Are these the best performing LICs on the ASX?

Listed investment companies (LICs) offer access to an actively managed portfolio of stocks that seeks to outperform the market and pay dividends.

What is a LIC?

Listed Investment Companies (LICs) own and actively manage a portfolio of stocks. They are structured as companies, which means LICs can retain profits from year to year to smooth the income paid to investors. They also pay company tax. This allows them to distribute after-tax income to investors as franked dividends with a tax credit.

Explore the top Australian listed investment companies

Company Name | Ticker | Share Price | 1Y Return | Market Capitalisation |

|---|---|---|---|---|

Australian Foundation Investment Company | $7.20 | +0.70% | $9.03b | |

Argo Investments | $8.88 | +2.90% | $6.78b | |

MFF Capital Investments | $4.33 | +23.36% | $2.54b | |

WAM Capital | $1.57 | +6.80% | $1.77b | |

L1 Long Short Fund | $2.75 | -11.00% | $1.73b | |

WAM Leaders | $1.24 | -6.77% | $1.70b | |

BKI Investment Company | $1.69 | -0.29% | $1.37b | |

Australian United Investment | $10.76 | +4.47% | $1.34b | |

PM Capital Global Opportunities Fund | $2.52 | +13.00% | $1.21b | |

Diversified United Investment | $5.33 | +5.75% | $1.15b |

Share price data as of 23 May 2025. Source: ASX

*The LIC list is ranked by market capitalisation. When deciding what funds to feature, we analyse the company's financials, recent news, and whether or not they are actively traded on Stake.

Find the best performing LIC for your portfolio

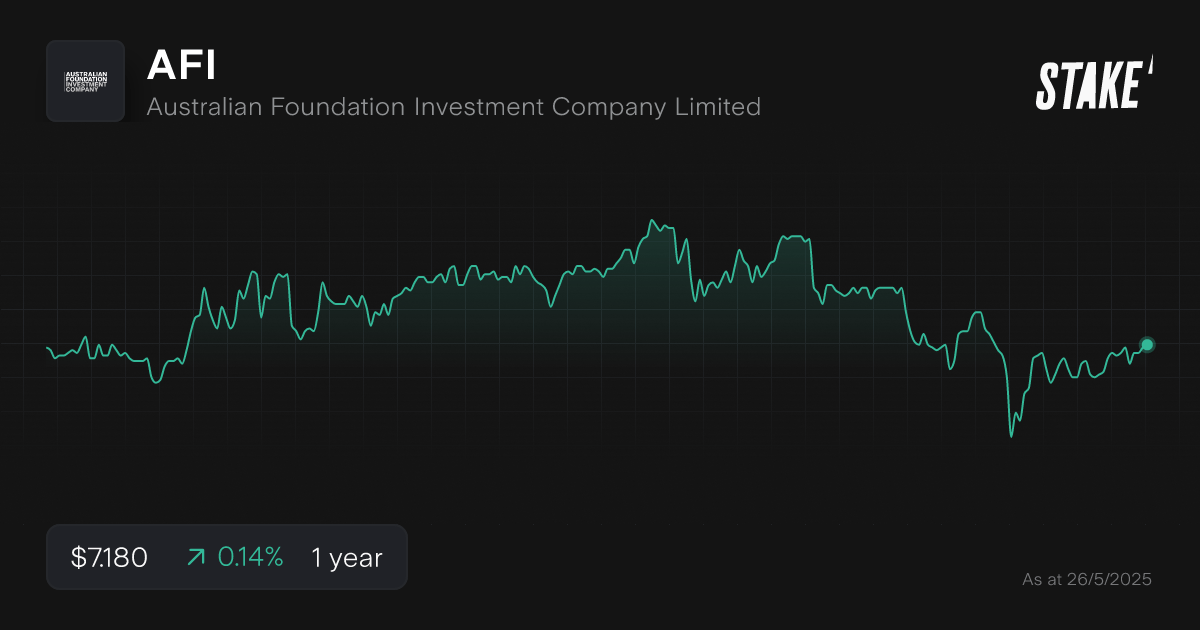

1. Australian Foundation Investment Company ($AFI)

Australian Foundation Investment Company invests in 60-80 companies across a range of industries that pay stable to growing dividends and can provide attractive total returns over the medium to long term. The cost of running the company was 0.15%.

Its top five positions at the end of April were Commonwealth Bank ($CBA), BHP ($BHP), CSL ($CSL), Wesfarmers ($WES) and National Australia Bank ($NAB). Commonwealth Bank accounted for 9.4% of the portfolio. Its top 25 positions accounted for 78.6% of its portfolio.

