.jpg&w=3840&q=100)

Under the Spotlight AUS: James Hardie Industries plc (JHX)

Constructing safe, durable and energy efficient homes requires specific materials. Building these foundations is where firms like James Hardie come to the fore. Let’s put it Under the Spotlight.

Before home building became his focus, James Hardie moved halfway across the world from his own. The Scotsman arrived in Melbourne in 1888 and soon afterwards set up a business. Following in his father’s footsteps in the tannery industry, he imported animal hides and oils for leather making. He soon brought in fellow Scot Andrew Reid as a business partner and explored the potential in other goods.

One of these new opportunities was a material called ‘fibro-cement’, which Hardie discovered during his travels to London. The product strengthened cement sheets used in roofs with asbestos fibre. It was well suited to the Australian market given it was fireproof, resistant to termites and very durable. The company benefitted from becoming the only importer for the nation.

Reid took over when Hardie retired in 1911 and his family continued to lead the company until 1995. But the original founder's name remained front and centre, with the firm to this day known as James Hardie Industries ($JHX).

Breaking ground

The company’s monopoly on fibro-cement was challenged by the outbreak of World War I, which disrupted import supply lines. But constructing its own plants for local production proved a good decision, as the housing industry experienced a boom after the war.

The firm continued to expand its offerings by creating its own cement mixes and streamlining production processes. One successful procedure to be implemented was the Sutton Process, which allowed the company to create low cost pipes.

The firm branched off its import operations into a separate business and put greater emphasis on the construction materials side of its endeavours. To support fibro-cement growth, James Hardie even took part ownership in an asbestos mine in the 1940s as a joint venture with the firm Wunderlich, a company later taken over by major building materials corporation CSR ($CSR).

By the time of its ASX listing in 1951, James Hardie had become a significant manufacturer and distributor of various construction products, insulation, pipes and brake linings containing asbestos. In the 1960s, James Hardie also entered the UK market and later started dealings in the Asia-Pacific region.

Concerns about the damage asbestos caused to people’s respiratory health also began to emerge during this period. This jeopardised a key component of the business and meant the company needed to find alternatives to remain relevant. James Hardie eventually developed a new kind of reinforced cement using cellulose-based fibre instead of asbestos in the mid-1980s. The firm also started to use a material that contained magnesia for insulation.

It wasn’t until 2003 that the use, sale or import of asbestos was banned in Australia. And while the company did set up a compensation pool for former employees affected by asbestos, it faced long-running legal battles and criticism about the adequacy of the fund.

