Under the Spotlight AUS: Microba (MAP)

Funny how we sometimes trust our gut, even though we don’t know much about it. Maybe it’s time we learn more. Microba is building a suite of scientific products to help people understand and tweak what’s going on inside their gut.

.png&w=3840&q=100)

This is a sponsored article written by the team at Stake Connect. Stake Connect aims to bring interesting business stories to our customer base. While we have a commercial agreement with the featured company, we take a balanced stance, retain final editorial control and prioritise making content that's valuable to our community.

Funny how we sometimes trust our gut, even though we don’t know much about it. Maybe it’s time we learn more. Microba is building a suite of scientific products to help people understand and tweak what’s going on inside their gut.

While we all have a digestive system that includes a stomach and intestines, each individual has in it a unique mix of gut flora, or bacteria, interacting and impacting the whole body. That flora is part of the growing gut health field of study, in a sector that is estimated to be worth US$89.9b by 2030. That’s the market that Microba($MAP) is ready to swallow.

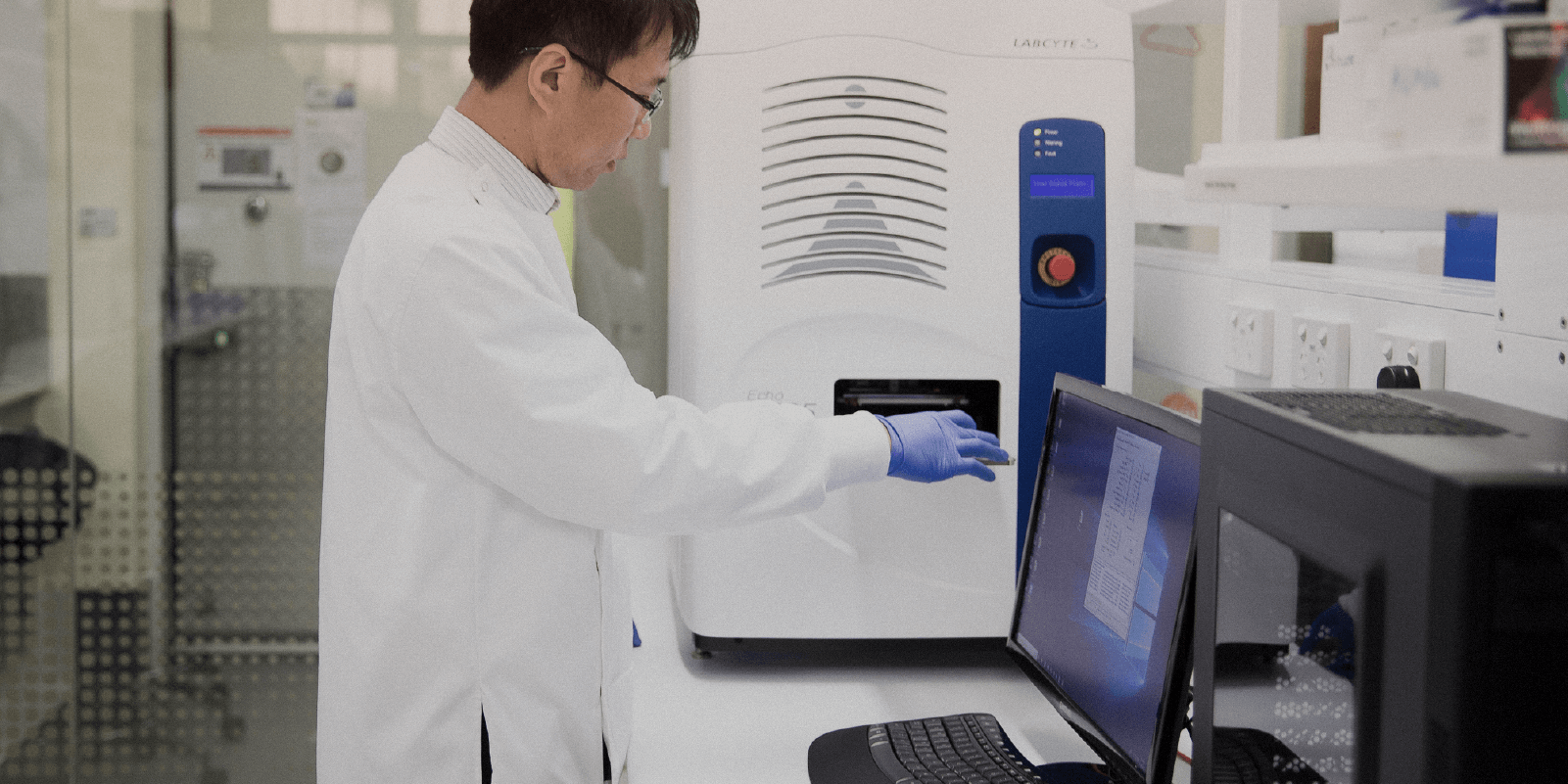

The idea behind Microba came about in 2004 when Professor Philip Hugenholtz and Professor Gene Tyson published the first metagenomic study into a microbial community. Over the next decade the duo continued microbial studies while acceptance of the science grew.

GI woes

There’s always been a general acknowledgement that what happens in the gastrointestinal tract is important, but it remains relatively untreatable. Even Irritable Bowel Syndrome, which impacts one in five people in Australia and is well understood, has very few treatments beyond just staying away from irritants like coffee (can you imagine?). But the two professors worked together to create genomic tools that have allowed researchers to better analyse gut bacteria.

As analysis isn’t enough, the co-founders wanted to bring preventative measures to the market. The theory is simple: by having the gut bacteria data, the company was in a unique position to create preventative treatments for patients. So, in 2017, they met with Dr Luke Reid to discuss how best to commercialise their research. And so Microba was born and started its path to publicly-listed company.

Plan of attack

The first step for Microba was to prove it could make money even without the preventative treatments. It was and is a difficult environment for biotechs, with a 90% failure rate for drug candidates. It’s not even easy once approval is secured – Deloitte found one third of drugs launched between 2012 and 2017 in the U.S. underperformed following launch.

