Are these the best U.S. Bond ETFs: Top 10 to watch

While bonds may not be as flashy as stocks, fixed-income assets generally come with less risk and more stable yields. For investors focused on building a diversified portfolio, bonds are an essential tool.

Bond ETFs have made investing in bonds easier than ever before, featuring low minimums and excellent liquidity. Review our choices for the best U.S. bond ETFs below.

What is the largest bond ETF in the U.S.?

As of March 2025, the largest U.S. bond ETF is the Vanguard U.S. Total Bond Market ETF ($BND), with a net asset value above US$127 billion.

This ETF offers broad exposure to the investment-grade universe, holding both Treasuries and corporate bonds. BND competes directly with the $AGG ETF, which has recently offered a slightly higher yield.

Explore these top bond ETFs from Wall St

Company Name | Ticker | Share Price | 1Y Total Return | AUM | 30-Day Yield |

|---|---|---|---|---|---|

iShares Core U.S. Aggregate Bond ETF | US$98.34 | +5.05% | US$125.11B | 4.56% | |

Vanguard Total International Bond ETF | US$48.46 | +3.53% | US$62.49B | 3.17% | |

iShares 20+ Year Treasury Bond ETF | US$90.28 | +1.00% | US$50.92B | 4.74% | |

SPDR Bloomberg 1-3 Month T-Bill ETF | US$91.58 | +4.95% | US$41.72B | 4.13% | |

iShares National Muni Bond ETF | US$105.85 | +1.29% | US$39.87B | 3.38% | |

iShares MBS ETF | US$93.07 | +5.48% | US$36.79B | 4.12% | |

Vanguard Short-Term Corporate Bond ETF | US$78.53 | +6.17% | US$34.53B | 4.71% | |

iShares iBoxx $ Investment Grade Corporate Bond ETF | US$108.04 | +4.67% | US$30.26B | 5.29% | |

Janus Henderson AAA CLO ETF | US$50.56 | +6.27% | US$21.99B | 5.97% | |

iShares Broad USD High Yield Corporate Bond ETF | US$94.58 | +8.76% | US$19.63B | 7.31% |

Data as of 14 March 2025. Sources: Stake, Google.

*The list of bond ETFs mentioned is ranked by assets under management. When deciding what ETFs to feature, we analyse the fund’s financials, recent news and earnings, upcoming dividends, and whether or not they are actively traded on Stake.

Find which is the best U.S. bond ETF for your portfolio

1. iShares Core U.S. Aggregate Bond ETF ($AGG)

The iShares Core U.S. Aggregate Bond ETF is one of the largest core bond ETFs on the market, providing broad exposure to U.S. investment-grade bonds.

AGG’s portfolio includes Treasuries, agency mortgage-backed securities, and corporate bonds, with a weighted maturity of 8.3 years.