Concrete plans

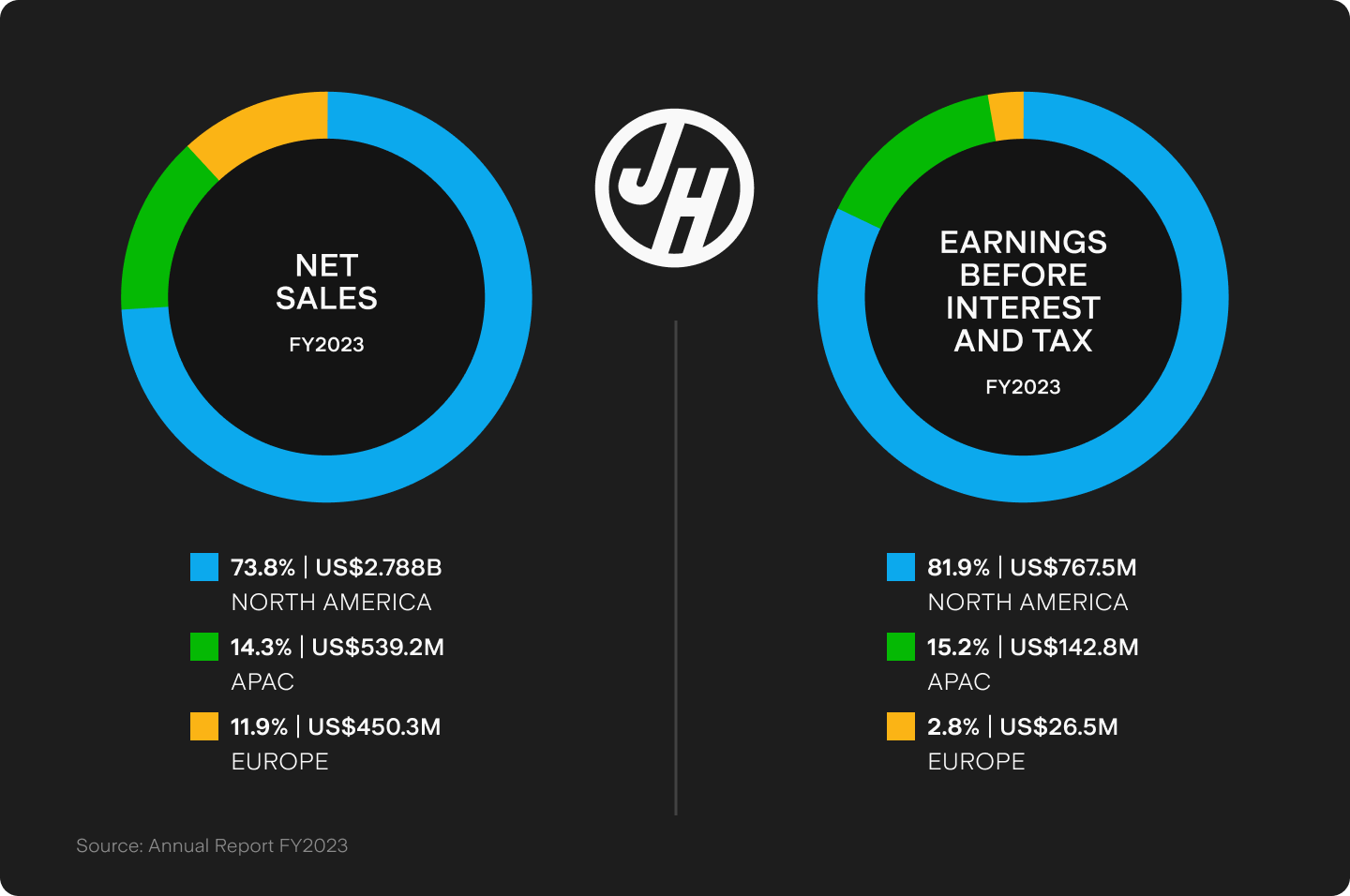

As well as the UK market, the company also worked towards establishing itself in the U.S., first founding a subsidiary in 1988 and later manufacturing products in the country. The early years in the U.S. were tough for the firm, as many builders were not interested in replacing their traditional vinyl and wood materials. However, trends began to shift in James Hardie’s favour in the second half of the 1990s, with the nation representing 60% of annual revenues and around 90% of profits by the turn of the century. The U.S. remains James Hardie’s largest source of revenue and accounted for over 80% of earnings before interest and tax in FY2023.

Today, James Hardie presents itself as a leader in both fibre cement siding used to cover the exterior of buildings and backerboard used to lay tiles on. Its European operations focus on fibre gypsum products for structural support and fire protection, largely continuing the activities of the Fermacell business it acquired in 2018. This region experienced lower demand in Q3 FY2024 as it was affected by higher energy costs.

Rather than commercial property such as offices or retail, the company’s main customers are focused on homes. The firm actively advertises to this clientele through mediums such as being a regular feature on Australian TV show The Block.

The company is particularly interested in trends in the U.S. around new builds, remodelling and home renovations. Construction of new single family abodes in the U.S. is expected to grow around 5%. Becoming the exclusive national supplier of hard and trim sidings for the U.S.’s largest homebuilder D.R. Horton ($DHI) in August 2023 could also help James Hardie further build out its reputation.