🆚 Compare listed investment vehicles: AFI vs ARG→

2. Argo Investments ($ARG)

Argo aims to provide consistent tax-effective income and long-term capital growth for shareholders by investing in a diversified portfolio of Australian listed companies.

On 30 April, its top five positions were Macquarie Group ($MQG), Commonwealth Bank ($CBA), BHP ($BHP), Wesfarmers ($WES) and CSL ($CSL). Macquarie accounted for 6.5% of the portfolio. The top 20 investments represented 63.9% of the portfolio.

3. MFF Capital Investments ($MFF)

MFF Capital Investments holds a minimum of 20 listed international and Australian companies with attractive business characteristics at discounts to their intrinsic values.

On 30 April, its top five positions included MasterCard ($MA), Amazon ($AMZN), Visa ($V), American Express ($AXP) and Bank of America ($BAC). MasterCard accounted for 10.1% of the portfolio. Other portfolio holdings include Microsoft ($MSFT), Meta Platforms ($META) and Home Depot ($HD).

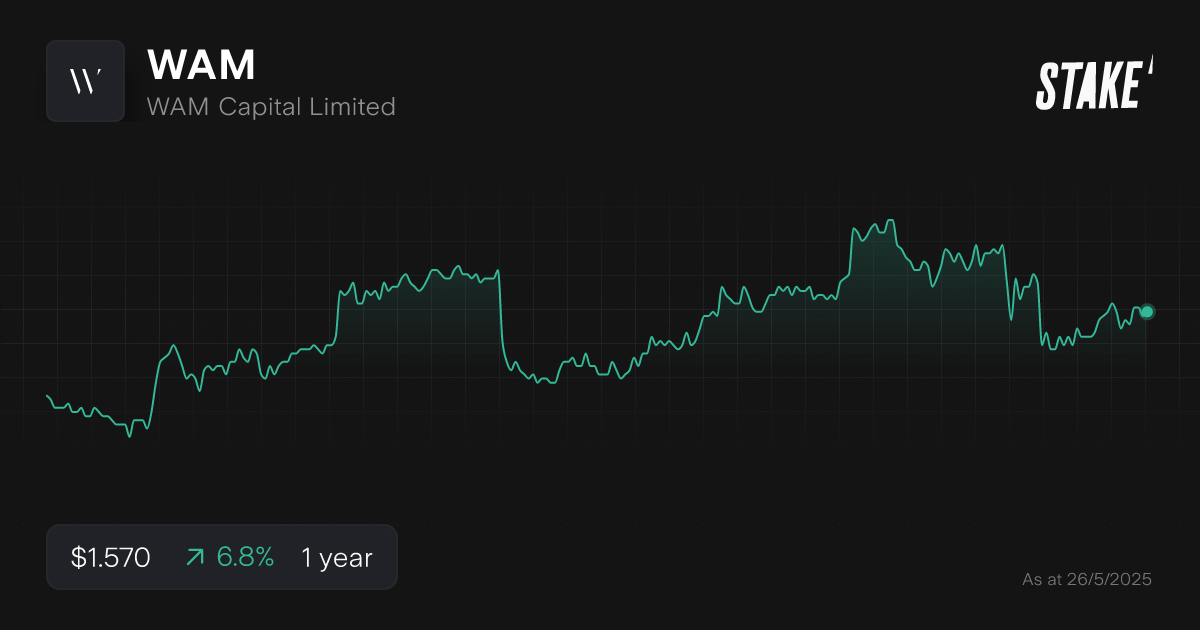

4. WAM Capital ($WAM)

WAM Capital provides investors with exposure to an actively managed diversified portfolio of undervalued growth companies listed on the ASX, with a focus on small-to-medium sized businesses. The manager charges a 1% management fee and a 20% performance fee for outperformance above the All Ordinaries All Accumulation Index.

On April 30, 18.4% of the portfolio was invested in consumer discretionary stocks and 14.1% was invested in information technology stocks.

Some of the top 20 holdings include Megaport ($MP1), Life360 ($360), Service Stream ($SSM) and a2 Milk ($A2M).

