Under the Spotlight Wall St: Alphabet ($GOOGL)

Profits are streaming as Alphabet soars past US$3T. Can the search titan keep the momentum?

ICYMI: do your own research and make your own decisions. This article drills down on a specific company, however it is not a recommendation to invest in the company and should not be taken as financial advice.

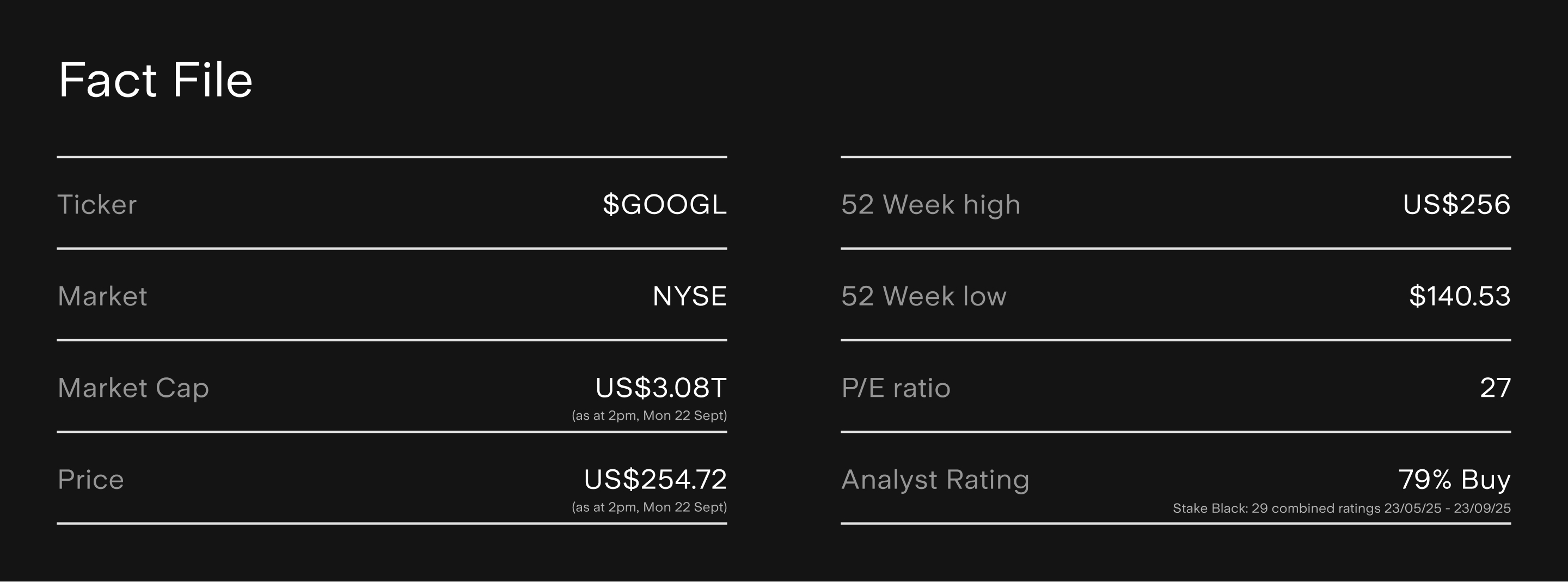

Search giant Alphabet ($GOOGL) has joined the US$3T club. Riding on a high, a quick Google might tell you more is coming – but there’s risk too. Most analysts agree. Price targets range from US$172 to US$290. But can Alphabet move fast enough in the AI battle?

Share prices have surged over 50% in the last six months. Long-term investors have seen a 250%+ uplift over five years. Big returns but not without big risks.

Think ongoing regulatory scrutiny, trade tariffs and privacy concerns. And then there’s AI – both the biggest threat and opportunity for Alphabet’s future.

Alphabet CEO Sundar Pichai remains confident. Cloud is finally turning a profit and capital expenditure spend is jumping US$10B. There’s an Apple ($AAPL) contract in the works for Gemini and ‘AI is positively impacting every part of the business, driving strong momentum’.

Head in the cloud

Alphabet has hit its payday after years of struggling to turn a dime in the cloud.

Cliff Man, CEO for ETF Shares, believes it is uniquely positioned to take market share.

‘Alphabet could really dominate in this space by further incorporating machine learning from its enormous data base,' he says.

