.png&w=3840&q=100)

Under the Spotlight AUS: Qantas (QAN)

Qantas has soared 450% from pandemic lows as it flies high on booming travel demand.

.png&w=3840&q=100)

The airline Australians now love to hate has taken off – at least for investors. Qantas ($QAN) has copped flack in recent years for sky-high fares, delayed flights and corporate scandals, but the Flying Kangaroo has delivered what investors prize most – a share price in full flight.

A post-pandemic travel boom has been the tailwind, filling cabins from Bali to Europe and sending Qantas shares soaring 450% from their 2020 lows. Investors have cashed in with bumper profits, dividends and a record share price.

That’s despite reputational turbulence caused by regulatory probes into ‘ghost flights’, fines over illegally sacked staff and a high-profile cyberattack.

CEO Vanessa Hudson is responding by spending billions on new planes, upgraded lounges and better service to keep customers from defecting to rivals like Virgin Australia ($VGN).

New planes, more seats and extra routes has Qantas booked for priority boarding, with many investors betting big ticket spending will provide additional lift to its profit outlook.

Full throttle

Qantas isn’t just riding the travel boom: it’s minting money. The airline banked $2.39 billion in underlying profit in FY25, up 15% year-on-year (YoY). Investors scored a $400m payout in dividends split between a $250m (16.5¢ a share) final dividend and a $150m (9.9¢ a share) special dividend.