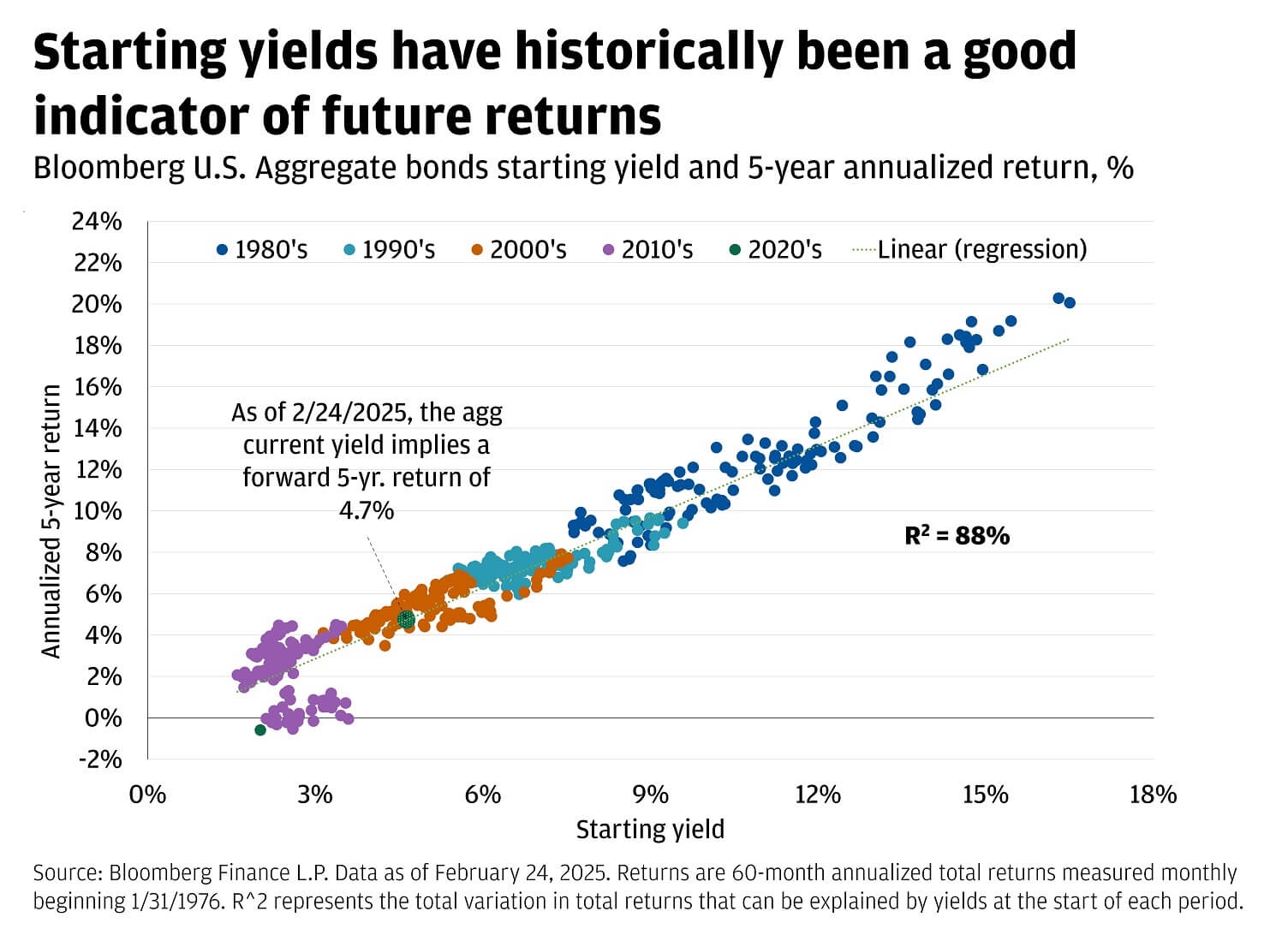

The fund tracks the Bloomberg Barclays U.S. Aggregate Bond Index, a widely recognised benchmark for the U.S. bond market. AGG has an expense ratio of 0.03% and a 30-day yield of 4.56%.

2. Vanguard Total International Bond ETF ($BNDX)

The Vanguard Total International Bond ETF invests in a diversified portfolio of investment-grade non-U.S. bonds. Holdings include government debt, corporate bonds, and asset-backed securities with an average maturity of 8.7 years.

Notably, the fund pursues a currency hedging strategy to minimise exchange rate volatility.

BNDX aims to track the performance of the Bloomberg Barclays Global Aggregate ex-USD Float Adjusted RIC Capped Index. The fund has an expense ratio of 0.07% and a 30-day yield of 3.17%.

3. iShares 20+ Year Treasury Bond ETF ($TLT)

The iShares 20+ Year Treasury Bond ETF invests in U.S. Treasury bonds with maturities of 20 years or more. Although long-maturity bonds often generate higher yields, they are also more sensitive to interest rate changes, meaning price fluctuations can be greater.

TLT could be a good choice for investors who want the safety of U.S. government debt while maximising yield potential. The fund has a 0.15% expense ratio and a 30-day yield of 4.74%.

