Are these the best space stocks to watch in 2025?

Since humankind first moved into orbit, economic gains have followed. Micro cameras, scratch-resistant lenses and wireless headphones are just a few pieces of technology developed by NASA and later commercialised by the private sector. Let’s dive into the top U.S. space stocks to watch in 2025.

Over the last two decades, the private sector has taken the reins of the space economy. While larger projects like the James Webb space telescope, International Space Station (ISS), and space exploration remain the purview of governments, the value of the global space economy reached US$469b in 2021, enticing corporations to enter the industry as market players.

Citigroup ($C) forecasts the total annual revenue of the space industry to reach US$1t by 2040. Investors can start trading the space economy today through these space stocks listed on the U.S. stock exchange.

Watch these space stocks on Wall St

Company Name | Ticker Symbol | Share Price | Year to Date | Market Capitalisation |

|---|---|---|---|---|

The Boeing Company | US$173.03 | -31.27% | US$129.28b | |

Lockheed Martin Corporation | US$490.61 | +7.56% | US$116.29b | |

Rocket Lab USA Inc | US$26.37 | +396.61% | US$13.18b | |

AST SpaceMobile Inc | US$24.78 | +410.93% | US$7.18b | |

Intuitive Machines Inc | US$13.89 | +488.56% | US$2.12b |

Data as of 15 December 2024. Source: Stake, Google.

*The list of shares mentioned is ranked by market capitalisation. When deciding what assets to feature, we analyse the financials, recent news and announcements, the state of the industry and the company's projects, and whether or not they are actively traded on Stake.

Explore the top space companies to invest in

1. The Boeing Company ($BA)

- 10,573 Stake customers watching

- 33,307 orders executed on Stake

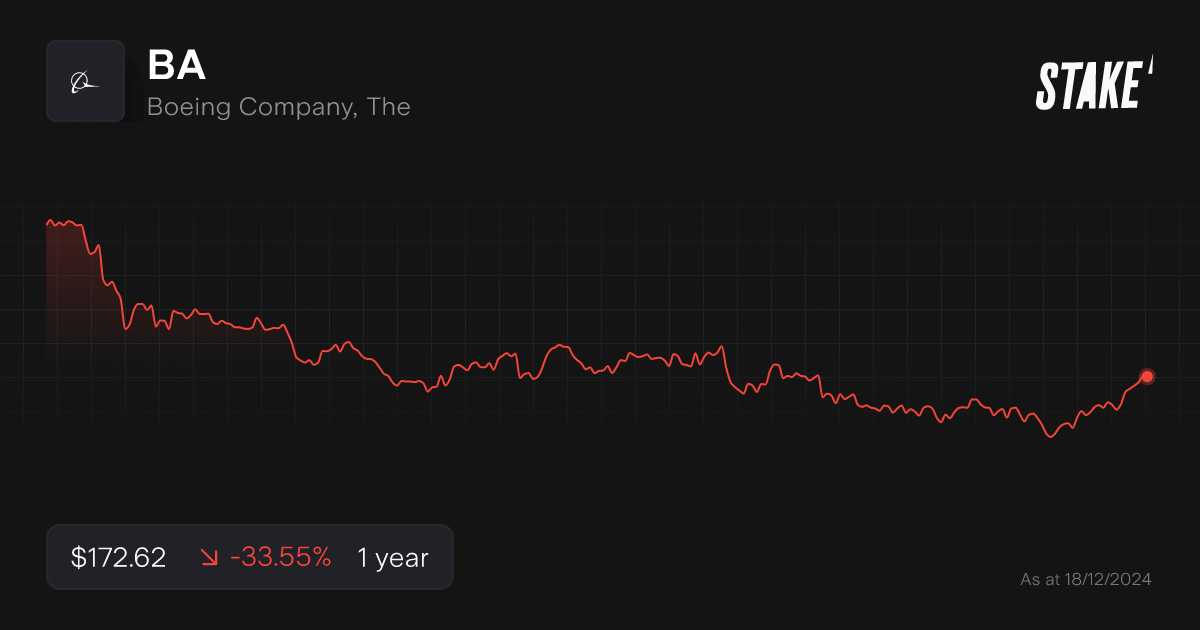

The Boeing Company is one of the most well-known companies in the aerospace industry, manufacturing one of the most famous commercial jetliners, the Boeing 737. However, it had a year of challenges in 2024, resulting in a 31% stock decline, marking its worst performance since 2008.

Some of those challenges include a mid-flight incident involving a door plug detachment, a management shake-up and CEO departure, whistleblower allegations, a seven-week labour strike and a substantial depletion of its cash reserves.

One of the staples of Boeing’s space division is its CST-100 Starliner, a ‘partially reusable’ spacecraft that transports crew to the International Space Station (ISS) and other LEO destinations. The CST-100 Starliner is manufactured for participation in NASA’s Commercial Crew Program.

In Q3, Boeing reported a net loss of US$6.17b on revenue of US$17.8b. Its net profit margin was a negative 34.59% for the quarter, with negative cash flow for the first half of the year.