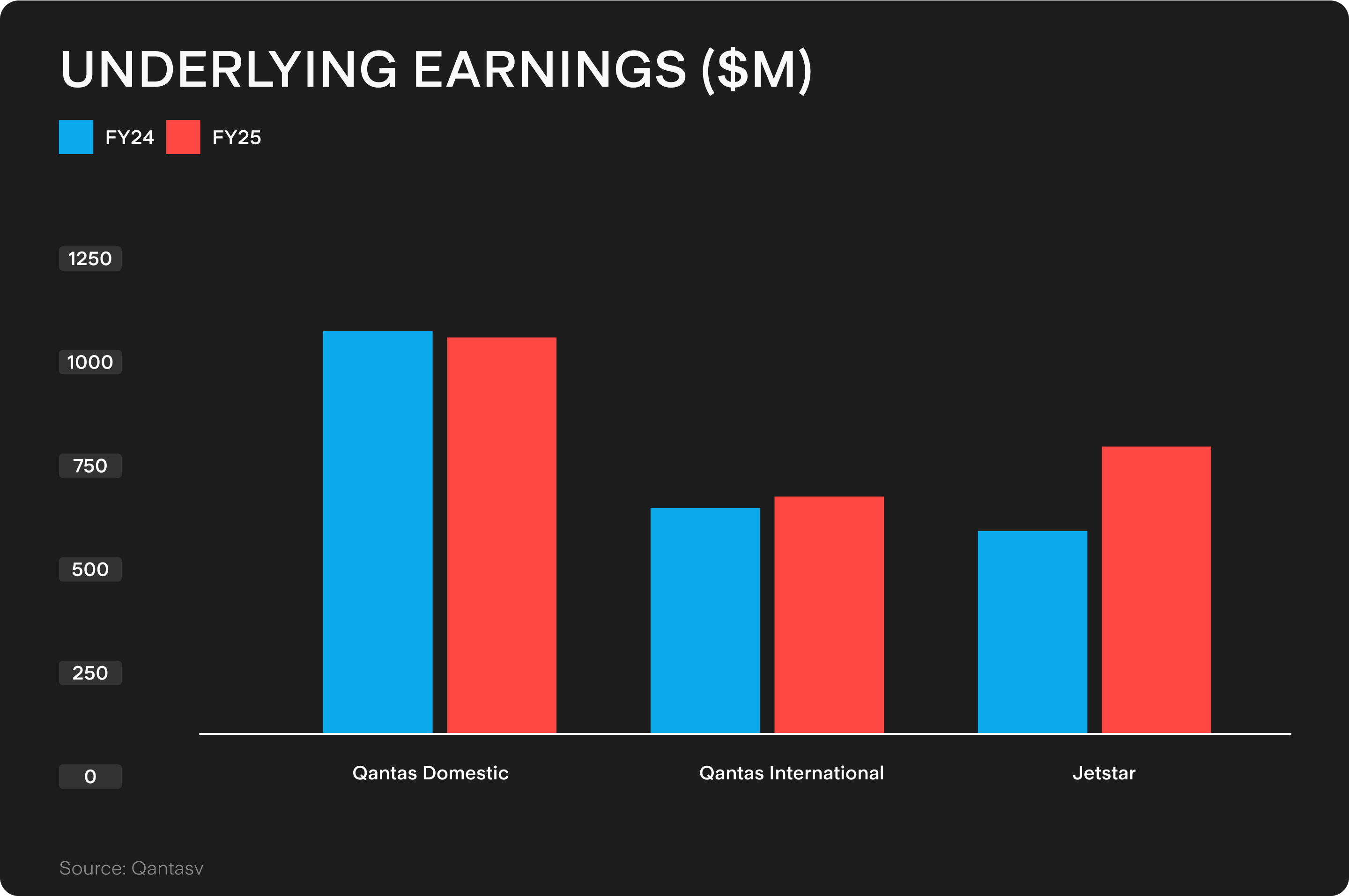

Qantas Domestic remained the engine room, earning $1.05b, down slightly from $1.06b a year earlier. Revenues climbed 5% YoY on fuller planes and stronger business travel, with Qantas squeezing more out of every premium seat.

Charter revenue rose 9%, powered by new A319s servicing Western Australia’s resource sector. New A220s promise lower costs and greater efficiency on key routes.

Jetstar was the star performer: the budget carrier delivered a business class result. Carrying more than 16m domestic passengers, it turned holiday demand into massive earnings growth: EBIT rose 55% YoY to $769m.

And with Jetstar Asia now closed, its 13 A320s will boost capacity, refresh the fleet and add room for growth across Australia, New Zealand and QantasLink. The first jet lands next month.

Qantas International also added thrust, with earnings up 7% to $596m as capacity lifted and premium cabins filled fast. The return of A380s, expanded long-haul routes and freight demand added extra lift.

But the Flying Kangaroo can soar higher – Qantas expects domestic unit revenue to climb 3-5% in H1 FY26, with international adding 2-3%.

Cleared for takeoff

With earnings at full throttle, Qantas is charting its next course: up to $4.3b spent on new jets, lounges and service upgrades in FY26.