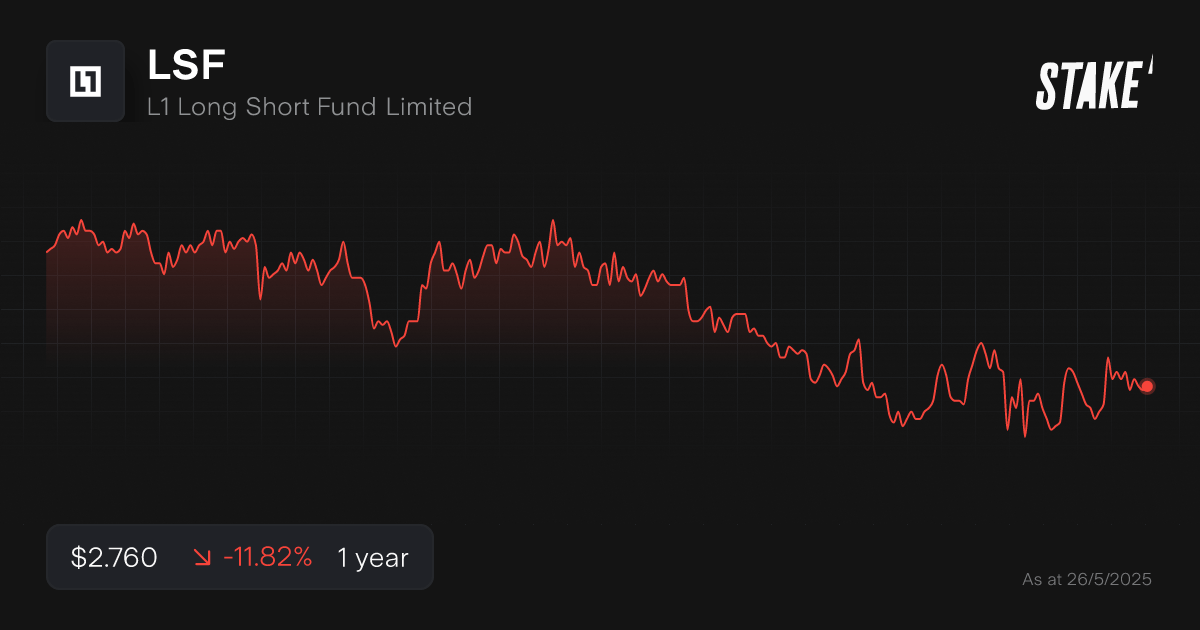

5. L1 Long Short Fund ($LSF)

The L1 Long Short Fund is an absolute return fund that offers investors a highly diversified portfolio of long and short positions based on a rigorous fundamental research process. The manager charges an annual management fee of 1.4% and a performance fee of 20% subject to a high watermark mechanism.

The fund referenced JD Sports and BlueScope ($BSL) as the biggest contributors to the portfolio’s performance in April. Mineral Resources ($MIN) and Santos ($STO) were cited as two of the biggest detractors.

6. WAM Leaders ($WLE)

WAM Leaders invests in large-cap companies with compelling fundamentals, a robust macroeconomic thematic and a catalyst. It aims to deliver a stream of fully franked dividends, provide capital growth over the medium-to-long term and preserve capital. The investment manager changes management fee of 1.02% (including GST) and a 20.5% performance fee when there is outperformance of the S&P/ASX200 Accumulation Index..

Around 30% of the portfolio was invested in materials stocks at the end of April, while financial stocks accounted for 15%. The top five overweight positions include Rio Tinto ($RIO), Spark New Zealand ($SPK), Amcor ($AMC), Mirvac Group ($MGR) and APA Group ($APA).