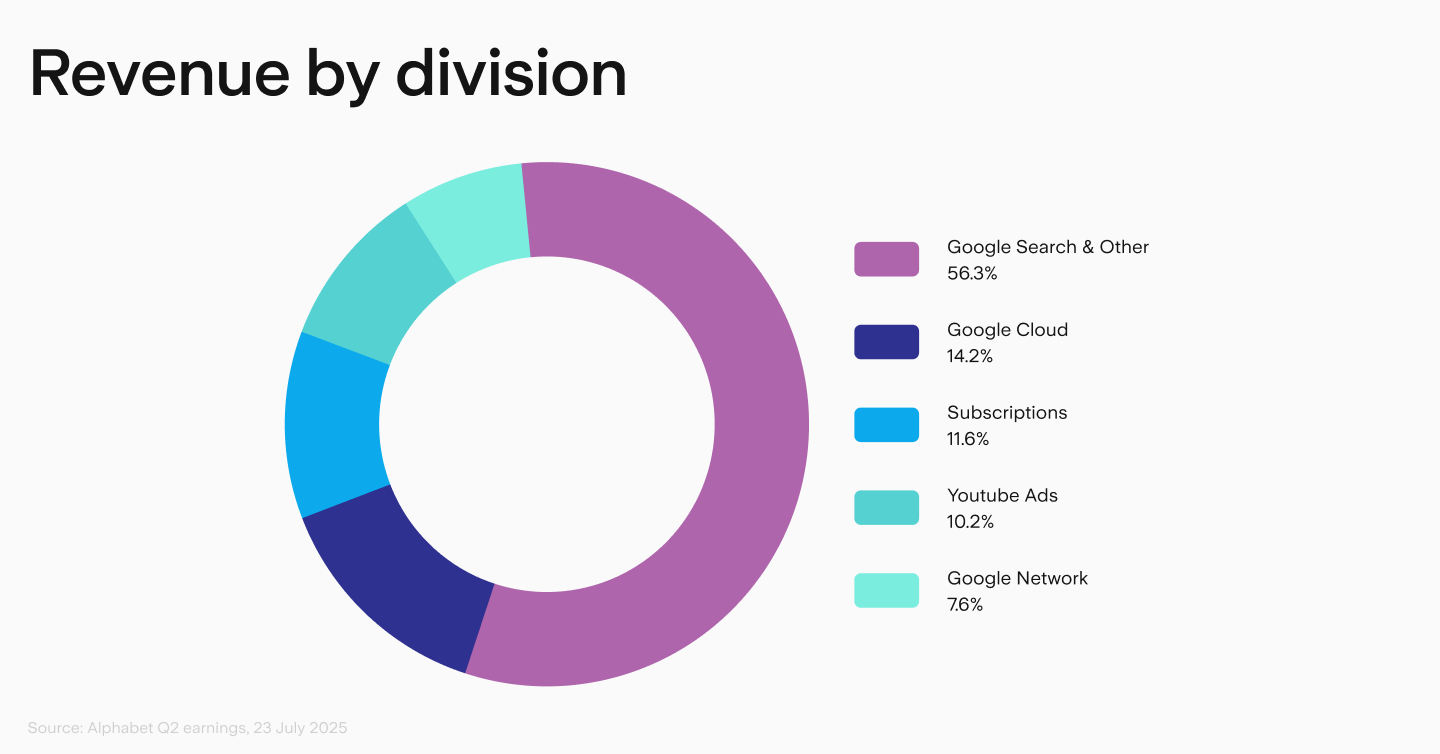

Cloud revenue’s up 32% year-on-year and now makes up 14% of Alphabet’s total. Not bad for a division that only become profitable in 2023.

The competition? Microsoft ($MSFT) and Amazon ($AMZN) cloud businesses hit 39% and 17% year-over-year growth respectively this year.

In other words, Alphabet is pulling its weight and has a hefty US$106M backlog in contracts.

Recent wins include a £400 million contract with the UK Ministry of Defence and a US$10B deal with Meta ($META).

It even services competitors: ChatGPT’s (OpenAI) and Anthropic (Claude) both use the cloud to train and service their models, along with another seven major AI labs. It’s also taking on Nvidia ($NVDA) by producing its own chips.

Sign up to Stake today and buy U.S. shares like Google ($GOOGL), Amazon ($AMZN), Microsoft ($MSFT) and more!

Search and destroyed

Google search continued to dominate revenue. But analysts also see Alphabet’s biggest risk.

Why? Two reasons.

Anti-trust lawsuits and regulations

Growing use of generative AI search

Alphabet has faced a number of antitrust trials in the US, Australia and Europe about whether it has created an illegal monopoly in search.

Trials have focused on actions like paid arrangements to only pre-install Google search on Android and Apple iPhones. The outcomes have been mixed.

It settled cases in Australia and copped large fines in Europe (currently under appeal). But also scored a huge win in the U.S. this month, where an antitrust ruling let it keep both its Chrome browser and Android operating system.

With Google able to stay as the default search on iPhones and no forced sales, the market reacted positively: shares jumped 9.14%, adding an extra US$234B to Alphabet’s market cap.