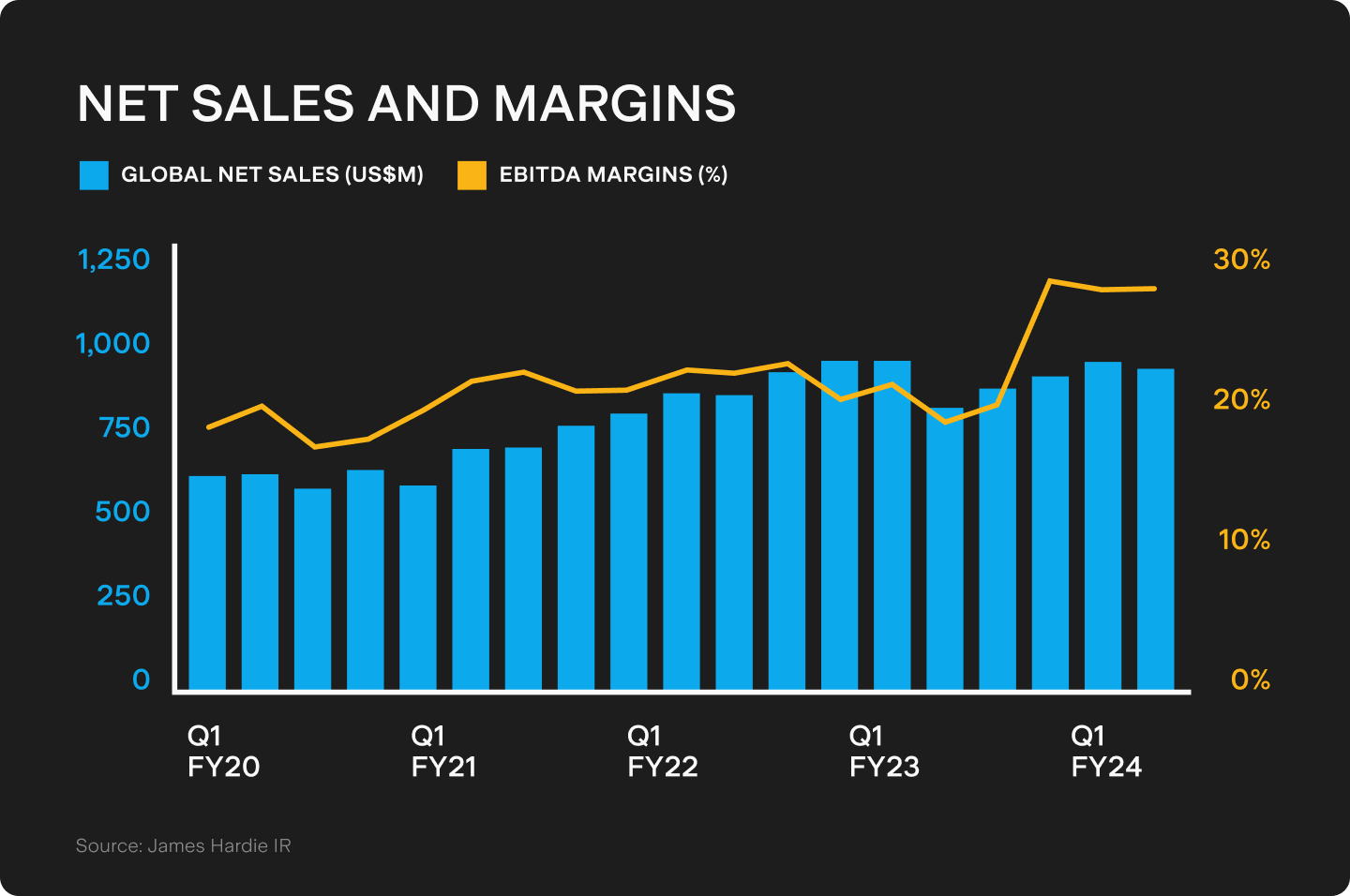

The firm has gained from strategic price increases of its products, which has seen margins grow while sales have fluctuated. However, the overall outlook for FY2024 is flat as larger projects and repairs are declining.

Finishing touches

The company has benefitted from construction material shortages and its customers gaining wealth through rising home prices in the past few years. However, this has made it harder for first time buyers to get on the property ladder, while rising interest rates have put a dampener on renovation projects. Sales volumes for the first three quarters of FY2024 have reached 3.23 billion square feet, down from 3.40 billion square feet for the same period in FY2023.

A shift in consumer confidence and clearer expectations that rate rises have peaked could help change this trend, but it will depend on multiple factors beyond the company’s control. Falling numbers of building approvals in Australia and fewer drilling permits in Europe also present headwinds. Rather, James Hardie sees the fact that 38% of American homes were built before 1970 as a growth opportunity.

The building materials industry is attracting attention, with French giant Saint-Gobain’s recent takeover offer for CSR, and Seven Group ($SVW) proposing to acquire the remaining shares of Boral ($BLD), signalling the strength of deep pockets in uncertain times. James Hardie has built strong foundations by gaining market share against competitors and managed to increase cash flows, but it may take time to get to the next level.

This does not constitute financial advice nor a recommendation to invest in the securities listed. The information presented is intended to be of a factual nature only. Past performance is not a reliable indicator of future performance. As always, do your own research and consider seeking financial, legal and taxation advice before investing.

Megan is a markets analyst at Stake, with 7 years of experience in the world of investing and a Master’s degree in Business and Economics from The University of Sydney Business School. Megan has extensive knowledge of the UK markets, working as an analyst at ARCH Emerging Markets - a UK investment advisory platform focused on private equity. Previously she also worked as an analyst at Australian robo advisor Stockspot, where she researched ASX listed equities and helped construct the company's portfolios.