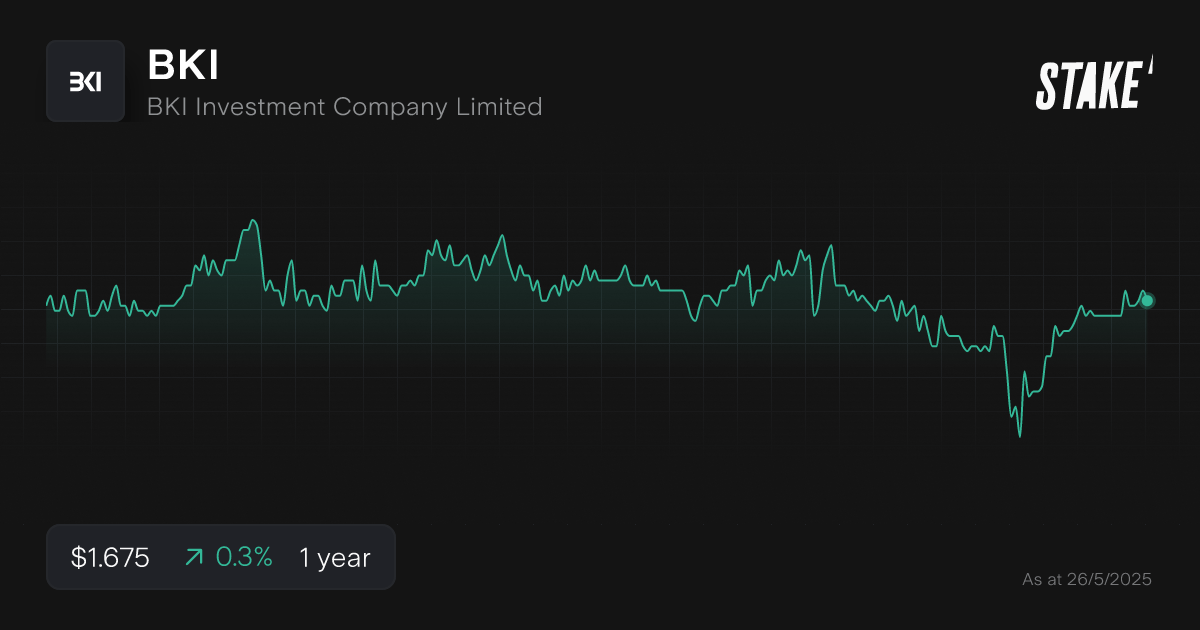

7. BKI Investment Company ($BKI)

BKI takes a long term investment approach in quality, profitable Australian companies that have a history of and are expected to continue to pay attractive dividends. The management expense ratio was 0.168% at the end of 2024.

The top five positions at the end of April were Commonwealth Bank ($CBA), National Australia Bank ($NAB), BHP ($BHP), APA Group ($APA) and Wesfarmers ($WES). The top 25 stocks and cash accounted for 89.9% of the portfolio.

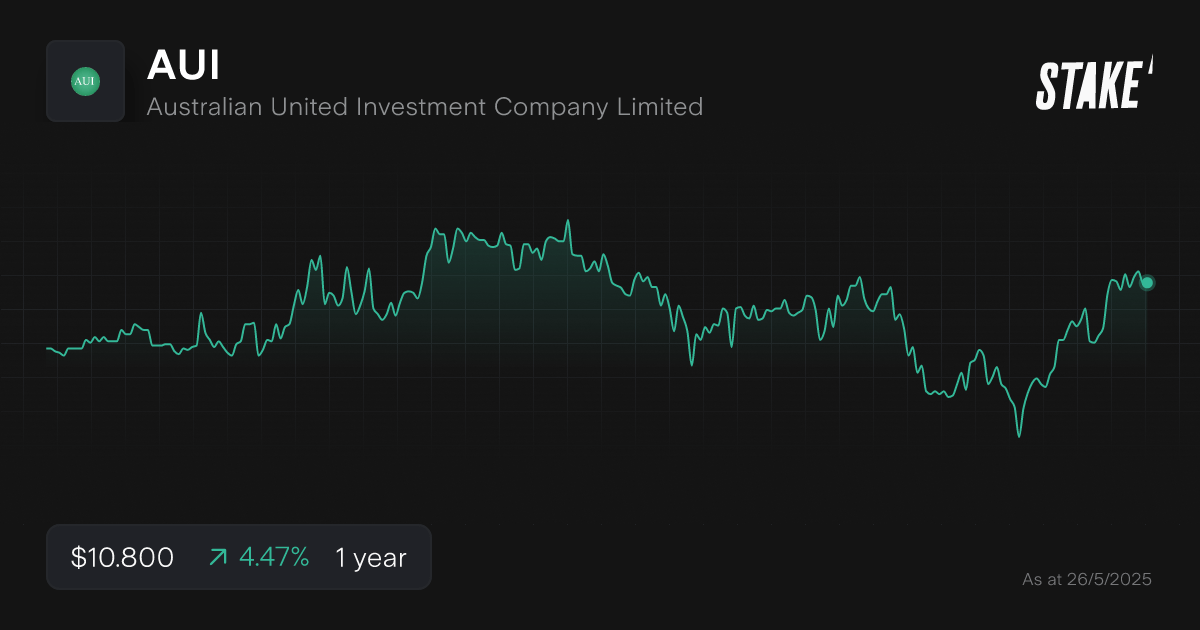

8. Australian United Investment Company ($AUI)

Australian United Investment Company invests in a diversified portfolio of quality Australian companies, with a medium to long term view of providing income and capital appreciation. The management expense ratio is 0.10% at the end of 2024.

The top five positions at the end of April were Commonwealth Bank ($CBA), BHP ($BHP), Wesfarmers ($WES), CSL ($CSL) and Rio Tinto ($RIO). The top 25 investments accounted for 92.4% of the portfolio.

9. PM Capital Global Opportunities Fund ($PGF)

The PM Capital Global Opportunities Fund aims to long-term capital growth over a seven-year plus investment horizon through investment in a concentrated portfolio of undervalued global (including Australian) equities and other investment securities.

