Under the Spotlight AUS: Kleos Space SA (KSS)

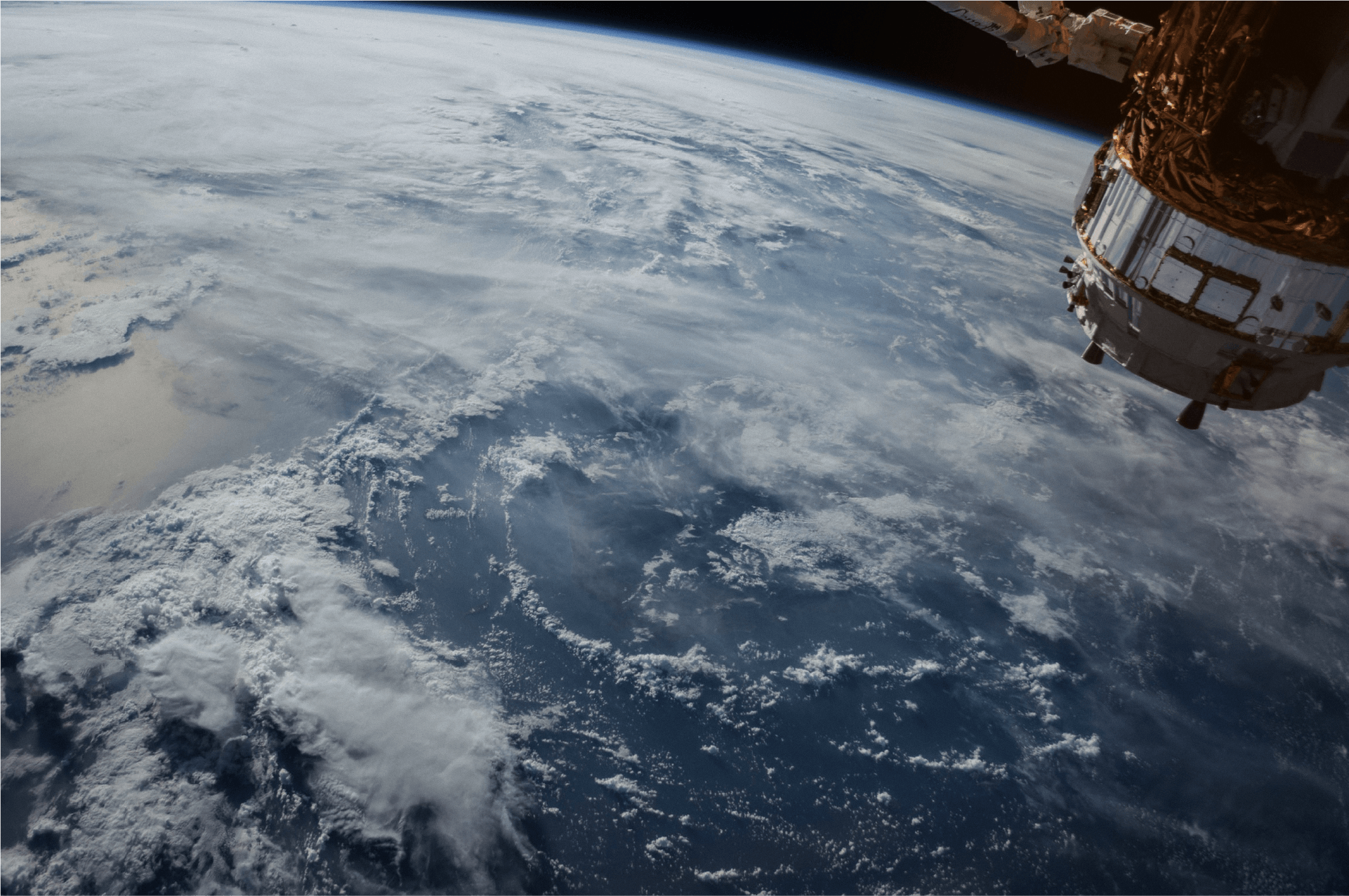

The age of the satellites began with the USSR launch of Sputnik 1 in 1957. We’ve come a long way, where now a private company can develop and launch nanosatellite clusters, to sell on the information. Enter Kleos Space SA.

