Under the Spotlight AUS: PolyNovo Ltd (PNV)

Medical products are often essential to helping our bodies heal. Enabling skin and tissue injuries to recover is the goal of PolyNovo. Let’s put it Under the Spotlight.

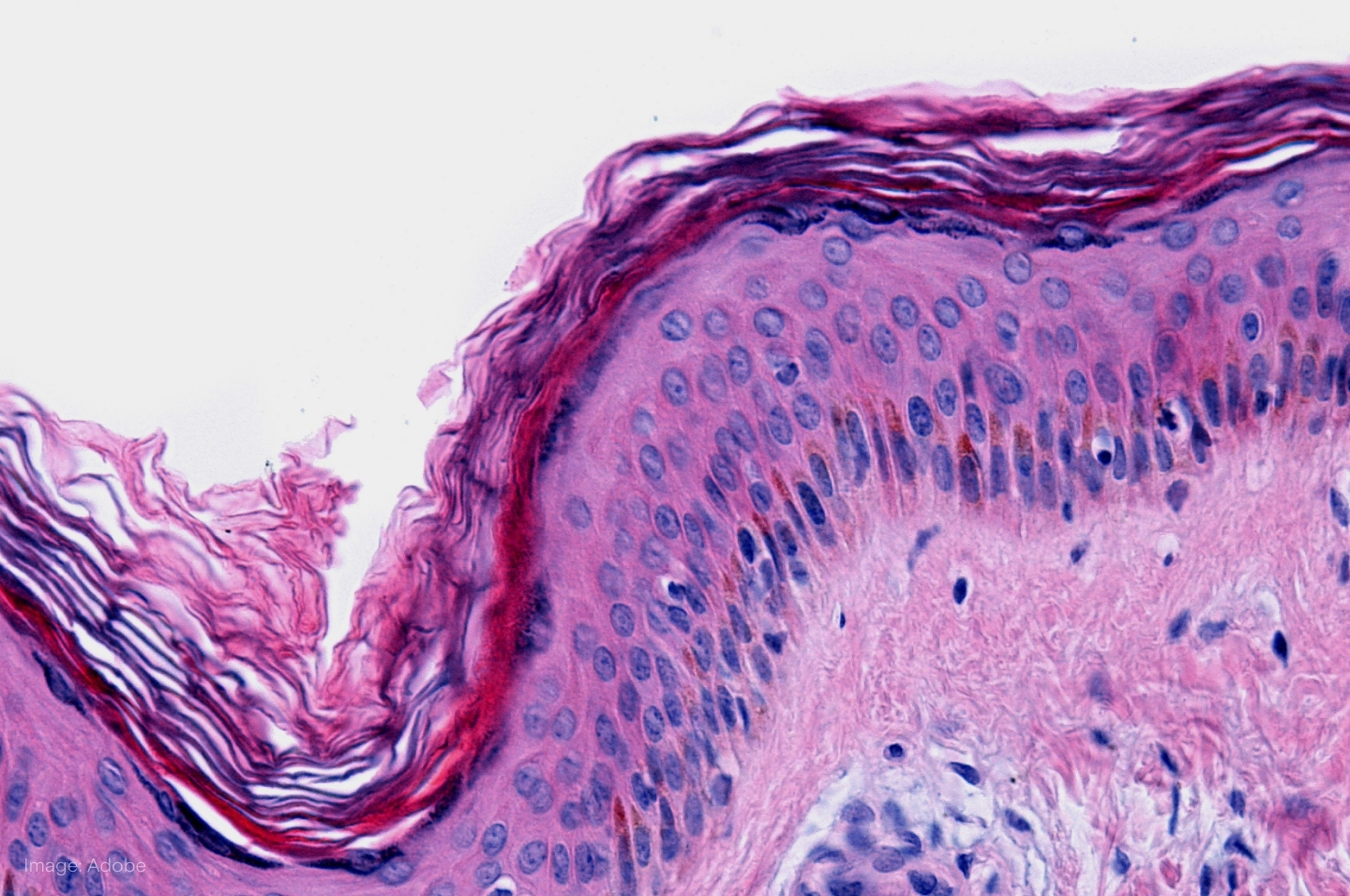

As our largest organ, skin enables us to perceive touch, regulate temperature and protect vital parts of our bodies. While scrapes on the surface soon heal, it’s not an impenetrable coat and deeper damage can seriously affect our quality of life. However, we’ve developed several methods over the years to aid our exterior’s remarkable tendency to recover.

Techniques of transplanting skin to other locations of the body date back to around 3000 years ago, where skin grafting was used to reconstruct noses. Today, there are many substitute materials available, mostly made in laboratories from animal collagen or human tissue.

The principal scientist of PolyNovo ($PNV), Dr Tim Moore, worked with Professor John Greenwood of the Royal Adelaide Hospital to develop a synthetic material to support missing or damaged skin, and to help the body generate new tissue, after seeing terrible injuries suffered by victims of the 2002 Bali Bombings.