At the end of April, some of the top ten stocks included Allied Irish Bank, Bank of America ($BAC), Newmont Mining ($NEM), Teck Resources ($TECK) and Wynn ($WYNN).

10. Diversified United Investment ($DUI)

Diversified United Investment seeks to provide income and capital appreciation over the longer term to its shareholders through a portfolio of securities predominantly comprising shares of companies listed on the ASX with additional exposure to international markets. Its management expense ratio is 0.12%.

The top five positions at the end of April included Commonwealth Bank ($CBA), CSL ($CSL), Transurban ($TCL), BHP ($BHP) and ANZ ($ANZ). The top 25 investments accounted for 93.6% of the portfolio.

How we chose the best performing LICs

We have selected the top 10 listed investment companies based on market capitalisation. We have not included listed investment trusts (LITs), which are structured differently.

We gathered our information from the ASX, the individual LIC websites and The Listed Investment Companies and Trusts Association.

Why consider Australian listed investment companies?

Review some of the core reasons that investors include LICs in their portfolio.

- Market fit: LICs suit long-term investors seeking diversified exposure to a basket of stocks, offering stability, income, and capital growth in one vehicle.

- Management: LICs typically feature experienced managers with a long-term focus, investing through market cycles, offering investors consistent strategies and professional oversight.

- Tax & dividends: LICs provide regular, often fully franked dividends, which are attractive for income investors. The attached franking credits can reduce tax liability, enhancing after-tax returns.

What are the risks and considerations when investing in LICs

There are some important considerations to be aware of before investing in these assets:

- Premiums/discounts to NTA: LICs may trade at a premium or discount to their underlying net tangible assets (NTA), meaning the share price might not reflect the true value of holdings.

- Liquidity: LICs can have lower trading volumes, especially for smaller companies, leading to larger spreads and potential difficulty entering or exiting positions without price impact.

- Management fees: Many LICs are internally managed, which means they have low management expense ratios. Other LICs are externally managed, which incurs a management fee and sometimes a performance fee.

- Market conditions impact: LIC performance is tied to market movements; in downturns, underlying holdings may lose value, and discount to NTA may widen, amplifying downside risk.

How to invest in LICs in Australia?

Follow our step-by-step guide below to start investing in LICs from within Australia:

1. Find a stock investing platform

To invest in LICs, you’ll first need to find an investing platform that offers access to the ASX. There are several share investing platforms available, of which Stake is one.

Get started with Stake

Sign up to Stake and join 750K investors accessing the ASX & Wall St all in one place.

2. Fund your account

Next, open an account by completing an application with your personal and financial details. You’ll then need to fund your account with a bank transfer, debit card, or Apple/Google Pay.

3. Search for the LIC

Find the LIC name or ticker symbol. Always conduct your own research to ensure that the investment is suited to your risk tolerance and financial goals.

4. Set a market or limit order and buy the shares

You can buy a LIC almost instantly at the current price by using a market order during the trading day. Alternatively, enter a limit order to purchase LIC when it reaches a specific price. Consider dollar cost averaging to spread out your risk, which involves buying at consistent intervals.

5. Monitor your investment

Once you own the LIC, monitor its performance over time. Check your portfolio regularly to ensure that your investment remains aligned with your financial goals.

LICs on the ASX FAQs

There will be brokerage fees when buying the listed investment companies' shares. Some LICs charge management and performance fees as well.

LICs often pay fully franked dividends, which can reduce tax through franking credits. Capital gains tax may apply when selling LIC shares at a profit, depending on your holding period and individual tax situation.

Most LICs pay dividends twice a year, though some pay at different intervals. Dividend frequency and amounts depend on the company’s investment strategy and profits.

This article was written by Robert Guy - Senior Markets Writer at Stake.

Disclaimer

The information contained above does not constitute financial product advice nor a recommendation to invest in any of the securities listed. Past performance is not a reliable indicator of future performance. When you invest, your capital is at risk. You should consider your own investment objectives, financial situation and particular needs. The value of your investments can go down as well as up and you may receive back less than your original investment. As always, do your own research and consider seeking appropriate financial advice before investing.

Any advice provided by Stake is of general nature only and does not take into account your specific circumstances. Trading and volume data from the Stake investing platform is for reference purposes only, the investment choices of others may not be appropriate for your needs and is not a reliable indicator of performance.

$3 brokerage fee only applies to trades up to $30k in value (USD for Wall St trades and AUD for ASX trades). Please refer to hellostake.com/pricing for other fees that are applicable.