✅ Learn more: How to buy U.S. treasury bonds in Australia?→

4. SPDR Bloomberg 1-3 Month T-Bill ETF ($BIL)

The SPDR Bloomberg 1-3 Month T-Bill ETF invests in some of the shortest-term Treasury debt on the market – bills with just a few months to maturity. Since this fund has an average maturity of just over a month, investors take on very little interest rate risk.

With that said, yields on BIL will be heavily influenced by the Fed’s interest rate decisions, as managers need to keep rolling maturing bills into new investments.

BIL could be a good fit for investors who are willing to sacrifice some yield for safety and stability. The fund has an expense ratio of 0.14% and a 30-day yield of 4.13%.

5. iShares National Muni Bond ETF ($MUB)

The iShares National Muni Bond ETF invests in municipal bonds, which are debt issued by local and state governments in the U.S. Although ‘muni bonds’ are higher risk than U.S. federal government debt, they often end up carrying lower yields due to unique tax advantages for U.S. investors.

Although international investors may not benefit from the tax advantages of muni bonds, this asset class can still offer a valuable diversification outside of traditional fixed income.

MUB invests in a portfolio of investment-grade muni bonds with an average maturity of 7.2 years. The fund has an expense ratio of 0.05% and a 30-day yield of 3.38%.

6. iShares MBS ETF ($MBB)

The iShares MBS ETF invests in mortgage-backed securities (MBS), a unique type of asset secured by pooling together residential mortgages. Specifically, MBB invests in MBS issued or backed by U.S. government-sponsored enterprises (GSEs).

Although MBS assets have a poor reputation from their part in fueling the 2008 financial crisis, the market has undergone significant reform, with GSEs like Fannie Mae and Freddie Mac now explicitly backed by the U.S. government. MBB has an expense ratio of 0.04%, an average maturity of 7.7 years, and a 30-day yield of 4.12%.

7. Vanguard Short-Term Corporate Bond ETF ($VCSH)

The Vanguard Short-Term Corporate Bond ETF invests in investment-grade corporate bonds with maturities between 1 and 5 years. This short-term focus allows investors to access the corporate bond market without taking excessive interest rate risk.

The fund tracks the Bloomberg US 1-5 Year Corporate Bond Index and carries an average maturity of 2.8 years. VCSH could be a good fit for investors who want exposure to the corporate bond market with reduced price volatility. The fund has an expense ratio of 0.03% and a 30-day yield of 4.71%.

8. iShares iBoxx $ Investment Grade Corporate Bond ETF ($LQD)

The iShares iBoxx $ Investment Grade Corporate Bond ETF invests in a wide array of high-quality corporate bonds, including both short and long-term obligations. The fund carries an average maturity of just under 13 years and holds debt from companies like CVS ($CVS), Goldman Sachs ($GS), and Pfizer ($PFE).

LQD could be suitable for investors looking for a core corporate bond allocation in their fixed-income portfolio. The fund has an expenses ratio of 0.14% and a 30-day yield of 5.29%.

9. Janus Henderson AAA CLO ETF ($JAAA)

The Janus Henderson AAA CLO ETF offers access to a unique corner of the fixed-income universe: collateralised loan obligations (CLOs).

CLOs are a form of debt backed by an underlying pool of additional debt, typically corporate loans made on the private market.

In fact, JAAA holds AAA-rated interests in CLOs from leading private credit lenders like Ares, Carlyle, and KKR. Compared to Treasuries and public corporate bonds, JAAA could offer compelling yields and additional diversification. The fund has an expense ratio of 0.21% and a 30-day yield of 5.97%.

10. iShares Broad USD High Yield Corporate Bond ETF ($USHY)

Unlike other funds on this list, the iShares Broad USD High Yield Corporate Bond ETF doesn’t focus on the high-quality bond market. Instead, this ETF holds debt from shakier borrowers with lower credit ratings, a market euphemistically known as ‘high-yield debt.’

USHY has a 30-day yield of 7.31%, well above funds focused on the high-quality market. However, investors may also experience greater volatility, especially if a recession drives risky borrowers to bankruptcy. The fund carries an expense ratio of 0.08% and an average maturity of 4.1 years.

