Klarna IPO: How to buy Klarna shares

Swedish fintech Klarna listed on the NYSE on 10 September after walking back on its IPO plans earlier this year. In this guide, we’ll walk you through everything you need to know about Klarna and how to buy shares in the company.

What does Klarna do?

Klarna is a Swedish fintech company that primarily operates in the buy now, pay later (BNPL) space. Essentially, the firm allows shoppers to make purchases from online retailers and physical stores without paying the full amount upfront.

Consumers can split their payments into four interest-free instalments every two weeks, pay the full amount within 30 days, or finance purchases over a longer period through a partner bank.

Klarna operates globally, working with over 11 million active consumers globally and is partnered with 790,000. The firm earns revenue by charging retailers a fee for each transaction and consumers interest on longer-term financing or late payment fees.

What is the Klarna IPO date?

The Klarna IPO took place on 10 September 2025.

The public debut came after Klarna abandoned its initial IPO plans in April 2025 due to severe market volatility triggered by the announcement of sweeping U.S. trade tariffs by President Donald Trump, which caused a sharp selloff and unpredictable market sentiment.

What was the Klarna IPO share price?

Klarna raised US$1.37b after selling 34.3 million shares at US$40 each, above its targeted range. Shares rallied 15% at the open to US$52 before ending the day at around US$45.82.

The IPO initially planned to raise up to US$1.27b by pricing shares between US$35 and US$37 each.

Klarna is now valued at US$17b – still a 70% drop in value from its 2021 peak valuation of US$45.6b, when it was Europe’s most valuable startup.

Why did Klarna’s valuation drop?

Klarna's business model, centered on BNPL financing, thrived during an era of ultra-low borrowing costs. Since 2022, aggressive interest rate hikes by the Federal Reserve have made capital more expensive, impacting speculative fintech companies like Klarna.

However, a rate-cutting cycle is expected to begin soon, with market participants now pricing in a 98% chance of a September rate cut. This anticipated cycle of rate cuts is driven by concerns over a weakening labour market in the U.S. and the need to balance inflation control with economic growth support.

A consumer spending slowdown was another factor that created challenges for Klarna. The American consumer is a major engine for Klarna's growth, and has shown signs of fatigue amid stagnant labor markets and rising inflation.

Klarna and the BNPL industry faced tighter regulation, especially in the United States, where the Consumer Financial Protection Bureau (CFPB) stepped up oversight. Concerns about vulnerable consumers being targeted and political pressure for stronger regulations created additional headwinds, negatively affecting investor sentiment.

What is the ticker symbol for Klarna?

Klarna shares are listed on the New York Stock Exchange (NYSE) under the ticker symbol $KLAR.