Building blocks

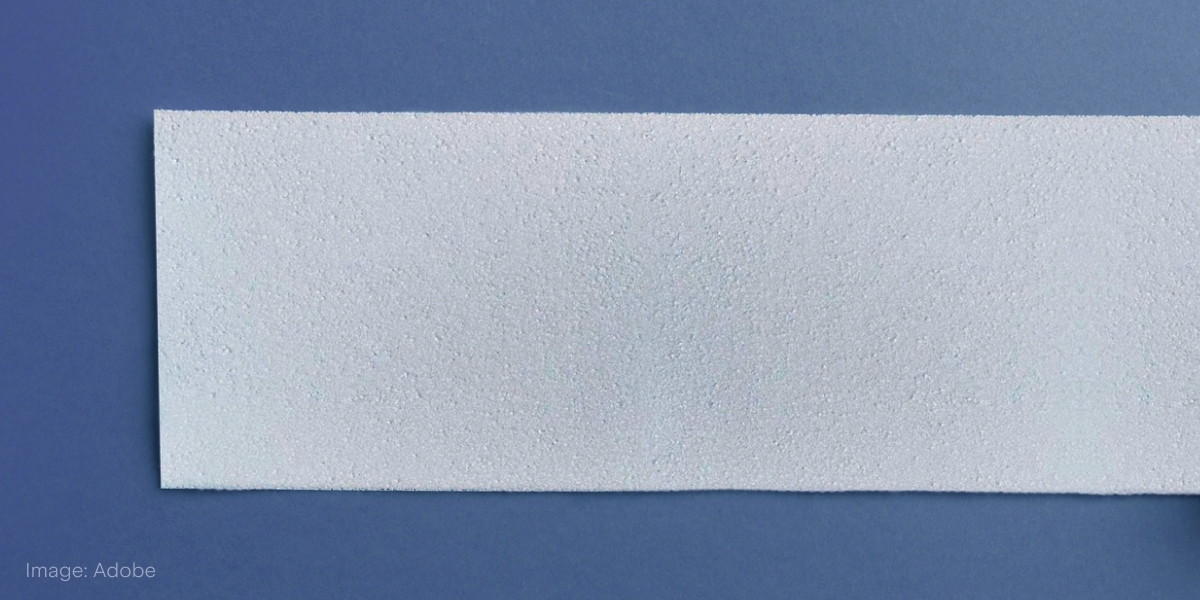

The main aim was to create a product - now known as NovoSorb BTM - that was suitable for use with medical devices, that was biodegradable and could be adapted to individual patients with different needs. NovoSorb BTM has a foam support structure, a layer for bonding and an external membrane to seal injuries while they heal. It’s designed to help the wound form new blood vessels and to act as scaffolding while the tissue regenerates.

The sealing layer is usually removed once the tissue has regrown and a clinician can then determine which other process can be used for the next stage of recovery. The foam structure stays in place, eventually breaking down due to its chemical reaction with water and then exiting the body. The product is considered a dermal substitute, with the three layers of human skin from the outside being the epidermis, dermis and hypodermis.

Striving for growth

The initial focus of the product was on patients suffering from serious burns. However, the varying nature of such injuries has meant that demand for treatments such as NovoSorb BTM has been inconsistent, with hospitals reluctant to place regular orders.

As such, PolyNovo has expanded the application of NovoSorb BTM to more general soft and hard tissue problems. The company has been directly marketing NovoSorb BTM towards medical professionals as gaining acceptance among specialist surgeons tends to translate into arrangements with medical facilities. Mentions of the product in studies and research papers have also helped the firm gain traction.

The company is also establishing a larger range of products using its patented NovoSorb polymer technology. NovoSorb MTX is a complementary option to BTM and can be used for wounds that don’t need the sealing membrane. MTX is expected to be utilised for various types of injuries and ulcers. It received initial approval to enter the U.S. market in September 2022, which increased PolyNovo’s potential addressable market in the U.S. by approximately A$500m.

There are other opportunities in the pipeline at earlier stages of development. A product called SynPath is currently being trialled for managing chronic wounds, in particular diabetic foot ulcers, while SynTrel could help with hernia repair and breast reconstruction.

A key upcoming event in Q2 2024 is the release of results from a trial funded by U.S. public health agency BARDA. This could see NovoSorb BTM approved for full thickness burns treatment and become part of stockpiles for disaster management.