Join 750K investors

Get a full U.S. share when you fund Stake Wall St or A$10 trading credit when you fund Stake AUS. Fund both, get both. T&Cs apply.

Which U.S. bond ETF has the best 5-year return?

Over the past five years, the iShares Convertible Bond ETF ($ICVT) has been the best-performing non-levered bond ETF. This fund has seen a total five-year annualised returns of 10.24%. In comparison, competitors like $AGG have lost money over this period, with an annualised return of -0.34%.

With that said, it isn’t fair to directly compare ICVT with traditional bond funds. This ETF invests in a niche corner of fixed-income called ‘convertible bonds.’ While convertible bonds are technically debt, they can also be swapped into stock under certain circumstances, making them a hybrid asset class. Although the convertible market can potentially offer higher rewards, it’s also riskier than traditional fixed income.

💡Related: Find out how to buy U.S. treasury bonds on the ASX→

💡Related: Looking for Bond ETFs on ASX?→

Which is the best long-term bond ETF?

Determining which long-term bond ETF is ‘best’ depends on an investor’s goals. For individuals who prefer security and stability, ETFs like $TLT, which tracks the long-term Treasury market, might be a good fit.

For investors who would rather earn a higher yield, investing in the long-term corporate bond market with $VCLT might be a better choice.

Just as in stocks, it’s important to remember the benefits of diversification in fixed income. While bonds are traditionally viewed as lower-risk than stocks, fixed-income performance is still sensitive to many factors – including inflation, interest rates, and corporate bankruptcy rates. Therefore, consider assembling a long-term bond portfolio with multiple funds focused on distinct markets.

U.S. Bond ETFs FAQs

Bond ETFs can be a good investment for certain types of investors, depending on their investment objectives and risk tolerance. Here are some factors to consider:

- Diversification: Bond ETFs can offer broad diversification across a range of fixed-income securities, including government, corporate, and asset-backed bonds. This can help reduce the risk of investing in individual bonds and improve overall portfolio diversification.

- Liquidity: Although individual bonds are traded over the counter, bond ETFs trade on national exchanges like stocks. This means investors can easily buy and sell them throughout the trading day.

- Cost: Bond ETFs are generally index funds with low expense ratios, although funds focused on niche corners of the fixed-income market may come with higher costs.

- Interest rate risk: Bond prices tend to fall when interest rates rise, which can affect the value of bond ETFs. However, bond ETFs focused on short-term bonds or floating-rate bonds may be less sensitive to interest rate risk.

- Credit risk: Due to corporate bankruptcies or sovereign defaults, bonds are not always repaid as expected. Bond ETFs offer a way to minimise this credit risk by holding a large number of underlying assets, meaning the risk from a single default is relatively small.

Overall, bond ETFs can be a good investment for investors seeking income, diversification, and a lower-risk investment option compared to stocks. However, you should research each ETF individually to ensure it aligns with your investment objectives and risk tolerance.

Generally speaking, individual investors may find it challenging to invest in individual bonds. Bonds typically come with high minimum investments and no opportunity for fractional purchases.

Dealers usually trade bonds ‘over the counter,’ meaning you’ll need to work through a broker to source and purchase your desired assets.

Not only are bond ETFs generally easier to buy and sell, but the added diversification helps limit risk. Overall, most individual investors will benefit from purchasing bond ETFs over individual bonds.

Disclaimer

The information contained above does not constitute financial product advice nor a recommendation to invest in any of the securities listed. Past performance is not a reliable indicator of future performance. When you invest, your capital is at risk. You should consider your own investment objectives, financial situation and particular needs. The value of your investments can go down as well as up and you may receive back less than your original investment. As always, do your own research and consider seeking appropriate financial advice before investing.

Any advice provided by Stake is of general nature only and does not take into account your specific circumstances. Trading and volume data from the Stake investing platform is for reference purposes only, the investment choices of others may not be appropriate for your needs and is not a reliable indicator of performance.

$3 brokerage fee only applies to trades up to $30k in value (USD for Wall St trades and AUD for ASX trades). Please refer to hellostake.com/pricing for other fees that are applicable.