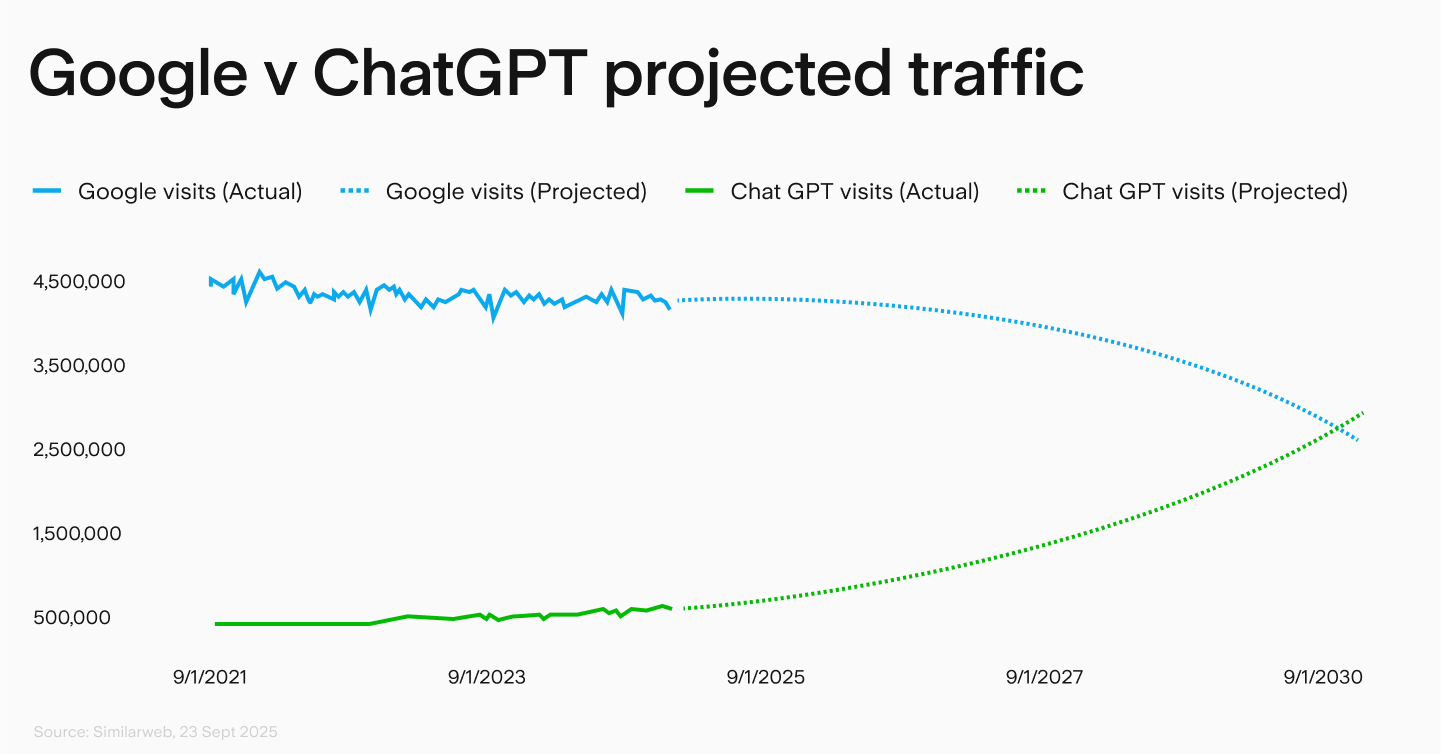

Then there’s the rise of AI search. Why sift through links when you can just ask ChatGPT or Perplexity?

Alphabet has responded by adding AI summaries at the top of search results and is spending big to embed Gemini across its various divisions.

The efforts are paying off. The latest iteration of Gemini Flash Image model (Nano Banana) recently helped dethrone ChatGPT to top the Apple free downloads charts.

But the big story is Alphabet’s advertising revenue. In Q2, it pulled in US$64.6B – now this is threatened by alternative tools and its own AI summaries. But ETF Shares’ Cliff Man notes that advertising revenue is still growing and there’s no other option with Google’s depth.

That said, he also says ‘there is the opportunity to pivot to better monetise its data for machine learning’, as part of the growth in cloud services.

Moonshot

There’s a reason Alphabet is one of the Magnificent Seven. It comes back to the bottom line.

Q2 earnings saw the business achieve double-digit revenue growth to US$96.4B. Net income increased 19% and earnings per share by 22%.

The main businesses are still offering double-digit growth – especially search and YouTube – and there’s the smaller bets in play.

Alphabet is quietly dipping its toes into the innovative waters of autonomous driving, biotech, venture capital and an experimental arm known as The Moonshot Factory.

These aren’t making money. But every big company must invest in the future or risk being disrupted down the track. One of these could be Alphabet’s next big growth opportunity. Or not.

Alphabet has the opportunities at hand, but will it be nimble enough to capitalise? Investors will be watching the cloud while remaining wary of search.

This is not financial advice nor a recommendation to invest in the securities listed. The information presented is intended to be of a factual nature only. Past performance is not a reliable indicator of future performance. As always, do your own research and consider seeking financial, legal and taxation advice before investing.

Sara is a passionate finance writer with more than 15 years’ experience in the Australian finance industry. She has worked in marketing and content with Macquarie Group, Westpac, ETF Securities (now Global X ETFs) and Livewire Markets across investments, insurance, financial advice and superannuation.

.png&w=3840&q=100)

.png&w=3840&q=100)

.png&w=3840&q=100)