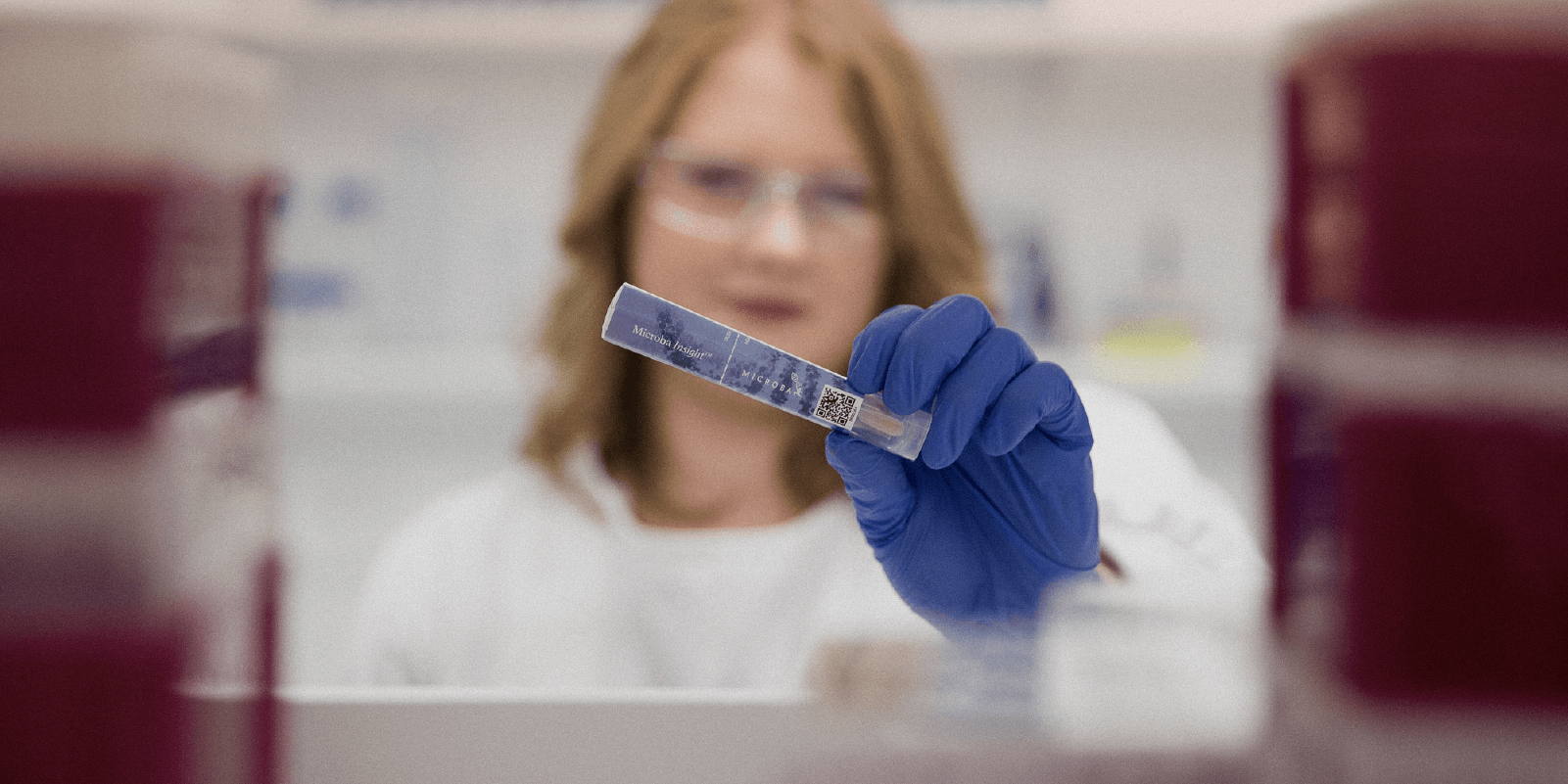

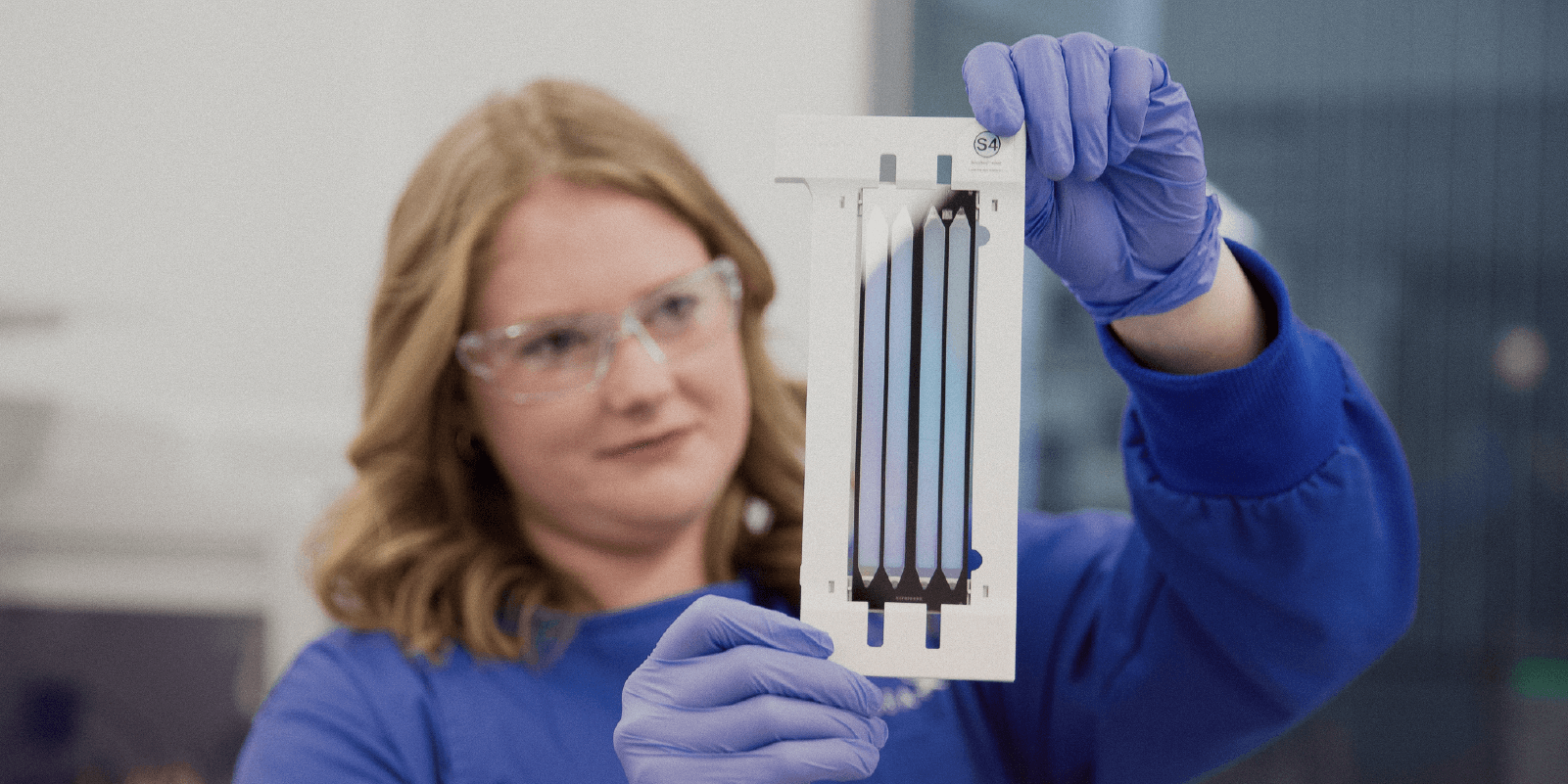

With that in mind, Microba set up three revenue-generating services. The first was a consumer product: a microbiome test to be sold to customers as well as healthcare practitioners, which could analyse samples and give a breakdown of gut bacteria. Dr Reid told Stake that demand in this segment is growing as gut health becomes a routine part of health management.

The second was building up a proprietary microbiome data bank to drive therapeutic discoveries. This is the world’s largest and most advanced microbiome data bank, containing 1.2m microbial genomes. This data has allowed Microba to build insights into developing the next generation of therapeutic products and chronic disease treatments. It’s a big playground as, according to census data, 46.6% of Australians have a chronic condition.

“In the short-term we have two goals: one is to make gut microbe testing more accessible by partnering with companies that can deploy the tests; and the second is to demonstrate the potential of microbe therapies in clinical trials. But longer term we want to be into market treatments, particularly for chronic diseases,” said Dr Reid.