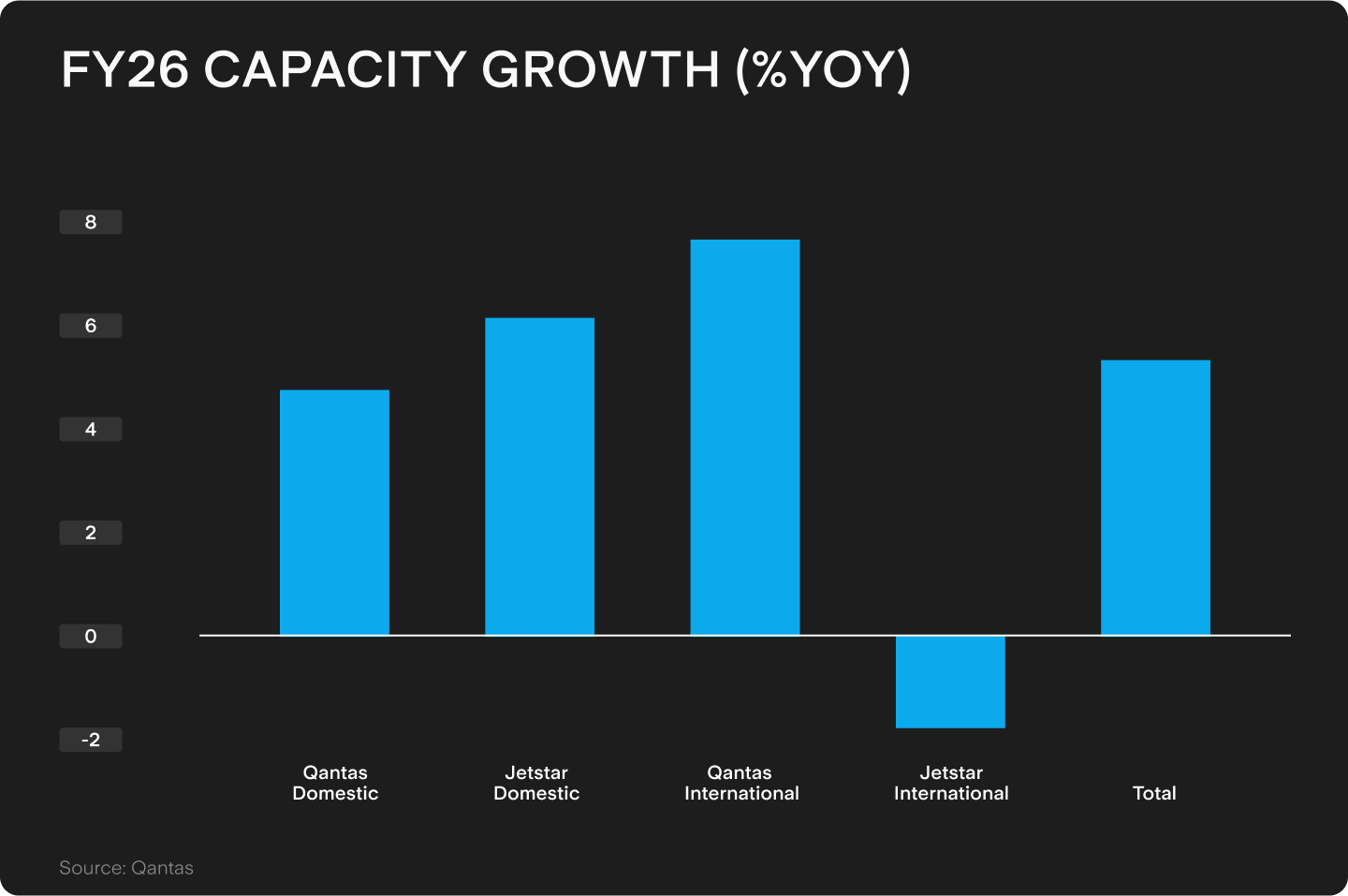

Twenty new aircraft are due in FY26 and 29 more in FY27, including A220s for regional routes and A321XLRs with lie-flat business seats. Total capacity is forecast to rise 5% in FY26.

Project Sunrise – its planned ultra-long-haul flights to London and New York – is on track for 2027. Work on Qantas’ first A350-1000ULR begins in October and will be delivered in October 2026. The plane will make its first ultra-long-haul flight in 2027. Once airborne, Project Sunrise is expected to deliver $400m of annual incremental earnings.

But it isn’t just new aircraft. Qantas is pouring money into the passenger experience: a new Auckland international lounge opening in February 2026, a refreshed Los Angeles business lounge the same month, and a rebuilt Sydney international business lounge by FY27.

Baggage systems are being upgraded, while first-class dining and cabins are being refreshed. A330s arrive from February 2026 and Jetstar’s 787s from April. And from December, international wi-fi extends deeper into Asia.

These investments are about more than comfort – they’re about loyalty points. Qantas Frequent Flyer (QFF) delivered $556m in profit, up 9%, and remains one of Australia’s most popular loyalty schemes.

Management expects QFF to remain a growth engine. Underlying EBIT is forecast to rise another 10-12% in FY26 with New Classic Plus fares and fresh retail deals, including an extended Woolworths partnership and tie-ups with David Jones, expected to keep members engaged and loyal even when fares rise.

Cost savings remain part of the flight plan. Qantas is targeting about $400m in efficiencies in FY26 with fuel efficiency, rostering and productivity gains under scrutiny as it looks to blunt rising wages and other inflationary pressures.

Altitude check

Qantas shares have soared more than 70% in 12 months, brushing record highs. The rally has rewarded investors, but raises the question of whether there’s more runway ahead or if the Flying Kangaroo is cruising at peak altitude.

Morgan Stanley is firmly bullish, keeping an overweight rating and lifting its target to $13.50, citing strong travel demand and Qantas’ investment into fleet and service. Its view? The stock is good value at 9x forward earnings.

Jarden shifted from cautious to optimistic, upgrading to overweight with a $12.90 target. The shift is due to stronger-than-expected domestic profits, a healthy balance sheet, the fleet refresh and network expansion.

But UBS remains cautious, holding neutral with a $12 target. It doesn’t see ‘compelling valuation upside.' At 9.6x its forecast FY26 earnings, UBS thinks the share price is fair for a mid-cycle valuation.

Departure lounge

Qantas has delivered big profits, healthy dividends and outlined ambitious fleet plans.

But despite the stock flying near record highs, valuations assume smooth skies ahead. For investors, the Flying Kangaroo still looks like a first-class ride – though the ticket isn’t cheap.

This is not financial advice nor a recommendation to invest in the securities listed. The information presented is intended to be of a factual nature only. Past performance is not a reliable indicator of future performance. As always, do your own research and consider seeking financial, legal and taxation advice before investing.

.png&w=3840&q=100)

.png&w=3840&q=100)

.png&w=3840&q=100)