management and essential home services. The firm is behind 24 brands and operates 130 subsidiaries across Australia, New Zealand and the U.S.

Since buying the Bright & Duggan brand in 2019, Johns Lyng now runs one of Australia’s largest strata businesses and has an approximately four per cent market share. This segment could provide more stable income streams for the company, as well as an opportunity to cross-sell services as buildings age.

Commercial building services is another unit, but the company is reducing commercial construction operations and only completing works related to legacy contracts or projects. The industry has experienced a downturn due to inflated costs of building materials and subcontracting firms shutting down.

Essential home services is viewed as an area of strategic growth. The takeover of Smoke Alarms Australia and Link Fire Holdings gives Johns Lyng new capabilities in fire, electrical and gas compliance and testing. With subscription-based revenue models, this could be another source of recurring revenue. The demand for these services is closely related to government regulations and deadlines for new safety standards are usually determined a few years out.

Raising the roof

Johns Lyng entered the U.S. market in April 2019 by acquiring the global master franchise for Steamatic, a restoration and cleaning company. This provided a springboard to research further opportunities in America, with the company going on to acquire Reconstruction Experts, a leading provider of insurance-focused repair services. This expanded Johns Lyng’s footprint in the US significantly, with Reconstruction Experts also performing maintenance and repairs on behalf of homeowner associations (similar to body corporates in Australia).

With its expansion into the U.S., Johns Lyng needs to manage an even broader range of products and businesses. It is therefore aiming to consolidate across markets within its strata sector, its essential home services unit and its insurance, building and restoration services division.

Unpredictability, however, in the insurance industry presents a risk to the firm. Consumers are dealing with rising premiums as insurers look to pass on costs, while in the U.S., a few companies have even stopped issuing new home insurance policies in California and Florida due to the high possibility and costs of natural disasters in these states. More changes are likely ahead in an already unsteady sector.

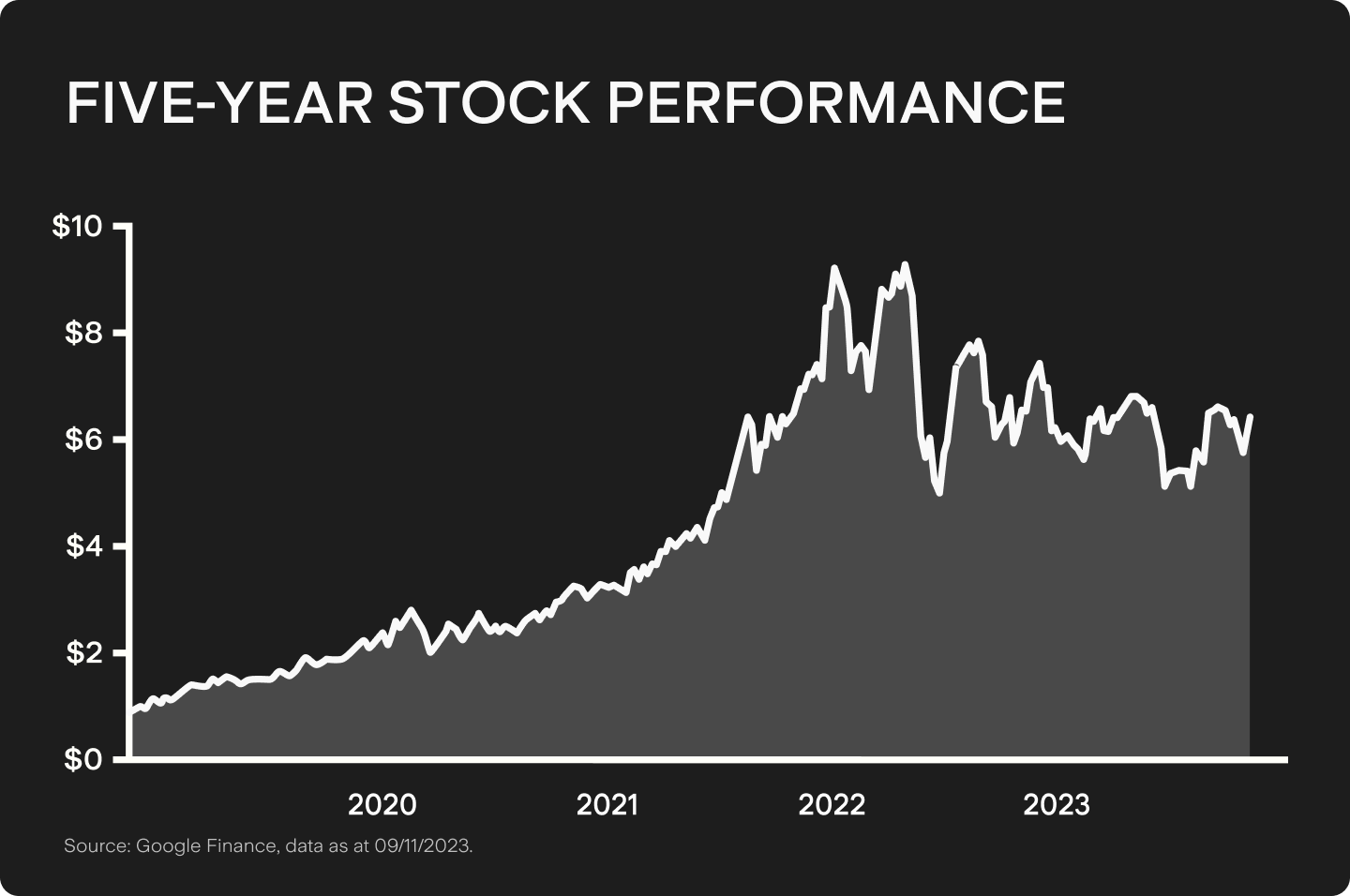

The fact the company consistently depends on other players, especially insurers and subcontractors, also creates uncertainty for the firm. Another variable is that Didier retains a significant holding in the company and his selling of a large number of shares has previously affected the stock price.

Despite these concerns, Johns Lyng has achieved rapid growth since listing on the ASX in 2017. But it’s tough to keep building higher. The blueprints for future strategies are in place, but only time will tell whether they can be successfully implemented.

This does not constitute financial advice nor a recommendation to invest in the securities listed. The information presented is intended to be of a factual nature only. Past performance is not a reliable indicator of future performance. As always, do your own research and consider seeking financial, legal and taxation advice before investing.

Megan is a markets analyst at Stake, with 7 years of experience in the world of investing and a Master’s degree in Business and Economics from The University of Sydney Business School. Megan has extensive knowledge of the UK markets, working as an analyst at ARCH Emerging Markets - a UK investment advisory platform focused on private equity. Previously she also worked as an analyst at Australian robo advisor Stockspot, where she researched ASX listed equities and helped construct the company's portfolios.