Increasing returns

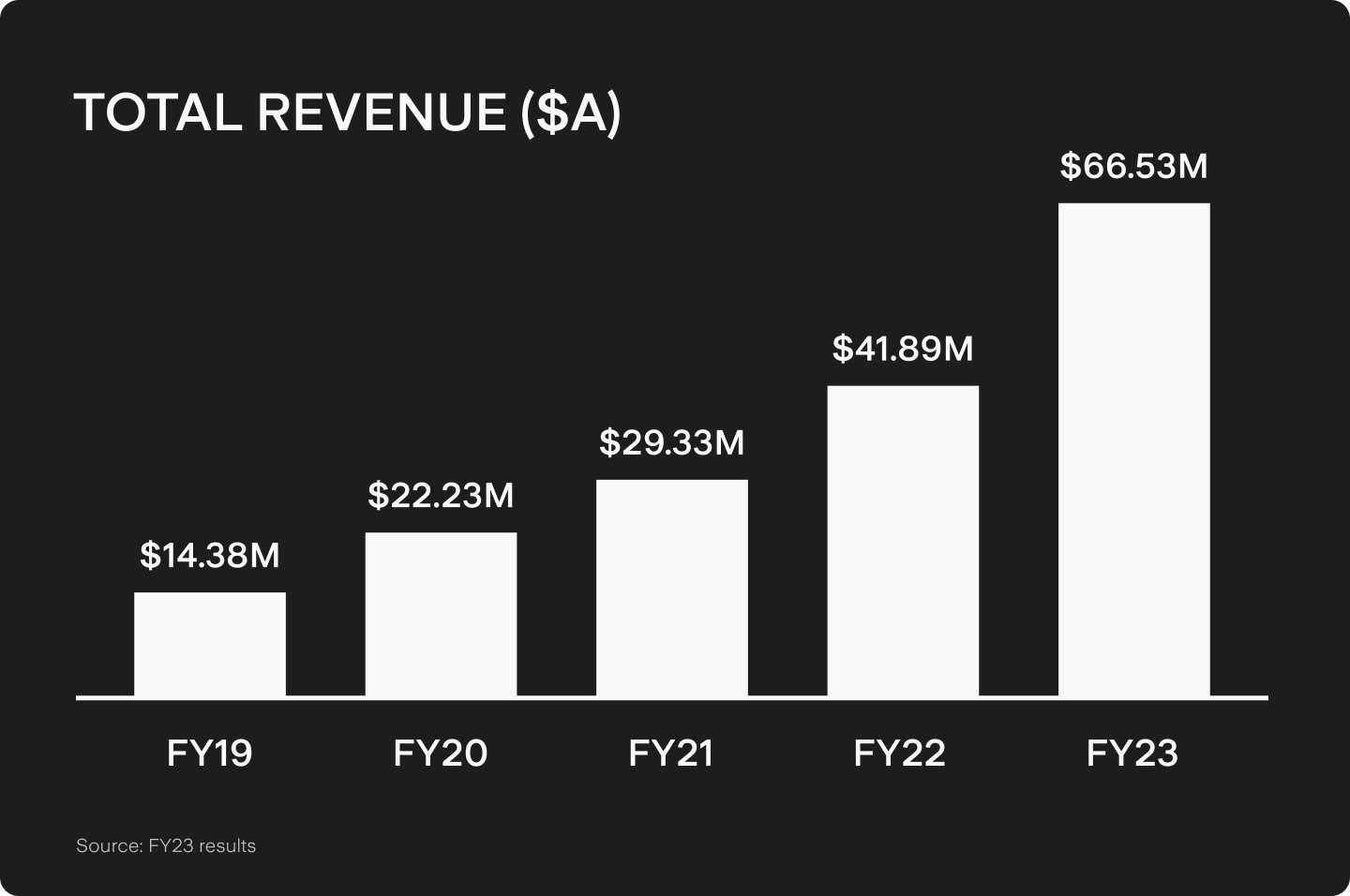

While PolyNovo has been striving for success since it was founded in 2004, financial gains from its products have only recently been realised. Annual revenue grew almost 59% in FY2023 to reach A$66.5m. The U.S. business is profitable as a standalone segment, accounting for A$51.8m of the total. NovoSorb BTM sales were responsible for 89% of the total revenue and the firm actually gained another 8% of its revenue from the BARDA trial.

However, these financials are starting from a low base, with the company’s growth having been slowed in previous years due to the COVID-19 pandemic filling hospitals and constraining manufacturing capabilities.

Furthermore, PolyNovo is still an emerging business and operating expenses have also been scaled up alongside earnings. Entering new markets and increasing its number of employees pushed costs up to A$68.3m, with the company experiencing a A$4.9m net loss after tax for FY2023.

Just like many biotechnology companies with newer products, PolyNovo’s share price has been a bit volatile, with announcements about trials, regulatory approvals and the winning of contracts affecting its movements.

.png&w=3840&q=100)

PolyNovo is hoping to increase its share of the US$2.4b advanced skin substitute market, but if the company’s new products fail to gain traction or if the trial funded by BARDA does not succeed, the firm will face question marks as to how it can grow its revenue. While treatment and time heal most wounds, the chances of success in the stock market are less certain.

This does not constitute financial advice nor a recommendation to invest in the securities listed. The information presented is intended to be of a factual nature only. Past performance is not a reliable indicator of future performance. As always, do your own research and consider seeking financial, legal and taxation advice before investing.

Megan is a markets analyst at Stake, with 7 years of experience in the world of investing and a Master’s degree in Business and Economics from The University of Sydney Business School. Megan has extensive knowledge of the UK markets, working as an analyst at ARCH Emerging Markets - a UK investment advisory platform focused on private equity. Previously she also worked as an analyst at Australian robo advisor Stockspot, where she researched ASX listed equities and helped construct the company's portfolios.

.jpg&w=3840&q=100)