Market treatments is where Microba sees the future, with the company developing multiple novel microbial therapeutics to target unmet clinical needs by leveraging the biology of the healthy gut microbiome. Currently its lead therapeutic program is focused on inflammatory bowel disease. It has discovered the bacteria responsible for the disease and is currently looking to support a clinical trial for its treatment in 2023. The company has multiple immuno-oncology programs currently at the preclinical stage, while it is working with Ginkgo Bioworks $DNA on multiple autoimmune therapeutics.

Listed life

With commercialisation in play, Microba went for the ASX listing in April 2022, raising $30m for a $123.4m valuation. It was the largest biotech IPO on the ASX for 2022, but shares fell 22% on the day. While the company has spent 2022 in the red, this must be considered in the broader economic context. Of the 15 biotechs that listed on the ASX last year, only two are above their listing price today. And more broadly, the biotech index fell 25% in 2021.

The company’s financial results are a better indicator of where it sees its growth. Microba reported 25% growth in revenue to $4.68m for the year, with a number of distribution partnerships signed worldwide. In fact, distribution grew 66% over six months in 2022, thanks to a partnership with SYNLAB, Europe’s largest pathology company, to pursue a multi-phased distribution strategy. Losses have almost doubled over the year, due to continued investment in research activities.

Moving forward, Dr Reid says Microba is working to jump on the growing trend of consumer-initiated healthcare, by extending its customer testing division. ‘COVID really got people looking at their health and it broke down the barriers for that access. We want to continue to break barriers to deliver tests directly to consumers and enable them to be proactively healthy’.

The space is moving fast, with two competitors progressing towards the first microbiome drug approval with the U.S. Food and Drug Admission. If successful, they would be the first drugs of their type to get FDA approval. A catalyst for the sector and a path to market for Microba’s drugs when they’re ready.