Under the Spotlight AUS: Austal (ASB)

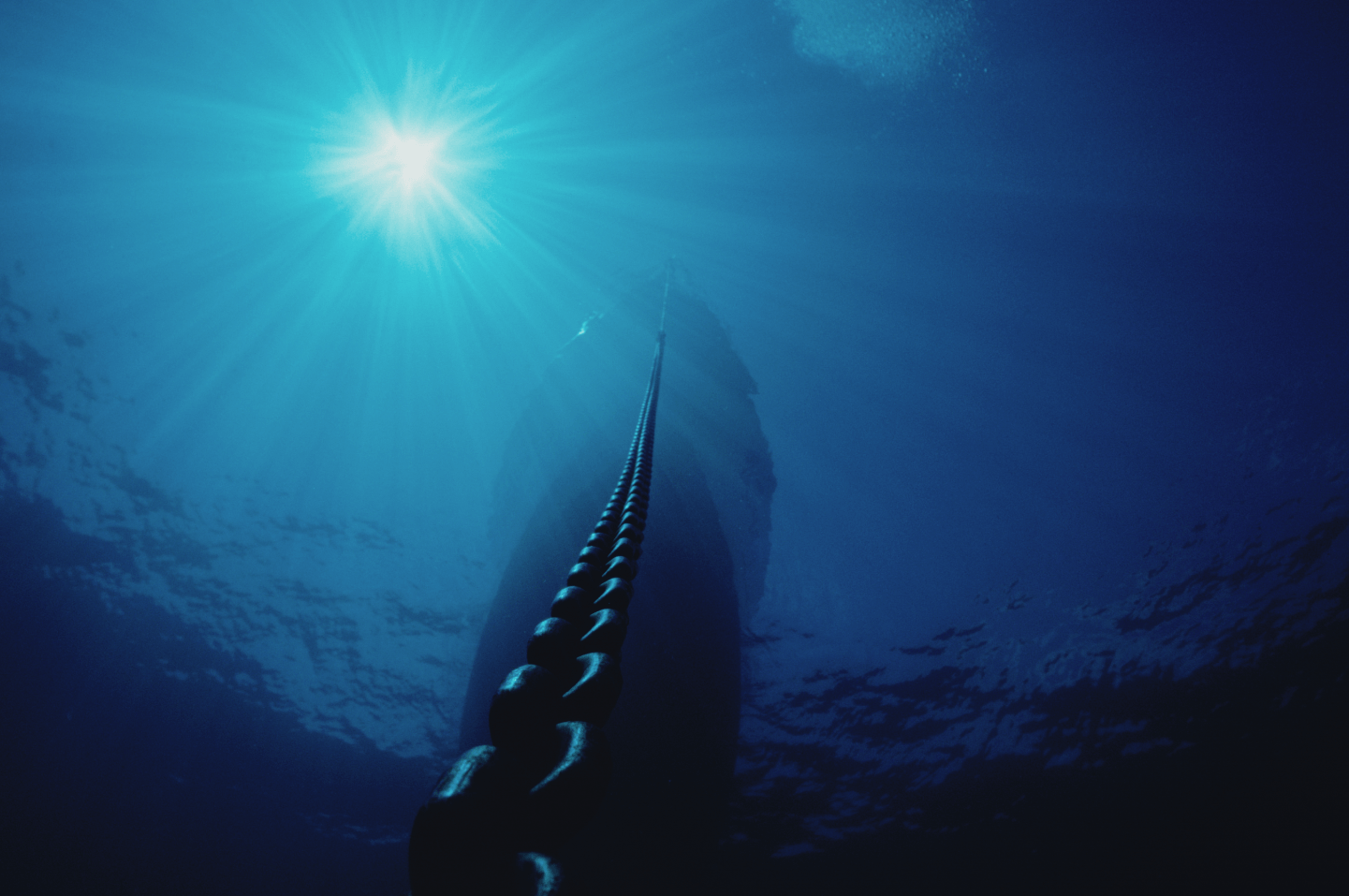

Whether it’s escalating geopolitical tensions, fishing wars, rising sea levels or increasing levels of actual piracy, the world’s oceans are only getting more dangerous. It’s causing price pressures for many companies, but for global, defence-contracting shipbuilders like Austal, it’s good for business.

.png&w=3840&q=100)

Founded in 1988 by John Rothwell, Austal (ASX: ASB) started with a single commercial vessel shipbuilding facility in Perth, Western Australia, and thrived. By December 1998, the company was ready for the big leagues with an IPO on the ASX. It then only took a year for the company to expand operations. Its first shipyard in the U.S. was opened in 1999 and grew to become one of Mobile, Alabama’s largest employers, producing ships for the U.S. Navy.

Over the next decade, Austal continued to make military and commercial vessels under John Rothwell’s leadership, now as Chairman, a position the founder still holds today. In 2011, the company expanded again by acquiring a commercial shipbuilding facility in the Philippines. It allowed Austal to produce high-speed and vehicle-passenger ferries, offshore crew transfer and wind farm vessels for the South East Asia market.

Sailing towards today

By FY21, Austal was constructing 29 ships through six shipyards in five countries, all aluminium commercial and defence vessels. Combined with the 35 ships under sustainment contracts through eight centres, the company generated $1.6b in revenue and $160m in EBITDA.

Before we go further, what is a sustainment contract? Primarily a military term, it refers to the support or maintenance of equipment or personnel. In Austal’s case, its sustainment contracts are split between the Australian and U.S. defence forces.

Austal has a significant history with the U.S. and Australian navies, providing high-quality aluminium vessels. However, the real money is in steel ships. The company’s history with the U.S. Navy allowed them to win US$50m in federal funding to build a new US$100m steel shipbuilding facility in Mobile by April 2022. While Austal’s US$50m share of the cost might seem like a big swing, it’s already paid off.

A future etched in steel

Right on schedule, Austal opened its US$100m steel shipbuilding facility on 13 April 2022. And in under three months, it paid for itself. How? Through a contract to build up to 11 Heritage class Offshore Patrol Cutters for the U.S. Coast Guard, worth US$3.3b. Not only that, but a contract for up to five Navajo (T-ATS 6) class ships for the U.S. Navy removed any risk that the steel shipyard would sink before it had a chance to float.

The US$3.3b in revenue was not recorded in FY22’s results, and revenue dropped 9% to $1.4b, generating $165m in EBITDA – 3% growth year-on-year. Revenue was split 75% from the U.S. and 25% from Australasia. Based on management commentary and the company’s trajectory, it seems likely the U.S. division will continue to increase in prominence – especially since steel ships generate both more revenue and higher profit margins than their aluminium counterparts.

That’s why the company remains confident despite the dip in revenue during COVID-19. Its founder and Chairman has a 9.1% stake in Austal’s 362m shares outstanding as of 30 June 2022. But only you can decide whether to jump aboard this ship.

This does not constitute financial advice nor a recommendation to invest in the securities listed. The information presented is intended to be of a factual nature only. Past performance is not a reliable indicator of future performance. As always, do your own research and consider seeking financial, legal and taxation advice before investing.