Despite its challenges, Boeing's strong market presence and substantial backlog of orders of US$500 billion worth provide some stability for the company's future prospects. Still, analysts maintain cautious expectations for Boeing's stock recovery in 2025. The average 12-month price target suggests a potential increase of around 7% from current levels.

2. Lockheed Martin Corporation ($LMT)

- 5,725 Stake customers watching

- 9,753 orders executed on Stake

You might know the Lockheed Martin Corporation as the developer of the most famous military aircraft of all time, the U.S. Air Force F-16 Fighting Falcon, which accounts for 26% of all its revenue. Lockheed Martin’s space division is also a big driver of revenue – its satellites, space transportation systems, Orion Multi-Purpose Crew Vehicle and Trident II D5 Fleet Ballistic Missile contributed to18% of total revenue .

One of the keys to Lockheed Martin’s space division's future is its Orion joint venture with NASA. The Orion Spacecraft is designed to take humans into deep space. This involves developing life support, navigation, communications, radiation shielding and the world’s largest heat shield that is of higher quality to withstand more extreme exposure for extended periods.

The firm reported Q3 revenue of US$17.1b, missing estimates for the period, but upped its full year revenue guidance for FY24 to US$71.25b. As a large-cap stock, LMT benefits from high liquidity, making it responsive to material news and market trends, including a potential uptick in defense spending under the Trump administration.

3. Rocket Lab USA Inc ($RKLB)

- 5,402 Stake customers watching

- 33,141 orders executed on Stake

Rocket Lab USA is consistently one of Stake’s most popular stocks, trading more than Boeing and Lockheed Martin combined. Founded in 2006, Rocket Lab provides launch services, spacecraft and launch components, and on-orbit management.

The company has experienced significant growth over the past year, seeing triple-digit percentage gains in its share price. But its stock price has been volatile, with average weekly movements of 13.5%, higher than the aerospace and defense industry average of 6.7%

Rocket Lab's core business has shown strong momentum, with annual growth exceeding 50% and gross margins above 26% – signs of a highly scalable model. Rocket Lab reported a 55% YoY increase in Q3 revenue – its Space Systems business contributed significantly to the revenue growth, accounting for US$83.9m or 80% of quarterly revenue.

As of November 2024, Rocket Lab had conducted 56 Electron launches, including 14 launches in the last year alone. The firm has deployed a total of 203 satellites to orbit, cementing Electron's position as the leading small launch vehicle globally.

4. AST SpaceMobile Inc ($ASTS)

- 1,566 Stake customers watching

- 6,640 orders executed on Stake

AST SpaceMobile, Inc. is a satellite designer and manufacturer developing a space-based cellular broadband network called SpaceMobile, which aims to provide connectivity to standard smartphones in areas with coverage gaps.

In January 2024, AST SpaceMobile announced a partnership with Google and AT&T for satellite connectivity to Android smartphones. The firm also announced a US$100m partnership with Verizon to expand coverage in remote areas in May 2024. In September, AST SpaceMobile successfully launched its first five BlueBird satellites, marking a critical step towards establishing its space-based cellular broadband network.

Those factors likely resulted in a surge in optimism around the company’s future prospect for revenue generation. The company’s stock price is up by more than 400% YTD and has seen a massive uptick in trading volume.

In Q3 2024, the company reported a net loss of US$12.6m (compared to US$9.3 million in Q3 2023). Its revenue for the quarter was US$23.1m – a 15% increase YoY. It's worth noting, though, that its current enterprise value may be pricing in future revenue not expected until 2027.