Since the world learned on 4 October 1957 that the USSR had launched the world’s first satellite (Sputnik 1), humankind has been on a rapid progression towards mastering the ‘final frontier. Owning space currently exists in the minds of science fiction writers, but it won’t for long. We are in the early steps of conquering the unknown and offering profit potential for those who ‘boldly go where no one has gone before’. Investing in space-related technology and companies is far from a new phenomenon, but until recently this was limited to the likes of indirect investments like Boeing ($BA) or Virgin ($SPCE). The issue with these investments is you are either exposed to other industries or face intense market scrutiny. Enter Kleos Space SA, a Luxembourg-based company that develops, launches and manages nanosatellite clusters.

Magnifying Nanosatellites

You may not know this, but there is actually a large range of different satellite types. However, since Kleos uses one type, Low Earth Orbit (LEO) nanosatellites, this is where we will focus. Starting first with the LEO part, these types of satellites fly between 160km and 1,000km above the earth. If 160km seems low, remember that planes only fly around 14km above the earth’s surface. The European Space Agency (ESA) argues that LEO satellites have several advantages, the main one being unlike satellites in geo orbit, the lower orbit allows the satellite to change paths quickly around the earth. Other advantages include significantly reduced cost of achieving orbit, due to the reduced fuel needed.

According to NASA, nanosatellites are generally described as those that weigh less than 10kg, usually around the size of a shoe box. In the case of Kleos, the company uses these nanosatellites as they can be quickly moved, are far cheaper to launch and develop, and can geolocate radio frequency emissions.

The Road So Far

Before we continue, it’s important to note that Kleos only began generating revenue from operations in March 2022 ($167,000). In 2021, the company generated €125,528 in revenue but this was due to government grants and the resale of a portion of space Kleos had purchased. You should think of Kleos as a telecommunications company. Before it can start selling its services, it needs to build up sufficient infrastructure. This infrastructure build-up is what the company has been doing since it was founded in 2017.

Kleos has made significant strides in launching,pun intended, the infrastructure it needs to begin generating revenue. Each year since 2020, the company has launched one nanosatellite cluster, with four nanosatellites making up a cluster. The last cluster was launched in April 2022 aboard a SpaceX Falcon 9 rocket, and continued the company’s track record in achieving stable LEO orbit. The end goal is to develop and deploy 20 clusters. Kleos has increased its rate of deployment and is planning on launching its fourth cluster on the Transporter-6 SpaceX mission in October 2022.

The Road Ahead

The first step to launching the fourth cluster, is to increase Kleos’ data collection capability by up to 119m km2 per day and average daily revisit rate to approximately five times a day. Around the same time the fourth launch was announced, the company reported it had executed a Cooperative Research and Development Agreement (CRADA) with the U.S. Naval Surface Warfare Center Division, Crane (NSWC Crane), for joint data experimentation. This agreement will begin in mid-2022, and phase 1 will last between three and six months. Despite no revenue generated from Phase 1, there will also be no cost, and there is the added bonus of Kleos being able to show real-world proof of its data value.

As the 15 June 2022 announcement said: ‘Under the CRADA agreement, Kleos will provide its radio frequency (RF) geolocation data in realistic test scenarios to improve maritime domain awareness for real-world challenges, including sanctions reporting, embargo, transhipment monitoring, search and rescue, resource management, fisheries control, smuggling, and border control’.

As we mentioned above, Kleos generated its first revenue from operations in March 2022, $167,000. A far cry from its €6.4m loss after tax for 2021, but the U.S. Naval agreement proved to the market that Kleos’ Mission-as-a-Service and data-as-a-service plan has significant scale possibilities. Since then it has racked up €1m in orders and contracts received for Q3 2022. Its Mission-as-a-Service revenue stream asks customers to pay for dedicated access to the data collected by the company’s clusters for a fixed period and capacity. While the data stream offers customers access to the data collected for a fee.

As Kleos continues to launch its infrastructure and with revenue finally coming in, the question for investors is whether 2022 will be the year it finally probes the final frontier of profitability.

Sign up to Stake today and invest in ASX stocks like $MQG, $CBA, $NAB and more!

This does not constitute financial advice nor a recommendation to invest in the securities listed. The information presented is intended to be of a factual nature only. Past performance is not a reliable indicator of future performance. As always, do your own research and consider seeking financial, legal and taxation advice before investing.