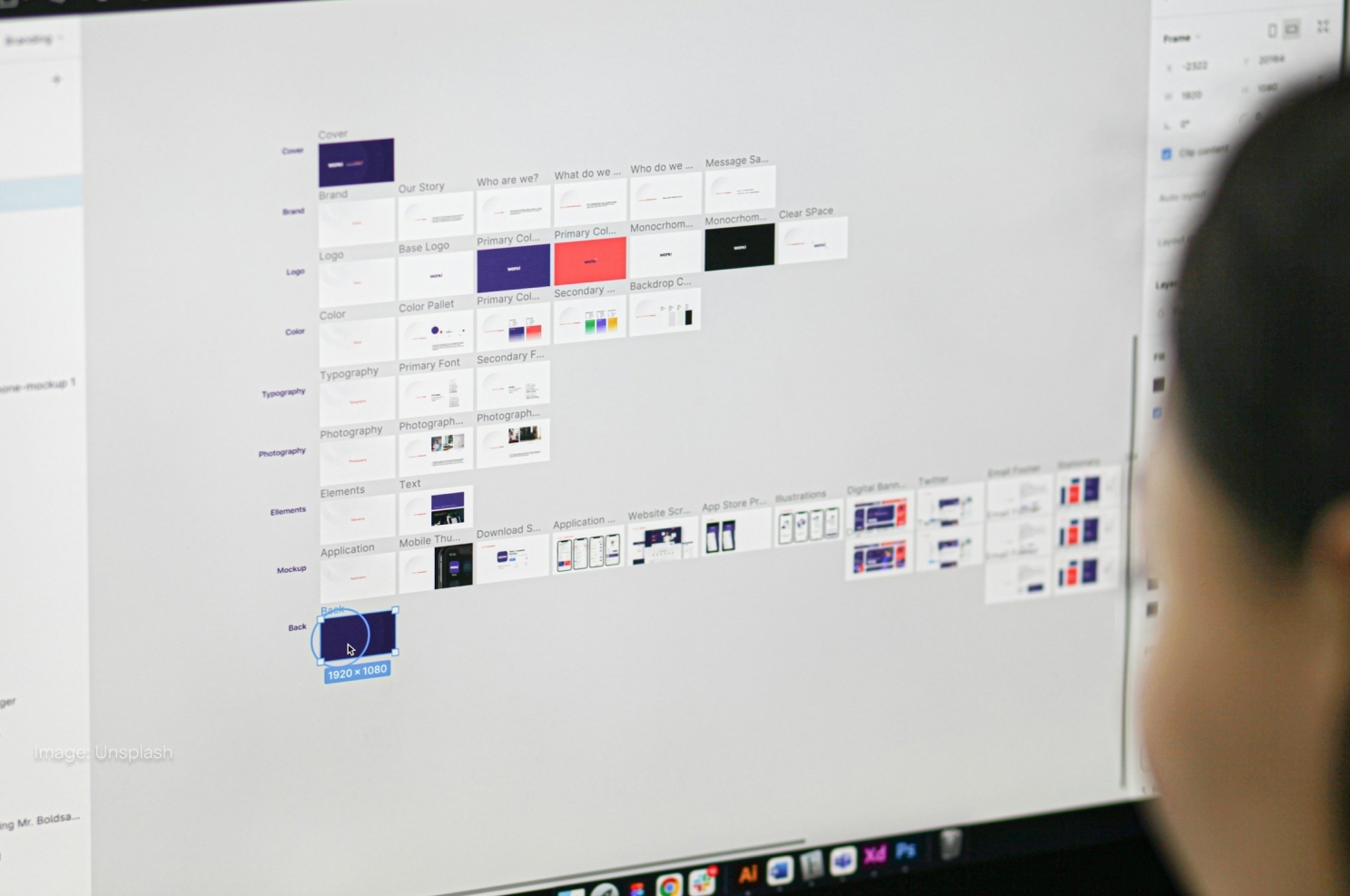

How to buy shares in Klarna

Want to start buying $KLAR shares but not sure how? Learn how to buy Klarna shares in 5 simple steps on the Stake stock investing platform below.

1. Open a stock investing account

If you want to buy Klarna stock, you'll need to sign up to an investing platform with access to the New York Stock Exchange. Lucky for you, Stake has access to the Nasdaq and NYSE.

2. Fund your account

Complete an application with your personal and financial details. Fund your account with a bank transfer, debit card or even Apple/Google Pay.

3. Search for Klarna

Find the asset by searching for the name or ticker symbol ($KLAR). Do your own research to ensure it is the right investment product for your own circumstances.

4. Choose an order type and buy the asset

Buy on any trading day with a market, limit or stop order. Look into dollar cost averaging to spread out your risk, which smooths out buying at consistent intervals.

5. Monitor your investment

Optimise your portfolio by tracking how the security performs with an eye on the long term. You may be eligible for dividends and shareholder voting rights that affect your shares.

Sign up in minutes and get access to this company when it enters the market.

Who is underwriting the IPO?

The lead underwriters for Klarna's IPO are Goldman Sachs, J.P. Morgan, and Morgan Stanley.

These investment banks managing the offering also have a 30-day option to purchase an additional approximately 5.15 million shares to cover over-allotments.

Who owns Klarna?

Klarna was founded in 2005 by Sebastian Siemiatkowski, Niklas Adalberth and Victor Jacobsson. Siemiatkowski still leads the company as CEO. Although Jacobsson has left Klarna, he still holds a significant stake in the company as a shareholder.

The original idea behind Klarna was conceived while the group was studying at the Stockholm School of Economics. Their goal was to simplify and secure online payments.

Klarna's growth and global presence have attracted substantial investments from renowned venture capitalists and private equity firms. Notable investors such as Sequoia Capital, Silver Lake, Bestseller Group, Dragoneer, Permira, Ant Group, Visa ($V) and Atomico have contributed to Klarna's development. Commonwealth Bank ($CBA) is also on the list of investors, holding a 5.5% share of the firm and 50% ownership rights to its Australia and New Zealand business.

What is Klarna’s financial position?

Klarna's financial position as of Q2 2025 shows strong growth and improving profitability. The firm achieved operational profitability for five consecutive quarters, with an adjusted operating income of US$29m in Q2 2025.

Klarna’s revenue hit US$828m, representing a 20% YoY increase, while gross merchandise volume (GMV) rose 19% YoY, accelerating to 24% growth in June 2025.

Despite operational profitability, Klarna reported a net loss of US$53m in Q2, up from US$18m the previous year, mainly due to restructuring and stock-based compensation costs.

How will the Klarna IPO perform in the long term?

Despite a significantly lower valuation than what Klarna had originally planned to go public with, analysts are skeptical about the prospects for this BNPL firm.

The firm’s projected valuation implies that it would need to grow revenue at a 24% compounded annual growth rate, while improving its margins for the next seven years to be fairly valued.

Still, a rebound in consumer spending and a growth in digital wallets could help Klarna’s revenue growth ambitions.

Over the trailing twelve months (TTM), Klarna generated US$112B in gross merchandise volume (GMV), significantly ahead of Affirm’s US$34b.

For comparison, Block’s ($XYZ) Afterpay reported US$8.2b in GMV for Q3 FY24, which annualises to approximately US$33b.

Klarna has also leveraged artificial intelligence (AI) to improve efficiency and expanded its offerings beyond BNPL, hinting at another source of long-term growth potential.

The firm’s scale and market position could attract significant interest, particularly considering market sentiment for IPOs in 2025 has been relatively strong, with an average return of about 20% for the year.

Klarna IPO details

Ticker symbol | KLAR |

Company Name | Klarna Bank AB |

Exchange | New York Stock Exchange (NYSE) |

Opening share price | US$40 |

Shares offered | 34.3 million shares |

🎓 Learn more: What is an initial public offering and how do they work?→

Disclaimer

The information contained above does not constitute financial product advice nor a recommendation to invest in any of the securities listed. Past performance is not a reliable indicator of future performance. When you invest, your capital is at risk. You should consider your own investment objectives, financial situation and particular needs. The value of your investments can go down as well as up and you may receive back less than your original investment. As always, do your own research and consider seeking appropriate financial advice before investing.

Any advice provided by Stake is of general nature only and does not take into account your specific circumstances. Trading and volume data from the Stake investing platform is for reference purposes only, the investment choices of others may not be appropriate for your needs and is not a reliable indicator of performance.

$3 brokerage fee only applies to trades up to $30k in value (USD for Wall St trades and AUD for ASX trades). Please refer to hellostake.com/pricing for other fees that are applicable.

Samy is a markets analyst at Stake, with seven years of experience in the world of investing, working across roles in private banking, venture capital and financial media. She has a Master’s degree in Finance and Data Analytics from The University of Sydney Business School.