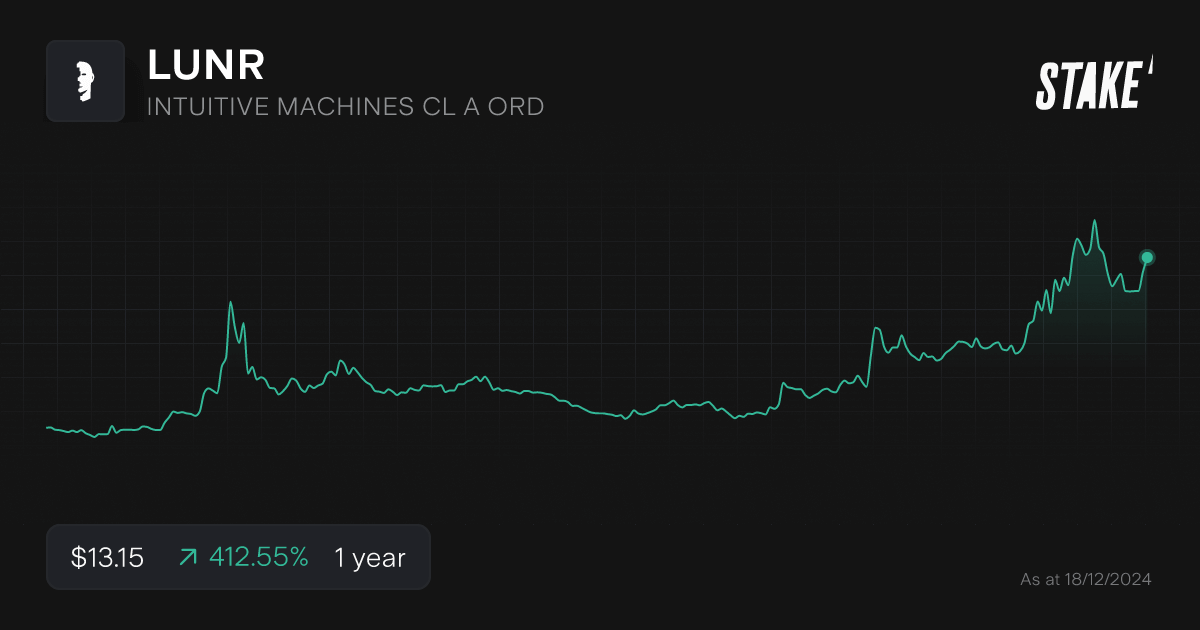

5. Intuitive Machines Inc ($LUNR)

- 808 Stake customers watching

- 2,895 orders executed on Stake

Intuitive Machines, Inc. has shown significant growth and strong financial performance in 2024. The company's stock price has experienced considerable volatility throughout the year, trading with a day range of US$12.67 to $US14.10, and a broader 52-week range of US$2.09 to US$17.14.

The company’s Q3 earnings were a big driver of investor interest. Revenue for the quarter was US$58.5 million, marking a substantial 359% YoY increase. It also reported a positive gross margin of US$4.1m in the quarter, and its highest cash balance in history of US$89.6m.

Intuitive Machines has secured significant contracts, including a US$116.9 million NASA CLPS contract and a US$4.82 billion Near Space Network data services contract. Intuitive’s stock price jumped nearly 60% to $8.53 during late-morning trading on 18 September after the NASA contract was announced. These contracts were a big contributor to the company’s record US$316.2m backlog.

🆚 Compare the performance of RKLB vs LUNR using our stock and ETF comparison tool.

How to invest in space stocks in Australia?

The main way of investing in space companies is through shares listed on the Nasdaq and NYSE stock exchanges, using an online investment platform. Follow our step by step guide below:

1. Find a stock investing platform

To buy space stocks on the U.S. stock market or over-the-counter stocks, you'll need to sign up to an investing platform with access to Wall St. There are several share investing platforms available, of which Stake is one.

2. Fund your account

Open an account by completing an application with your personal and financial details. Fund your account with a bank transfer, PayTo, debit card or even Apple/Google Pay.

3. Search for the company

Find the company by name or ticker symbol. It is advised to conduct your own research to ensure you are purchasing the right investment product for your individual circumstances.

4. Set a market or limit order and buy the shares

Buy on any trading day using a market order, or a limit order to delay your purchase of the asset until it reaches your desired price. You may wish to look into dollar cost averaging to spread out your risk, which smooths out buying at consistent intervals.

5. Monitor your investment

Once you own the shares, you should monitor their performance. Check your portfolio regularly to ensure your investment is aligning with your financial goals.

Get started with Stake

Sign up to Stake and join 750K investors accessing the ASX & Wall St all in one place.

Space stocks FAQs

Are space stocks a good investment?

While still a new industry, many space-related, publicly traded companies are either financially viable or are close. There are unique risks, like space debris, but the industry has developed to the point where it is worth a look. To get more information on how space-related companies performed in lieu of the SpaceX tender offer news, it’s worth giving X-Factor a read.

What space stock ETFs are available to invest in?

The industry is still new, and we expect additional ETFs to be created in the future but here is our list of the space indusrty ETFs available to invest in:

- ARK Space Exploration & Innovation ETF ($ARKX)

- Procure Space ETF ($UFO)

- iShares U.S. Aerospace & Defence ETF ($ITA)

- Invesco Aerospace & Defence ETF ($PPA)

- SPDR S&P Aerospace & Defence ETF ($XAR)

- Spear Alpha ETF ($SPRX)

💡 Related: Dive into some of the best defence ETFs to invest in

Is SpaceX publicly traded?

SpaceX is not a publicly traded company. Based on previous comments by Elon Musk, it is unlikely SpaceX will ever join the list of top space stocks. However, his past comments are not always the best gauge when it comes to what Elon Musk will do in the future. Learn more about how you can invest in SpaceX.

Disclaimer

The information contained above does not constitute financial product advice nor a recommendation to invest in any of the securities listed. Past performance is not a reliable indicator of future performance. When you invest, your capital is at risk. You should consider your own investment objectives, financial situation and particular needs. The value of your investments can go down as well as up and you may receive back less than your original investment. As always, do your own research and consider seeking appropriate financial advice before investing.

Any advice provided by Stake is of general nature only and does not take into account your specific circumstances. Trading and volume data from the Stake investing platform is for reference purposes only, the investment choices of others may not be appropriate for your needs and is not a reliable indicator of performance.

$3 brokerage fee only applies to trades up to $30k in value (USD for Wall St trades and AUD for ASX trades). Please refer to hellostake.com/pricing for other fees that are applicable.

Samy is a markets analyst at Stake, with seven years of experience in the world of investing, working across roles in private banking, venture capital and financial media. She has a Master’s degree in Finance and Data Analytics from The University of Sydney Business School.